Growth stocks are a fantastic way for investors to profit from the stock market, but you need to be aware of what you’re buying or selling. If you have a thorough understanding of growth stocks, you’ll get there more quickly.

Finding equities with genuine possibilities for appreciation becomes much harder. In this guide, we’ve picked the Best Growth Stocks to Buy in UK 2022 to help you cut through the research clutter.

Best Growth Stocks in 2022

The best growth stocks to acquire right now in the United Kingdom are listed below

- Lloyds Banking Group PLC (LON: LLOY)

- Calnex Solutions (LON: CLX)

- Boohoo Group (LON: BOO)

- Booking Holdings (NASDAQ: BKNG)

- Agnico Eagle Mines (NYSE: AEM)

- Clarivate (NYSE: CLVT)

- Pioneer Natural Resources (NYSE: PXD)

- Roku (NASDAQ: ROKU)

- Micron Technology (NASDAQ: MU)

- Generac Holdings (NYSE: GNRC)

Best Growth Stocks Analysis

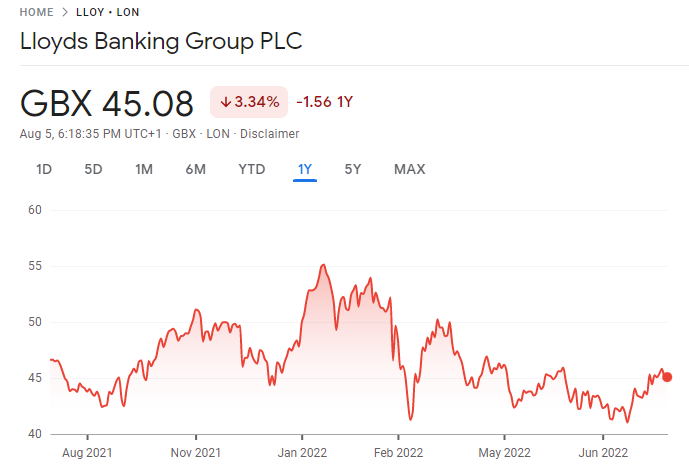

Lloyds Banking Group PLC (LON: LLOY)

The share price of London-listed bank Lloyds Group has already increased by more than 114 percent since its bottom in October 2020, but this boom may only be the beginning.

Looking at LLOY stock price performance over a longer time period reveals that although the stock is currently trading at 51p, it had previously reached a high of 529p. Although those record prices were set years ago, the underlying economic circumstances that led to them may be resurfacing now.

The last 11 years of low-interest rates have been difficult for banks. US base interest rates have been below 1% for more than 50% of the time since 2009. As their returns are based on the difference between the rates for loans and savings, which narrows when interest rates are low, that is a challenging climate for banks to operate in.

Between 2006 and 2008, when US interest rates were last above 4%, the share price of Lloyds rose as high as 300p. The prognosis for banks will improve significantly with only a few interest rate increases, and with inflation fears dominating the financial press, those changes may be ready to take place. That possibility would allow Lloyd’s share price to maintain its upward trend and beat the rest of the market, especially since many stocks suffer when interest rates are higher.

Calnex Solutions (LON: CLX)

This UK-based tech stock specializes in developing synchronization and network emulation technologies. It started trading on the Alternative Investment Market since October 2020.

The growth of 5G networks and cloud computing is anticipated to be advantageous for the company. After all, the development of driverless vehicles and smart cities would require a rapid expansion of telecommunication standards in the future. as a supplier of services for testing 5G networks. Calnex will benefit from current advances.

Additionally, it appears that the business is enjoying a successful fiscal year, which has extended into the first quarter of 2022. The price of CLX’s shares was 51p at the time of its IPO listing, but they are now worth 114p. In only a single year, this amounts to a rise of about 123 percent.

Having said that, it’s crucial to note that the majority of the company’s transactions are processed in US dollar. So, when the dollar declines in value, profitability may be impacted. The upside potential of this stock, which is just beginning its AIM listing journey, far outweighs any currency risk.

Boohoo Group (LON: BOO)

Nine market-dominating fashion companies, including PrettyLittleThing, Nasty Gal, and Oasis, are owned by the Boohoo Group. The brands indicated above are anticipated to gain from the steadily increasing transition from high-street to online.

The company is well-liked by millennials as well, and it maintains a strong online presence. The Boohoo Group shares were worth about 280p a year ago. Since then, the stock price has dropped by 61%, and it now costs 63p per share.

