The landscape of social media stocks is evolving rapidly in 2024, driven by technological advancements, shifting consumer behaviors, and robust financial performances. As investors weigh their options, several factors come into play when considering the potential of investing in social media stocks this year.

1. Financial Performance and Growth Trajectories

Top social media companies like Meta Platforms, Pinterest, and Snap have shown impressive growth in 2024. Meta, known for its flagship Facebook platform, has seen its stock soar by 195%, buoyed by strong ad revenue growth and strategic investments in AI and the metaverse. Pinterest and Snap, although recovering from previous setbacks, have also demonstrated significant rebounds with their stocks climbing 53% and 87% respectively year-to-date. Both companies are leveraging AI to enhance user engagement and advertiser value, positioning themselves for sustainable growth.

2. Market Trends and Competitive Edge

The resurgence in ad spending, coupled with advancements in AI-driven advertising technologies, has bolstered the revenue streams of social media companies. Meta’s Advantage+ and Pinterest’s Performance+ are prime examples of how AI is reshaping digital advertising, offering targeted solutions that attract advertisers and drive revenue growth. These technological innovations not only differentiate these companies but also enhance their competitive edge in a crowded market.

3. Regulatory Environment and Strategic Risks

The regulatory landscape remains a critical factor for social media stocks. Concerns over data privacy, content moderation, and antitrust issues continue to pose challenges, potentially impacting future growth prospects. Investors should monitor how companies navigate regulatory hurdles and adapt their strategies to mitigate risks associated with changing regulations.

4. Long-Term Investment Potential

Looking beyond short-term gains, social media stocks present compelling opportunities for long-term investors. As these companies expand their AI capabilities, explore new revenue streams like virtual reality (VR), and adapt to evolving consumer preferences, they may unlock additional value that could drive sustained growth over the coming years.

5 Best Social Media Stocks to Invest in 2024

Investing in social media stocks in 2024 holds promise as these companies capitalize on evolving consumer trends, technological advancements, and robust digital advertising growth. Here are five standout social media stocks poised to deliver potential returns:

1. Meta Platforms (NASDAQ: META)

Meta Platforms, formerly Facebook, remains a dominant force in social networking with a suite of apps including Facebook, Instagram, WhatsApp, and emerging platforms like Reels. The company’s stock has surged by 45% year-to-date, fueled by robust earnings driven largely by advertising revenue. Meta’s strategic investments in AI and metaverse technologies position it at the forefront of future digital trends. Despite regulatory challenges and competition, Meta’s forward-thinking approach and strong financial performance make it a compelling investment option in 2024.

2. Pinterest (NYSE: PINS)

Pinterest has redefined social media with its visual discovery platform, attracting users seeking inspiration for hobbies, recipes, and lifestyle interests. The company’s stock has climbed 20% YTD, driven by its innovative AI-driven advertising tool, Performance+. This tool enhances ad targeting and effectiveness, mirroring Meta’s successful Advantage+ model. As Pinterest expands its AI capabilities and refines its content-recommendation algorithms through Pinterest Labs, it continues to strengthen its competitive position in the digital advertising landscape. For investors looking at long-term growth potential in social media, Pinterest offers a promising opportunity in 2024.

3. Snap (NYSE: SNAP)

Snapchat, operated by Snap Inc., remains a pioneer in mobile communication through short videos and images known as Snaps. Despite challenges and fierce competition, Snap’s stock has soared 38% over one year as the company pivots towards AI-driven ad optimization. Snap’s focus on augmented reality (AR) and innovative content creation tools aligns with evolving consumer preferences and digital advertising trends. With potential upside from a potential TikTok ban in the U.S., Snap presents a high-growth opportunity for investors bullish on digital engagement and advertising recovery in 2024.

4. Adobe (NASDAQ: ADBE)

Adobe, though not a traditional social media company, plays a pivotal role in digital marketing and creative software solutions. The company’s diverse suite of products, including Photoshop and Adobe Creative Cloud, empowers businesses and creators to enhance their digital presence through content creation and marketing. Adobe’s robust financial performance, highlighted by a 10% increase in revenue year-over-year, underscores its resilience and strategic relevance in the digital economy. For investors seeking exposure to digital transformation beyond social networking, Adobe offers stability and growth potential in 2024.

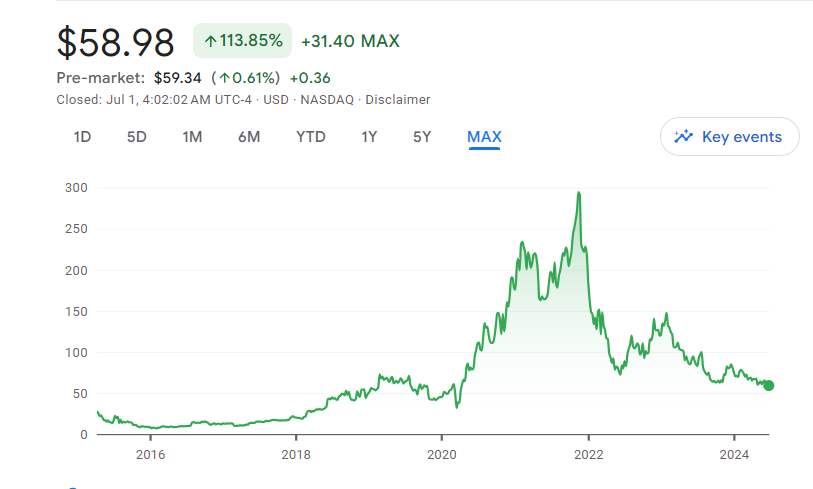

5. Etsy (NASDAQ: ETSY)

Etsy has carved a niche in e-commerce by connecting millions of buyers with unique handmade and vintage goods. Beyond its role as a marketplace, Etsy fosters social engagement and community among creators and consumers worldwide. The company’s strategic acquisitions, including Reverb and Depop, have expanded its market reach and relevance, particularly among younger demographics. With over 96 million active buyers and a commitment to sustainable commerce, Etsy continues to innovate in social commerce, making it a compelling investment for those interested in the intersection of e-commerce and social interaction in 2024.

Final Thoughts

Investing in social media stocks in 2024 presents a compelling opportunity amidst technological innovation and robust financial performances. Companies like Meta Platforms, Pinterest, Snap, Adobe, and Etsy are leveraging AI, digital advertising, and unique market niches to drive growth.

In conclusion, social media stocks remain poised to capitalize on shifting consumer behaviors and technological advancements, offering investors diversified avenues for potential returns in the years ahead.

Leave a Reply