When it comes to trading, no one wants to lose money. That is why it is critical to establish a limit for your security stance. Stop-loss orders are used in this situation. Many investors, however, struggle to determine where to place their stop-loss thresholds. If you place them too far apart and the market moves in the opposite direction, you might lose a lot of money. You can get out of a position too rapidly if you set your stop-losses too close together.

We will explain how stop-loss orders work, why they are essential, and how to set them up in this guide. You’ll have greater control over your portfolio this way, which is the whole goal of investing.

What is Stop Loss?

A stop-loss order is a purchase or sale order made with a broker when the price of an asset reaches a certain level. Stop-loss orders are different from stop-limit orders in that they are intended to minimize an investor’s loss on a position in a security. When a stock goes down below the stop value, the order transforms into a market order, which executes at the best available price.

For example, consider a trader who is placing a $30 investment on a stock. If he sets a stop-loss order at $25, his position will be automatically terminated if the price falls to $25. As a result, the risk level of the company is reduced to $5 per share.

What is Stop-Limit?

Stop-limit orders are similar to stop-loss orders in that they limit the amount of money you can lose. However, as their name implies, the price at which they will execute has a limit. The stop price (which changes the order to a sell order) and the limit price are both specified in a stop-limit order. Rather than being a market order to sell, the sell order becomes a limit order that will only perform if the price is equal to or better than the limit price.

Let’s continue with the previous scenario and assume a stock never reaches the stop-loss price. Instead, it keeps rising, finally reaching $40 per share. The trader cancels his stop-loss order at $25 and replaces it with a stop-limit order at $35 with a $33 limit. The order becomes an active sell-limit order if the stock price goes below $33. If the stock price drops below $35 before the order is filled, it will remain unfilled until the price raises over $35 again.

How does Stop-Loss Work?

The concept is simple when the price of the asset approaches or surpasses the amount of the stop loss specified before placing the order, the position is immediately closed. As a result, we can conclude that in some situations, this method can also be used to lock in a profit.

Let’s imagine a trader paid $2 for an instrument. The price eventually jumps to $5. He can then elect to sell the stock using a $3 stop-loss order. If the price falls back to $3, he will receive $1 per share.

How to start trading with Stop Loss?

We’ll now walk you through the detailed guide on how to place a stop-loss order.

Step 1: Choose an Online Broker

To be able to trade with stop-loss, you must first choose a trusted broker. However, choosing from the hundreds of possibilities available on the internet today might be challenging, so we’ve made it easy for you. Our top 5 online brokers for stop loss trading are listed below:

1. eToro

eToro was founded in 2006 and is now one of the world’s leading online brokers. It is licensed by various financial regulators, including the FCA of the United Kingdom and the CySec of Cyprus. It functions in more than 190 countries throughout the world.

eToro is well-known for its efficiency and simplicity. It also equips you with the necessary tools to conduct accurate technical analysis and properly establish an eToro stop loss.

Furthermore, beginner traders will like this broker’s practical features, such as the demo account and social trading. It also provides a wide range of instruments, including stocks, ETFs, indexes, cryptocurrencies, currency pairs, and commodities, among others. It allows you to choose between two investing options:

- Direct investment in stocks or ETFs: this allows you to purchase stocks or ETFs and own them outright.

- CFD Trading: you open a sell or buy position on an asset without really owning it when you trade CFDs.

Pros

- Regulated BrokerTrading platform that is both efficient and simple to use

- Security system from the start: 2-factor authentication and SSL encryption

- There are a variety of financial instruments to trade.

- Beginner-friendly features

- Apps for Android and iOS are available.

- Fees that are reasonable

- Possibility of making product recommendations by contacting customer care

Cons

- Not recommended for the advanced trader

2. Libertex

This broker is one of the market’s earliest internet brokers. It was founded in 1999 and now provides services all over the world. The Cyprus Securities and Exchange Commission (CySec) regulates this serious and professional broker.

Libertex provides two different trading platforms:

- MetaTrader 4: a well-known and effective trading platform, but because of its sophisticated interface, it is best suited to experienced investors. It is also well-liked by traders who use trading robots.

- WebTrader: a web-based trading platform that can be used in any web browser. Because of its intuitive interface and ease of use, it is better suited for beginners.