Booking Holdings (NASDAQ: BKNG)

Early in June, Truist Securities reaffirmed its Buy rating for Booking Holdings, citing findings from a study that it conducted that revealed strong demand for summer travel.

The research company also reduced its target price for the online travel stock from $3,340 to $3,000, citing the possibility that inflationary pressures could affect growth projections. Even so, that is significantly over the median analyst price objective of $2,677.67 and offers a potential upside of almost 60% over the next 12 months.

Six major travel and hospitality companies are owned by the holding company: Booking.com, Priceline, Agoda, Rentalcars.com, Kayak, and OpenTable. Together, they were in charge of its consumers booking $27.3 billion worth of travel services in Q1 2022, up 129% from the same period in the previous year.

Even though the economy has since become more unstable, BKNG’s long-term outlook for its different brands is still positive, making it one of the greatest growth stocks to watch as macro challenges subside.

More significantly for investors, Booking Holdings produced $1.59 billion in free cash flow in the first quarter of 2022. That amounted to 58.8% of the company’s overall revenue for the quarter. Thus, it has a trailing 12-month free cash flow of $4.27 billion, or 5.4 percent of its market value. Something with an interest rate of between 4 and 8 percent is regarded as reasonably priced.

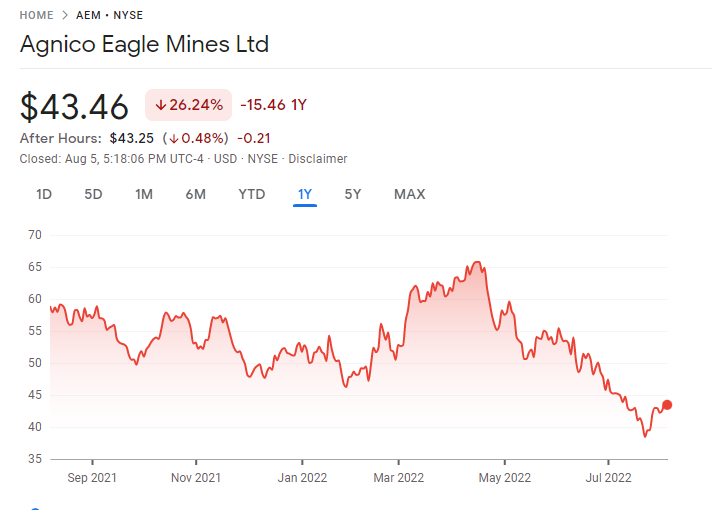

Agnico Eagle Mines (NYSE: AEM)

The third-largest global gold production is Agnico Eagle Mines. Only Barrick Gold and Newmont Mining produced more gold in Q1 with 661,000 ounces produced than it did with 1.34 million ounces.

52 days of production from the Ontario and Australian mines of Kirkland Lake Gold were included in Agnico’s first-quarter results. In February, AEM and Kirkland Lake combined.

Following the $10.7 billion merger, stockholders received 0.7935 AEM shares for every Kirkland Lake share they owned. Kirkland Lake owners hold the remaining 46% of the combined firm, which is owned by AEM shareholders to the tune of 54%. Sean Boyd, the former CEO of Agnico Eagles, was named executive chairman of the combined business, while Tony Makuch, the former CEO of Kirkland Lake, was named CEO following the merger.

It is anticipated that it would produce between 3.2 million and 3.4 million ounces in 2022 on a base of 44.6 million ounces in mineral reserves. The cash price per ounce at the median of its prediction for 2022 is $750.

In five years, AEM hopes to save $900 million, and in ten years, $2 billion. The mine’s operating margins would grow by $300 million for every $100 increase in the price of gold. Its balance sheet is in excellent shape, with just $504 million in net debt and $2.3 billion in liquidity.

Clarivate (NYSE: CLVT)

A leading provider of information and data analytics is Clarivate. It assists more than 50,000 users in more than 180 nations in obtaining the knowledge required to decide wisely about their enterprises and organizations.

About 48 percent of its revenue in 2021 came from the science sector, and 52 percent from the intellectual property sector. 79 percent of the $1.88 billion in revenues came from subscriptions and recurring income. The remaining 21% was made up of one-time deals.

Clarivate’s Q1 2022 sales were $662.2 million, up 54.6 percent from the previous quarter thanks to the purchase of ProQuest. Its sales increased 4.4 percent in the first quarter after adjusting for acquisitions and foreign exchange. Its adjusted net income increased by 75.4% from the prior year to $155.1 million.

