Do you need to establish a cash-generating portfolio? Are you worried about paying your bills and having enough money right now and need a second source of income? If that’s the case, you should consider employing an older investment strategy known as income investing.

This article is for you if your goal is to generate revenue from your investments. We’ll go over how to get started with income investing.

What is Income Investing?

The art of good income investing involves assembling a portfolio of assets such as equities, bonds, mutual funds, and real estate that will produce the most annual income while posing the least amount of risk. The majority of this revenue is distributed to the investor so that they can use it to buy clothes, pay bills, go on vacations, and live a happy life without worrying about money.

Some people believe that income investing is only for retirees and older investors, investing for retirement and there are good reasons for this. Income-generating investments, on the other hand, can be beneficial financial vehicles for people of all ages. Dividend-paying stocks have tended to outperform non-paying stocks, and high-quality bonds are one of the safest strategies to protect wealth and keep your assets’ purchasing power from being destroyed by inflation. As a result, there’s no need to think too narrowly about who should use income-investing strategies.

The appropriate composition of an income-generating portfolio depends on the investor’s goals and risk tolerance. To check out the strategies and holdings that better match your specific needs, you’ll need a knowledge of the relevant types of assets that can create up a proper income-generating portfolio, some measurements and characteristics to use and look for when assessing various candidates, and a full understanding of your goals.

The Most Important Assets for Your Income Investing Portfolio

Here are a few different types of investments to consider.

- Bonds

- Dividend-paying stocks

- Real estate

- ETFs and mutual funds

A detailed analysis of each category might help you manage your portfolio and figure out which investments are best for your income investing portfolio.

Bonds in an Income Investing Portfolio

Bonds are frequently regarded as the cornerstone of income investing due to their lower volatility than stocks. You are lending money to the corporation or government that issues the bond when you buy one. You own a piece of the company when you buy a stock. Bonds have a significantly lower potential reward, but you have a better chance of recapturing your investment in the case of bankruptcy.

Bonds are less risky than stocks, but they are not without risk. Bonds, in fact, come with their own set of dangers for income investors.

Bonds are divided into two categories-

1. Government bonds- Government bonds are thought to be a very safe way to invest money and generate income. They are considered as low-risk investment instruments that make for appealing investment opportunities. They are described broadly as an investor lending fund to the government for a certain period in return for low-risk exposure and a bond yield.

2. Corporate bonds- Corporate bonds are related to government bonds, except that instead of lending money to the government, investors lend it to firms for a set length of time. Though the only difference among the two bond types is that corporate bonds are riskier than government bonds. Corporate bonds, on the other hand, offer greater bond yields than government bonds due to the higher risk involved with them.

Dividend Stocks in an Income Investing Portfolio

Companies that opt to pay cash dividends to shareholders on a regular basis are known as dividend stocks. Dividends are a mechanism for corporations to distribute a portion of their earnings to investors, and they are normally paid out of the free cash flow generated by their company.

The finest dividend stocks pay dividends on a regular basis and increase the amount paid overtime. This provides investors with both the income and the growth they require to stay up with escalating costs over time.

Dividend companies with a variety of qualities should be included in your personal income investment portfolio.

- Dividend payout ratio: A dividend payout ratio of 50 percent or less is ideal, with the remainder reinvested back into the business for growth in the future.

- Dividend yield: A company’s competitive position might be harmed if it gives out too much of its profit. A dividend yield of 2% to 6% is considered to be a healthy distribution.

- Earnings: At the very least, the company should have produced positive earnings with no losses over the previous three years.

- Track record: It’s also preferable if you have a track record of steadily increasing dividends. If management is concerned about its stockholders, it will prioritize returning extra cash to them overextending the empire.

- Ratios: The return on equity and a debt-to-equity ratio of a company are also factors to examine. When opposed to industry peers, ROE and debt-to-equity should be healthy. In a downturn, this can provide a wider margin and keep dividend checks coming in.

Real Estate in an Income Investing Portfolio

Real estate is a popular source of income for many investors. Rental payments from the right real estate investments can create more income than property-related expenses and financing fees. You have complete control over any residual income.

Real estate has a number of additional benefits. It can help you diversify your portfolio and is considered as alternative investment beyond stocks, bonds, and traditional income assets. Real estate also provides tax advantages that other types of income investments do not. When combined with the chance of rising property values, real estate can be an appealing option for people looking for a source of income. This technique is not without risk, and you should not put all of your money into real estate. There are three problems with this strategy:

- When the real estate market declines, leverage, or the use of debt to finance your real-estate investments, magnifies the loss.