Libertex allows you to trade with a stop loss without having to pay a spread. It is, in fact, a commission broker that, as the name implies, compensates itself by keeping minimal commissions per transaction. Even though the departure from the spread is usually minor, many traders believe this technique to be more transparent.

Pros

- Online broker with a good reputation

- Two effective trading systems

- A demo account as well as educational content available

- A variety of instruments to trade

- A stock market app for Android and iOS

- Spread-free trading

- Commissions are low

Cons

- There will be no social trading

- There will be no direct investment

3. Capital.com

Capital.com was founded in the year 2016. As a result, it is not only one of the most recent brokers, but also one of the most trustworthy. It is currently regulated by the FCA and CySec, and its services are offered all around the world.

Capital.com has created its own trading platform that incorporates artificial intelligence. As a result, it analyses the market and gives traders individualized advice based on their profile and activity. Furthermore, several indicators such as Fibonacci retracements and others are available to assist you in determining where your stop Loss should be placed.

Pros

- Regulated and trustworthy

- Trading platform that is smart and simple to use

- There are a number of indicators and trading tools available

- Financial instruments with a wide range of uses

- There is a mobile app available

- A demo account and training

Cons

- There will be no social trading

- There is no direct investment

- Trading fees are a little more than on eToro

4. XM

XM is a brokerage firm founded in 2009. The online broker provides a wide range of services, including currency, commodity, CFD, and stock indices trading. The XM platform is well-known around the world. It has about 3,500,000 users in more than 190 countries.

The XM platform also has a high level of dependability. It is, in fact, regulated by a number of international financial firms, including CySEC, ASIC, and the IFSC.

XM showcases some of the most fascinating and useful aspects. The site has a lot of educational content to cater to traders of all levels.

You can choose from a variety of educational content, including clear, informative, and easy-to-understand webinars and video tutorials. The XM Live feature, which gives you access to live training, is also available.

XM offers the MetaTrader 4 and MetaTrader 5 trading platforms to its customers for stop-loss trading. If the broker does not have its own platform, MetaTrader 4 may be a benefit because it is used by the vast majority of traders throughout the world.

Besides that, MetaTrader 5 is a valuable asset for the XM broker, as it is still only available from a small number of brokers, and only a select few have access to it. XM, an online broker, also includes a number of analytical tools that can help you properly determine your stop losses at the chart level.

Pros

- The platform offers extensive educational and training resources

- Excellent client service

- There are no fees for deposits or withdrawals

- Forex offers a diverse choice of currency pairs

- CySEC, ASIC, and the IFSC all regulate the broker

Cons

- In the United States and Canada, the platform is not available

5. XTB

/xtb_productcard-5c61e60d46e0fb0001f08eb8.png)

XTB is a Polish internet broker that first opened its doors in 2002. This is a Forex and CFD broker that focuses on trading. This online broker boasts a large user base of several hundred thousand people. This trust is largely due to the broker’s reputation, which it has built over the course of its two decades in business.

XTB is a trustworthy online broker that is regulated by a number of financial agencies. AMF is one of the institutions in charge of broker regulation.

XTB offers a variety of trading platforms, including xStation, xStation Mobile, and MetaTrader 4. These platforms include a variety of technical analysis tools that are suited for both beginners and experienced traders. advancements. Stop-loss traders, independent of Fibonacci retracements or other indicators, have instruments at their disposal.

Pros

- Fees and charges that are reasonable

- Traders have access to a wide range of financial assets through its MT4 and xStation trading platforms, which are appropriate for traders of all levels

