Nvidia stock investors are grappling with concerns as the chipmaker’s stock plunges 11% from its record high set last month. The recent dip comes amidst fears of intensifying competition in the AI chip market, exacerbated by Intel’s latest move.

Intel Unveils Gaudi 3 Accelerator

Intel’s latest salvo in the AI chip battleground is the Gaudi 3 accelerator. Touting superior performance and cost efficiency compared to Nvidia’s H100, Intel aims to challenge Nvidia’s dominance in AI processing. The Gaudi 3 claims a 50% improvement in inference and 40% better power efficiency over Nvidia’s offering, potentially enticing customers with its promise of cutting-edge performance at a fraction of the cost. Moreover, with major players like Dell, Lenovo, and HPE expected to adopt systems powered by Gaudi 3, Intel signals its serious intent to penetrate the lucrative AI chip market.

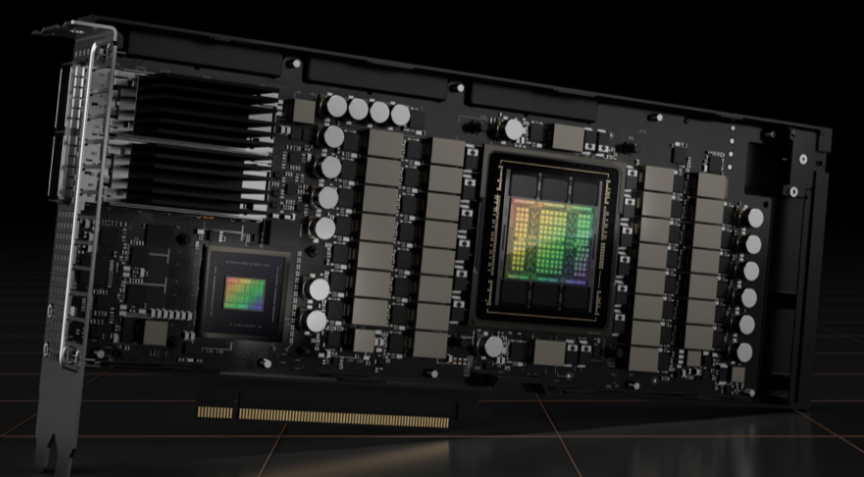

Despite Intel’s aggressive push, Nvidia stock remains unfazed. The company recently unveiled its Blackwell GPU architecture, boasting significant advancements in AI processing power and energy efficiency. With the Blackwell B200 GPU expected to outperform Nvidia’s H100 by fourfold during training and 30 times during inferencing, Nvidia aims to maintain its stronghold in the AI chip space. Moreover, Nvidia plans to price the Blackwell processors competitively, potentially neutralizing any cost advantage Intel may possess.

Market Expectations

Despite Intel’s efforts to challenge Nvidia’s dominance, market analysts remain bullish on Nvidia stock prospects. Analysts estimate that Nvidia’s data center revenue could double in 2024, reaching an impressive $95 billion. This projection reflects the market’s confidence in Nvidia’s ability to continue leading the AI chip market, where it reportedly commands a share of over 80%.

Furthermore, major cloud computing providers such as Amazon, Alphabet’s Google, Meta Platforms, Microsoft, and Oracle are expected to deploy Nvidia’s Blackwell processors. This widespread adoption underscores the industry’s trust in Nvidia’s technology and its potential to drive significant advancements in AI applications.

In conclusion, while Intel’s Gaudi 3 processor poses a new challenge to Nvidia’s dominance in the AI chip market, the unveiling of the Blackwell architecture demonstrates Nvidia’s commitment to innovation and its determination to maintain its leadership position. With promising advancements in performance, efficiency, and market adoption, Nvidia stock remains well-positioned to navigate the competitive landscape and deliver value to investors.

Also read: Analyzing The Future Trajectory Of Nvidia Stock In 2024

Leave a Reply