Many stocks now appear to be reasonably priced as a result of the FTSE 100’s turbulent recent months, and we have taken advantage of this by adding to our portfolio this month.

Since the FTSE 100 has been down for some time, several stocks appear to be in excellent value. Here are three equities that we just purchased, one of which is currently the best value investment for the FTSE 100.

1. Persimmon

Housebuilder Persimmon (LSE: PSN) ranks first on the list. As a result of the stock’s continuous decline since 2021—a decline totaling 57%—we can now purchase shares for the lowest price in ten years.

To be fair, it’s hardly shocking that the stock has been falling. With the stamp duty holiday coming to an end, rising interest rates, and a cost-of-living problem, the property market will likely face difficulties. Housing completions for the company in Q1 decreased by 42%.

However, the housing market is cyclical. When it last crashed, persimmons lost 84% of their value and in the years that followed, reached a 12-bag level. Such is the benefit of investing when others are frightened.

Although we can’t say for sure, we believe Persimmon has reached its lowest point. The company has £4 billion in assets, no debt, and a price-to-book ratio of one. Additionally, it trades at just five times earnings. To us, it seems like a really decent value.

2. Apple

On the other end of the spectrum is Apple (NASDAQ: AAPL), the world’s most valuable company. The market worth of the iPhone manufacturer recently reached $3 trillion.

So why invest here? Well, the company simply keeps rewarding its investors. The share price has increased by 300% during the past five years, and by much more going further back. Additionally, it has been paying dividends since 2012.

There is also a growth tale in this. Beginning in early 2024, the business will begin selling its newest item, a VR headgear. As a result, we believe that now is an excellent moment to open a position before the excitement takes off.

Also read: How To Buy Apple Shares

3. Aviva

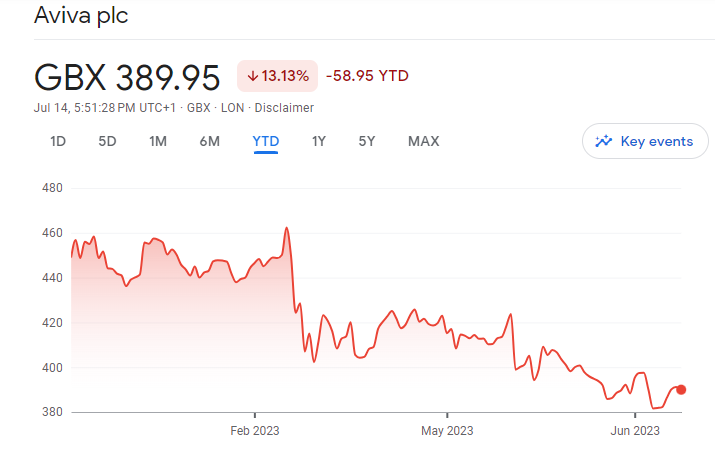

The last stock we recently purchased was from the insurance company Aviva (LSE: AV). This company has declined alongside the FTSE 100 and is now 18% less expensive than it was earlier in the year.

Due to the lower price, the yield has increased, and an 8.13% dividend now appears alluring. The cover of 1.6 times profits looks reasonable to us, and it is more than twice as high as the FTSE 100 average.

Given that the insurance sector is defensive, we would anticipate Aviva to withstand current economic difficulties. Even better, the company’s product line is expanding rapidly under the leadership of new CEO Amanda Blanc. We doubt that the price will remain this low for very long given all the good news.

We’ve aimed to enhance our exposure to reliable income shares that pay dividends. We believe that this is currently the best the FTSE 100 has to offer.

Is Aviva the FTSE 100’s best value buy?

Since the economy fell in May, the share price of Aviva has fallen along with that of the rest of the insurance industry. Is it time to buy yet?

We are constantly attempting to choose the best FTSE 100 stock to purchase. And the options are typically limited to the same few. Today, we’ll examine this year’s share price declines for Aviva. We like what we see, too.

Another bad year

Shares of Aviva have decreased by another 12% so far in 2023. And that gets them to a 40% loss over five years.

Given that, anybody who was wise enough to buy soon after the Covid meltdown would currently be sitting on a tidy profit. No, not at all. No, we made the purchase earlier.

Still, trying to time our purchases is pointless. This is due to the fact that we simply cannot predict what may occur next month, next week, or tomorrow. The pandemic proved it.

Long-term clarity

We learned another thing from the pandemic. On a long-term chart, even the worst stock market disasters frequently appear as brief blips.

We are referring to the FTSE 100’s drop of just 3% over a period of five years, which is barely noticeable to a long-term investor. And that comes after the worst worldwide calamity in recent memory.

Stock valuation

What matters is long-term valuation, and we believe that the low share price of Aviva makes it very alluring.

In terms of headline metrics, the anticipated price-to-earnings (P/E) ratio is only 7.5, which is less than half of Footsie’s long-term average. Additionally, the City anticipates a dividend return of about 8%.

Now, if a company isn’t having any issues, everything can seem wonderful. But let’s face it, during difficult economic times, the insurance industry can experience significant pressure. And the newest data indicate that the UK GDP contracted in May. So sure, difficult times.

Company refocus

Aviva is also going through a refocusing process. It hasn’t exactly been the sector’s leanest or most efficient in recent years. Those who are wary of insurers, in general, maybe even more so of Aviva.

Does this suggest that one should avoid using Aviva? For people who seek to minimize risk and have a short-term outlook, it might be. Oh, and for investment companies that just look ahead to the following quarter and don’t want to be seen holding losers from this year.

We do, however, believe that there may be a fantastic opportunity to buy in at a low price for long-term investors who are willing to take some risk.

Sentiment change

Currently, opinion is against Aviva shares, but attitudes might shift. And one of the things that might do it is seeing how the first half went.

The deadline for H1 results is August 16. We’ll mostly be on the lookout for measures of liquidity and cash flow. We may purchase more if they are sound and the dividend prospects are promising.

By no means is Aviva the FTSE 100 stock with the lowest risk. And insurance stock prices can fluctuate and follow cycles. However, it might be the best contrarian stock to buy right now.

Also read: How Buying FTSE 100 Stocks Could Help You Live Well In Retirement

Leave a Reply