- Forex spreads are rather low

Cons

- Withdrawal times that are unusually long

- Unable to create a PEA account

Step 2: Open A Trading Account

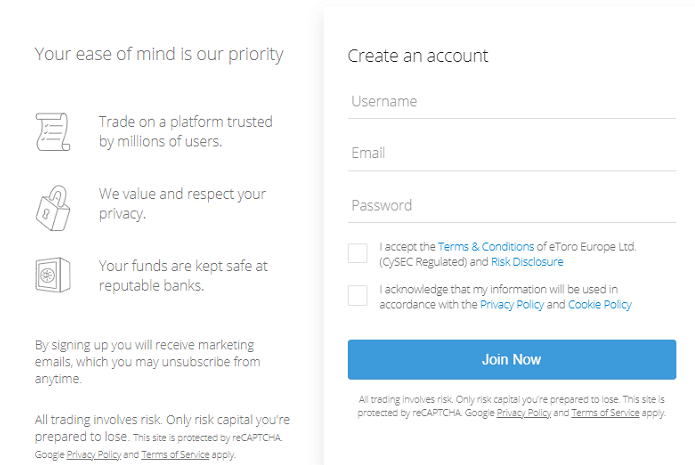

We now explain to you the procedures to take in order to trade with a stop loss at the eToro broker. To begin, you must first create an account on the platform.

Create an account

Go to the eToro main website and select “Join Now.” Then, by providing some basic information, fill out the form that appears.

Then, click the boxes that say you agree to the terms of service and privacy policies. Finally, select “Create an account”.

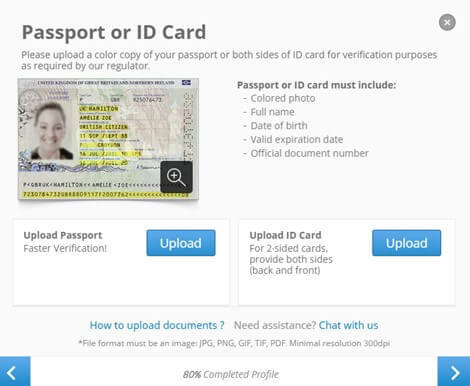

Verification

To use the features, you must first validate your account and verify your identity.

To do so, go to “Complete profile” and then follow the instructions below.

- Provide more detailed personal data, such as your full name or actual address.

- Complete the ” Know Your Customer ” survey.

- Enter your phone number and the code sent to you via SMS.

- Upload a copy of your driver’s license and proof of residency.