- Due to lawsuits, maintenance, taxes, insurance, and other factors, real estate demands more effort than stocks and bonds.

- Stocks have always outperformed real estate in terms of long-term performance when adjusted for inflation.

ETFs and mutual funds in an Income Investing Portfolio

Mutual funds are also an essential component of income investing portfolios. They generate revenue on a consistent basis in the form of dividends, interest payments, and etc. Moreover, interest-bearing bank accounts, such as savings and money market accounts, are the least risky and most secure option to maintain a consistent inflow of cash.

Investors can buy shares in exchange-traded funds (ETFs) or mutual funds instead of individual investments. Both of these investment vehicles provide exposure to a diverse range of investments while allowing investors with limited funds to participate. There are numerous ETFs and mutual funds that specialize in income investments, some of which take a wide approach to encompass various types of assets, while others focus on specific categories such as bonds or dividend stocks.

Monthly Income Investing

When putting out an income investment portfolio, keep in mind that different assets payout at different periods and with varied frequencies. Some dividend stocks, for example, payout quarterly, while others only payout once a year. Bonds may only send you cash payments twice a year.

You’ll need to optimize your investments if your goal is to invest for a monthly income stream – that is, a consistent amount of money coming into your account each month. Look for dividend equities that payout at different times of the month, as well as bonds that payout once a month. While obtaining more income in some months and less in others isn’t entirely a bad thing, you can change the size of your investments to assure you get around the same amount of money each month.

Investing for Retirement Income

It’s a prevalent misconception in the UK that income investing is mainly for pensioners looking to supplement their pensions. While this isn’t the case — investing for income is a great strategy for everyone at any age – retirees can often benefit from this type of investing.

The rationale for this is because if you’ve previously built up a retirement nest fund, you may use it to produce a significant monthly income in retirement. All you have to do is move from growth or value investing to income investing.

In the United Kingdom, investing for retirement income carries a low risk. You won’t have to sell your major investments to fund your retirement lifestyle because you can use the cash payments for routine expenses. In this way, income investing in the UK allows seniors to have a more comfortable retirement while also passing on more assets to their descendants.

Advantages of Income Investing

1. Provides a supplement to a fixed income- Income investing is a fantastic way to supplement a set monthly or annual income. It’s a terrific method to supplement one’s income using assets they already possess, which can be used for day-to-day expenses.

2. Capital stock growth potential- Income investing has the ability for long-term capital stock growth, which can help to increase one’s wealth in the coming years.

Income Investing Limitations

Every investment strategy entails some level of risk. The same may be said for the income-investing plan. While the strategy aims to maximize income with the least amount of risk, the income it generates has a certain amount of risk attached to it.

In the case of a bad investment selection or an economic downturn, the investment may fail, ending in earnings loss rather than earnings gain.

Three more strategies that can help you invest for profit

Build a bond ladder

This is one of the most common income-generating strategies, and it can be used in any interest rate environment. You can build a ladder by investing in a combination of short, medium, and long-term bonds. All bonds have a maturity date, which is the date on which you, the investor, will receive the entire value of your investment. When you purchase shorter-term bonds, you will have accessibility to cash when they bloom, allowing you to replace your income earlier rather than later.

Investing with funds can help you save time and money

According to Diczok the most cost-effective option for the average investor to establish an income portfolio is through ETFs and mutual funds. These investments can give you accessibility to a large range of securities while decreasing transaction costs.

Instead of focusing on short-term market fluctuations, consider your overall profits

It doesn’t matter as much if the value of the underlying asset varies when you’re getting the income you need from an investment, whether it’s a stock or a bond.

The Importance of Savings in a Portfolio of Income Investing

Saving money and investing money are two different things, but they both help you achieve your long-term financial goals. Even if you have a well-diversified income investing portfolio that earns a lot of money each month, having enough savings in risk-free FDIC-insured bank accounts in case of an emergency is critical.

A bank account’s funds are liquid, meaning they can be swiftly withdrawn if needed. Your capital is locked up when all of your funds are invested, and you may be forced to liquidate positions in order to get cash. This could have a detrimental impact on your tax returns and efficiency.

The quantity of cash you’ll need will be determined by your total fixed payments, your debt levels, your health, and how quickly you’ll need to convert assets into cash.

