Paper trading is a very popular way to practice trading to enter the market in the UK. Paper trading provides a safety net. When we started, paper trading helped us navigate and explore the world of the stock exchange. Paper trading accounts are a viable way to test your trading strategy. If you’re looking to step into the business world with a paper business account, this guide has everything you need to know.

This detailed guide covers everything you need to know about the British paper trade. Here we will cover the advantages and limitations of paper trading. Read this guide till the end to know everything about this robot.

What is Paper Trading?

Paper trading is a simulated trading environment where users can “practice” trades without winning real money or taking risks. The term “paper trading” is derived from an ancient trading strategy backtesting method that allowed investors to practice paper trading with a newspaper, pen, and paper.

Paper trading is a hands-on skill using virtual currency, so you can enter and close trades, check the size of a commodity contract, familiarize yourself with the features and tools of the platform, find the right leverage for you and improve your operations, Skills, and backtesting of various trading strategies.

Paper trading is a very popular way to practice trading to enter the market in the UK. However, experienced traders and investors often use this type of trading account to test a specific trading strategy before putting it on the live applied market.

Paper trading is a great way to test new trading strategies or practice trading without risking losing real money. Losing your mock money trading documents is not a big deal. You can reset your account balance and start over at any time.

Benefits of Paper Trading in UK

Paper trading is a great tool for beginners and professional traders alike. So, below we have listed some of the main reasons you should use a UK paper trading account before you start trading for real money.

No risk of capital

Paper trading allows traders to simulate business activities without risking real capital. In other words, an account that allows you to practice trading, regardless of your trading knowledge and experience. This is possible because some online brokers allow you to open a demo account and practice virtual currency trading without making an initial deposit.

Easy Learning

A demo account is the best way to start trading and learn about the market. Because trading is not an easy task and entails many trading mistakes before becoming an expert, this type of account is designed to allow you to learn how to order, how to navigate the platform, analyze trading charts and understand the dynamics. of the market. You can also use the demo account to learn how to use the various trading features and tools offered by the broker.

Backtest trading strategy

One of the main advantages of paper trading accounts for beginners and experienced investors is the opportunity to test your trading strategy. Your trading strategy is very important to your trading success and should be tested on a demo account before putting your capital at risk. Also, while most online brokers allow access for a limited period of about 30 days, other trading platforms like eToro allow unrestricted access. This means you can test new trading strategies at any time on your practice account.

Limitations of Paper Trading

UK paper trading accounts allow traders to simulate real market prices and trading strategies without capital risk, but there are some important limitations to be aware of. These include:

- Emotionless trading- If you’re trading on paper, you’re most likely not doing it right because you’re not putting real money at risk. So you won’t feel connected to your trades and the demo account simply doesn’t simulate the feelings traders feel when trading real live markets.

- No slip- Transaction slippage is the term used to describe the difference between the expected price of a trade and the actual price at which the trade is executed. Trading through paper trading accounts is non-slip.

- Huge Commissions and Spread- You may face all kinds of hidden costs in real live trading accounts and various spreads not shown in demo accounts.

Paper Trading Strategies

The demo trading account is used to examine the capabilities of the trading platform of your choice, the trading conditions offered by the broker, and, most importantly, to test your trading strategies. So, let’s take a look at some of the most popular trading strategies available for paper trading accounts.

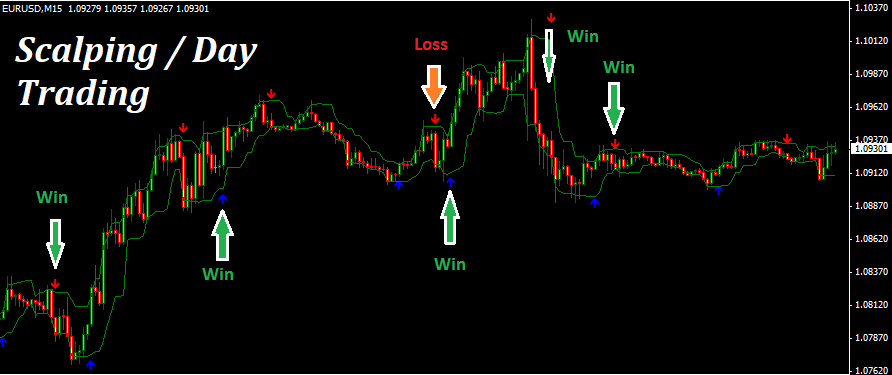

Scalping / Day Trading

Traders have been using intraday trading for years and are still considered risky and not suitable for all types of traders. However, to increase their chances of success, many day traders test different strategies on paper trading accounts before testing them in the real live market. When planning your day-to-day trades, you need to find a trading platform you can trust and test your trading skills and strategies before putting your capital at risk.

Day trading is about avoiding big losses rather than just making a profit, a paper trading account can be a great way to learn about the market. Therefore, it is important to track results and analyze entry and exit points at the end of each trading day.

