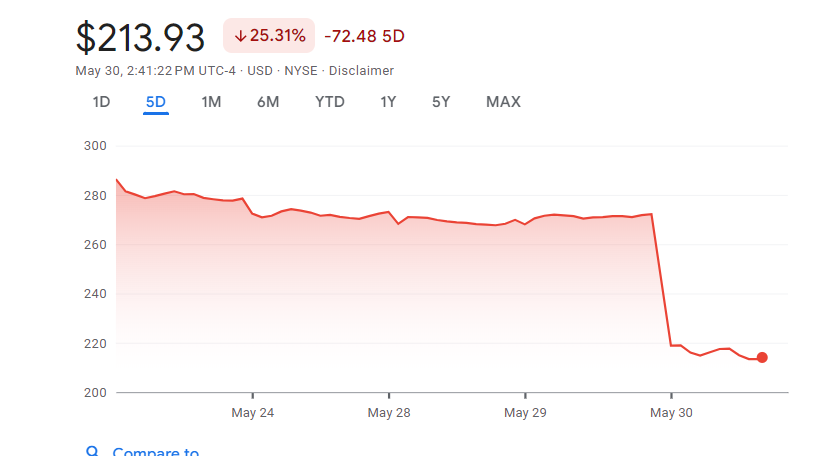

Salesforce stock has recently faced a dramatic decline, plummeting as much as 25% in premarket trading following the company’s first-quarter earnings report for 2025.

This sharp decline has raised concerns among investors about Salesforce’s future prospects. With a history of strong growth, the recent downturn poses a critical question: Should you invest in Salesforce stock now?

Salesforce Recent Performance

In the first quarter of 2025, Salesforce reported an EPS of $2.44, exceeding the analyst estimate of $2.37. This positive earnings surprise indicates that Salesforce’s cost-cutting measures and profitability improvements are bearing fruit. However, the company reported revenue of $9.13 billion, slightly below the analyst estimate of $9.15 billion. This 0.19% shortfall in revenue reflects a slower-than-expected growth trajectory, which has been a growing concern for investors.

Salesforce’s guidance for the current quarter fueled further apprehension. The company projected revenue to rise by 8% to $9.25 billion, marking the slowest growth rate in its history as a publicly traded company. This projection fell short of the average analyst estimate of $9.35 billion. Additionally, the forecasted EPS of $2.35 was below the expected $2.40. As a result, Salesforce stock dropped to $213 in premarket trading, a stark contrast to its previous close at $271.62. If this decline persists, it will be the biggest intraday drop since August 2008.

Factors Behind the Decline

- Slowing Sales Growth: Over the past year, the company has shifted its focus towards improving profitability, but this has come at the expense of revenue growth. Analysts have expressed concerns about Salesforce’s ability to maintain relevance as the industry increasingly embraces AI tools. The company has touted its AI-oriented software as a potential revenue booster, but most analysts do not expect significant contributions from these features until 2025 or 2026.

- Industry Dynamics and Competition: Salesforce operates in a highly competitive environment, facing challenges from both established tech giants like Microsoft and emerging players in the CRM space. Microsoft’s Dynamics CRM platform, for instance, has been growing rapidly, adding pressure on Salesforce to innovate and expand its offerings.

- Strategic Shifts and Investor Sentiment: The company has increased its share buybacks and initiated a dividend, moves that are typically seen as indicators of limited growth opportunities. While these measures are designed to keep investors happy, they also signal a shift towards a more mature, slower-growing phase for the company.

Future outlook

Salesforce’s management has emphasized the long-term potential of its AI and data cloud offerings. The company’s Data Cloud, which organizes information for analysis and AI, saw a 24% increase in revenue, reaching $1.4 billion. This performance exceeded analyst expectations and highlights the growing importance of data analytics and AI in Salesforce’s strategy. However, the broader impact of these technologies on Salesforce’s overall revenue is still uncertain and will take time to materialize.

Salesforce has a history of strategic acquisitions to bolster its product portfolio and drive growth. Recent reports indicated that the company considered acquiring Informatica Inc., a data organization software maker, although talks did not progress. This reflects Salesforce’s ongoing commitment to enhancing its capabilities through inorganic growth. However, past acquisitions, such as the $27 billion purchase of Slack, have faced mixed reactions from investors, some of whom are wary of large-scale deals.

Despite the challenges, Salesforce remains financially robust. The company’s focus on improving profitability has yielded positive results, as evidenced by the higher-than-expected EPS. Additionally, Salesforce’s current remaining performance obligation, a measure of contracted sales, increased by 10% to $26.4 billion. This indicates a healthy pipeline of future revenue, although it fell short of some estimates.

Should You Invest in Salesforce Stock Now?

Salesforce’s current valuation and growth prospects present a mixed picture for potential investors. The Salesforce stock decline has made it more attractively priced, but the underlying concerns about slowing growth cannot be ignored. Analysts expect Salesforce’s revenue to grow at a compound annual growth rate (CAGR) of 10% from fiscal 2024 to fiscal 2027, while EPS is projected to increase at a CAGR of 28% during the same period. These figures suggest that Salesforce still has room for growth, albeit at a slower pace than in the past.

Salesforce remains a dominant player in the CRM market, with a comprehensive suite of cloud-based services that are deeply embedded in many organizations. The company’s strong market position and extensive customer base provide a solid foundation for future growth. Additionally, Salesforce’s ongoing investments in AI and data analytics could drive innovation and enhance its competitive advantage over time.

Investors should also consider several risk factors before deciding to invest in CRM stock. The primary risk is the potential for continued deceleration in revenue growth, particularly if macroeconomic conditions remain challenging. Additionally, increased competition from other tech giants and smaller CRM providers could erode Salesforce’s market share. Finally, any missteps in executing its AI strategy or integrating future acquisitions could negatively impact the company’s performance.

Also read:

Final Thoughts

Salesforce stock decline reflects a complex interplay of slowing growth, competitive pressures, and strategic shifts. While the company’s long-term potential remains intact, the near-term outlook is clouded by uncertainty. For investors, the decision to invest in CRM stock now hinges on their risk tolerance and confidence in Salesforce’s ability to navigate its current challenges and capitalize on emerging opportunities in AI and data analytics.

Leave a Reply