It is impossible to overstate the importance of understanding the value of cash in a savings account. You should put off investing until you have enough money saved to cover emergencies, health insurance, and other obligations. After then, and only then, should you begin investing.

How to Invest for Income

A stock broker is required to invest in income-generating assets, It’s crucial to pick a low-cost broking service provider so that your investment profits aren’t squandered on account and trading costs. You also want a broker who has a large selection of individual dividend stocks, bonds, and income ETFs to choose from.

We’ll show you how to buy your first income fund with eToro, a platform that charges no costs on any investment.

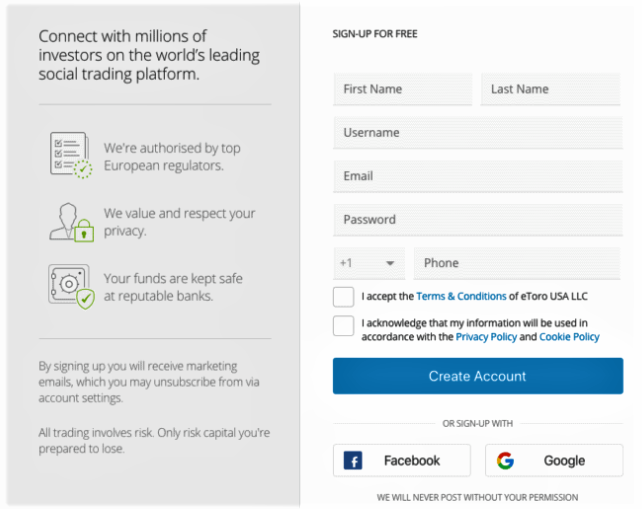

To get started, go to eToro’s main page and sign up for a new account by clicking ‘Join Now.’ Along with your name, email, and address, create a username and password.

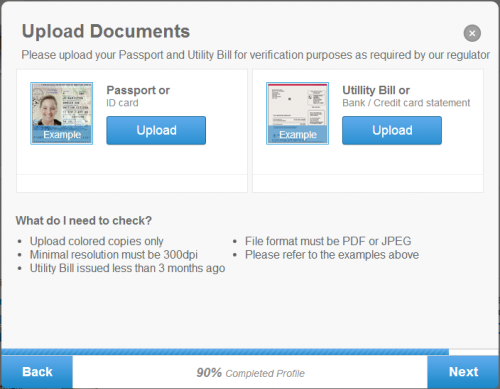

eToro asks you to authenticate your identity in order to comply with UK regulatory rules. Upload a copy of your driver’s license or passport to complete this step online. You’ll also need to attach a bank statement or a utility bill with your current address on it.

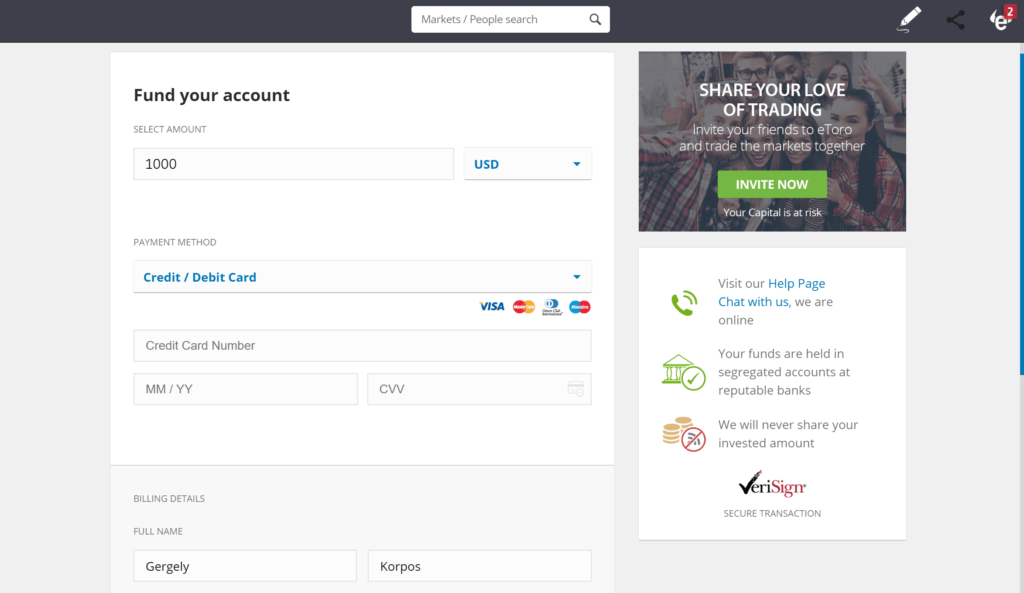

After that, you must fund your account. A minimum deposit of £140 is required by eToro, which can be made in a variety of ways. Credit or debit cards, UK bank transfers, and e-wallets such as Neteller and Skrill are all accepted by the broker.