Automated Trading

A UK paper trading account allows you to test your automated strategy. This means you can choose a specific automated trading solution and see if it works on a demo account. For example, brokers like eToro and FXCM allow you to use the CopyTrading tool, which allows you to copy other traders’ trades. If you are concerned about choosing the right trader, you can use a paper trading account to analyze a trader’s performance before putting your capital at risk.

Position Trading

Position trading is a trading strategy in which an investor holds a position for an extended period usually weeks or months. Testing your position trading strategy on a paper trading account can be challenging, but it can help you learn how to order, manage your existing trading positions, and become familiar with the broker’s software and trading conditions such as fees, margin, and leverage requirements.

Algorithm Trading

Algorithmic trading is a trading method in which orders are executed using advanced mathematical models and computer programs to define a set of instructions for placing orders on the market. Backtesting an algorithm means running it on historical data and checking its performance before using it in the real market. So, some brokers like AvaTrade allow you to test your algorithmic trading in a virtual trading environment.

How to find Best Trading Platform

Today, you have many options to choose from among the many different online Forex and CFD brokers operating in the UK. However, there are several key factors to consider before deciding on a paper business account.

Limited Time

Most online brokers offer paper trading accounts, but few offer unlimited access to demo accounts. I prefer to trade documents with brokers that offer non-expiring demo accounts, such as eToro and Plus500.

Tradeable Assets

It is wise to choose an online broker that offers access to a variety of markets and products, especially for beginners. This will help you find a product or market that suits your trading style.

Fees

Paper trading accounts are often offered by brokers with the best margins and trading fees. These terms do not necessarily carry over to your real account and should take into account the fees and margins charged by the broker.

Trading Platform

Choosing a trading platform is an important decision for traders and the choice largely depends on your needs and the trading strategy you want to follow. For example, eToro is the most recommended trading platform for social trading and Plus500 is the best for those looking for an affordable platform. Platforms like FXCM, AvaTrade, and Capital.com are more suitable for experienced traders.

Educational Materials

The purpose of having a paper trading account is to learn more about the trading process, understand the market, and use trading software. Many of the best online CFD brokers offer educational materials and research trading tools. It includes news articles, technical analysis alerts, guides, economic calendars, price alerts for trading signals, and calculation tools.

Trading Account Size

Each demo account has a starting virtual currency balance. Some brokers offer anywhere from £5,000 to £20,000 as a starting balance, while others allow you to exchange generous amounts of virtual currency. Regardless of your starting balance, it is wise to ensure realistic paper trades and adjust the correct position size to your expected investment amount. More importantly, you will learn how to calculate the lot size and pip of the platform.

Customer Service

Beginners are more likely to face many technical issues. Because of this, you need to make sure that the broker you choose supports multiple communication channels that provide an engaging trading experience.

Best Paper Trading Platform UK 2021

There are a lot of brokers to choose from, but we’ve compiled a list of the top 3 most trusted brokers in the UK that offer paper trading accounts.

eToro

eToro is one of the top-rated platforms. This paper stock trading app is compatible with iOS and Android devices and is free to download. It is important to create a trading account with eToro.

This is enough to learn all about online trading. In terms of tradable items, eToro has the largest number of asset classes. You can buy stocks, ETFs, and cryptocurrencies in terms of direct ownership. If you are interested in short-term trading strategies, eToro also offers CFDs. It includes the best stocks, indices, digital currencies, forex, commodities, and interest rates.

Another advantage of the eToro platform is its switching network capability. You can switch between demo and live accounts with a single click on their platform. Opening a paper trading account with eToro is completely free and you can use an unlimited demo account for as long as you want. When you’re ready to start trading real markets, eToro will ask UK investors to deposit a minimum of £150.

Plus500

Plus500 is a leader in CFD trading rooms worldwide. The platform hosts thousands of financial instruments across most asset classes such as bonds, shares, stocks, indexes, bonds, digital currencies, forex, and commodities. All Plus500 account users have access to the paper trading system.

Plus500 also offers a fast registration process for its proprietary trading platform that is very intuitive and can be used from any web browser or mobile phone. The leverage available for Forex trading on the Plus500 platform is 30:1 and the leverage for stock CFDs is 5:1. Plus500 offers two types of accounts: a demo account with no time limit and a real account that requires a minimum amount of time. Deposit £100.

Capital.com

Capital.com should be at the top of the list to trade cryptocurrencies. Since you trade this asset class via CFDs, you are familiar with the many benefits. For example, all traders in the UK and Europe can apply 1:2 leverage while trading cryptocurrencies on Capital.com.

Capital.com allows new and experienced traders to test the platform before investing real money. Capital.com’s paper trading account registration process is very simple and can be completed quickly. Aside from its unique artificial intelligence technology, the main advantage of this broker is the wide selection of stocks and cryptocurrencies. In total, investors have access to over 3,000 markets from a single platform.

Finally, in the UK Capital.com is fully regulated by the Financial Conduct Authority (FCA). The broker offers three types of accounts including Standard, Plus, and Premier. You can trade CFDs with leverage of up to 30:1 on each account type.

