Elon Musk, the CEO of Tesla, is a figure of immense influence in the tech and automotive industries. His vision and leadership have been pivotal in transforming Tesla into a leading electric vehicle (EV) manufacturer. A significant aspect of Musk’s association with Tesla is his pay package, which has been a topic of considerable debate among shareholders, analysts, and industry experts.

This pay package, initially approved in 2018, was recently nullified by a Delaware court ruling, prompting Tesla to seek shareholder approval to reinstate it. This article explores the implications of this pay package on Tesla’s stock, analyzing scenarios based on shareholder decisions, Elon Musk’s potential response, and future stock predictions.

What the pay package is about?

In 2018, Tesla’s board approved a pay package for Elon Musk, potentially worth $56 billion, contingent upon achieving specific market capitalization and operational milestones. This package was designed to align Musk’s incentives with shareholder interests, ensuring his continued focus on Tesla’s growth. However, a Delaware judge invalidated the compensation plan in January 2023, citing insufficient disclosures to shareholders during the approval process. Tesla is now seeking a new vote to reinstate the package, claiming it’s crucial for retaining Musk and driving future innovations, particularly in artificial intelligence (AI) and autonomous driving technologies. This vote’s outcome could significantly impact Tesla’s stock performance and investor sentiment.

What Happens if Shareholders Vote Yes?

If shareholders vote to reinstate Musk’s pay package, it does not automatically become effective. Tesla will attempt to reverse the Delaware judge’s ruling, arguing that the affirmative vote demonstrates shareholders’ informed support despite the court’s criticisms. This legal battle could extend to the Delaware Supreme Court, potentially taking several months.

A successful reinstatement could lead to a modest uptick in Tesla’s stock. Musk’s continued engagement is viewed as a positive factor by many investors, as his leadership is seen as integral to Tesla’s innovative pursuits and market positioning. The company’s efforts in AI and other advanced technologies, which Elon Musk champions, are expected to benefit from his retained focus.

However, the legal uncertainty and ongoing litigation might dampen some of the positive sentiment. Despite this, Tesla’s management believes that demonstrating shareholder support for the package could strengthen their position in court and among investors.

What Happens if Shareholders Vote No?

A negative vote would complicate Tesla’s efforts to reverse the court ruling on Musk’s pay package. While Tesla remains committed to compensating Musk for his contributions, a shareholder rejection weakens their position. The company might need to negotiate a new compensation package with Musk, potentially involving a significant accounting charge due to the increased value of Tesla shares since 2018.

If the original plan’s invalidation stands, Tesla could face legal fees, adding to the financial burden. Moreover, the absence of a robust pay package might raise concerns about Elon Musk’s future engagement with Tesla. This uncertainty could lead to a considerable drop in Tesla’s stock, as investors might perceive increased risk regarding Musk’s involvement and the company’s strategic direction.

Will Tesla Lose Musk if He Does Not Get the Pay Package?

Elon Musk’s dedication to Tesla is undeniable, but the absence of a substantial compensation package raises questions about his long-term commitment. Elon Musk holds a significant stake in Tesla, worth approximately $75 billion, making it unlikely that he would completely disengage. However, the potential shift in his focus towards other ventures, such as his AI startup xAI or SpaceX, could affect Tesla’s stock negatively.

Board chair Robyn Denholm emphasized that reinstating the pay package is crucial for “retaining Elon’s attention and motivating him.” While Musk’s substantial equity in Tesla and his personal investment in the company’s mission suggest he will remain involved, the narrative that he might allocate more time to other projects if not adequately compensated could lead to stock volatility.

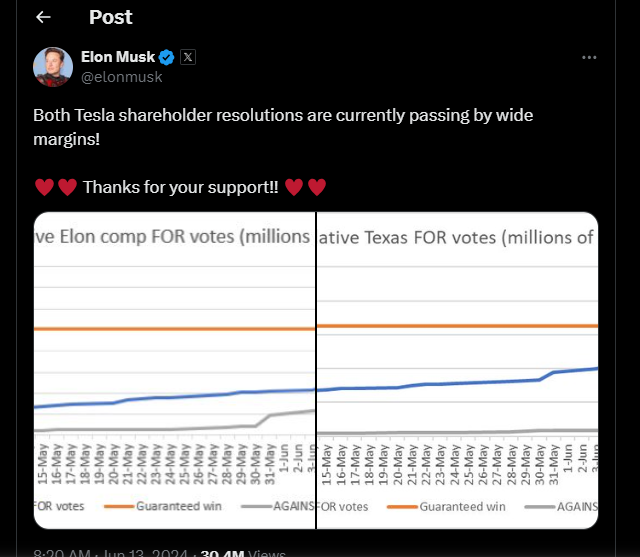

Elon Musk Hints That Pay Package Will Pass

Elon Musk has expressed confidence that the shareholder vote will favor his pay package. He noted that 90% of Tesla’s retail shareholders support the package, suggesting a high likelihood of passage. This optimism led to a 6.5% rise in Tesla’s stock, reflecting investor confidence in Musk’s leadership and the anticipated positive vote outcome.

Despite opposition from significant institutional shareholders like Norway’s sovereign wealth fund and advisory firms ISS and Glass Lewis, the support from retail investors and smaller institutional holders like Baron Capital and ARK Invest suggests a complex but potentially favorable voting outcome for Musk.

Can Tesla Stock Return to Rise or Will It Drop More After Pay Package?

The reinstatement of Elon Musk’s pay package could provide short-term stability to Tesla’s stock, with a slight positive movement anticipated. However, the long-term impact depends on several factors, including the outcome of ongoing litigation, Tesla’s operational performance, and broader market conditions.

If the pay package is not reinstated, Tesla’s stock could face significant downward pressure due to investor concerns about Musk’s engagement and the company’s strategic direction. The financial implications of renegotiating a new compensation package and potential legal costs could further strain Tesla’s stock performance.

Tesla Stock Price Prediction

Tesla stock has experienced considerable volatility, influenced by both internal developments and external market conditions. Cathie Wood’s ARK Invest recently raised its price target for Tesla to $2,600 by 2029, driven by expectations of growth in the autonomous vehicle sector, specifically robotaxis. This bullish prediction hinges on Tesla’s successful execution of its autonomous driving initiatives.

Absent a significant breakthrough in autonomous vehicles, ARK Invest’s lower price target for Tesla stands at $350 per share. The current uncertainty surrounding Musk’s compensation adds to the complexity of these predictions. For a more detailed prediction we advise you to check out our previous post of Tesla Stock Prediction: Should You Invest in 2024?

Final thoughts

In conclusion, the outcome of the shareholder vote on Elon Musk’s pay package is pivotal for Tesla’s stock trajectory. A positive vote could stabilize and potentially boost the stock, reflecting confidence in Musk’s leadership. Conversely, a negative vote might lead to significant stock volatility and raise concerns about Tesla’s future direction and Musk’s involvement. Investors and analysts will closely monitor these developments, as they have far-reaching implications for Tesla’s market positioning and growth prospects.

Leave a Reply