Clarivate anticipates that this change will lead to revenue and adjusted free cash flow of $2.84 billion and $700 million in 2022, respectively. In 2023, it expects to generate $3 billion in sales and more than $800 million in adjusted free cash flow.

Clarivate thinks its new strategy will enable it to sell more goods and services to its current clients, increasing total profitability and cash flow generation markedly. Consequently, CLVT is now well-positioned to rank among the top growth companies for the remainder of 2022 and beyond.

Pioneer Natural Resources (NYSE: PXD)

Most acres are owned by Pioneer Natural Resources, which is located in West Texas’s Midland Basin. As a result, it ranks as one of the best energy stocks to invest in the area that produces oil.

Furthermore, investors looking for income find the company to be appealing due to its dividend policy. Each quarter, Pioneer pays a fixed dividend of 78 cents per share and a variable dividend equal to 75% of its leftover free cash flow. In addition, it increases value by buying back shares.

Pioneer paid $1.07 billion in dividends to stockholders in the first quarter, in addition to repurchasing $276 million worth of its shares at an average price of $234.89 per share. It repaid to stockholders over 88 percent of its Q1 free cash flow in 2022.

During the Q1, Pioneer generated 638,000 barrels of oil equivalent per day and 355,000 barrels of oil each day, generating a $2.3 billion free cash flow. Over the previous 12 months, it produced annualised free cash flow of $4.64 billion. According to its current market capitalization, that amounts to a free cash flow yield of 8.3%. Value territory is anything above an 8 percent yield.

PXD continues to be one of the greatest growth companies for the remainder of 2022 as analysts expect full-year earnings per share to increase 150 percent year over year and revenue to jump 51 percent.

Roku (NASDAQ: ROKU)

Roku shareholders have endured a terrible 52 weeks, as the company has lost more than 75% of its value. The video streaming service’s revenues climbed by 40.7 percent annually from $512.8 million in 2017 to $2.76 billion at the end of December, however these losses still persist.

The business recently disclosed a collaboration with Walmart that will enable customers to make purchases while watching content on Roku devices.

Because the streaming service already has their credit card information, Roku users won’t need to provide it in order to make a purchase.

OneView, the company’s ad-buying platform, will now be able to make money in yet another method. It is still unclear, though, whether the Walmart and Roku partnership will have much of an impact given that TV viewers have not yet significantly increased sales for TV product vendors.

Micron Technology (NASDAQ: MU)

The semiconductor stock Micron Technology experienced two downgrades in June, indicating that analysts still have some reservations about the company.

The majority of covering analysts still rate MU stock as a Buy despite the two downgrades. Their median price target is $97.45, which is a lot more than the current share price.

Additionally, as stated in its May 2022 report, the company anticipates a fall in its consumer business from a total of 55 percent in fiscal 2021, which ended in August, to 38 percent in fiscal 2025. However, it also anticipates that its data center and graphics sector will provide 42% of its overall 2025 revenue, up from 30% in fiscal 2021, and that automotive, industrial, and networking will grow by 500 basis points to 20%.

Value investors have a great opportunity with Micron as well. Currently, its share price is 1.3 times its tangible book value. Advanced Micro Devices, a comparable semiconductor stock, is currently trading at 2.4 times its tangible book value.

Generac Holdings (NYSE: GNRC)

Generac Holdings describes itself as a provider of energy technology solutions. However, a lot of investors are probably familiar with it because of its home backup generators. Homeowners have chosen to offer some backup against the rising frequency of power disruptions as the weather gets increasingly erratic.

In order to advance its aim of offering energy technology solutions to the commercial and residential markets, Generac was busy buying six startups in 2021. The six purchases cost $1.3 billion, with the Toronto-based maker of smart thermostats ecobee receiving the greatest price tag in December 2021 at $734.6 million. A total of $420.8 million in Generac stock, $224.5 million in cash, and $89.4 million in stock-based performance incentives were used to fund the acquisition.

Since 2011, Generac has undertaken 25 acquisitions, choosing deals that produce returns on its weighted average cost of capital that are above average.

The midpoint of GNRC’s projection for revenue growth in 2022 calls for adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) to increase by at least 21.5 percent.

Right now, things are going well. Revenue for the company climbed 41% year over year to a record $1.1 billion in the first quarter.

And more expansion is probably still to come. According to business statistics, there are 23.1 percent more portable and home backup generators in North America. This presents Generac with a fantastic opportunity to increase its market share. Its typical client is a homeowner with a house worth $475k and a median household income of $135k.

