SoundHound AI, a leading player in the field of voice recognition software, has been making waves in the investment community and garnering significant attention from both investors and Wall Street alike. With interest in voice-powered AI assistants on the rise, SoundHound AI’s innovative technology and strategic partnerships, particularly with Nvidia, have positioned it as a standout contender in the market.

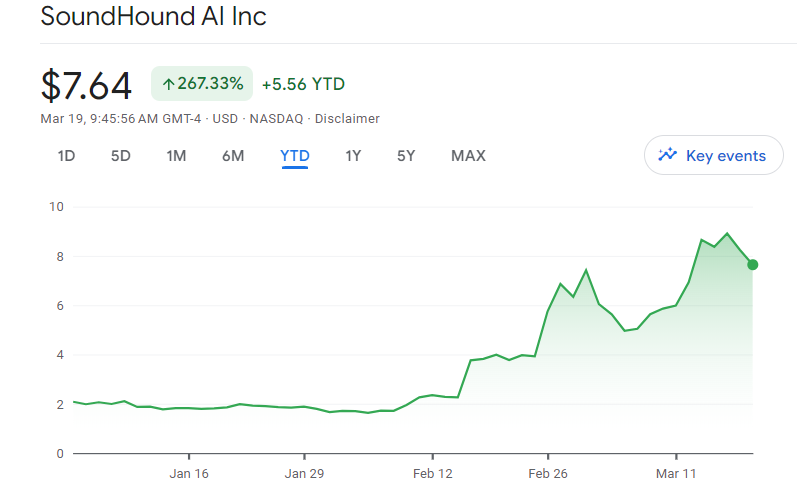

Since the beginning of 2024, shares of SoundHound AI have skyrocketed by an impressive 267%, signaling a remarkable growth trajectory for the company. Investors who seized the opportunity by purchasing shares at all-time lows in January have seen substantial returns, underscoring the potential for significant profits within this burgeoning sector.

A Closer Look at SoundHound AI

SoundHound AI’s technology is widely utilized across various sectors, including automotive, hospitality, and smart home appliances, boasting an impressive client roster that includes industry giants like Qualcomm, Toast, Block, and Hyundai. The company’s focus on delivering innovative solutions in voice recognition has positioned it favorably in an increasingly competitive landscape.

While SoundHound AI has demonstrated strong revenue growth, generating $45.9 million in revenue for the fiscal year ended December 31, 2023, representing a 48% year-over-year increase, it remains relatively small compared to other AI-driven industries. Despite this, disciplined cost controls have enabled the company to halve its losses on an adjusted EBITDA basis, showcasing promising financial momentum.

Forecast and Analysis

According to projections, SoundHound AI is expected to maintain its impressive growth trajectory, with revenue forecasted to increase by approximately 50% in both 2024 and 2025. Extrapolating this growth rate, the company could reach $100 million in revenue by 2025 and potentially achieve $780 million in sales by 2030.

However, while the prospects for SoundHound AI are undoubtedly promising, investors are advised to approach with caution. While the potential for significant returns exists, the competitive landscape and macroeconomic uncertainties present formidable challenges. As such, sound investment strategies, such as diversification and prudent risk management, remain essential in navigating the dynamic landscape of AI-driven industries.

Also read: Best AI Stocks to Buy in 2024

Leave a Reply