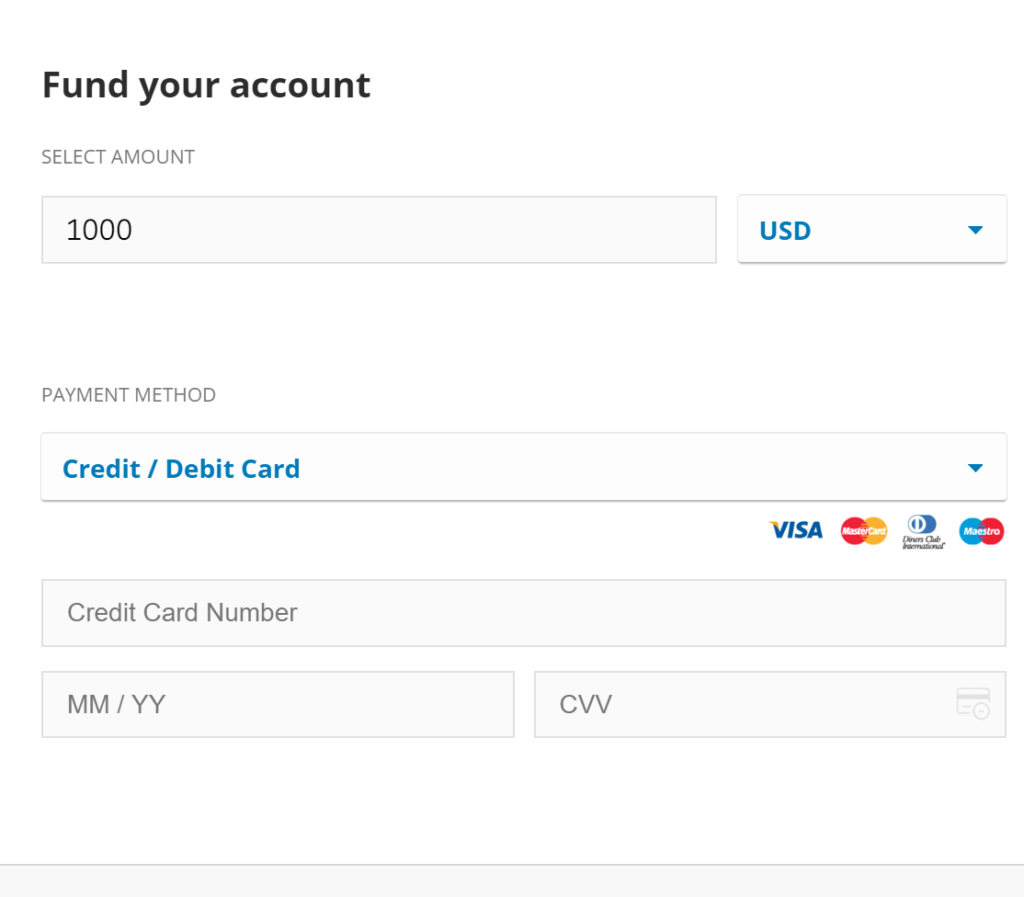

Step 3: Deposit Funds

To fund your eToro account, select “Deposit Funds.” Then enter the amount you want to deposit a $50 is the least amount that is required by eToro. Choose from a variety of payment options, including bank transfer, credit/debit card, PayPal, and Skrill.

Step 4: Trade with stop loss to limit your losses

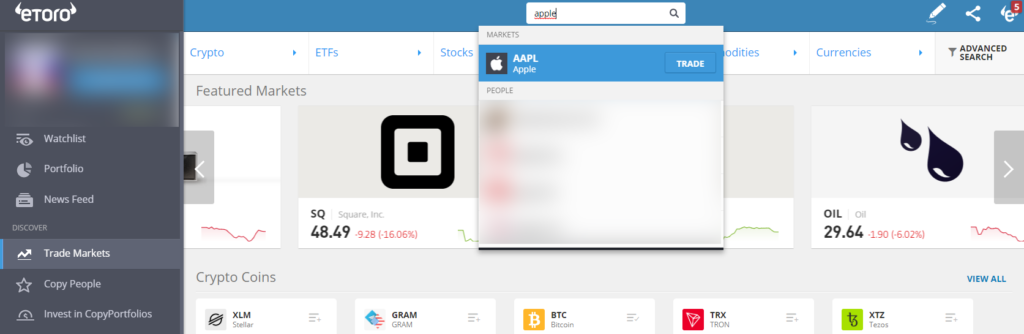

Click on the “Markets” option to see a list of financial instruments offered by eToro. Then select your preferred category: stocks, indices, currencies, Forex, commodities, or ETFs. For this example, we choose to invest in Stocks by trading apple stocks.

To save time, type “Apple” into the search field and then identify the correct choice.

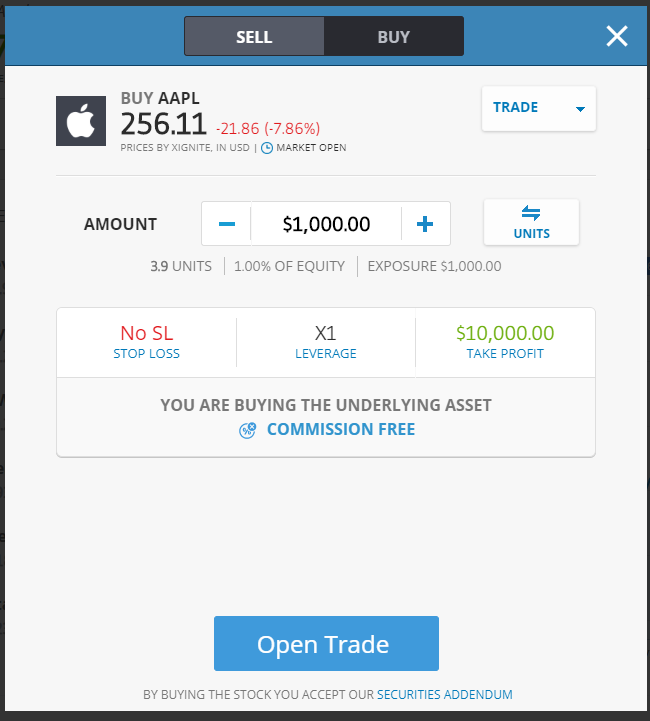

Consult the chart you have available and perform technical analysis using the tools and indicators to determine the stop loss. When you’re finished, click “Trade.” Next, enter the amount you want to invest in the stock and set the stop loss, leverage, and take profit settings.