You’re now prepared to make your first money investment. Enter Investment Trust name in the search bar at the top of the dashboard to buy shares . When the investment trust displays, click ‘Trade’ to begin a new order form.

Fill out the order form with the amount of money you want to put into this investment trust. Keep the stop loss and take profit boxes empty if this is a longer-term investment. Simply click ‘Open Position’ to complete your trade and begin investing or earning money in the United Kingdom.

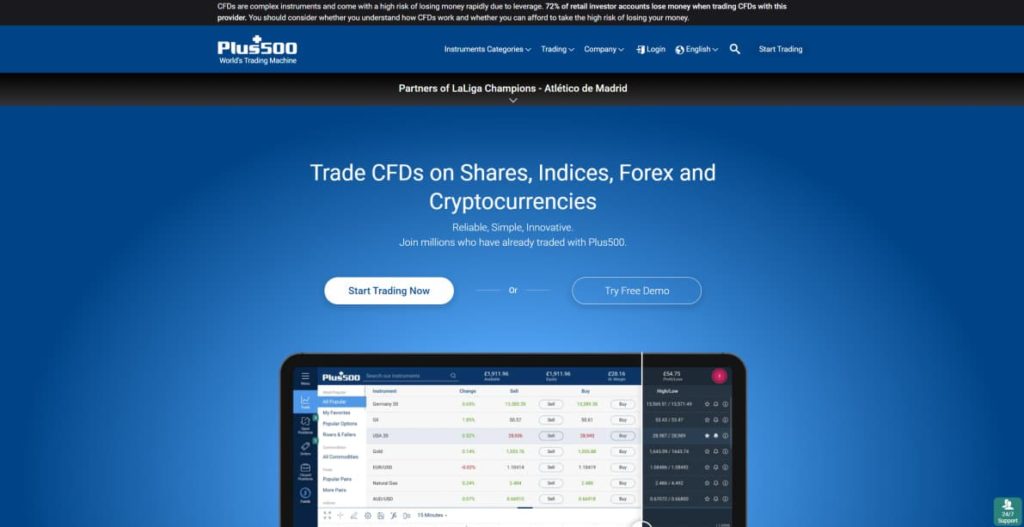

Plus500

Plus500 is a leader in CFD trading rooms worldwide. The platform hosts thousands of financial instruments across most asset classes such as bonds, shares, stocks, indexes, bonds, digital currencies, forex, and commodities. All Plus500 account users have access to the paper trading system.

Plus500 also offers a fast registration process for its proprietary trading platform that is very intuitive and can be used from any web browser or mobile phone. Plus500 offers two types of accounts: a demo account with no time limit and a real account that requires a minimum amount of time. Deposit £100.

Is it possible to create a full-time income from investing?

It is feasible to earn enough money from your assets to support your living expenses, but it does not happen quickly. Years of diligent and disciplined investing, as well as patiently allowing your wealth to build, are required. You must be careful not to remove more than your investments earn each year once you have enough invested to earn a full salary’s worth of annual returns.

Difference between income and growth investing

Income investing aims to offer a consistent stream of income in the near future, whereas growth investing aims to develop wealth that you can live off or pass down to your heirs in the long run. While the two methods aren’t mutually exclusive, they do differ in terms of how you invest and what you do with your money.

What is the minimum amount required to begin investing for income?

The amount you’ll need for income investing is determined by how much money you want to make each month. For example, if you had a $100,000 investment that earned 7% annually, you could securely withdraw between $3,000 and $4,000 per year (between 3 percent and 4 percent ). You can safely withdraw $30,000–$40,000 each year if you had $1 million invested.

Conclusion

One of the finest ways to put your money to work for you is to invest for income. You earn consistent dividends from income investing, which you may use to compound your investments or pay for day-to-day costs. Investing for income in the UK might be a good approach if you’re wanting to prepare for retirement, supplement your income, or stretch your retirement resources as far as possible.