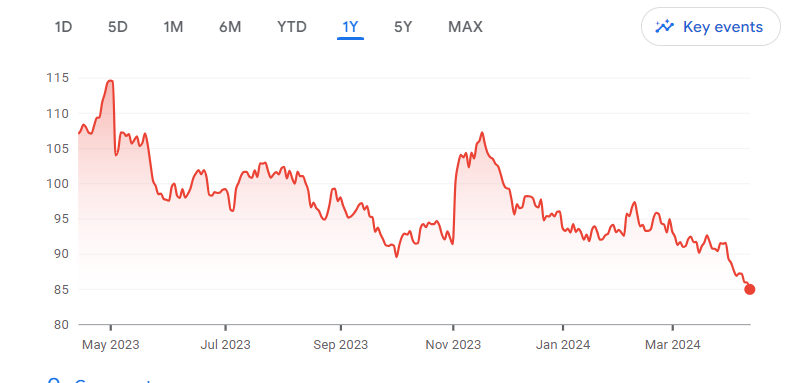

Starbucks stock emerges as a compelling growth stock despite facing a 31% decline from its recent high. This beloved coffee giant offers compelling reasons for investors to consider its stock as a strategic addition to their portfolios.

Solid Performance Amidst Challenges

Despite encountering challenges such as increased wage expenses in key markets like California, Starbucks has demonstrated commendable performance for being an impressive growth stock. The company’s recent earnings report showcases a robust 8% increase in net revenue, reaching a record $9.4 billion. Moreover, its earnings per share surged by an impressive 22%, outpacing revenue growth and indicating strong operating leverage.

Starbucks’ strategic initiatives, notably its Starbucks Rewards program, have played a pivotal role in driving customer engagement and boosting profitability. With a significant surge in active US Starbucks Rewards members, reaching 34.3 million and a staggering 133% year-over-year growth, the program has become a cornerstone of Starbucks’ success. Not only does it incentivize customer loyalty, but it also streamlines operations, reducing labor costs through increased app-based orders.

Starbucks’ growth trajectory extends beyond domestic borders, with a focus on international expansion. International locations offer promising prospects for profitability, with lower operating costs compared to domestic markets. Analysts anticipate a robust 15.81% earnings per share growth over the next five years, reflecting Wall Street’s bullish outlook on Starbucks’ profit potential.

Attractive Valuation

Despite recent headwinds impacting its stock price, Starbucks presents an enticing valuation proposition for investors. Currently trading at a forward price-to-earnings ratio of 18.49%, this growth stock stands at its most affordable level in several years. This presents a compelling opportunity for investors to capitalize on Starbucks’ growth potential at a discounted price.

In conclusion, Starbucks emerges as a compelling growth stock amidst market volatility, underpinned by its solid performance, strategic initiatives, international expansion, and attractive valuation. While challenges persist, Starbucks’ resilience and long-term prospects position it as an attractive addition to investor portfolios seeking sustainable growth. As the market fluctuates, Starbucks remains a beacon of stability and promise for investors looking to navigate uncertain terrain with confidence.

Also read: What Growth Stocks Are Currently The Best And Worst To Buy?

Leave a Reply