Finally, select “Open Trade”.

Methods of performing the stop loss calculation

You can calculate the stop loss in one of two ways: absolutely or relative. Find out what the key distinctions are between these two ways and how to pick the one that’s right for you.

1. Absolute Stop Loss

A stop-loss that is determined using a financial loss ratio is known as an absolute stop loss. Depending on the category of the asset being traded, this level can be expressed in a variety of ways. If you’re trading Forex, it’s represented in pips; if you’re trading stocks, it’s represented in euros or dollars.

As a result, if you set a stop loss at 10 pips, you will close your position if the loss reaches 10 pips. A $10 stop loss, on the other hand, suggests that you close your position if the stock price falls to $10.

In general, traders choose the absolute stop loss while trading in the short term. Those who engage in scalping trading are the ones who use it the most.

2. Relative Stop Loss

The percentage represents the relative stop loss. It entails calculating a percentage limit for the negative variance in order to close the trade. This is an approach that is most commonly employed in stock trading and is ideal for the short and medium-term.

Because the movement of currency pairings is measured in pips rather than percentages, relative stop losses are rarely used in forex trading. The relative stop loss is calculated as a percentage of the invested capital lost. For example, if your loss reaches 5% of your initial investment, you close your position.

What to choose between Absolute and Relative Stop Loss?

The period of your investment and the sort of financial instrument you desire to trade influence your stop loss decision. If you’re considering a short-term investment and primarily want to invest in Forex, an absolute stop loss is better.

The relative stop loss, on the other hand, is better ideal for long-term investments or swing trading. It’s better for people who want to invest in equities.

When the two stop losses are compared, the relative stop loss is best adapted for all trading methods. You can calculate the number of successive losses before losing all of your money by specifying a percentage in reference to your beginning capital.

Methods to Place Stop Loss Order

In this section, we’ll look at how to place a Stop Loss using a variety of approaches that can be used in conjunction.

Stop Loss In Points

Stop-loss orders are indicated in cash value and are represented in points. Then it’s a matter of pips for Forex and currencies like the dollar or the euro for stocks.

Stop Loss Chart

This is a stop loss defined by charts. To do so, the trader usually employs simple strategies such as resistance and support. For example, he may decide to trade his buy stop loss below a key support level.

Stop Loss with Indicators

As previously said, indicators can be used to determine how to position your stop loss before initiating a trading account. Fibonacci retracements, pivot points, and moving averages are the most well-known of these. Besides that, we should point out that there are a variety of additional techniques to consider.

Stop-Loss Volatility

The volatility approach entails deciding on a trading stop loss depending on market swings. The ATR (Average True Range) indicator is commonly used by traders to examine the extent of previous movements and candle sizes. Here’s how to assess the data to figure out where to set a stop loss:

- High ATR: It indicates that the asset’s previous volatility has been high. To avoid big volatility, it would be prudent to establish a high stop loss.

- Low ATR: It indicates that the asset’s past volatility has been low. As a result, the trader can use a tight stop loss.

It is recommended to use a stop loss 3 times higher than the ATR, according to a very common and effective technique.

Psychological Stop Loss

The psychological stop-loss refers to the highest loss quantity in dollars or another currency that you are willing to accept.

What Parameters Should Be Considered When Calculating A Stop Loss?

Calculating Stop Losses Using Important Thresholds

Technical analysis of the stock market or Forex is an effective approach to calculate stop-losses and take-profits. As a result, critical thresholds that translate into potential degrees of market obstruction or friction can be identified.

To identify them, you can use a variety of methods such as Fibonacci retracements, pivot points, or supports and resistances.

Calculation of the Stop Loss based on the Gains Targets

In trading, the risk must always be less than the profit target. Many experts also believe that choosing a take profit that is twice as large as the stop loss makes more sense. So, if you want to hit a +10 percent target, you should set a stop loss of around -5 percent.

Finally, essential criteria must be identified in order to calculate the stop loss and take profit while guaranteeing that the profit goal is always greater than the risk.

What is a Trailing Stop Loss?

A trailing stop loss, also known as a trailing stop, is a stop that moves automatically based on criteria set by the trader. It assists in risk management by allowing you to protect your profits in an open position by tracking the market price movement.

