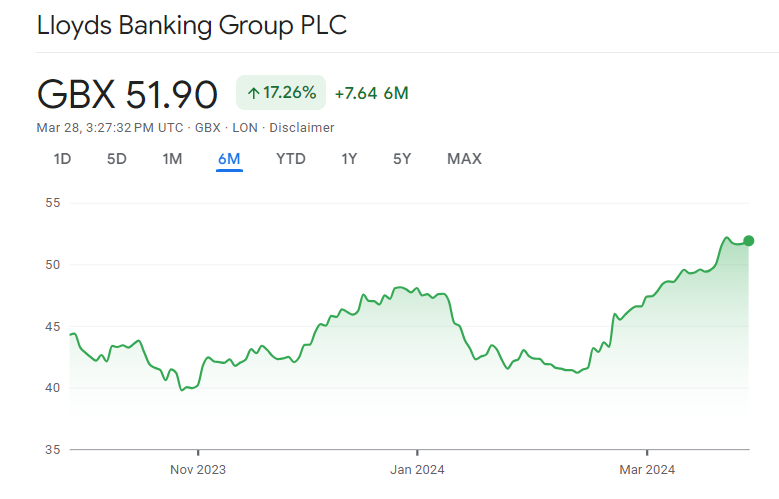

Investors in Lloyds shares have found renewed optimism as the company’s share price surged past the 50p milestone, sparking speculation of further gains.

Bolstered by positive momentum since mid-February, Lloyds shares have seen a steady climb, hinting at a potential bullish trend in the making. Analysts suggest that this momentum could play a crucial role in propelling the Lloyds shares price further, with hesitant investors possibly joining the fray to capitalize on the upward trajectory.

Moreover, the company’s recent announcement of a £2 billion share buyback initiative has added fuel to the fire. Share buybacks, are a favored strategy by many companies to enhance shareholder value, and reduce the number of outstanding shares, thereby increasing earnings per share and dividends for existing shareholders.

Lloyds’ buyback plan, equivalent to approximately 7% of its market capitalization at the time of announcement, has already contributed to a 12% surge in share price since its unveiling in February. With analysts predicting further buybacks totaling around £3.6 billion over the next two years, the prospect of additional share price appreciation remains tantalizing.

Risk Reduction and Economic Recovery Outlook

Amid prevailing economic uncertainties and concerns over inflation and interest rates, banks like Lloyds have faced heightened scrutiny. However, some analysts argue that perceptions of heightened risk could soon dissipate as economic conditions improve. Lower interest rates and a return to economic growth could significantly mitigate perceived risks associated with the banking sector, making shares more attractive to investors.

At a forecasted price-to-earnings (P/E) ratio of only seven, based on 2026 projections, a share price of 60p for Lloyds would still remain undervalued relative to historical averages. With the potential for economic recovery on the horizon and ongoing efforts to enhance shareholder value through buybacks, the prospect of Lloyds shares surpassing the 60p mark continues to garner attention among investors.

While uncertainties linger, fueled by financial market volatility and lingering effects of inflation, the bullish sentiment surrounding Lloyds shares persists. Investors remain cautiously optimistic, buoyed by the prospect of continued momentum and strategic initiatives aimed at unlocking hidden value within the company.

Also read: Rolls-Royce Or Lloyds Shares? Which FTSE 100 Stocks Should You Buy Right Now?

Leave a Reply