These days, growth stocks seem more and more intriguing. There are now many new chances quietly emerging, whereas these shares were pounded into the ground last year.

But not every company in this industry appears to be a good investment. Additionally, we are avoiding two that are on our radar.

2 worst growth stocks right now

We examine two increasingly well-liked growth stocks that, in the current market environment, appear to be poor bets.

1. boohoo

For shareholders of Boohoo (LSE: BOO), the past two years have not been easy. The business has experienced stagnant growth, was previously criticized for its bad working conditions, observed product return rates soar, and seen its pre-tax profits completely disappear as a result of rising costs, pushing it firmly into the realm of unprofitability!

The growth stock has plunged off a cliff as a result of this constant stream of misfortunes, with shares dropping by roughly 90% over the past 24 months. However, the worst may be over.

The management is making an effort to address the issue of high return rates. With £331 million in cash on the balance sheet and another £325 million accessible through a revolving credit line that is good until 2025, it has subsequently resolved the company’s immediate liquidity issues.

Better delivery times and cheaper prices are being made possible by ongoing developments in the logistics industry.

As a result, some growth investors are starting to think that the long-awaited resurrection of the online fashion retailer is about to happen. But given the difficulties Boohoo is facing, it might take years to resolve all of the issues and restore its previous splendor.

Personally, we won’t be adding this growth stock to our portfolio at this time.

2. Nvidia

Not every poor investment results from purchasing a terrible company. In truth, there are innumerable instances of great companies which turned out to be terrible investments due to a single, often-overlooked factor: price.

It can be just as detrimental to overpay for a great stock as it is to put money into a bad company. And we believe Nvidia (NASDAQ: NVDA) is a great example of this in the modern world.

The semiconductor business is the world’s foremost manufacturer of powerful GPUs utilized in the big data and gaming sectors. And during the past 12 months, the growth stock has increased by around 200%!

Investors appear to be becoming extremely enthusiastic about the important part Nvidia will play in artificial intelligence (AI). In the end, machine learning algorithms are powered by its chips, making it one of the most significant technology corporations in the world.

Additionally, according to the most recent quarterly data, revenue and earnings much exceeded analyst projections. Its market share is growing and there is a growing demand for its products.

But we don’t have any immediate plans to increase our stock holdings.

Actually, Nvidia is among the world’s best-run companies on our ranking. But as we noted, investing in a great company at a poor price will almost certainly be a mistake. And given that shares are currently priced at about 220 times earnings, we believe it is fair to argue that investors are pursuing all the AI hype way too hard.

This assessment is unjustifiable in our judgment. And if the buzz around AI fades, we wouldn’t be shocked to see this growth stock crash. However, if and when this does occur, a lower price can present a buying opportunity for your portfolio.

Also read: Top 3 FTSE 100 Stocks To Purchase Before August

2 best growth stocks right now

Over time, we anticipate that these UK equities will produce strong profit growth. Additionally, we believe they are excellent purchases during this time of great uncertainty.

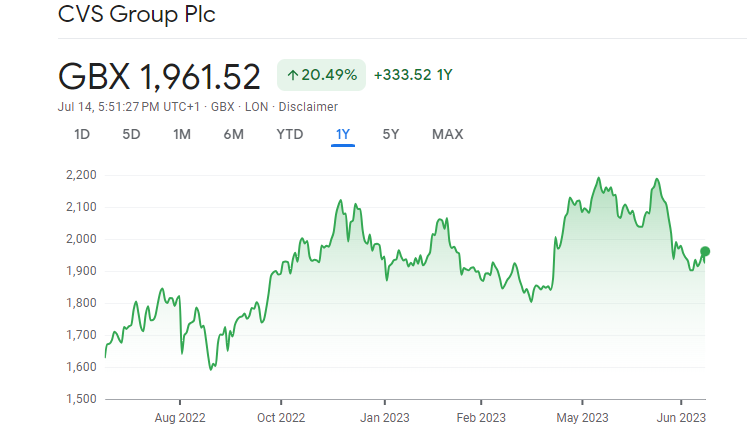

1. CVS Group

The market for veterinary services is expanding quickly. Both pet adoption and the amount of money spent on companion animals are on the rise over the long term. We purchased shares in the industry leader in animal medication, CVS Group (LSE: CVSG), for this reason.

Amazing trade results from Pets at Home this week highlight the benefits of owning equities in the animal care industry. In the year ending in March, like-for-like sales increased 7.9% here, driven primarily by the company’s vet care division.

Comparable revenue increased 13.4% year over year. Given that we are currently experiencing a crisis in the cost of living, these results are even more astonishing.

Additionally, CVS has shown remarkable resiliency recently. For the six months ending in December, the company, which operates 500 veterinarian offices in the UK, Ireland, and the Netherlands as well as a few diagnostic facilities and pet cemeteries, recorded a 7.5% increase in like-for-like revenues.

2. Primary Health Properties

In the UK, demand for healthcare services is at an all-time high due to a growing population. For this reason, we purchased Primary Health Properties (LSE: PHP), a different medical stock that we want to keep for the ensuing ten years.

This FTSE 250 firm, as its name suggests, owns and runs primary healthcare facilities like doctor’s offices. In an effort to get patients out of overcrowded hospitals, these kinds of homes are at the forefront of the NHS reform movement. This is the motivator that ought to continue the company’s long history of yearly earnings development.

In the current market, owning shares of Primary Health Properties is particularly appealing. Analysts in the City predict that due to its defensive activities, profits will continue to rise (increases of 1% and 3% are predicted for 2023 and 2024, respectively).

This and other property stocks offer investors security against rising inflation. Rents can be efficiently raised to reflect price increases in order to pay for them. Additionally, because government agencies guarantee the income it receives, it is not concerned about rent arrears.

A change in NHS policy could harm future wage growth in this country. But as of right now, we think things are going quite well for investors.

Leave a Reply