The trailing stop loss moves in line with the rising stock price, effectively closing the trade when the market moves against you. When going long, the trader places a trailing stop-loss order under the present market value. The trailing stop loss is placed above the present market value in the situation of a short position.

Basically, the trailing stop loss helps traders to protect their profits and keep their trades open as long as the market swings in their favor. When the price moves in the opposite direction of the specified stop loss, the order is automatically terminated.

How does the Trailing Stop Loss Works?

The trailing stop loss moves in the position of the favorable market movement automatically. It is, after all, designed to protect your winnings while limiting your losses.

If you place a 5% trailing stop loss on your long position your trade will automatically terminate if the price falls 5% below the maximum price specified at the time of purchase.

When the price reaches a new high, it will automatically move upward. The new trailing stop loss will be determined based on this new price and will no longer fall, protecting your previous gains.

A trailing stop loss may be more advantageous than a fixed stop loss. It is more adaptable, as it changes automatically in response to the direction of the stock market price. Furthermore, unlike the fixed stop loss, there is no need to manually adjust it.

How to Use a Trailing Stop Loss?

The most important thing to remember when utilizing a trailing stop-loss order is to set it at a level that is neither too wide nor too tight. However, if you set a trailing stop that is too tight, it will be activated by daily market fluctuations. In other words, your deal will not have the flexibility to develop as you would like.

A very strong trailing stop loss most often results in a loss. A trailing stop that is too big, on the other hand, will not adjust to the market’s daily changes, and you risk incurring huge losses unnecessarily or missing out on significant profit potential.

The actual issue is figuring just how far to set your trailing stop loss. Because markets move entirely by chance, this distance is difficult to define. Setting the trailing stop loss at 3x the ATR indicator is the best way to go. A technical indicator is used to determine the level of market volatility.

Advantages of using A Stop Loss In Trading

If you’re still undecided about employing a stop loss, we’ll walk you through the key benefits of doing so. Find out why using a stop loss can be beneficial for you.

Possible Losses are Reduced, and Performances are Improved

The stop loss is a maximum loss barrier that the trader establishes ahead of time. In other words, a stop loss is used to limit the amount of money that can be lost during a transaction. You contribute to the enhancement of your trading performance by mastering the poor periods in this way.

Better Emotional Control in Decision-Making

Most inexperienced traders, and traders in general, make the error of incorporating emotions in trading. This usually has unfavorable effects on your investment.

Whether you’re going through a tough patch or a good one, it’s best not to let your emotions get the best of you. Using a stop loss allows you to reduce the possibility of experiencing emotional pain.

Profitability Chances in Even the Most Difficult Situations

When you employ a stop loss and a limit, it is feasible to generate a profit even if the bulk of your transactions are losing. Indeed, you can predict the maximum loss as well as the gains on each position by creating a risk management strategy ahead of time.

Setting a stop-loss that is at least twice as tight as the limit is the rule. You can still benefit even if every second trade is a loser.

Implementation of Trading Strategies

Setting up a stop loss might help you evaluate the effectiveness of your trading strategy. You receive insight into its performance over time and can improve it by adjusting the stop loss parameters. You will be able to tweak your plan and be as efficient as possible as you gain experience.

No need to keep an eye on the market all the time

Setting up a stop loss allows you to avoid constantly monitoring the market and terminating your position if the price of the asset in question drops even little. Indeed, the threshold is set ahead of time, and when it is achieved, your trade is automatically closed.

Tips to consider when using stop loss for trading

We’d want to provide you with some tips on how to use stop-loss trading successfully:

Select the Best Online Broker

One of the most important factors in the success of your trading in general, and specifically your stop-loss trading, is the online broker you choose. If you wish to invest in stocks or Forex with stop losses, using a broker is the simplest, fastest, and safest option.

However, when it comes to these platforms, there are so many options that it’s difficult to know where to start. To choose the best online broker for you, look for one that is licensed by top regulators.

The broker must also be simple to understand, whether for a novice or a seasoned trader. Finally, it should have a good reputation among other users. To assist you in making your decision, we have chosen 5 online brokers who completely satisfy these criteria.

Make use of the free demo account

Online brokers are now providing demo accounts to anyone who signs up for one in order to attract additional customers. This is a free account that is immediately enabled when you create an account on the platform in question.

