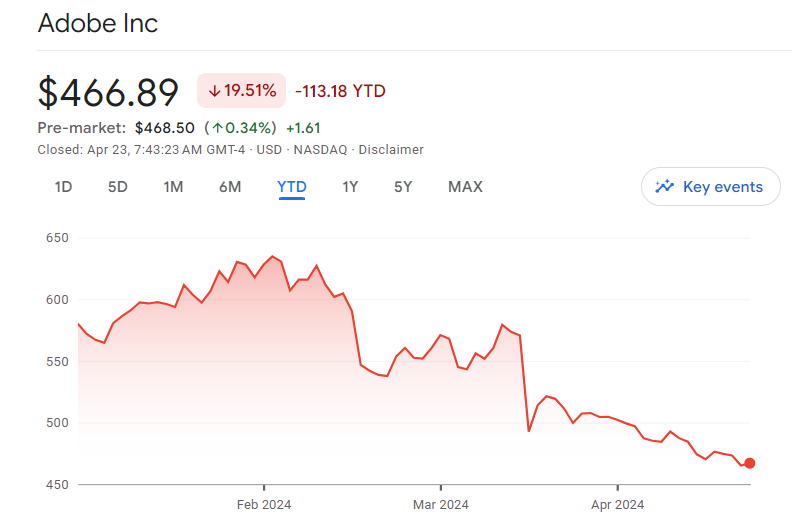

Adobe stock has been a formidable player in the software industry, delivering remarkable gains to investors over the past decade. However, despite its impressive long-term performance, the stock has faced significant challenges in 2024.

With a decline of over 20% year-to-date and trading 32% below its all-time highs, investors are presented with a compelling opportunity to consider whether it’s wise to buy the dip in Adobe stock.

Factors Influencing Investment Decisions

- Q1 Performance and Outlook: Adobe’s Q1 results for fiscal 2024 revealed mixed signals. While the company surpassed revenue and earnings expectations, a cautious outlook for Q2 triggered a substantial sell-off. The discrepancy between Adobe’s projections and Wall Street estimates has raised concerns among investors regarding the company’s growth trajectory.

- Analyst Sentiment: Following the disappointing forecast, Adobe experienced a wave of analyst downgrades. Despite the downgrades, several firms maintain bullish sentiments, emphasizing the potential of Adobe’s AI initiatives, particularly Firefly. The divergence in analyst opinions underscores the uncertainty surrounding Adobe’s future performance.

- Valuation Metrics: Adobe’s current valuation metrics indicate a relatively high price compared to its projected earnings growth. Trading at 10x forward sales and 28x forward earnings, the stock appears lofty, especially considering the modest earnings growth forecasted by analysts over the next five years. This suggests that investors may be paying a premium for Adobe’s growth potential.

Should you buy Adobe stock?

Considering the aforementioned factors, the decision to invest in Adobe stock amidst its 2024 dip warrants careful evaluation.

- Positive Outlook: Despite short-term setbacks, Adobe’s long-term prospects remain promising, fueled by its dominant position in the software industry and ongoing innovation in AI technologies. Furthermore, the bullish sentiment from some analysts reflects confidence in the company’s ability to overcome current challenges and deliver future growth.

- Risk Factors: However, there are notable risks associated with investing in Adobe at this juncture. The uncertainty surrounding the pace of monetization for AI initiatives, coupled with the cautious revenue outlook, could hinder the stock’s recovery in the near term. Additionally, the relatively high valuation metrics imply a heightened risk of potential downside if growth expectations are not met.

Final Thoughts

In conclusion, the decision to invest in Adobe stock in its 2024 dip requires careful consideration of both the company’s potential for future growth and the associated risks. While the stock presents an opportunity for investors seeking exposure to a leading software company with innovative AI offerings, it also entails risks related to valuation and revenue outlook. Investors should conduct thorough research and assess their risk tolerance before making any investment decisions regarding Adobe stock in its current state.

Also read: Two Cheap Dividend Paying Stocks In UK You Should Buy Right Now

Leave a Reply