We’re searching for outstanding stocks outside of the FTSE 100 and FTSE 250 to invest in. Here are a few AIM stocks that have caught our eye recently.

We have been searching the Alternative Investment Market (AIM) in London for the top growth stocks to purchase. Here are three that we might consider adding to our stock portfolio in 2023.

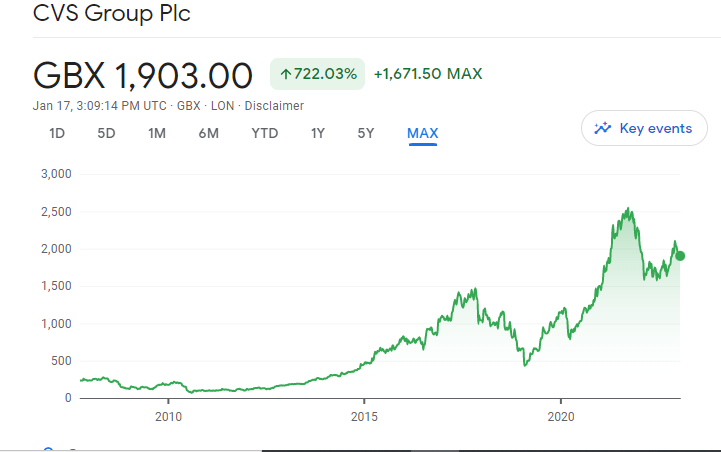

CVS Group

Over the previous ten years, spending on pets has increased significantly. And even while the cost-of-living crisis persists, it is predicted to continue expanding rapidly. The veterinary care industry, for instance, is anticipated to increase at a compound annual growth rate of 8.46% between 2023 and 2027, according to Statista analysts.

We invested in CVS Group, a UK stock, to profit from this trend. We also want to increase our holdings in light of the recent decline in share price. This company owns more than 500 veterinary clinics nationwide, in addition to diagnostic facilities and crematories.

Recent financial data revealed that organic sales increased 7.4% in the four months leading up to October. This was over the company’s 4-8% target range. Even though a labor scarcity in the animal care industry would hamper CVS’s expansion aspirations, we’d still purchase it.

Lok’nStore Group

As the property market cools, the self-storage business in Britain may experience a short-term slowdown. This rapidly expanding industry’s primary driver is the necessity for short-term storage among home movers.

However, the long-term forecast is still favorable because of factors like e-commerce expansion and population increase. Therefore, we are thinking about including shares of Lok’nStore Group in our holdings.

One of the biggest companies in the sector, it has ambitious expansion ambitions to boost profits over the coming ten years. In the year leading up to October, it plans to open four more large stores. Additionally, its secured pipeline of 10 sites will result in a staggering 44.1% increase in owned space.

For years to come, the UK self-storage market appears to be undersupplied. Rental incomes should therefore continue to rise rapidly after reaching record highs last year. According to Cushman Wakefield, a provider of real estate services, average rents increased by 9% last year.

Jubilee Metals Group

For UK share investors, the green energy revolution offers fantastic potential. Jubilee Metals Group is one stock we’re thinking about purchasing in order to profit from the fight against climate change.

Copper, cobalt, platinum group metals (PGMs), and other industrial commodities are all recovered by this AIM company. All of them are in high demand as the number of electric vehicles sales soars and catalytic converters are filling up with more metal every day.

We believe that right now would be an excellent moment to start investing in Jubilee Metals. Recent direct leaching copper production studies that were successful may present Zambia with new growth prospects. Additionally, the miner’s current price-to-earnings (P/E) ratio is only 6.2 times.

Despite the potential for oversupply in several of its markets, we would purchase Jubilee. This might have an impact on prices and, in turn, profit growth.

Leave a Reply