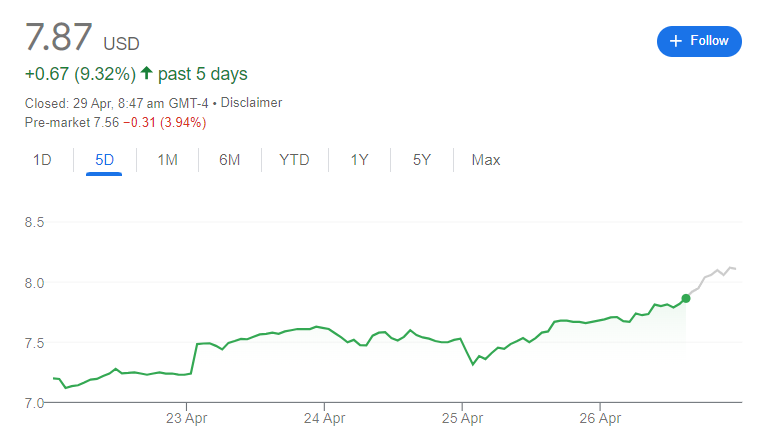

SoFi Technologies recently made headlines with a remarkable 6.0% surge in SoFI stock price following the release of its market-beating financial results for the first quarter. The personal finance company reported impressive figures, including a significant jump in adjusted revenue and earnings, coupled with a promising outlook for fiscal 2024.

As investors eagerly anticipate the company’s future growth trajectory, many are considering adding SoFi stock to their portfolios. Here’s a comprehensive guide on how to invest in SoFi stock, including key steps and considerations for prospective investors.

SoFi’s Strong Q1 Performance

SoFi’s first-quarter earnings report showcased robust growth across various financial metrics, underlining its position as a leading player in the fintech industry.

The company reported earnings of $88 million, translating to 8 cents per share, a substantial improvement compared to the $34.4 million loss, or 5 cents a share, recorded in the same period last year. Adjusted EBITDA surged from $75.7 million to $144.4 million, reflecting the company’s efficient management of operating expenses.

Furthermore, SoFi witnessed a notable increase in net revenue, climbing 37% year-over-year to $645 million, surpassing analyst expectations. Key highlights from the earnings report include a significant uptick in personal loans, student loans, and home loans, demonstrating SoFi’s ability to capture market share across multiple segments.

Steps to Invest in SoFi Stock:

1. Open a Brokerage Account:

The first step in investing in SoFi stock is to open a brokerage account. A brokerage account provides investors with access to various investment opportunities, including stocks, mutual funds, bonds, and more. Investors can choose from a wide range of reputable brokerage platforms, each offering different features and services. When opening a brokerage account, individuals will need to provide personal, employment, and financial information. This process typically takes 15 to 20 minutes and can be completed online.

Also read: Best Online Brokers in UK – Types of Brokers

2. Determine Your Budget and Investment Strategy:

Once the brokerage account is set up, investors should determine their budget and investment strategy. Consider how much capital you are willing to invest in SoFi stock and whether it will be a one-time investment or a recurring one. Additionally, decide on an investment strategy, such as dollar-cost averaging or lump-sum investing. It’s essential to allocate funds prudently and avoid overexposure to any single stock, including SoFi, by maintaining a diversified portfolio.

3. Conduct Thorough Research:

Before purchasing SoFi stock, conduct thorough research to understand the company’s financial health, growth prospects, and competitive positioning. Analyze key financial metrics such as the price-to-earnings (P/E) ratio and debt-to-EBITDA ratio to assess valuation and leverage levels. Evaluate SoFi’s business model, competitive advantages, and management team to gauge its long-term viability and growth potential. Remember that informed investing decisions are based on comprehensive research and analysis.

4. Place an Order:

Once you’re ready to invest in SoFi stock, log in to your brokerage account and navigate to the trading platform. Search for SoFi’s ticker symbol ($SOFI) and enter the desired amount you wish to invest. Choose between market orders, which execute immediately at the prevailing market price, or limit orders, which allow you to specify a price at which you’re willing to buy. After placing your order, monitor your investment periodically and be prepared to ride out market fluctuations.

Also read: Can SoFi Technologies Stock Make You Rich in 2024?

Final thoughts

Investing in SoFi stock offers an opportunity to participate in the growth story of a dynamic fintech company with promising prospects. By following these steps and conducting thorough research, investors can make informed decisions when adding SoFi stock to their portfolios. Remember to diversify your investments, stay updated on market trends, and maintain a long-term perspective to achieve financial goals.

Leave a Reply