The demo account allows you to simulate trading circumstances on a simulated market that is as close to the real market as possible. This allows you to practice trading and set up losses without risking any of your own money. You can also quickly become acquainted with the many features of the online broker.

Have a good understanding of how to identify key thresholds

You should be aware that there are various levels that may be used to accurately set a stop loss. Technical analysis tools and methodologies can be used to detect these levels. The most prudent course of action would be to understand these strategies, which will make it easier to highlight them. You will advance more swiftly if you meet these goals.

Moving averages, trend lines, and channels, as well as the Fibonacci retracement method and pivot points, are among the technical analysis approaches available. Despite the fact that these concepts appear to be particularly complicated, these strategies are simple to grasp.

Setup your stop loss in advance

When you open the position, you must define your stop loss. Indeed, if the situation appears to be moving in your favor, you may be tempted to set a stop loss that is excessively wide. If, on the other hand, the position goes in the opposite way, you are most likely using an excessively tight stop loss. Your stop loss could be off in any instance.

Consider the asset’s volatility as well as the investment’s duration

This is a rule that appears rational but is not immediately apparent. Indeed, the more volatile the asset you’re trading, the wider your stop-loss threshold should be. For example, if a stock’s daily historical volatility is 5% and your stop loss is placed at 3% of the entry price, your position may systematically close too soon.

Similarly, if you intend to keep your trade open for a longer period of time, a more distant stop loss is preferable. This will offer you some wiggle room in the market before closing your trade.

Be Careful When Moving Stop Loss

If you are a newbie trader, it is strongly recommended that you do not manually alter your stop loss in order to stick to the judgments you made before. You can move the stop loss if you have some trading experience, but only if the asset’s price moves in your favor.

Before increasing the stop loss, make sure that the price has moved far enough away from the entry price. Once your price objective has been met, you can adjust the stop loss by tightening it. This will allow you to secure your gains while also giving you the option to profit from a possible trend continuation.

Conclusion

The stop-loss should only be used if you were wrong about the market’s direction. On each trade, you must know your cents, ticks, or pips at risk since this allows you to calculate your dollars at risk, which is a far more essential calculation that will direct your future trades.

Your funds at risk on each trade should ideally be confined to 1% or less of your trading capital, so a loss will not drain your trading account significantly.

If you want to start trading with a stop loss and progress quickly, we recommend eToro, an online broker that is dependable, easy to learn, safe, and has a great reputation among traders.

Frequently Asked Questions

What is the role of a stop-loss order?

A stop loss is a risk management technique in trading that allows you to specify the greatest loss you’re willing to accept before taking a position. In other words, in the vast majority of cases, it reduces the danger of uncontrolled loss.

Where should you place your stop loss?

It is recommended that you analyze the essential thresholds that you may determine using numerous trading indicators or by looking at the chart when deciding where to place a stop loss. To be more efficient, you can combine this with the volatility approach. In any event, it’s critical to keep in mind that the risk must always be smaller than the goal.

Is the stop loss usually successful at protecting?

The stop loss, like any other strategy, has its limitations. Indeed, depending on the position held, it is unable to protect you against severe losses in the case of a significant and sudden decline or rise in the price, however, it is beneficial. As a result, we advise you to conduct a thorough technical analysis of the market before placing a trade. It may be necessary to include fundamental elements such as data or central bank releases in some cases, such as when trading currency pairings.

What is the best platform for stop-loss trading?

All of the brokers we’ve listed in this guide are reputable and provide appealing deals. Nonetheless, we favor eToro because of the simplicity of its trading interface. Furthermore, it provides you with all of the tools and technical indicators you’ll need to set the stop loss fast and efficiently, even if you’re a novice trader. If you are not yet ready to trade independently, the social trading features can be quite useful.

Is it better to use a tight or a high stop loss?

It all relies on how the asset you’ve picked behaves in general. However, even if you have chosen the common sense of position, a tight stop loss can compel you to leave the game too soon, causing you to miss out on the best opportunities to win. A stop-loss that is set too high, on the other hand, could be a waste of time and money, especially if your profit aim is unrealistically high. These are also the reasons why we always advise you to experiment with a demo account before going live.