How to start Paper Trading UK

We have discussed about the top-rated trading platform, once you choose the trading platform you have to create a trading account with it. Following are the steps to create the account with eToro-

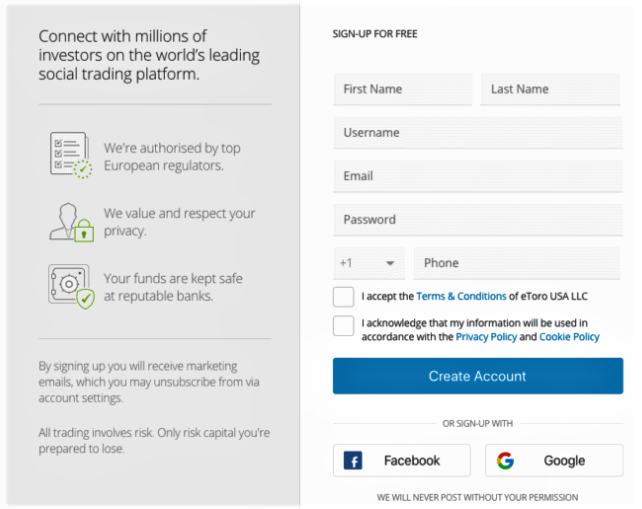

Step 1: Open a Paper Business Account

The first thing to do is to sign up for a risk-free paper trading account by visiting the eToro homepage and clicking the “Try Free Demo” button. You will then be prompted to enter your account creation email address and password, or you can log in with your Google, Facebook, or Apple account.

Step 2: Use demo account

You will now be redirected to the eToro trading platform where you can practice trading with a virtual balance of USD 100,000. However, it is important to familiarize yourself with the platform before you start trading. For those with experience with other platforms, it only takes a few seconds or minutes to become familiar with the eToro trading platform. For beginners, it is important to learn and easily learn all the tools the platform has to offer.

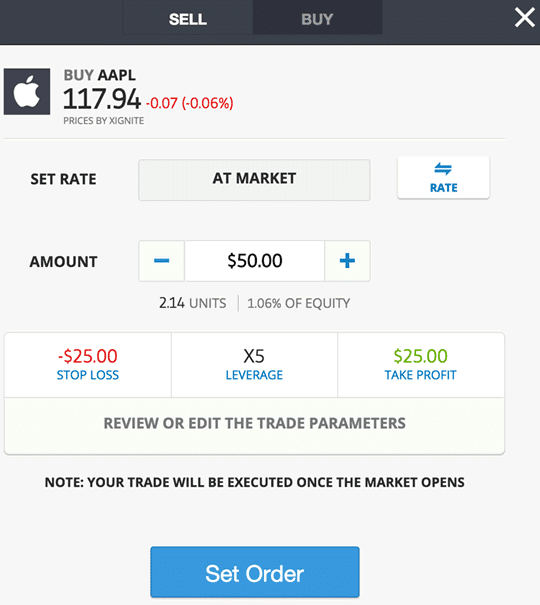

Step 3: Place your order

Next, you need to learn how to order. In this example, we want to trade British Pounds against US Dollars, so let’s enter this FX currency pair in the search box at the top of the platform. This will open the order box. By clicking Buy or Sell, you can change the trade amount and insert Take Profit and Stop Loss orders. Finally, click the Buy button to confirm the market order.

Step 4: Start real-time Trading

Once you are confident in trading your demo account, you should consider moving on to the next level of live market trading. The process is very simple and you can easily switch from a paper trading account to a real money account. To start a real account, you need to pay a deposit of at least £100.

Final Words

The paper trade is very important for anyone who wants to enter the commercial world. It’s also important to understand the limitations that come with demo accounts. Ultimately, banknotes are not real, so you won’t have the same feeling when trading real money.

UK paper trading is the most efficient way to gain trading experience without risking your money. Demo trading accounts give new investors and traders a general idea of how the market works and how the broker’s platform works. It is important to choose a demo account that suits your needs, try to learn as much as possible, and make it real with a paper trading account.

FAQs

Why is paper trading important?

The paper trade offers near-practical experiences that are far more valuable than mere theoretical knowledge. With theoretical insight, you can be a genius, but given the speed of movement in a real business environment, you can freeze and fail miserably.

Who can benefit from the paper trade?

Paper trading is considered very useful for new traders, but the truth is that it can benefit anyone. Even experts use paper trading when developing new strategies.

Can I make money with a virtual trading account?

Paper trading is a virtual account that uses virtual currency to conduct fake transactions. The profits and losses you make are just simulations of what might happen during live trading. However, you can use paper trades in investment contests, in which case you can win some cash as prize money.

What are the best paper trading sites?

It depends on your goals. Ask yourself what you want to achieve with the platform. You can list your goals and then take a look at some of the trading platforms that offer paper trading to see if you achieve your goals. We recommend choosing a trading platform that you plan to use for live trading and it should be regulated.