If you’re interested in alternative energy, Generac is one of the greatest growth stocks to keep on your watchlist, if not your purchase list.

Advantages of Investing In Growth Stocks

Growth stocks are not well renowned for their dividend yields, but rather for their rate of expansion. It makes it reasonable that the shares would be worth two times as much if the company has a value of $100 million and the stock trades at X dollars before increasing to $100 million.

Investors may also hope that a company will develop into a well-known, dividend-paying asset, but most investors take a very long-term perspective on that.

Companies going through aggressive expansion stages may also divide their stock. By expanding the number of existing shares, they are able to increase revenue while maintaining a low share price that attracts new investors. After the four splits that Apple has had in the past 30 years, if you had purchased only 10 shares of this computer giant in 1980, you would now own 650 shares of it.

Disadvantages of Investing In Growth Stocks

The biggest risk with growth stocks is investing too soon when they are still completely unproven. They might have a unique image that sets them apart from other inexpensive stocks to buy, but their business plan might fail miserably, they might declare bankruptcy, or the market might be overinflated like the cannabis market was.

Growth stock valuations may also be excessive. This is due to the fact that they draw a lot of attention and that the value of their shares depends on forecasts of future profits. If those results come through, that’s excellent news because it means the company is not overpriced; however, if they don’t, share prices risk collapsing.

Growth stocks have a reputation for being among the most volatile stocks on the market, which is bad news for the typical retail investor. Bumpy pricing will send them on a terrifying ride if they lack the knowledge to understand the stock market’s waves and when to get on and off, eventually bringing them back to where they started with little to no profit. It takes years of trading expertise to truly integrate the arts and sciences necessary to determine which stocks to buy right now.

How to invest in Growth Stocks?

Let’s look at the investment process after learning about the positives and downsides of growth stocks. A investment procedure for investing in growth stocks is provided below:

Step 1: Choose a broker

Finding a trustworthy stockbroker is the first step in buying a growth stock. To assist you, we’ve mentioned the top two brokers that provide some of the best stocks to invest in:

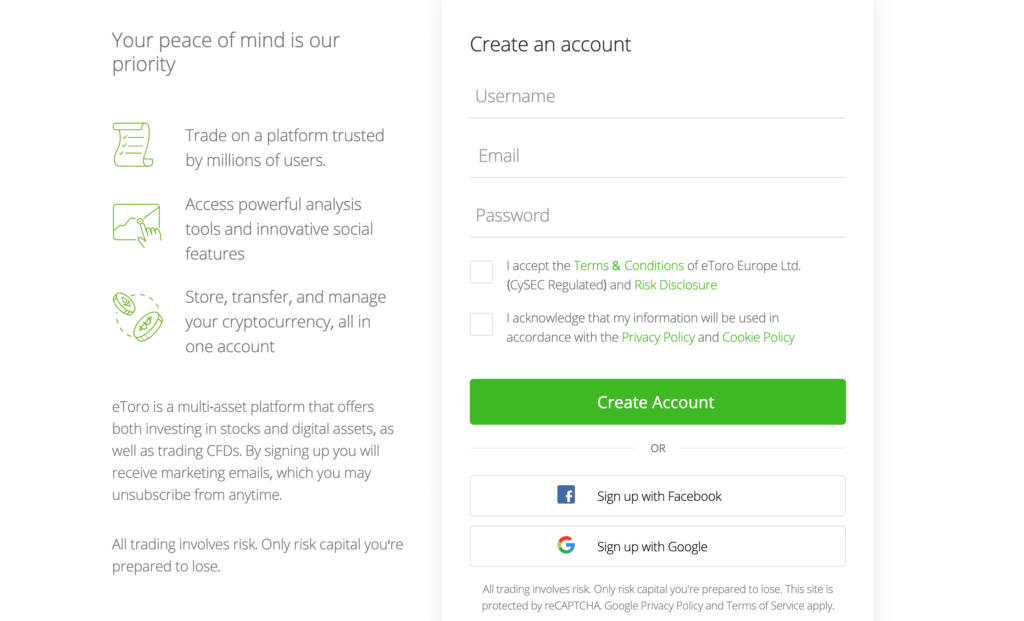

1. eToro

eToro has you secured whether you’re an experienced investor or a novice looking to make your first purchase. The trading broker has a vast stock portfolio with over 2400 equities accessible, including many of the best growth stocks to buy.

Both international shares and numerous UK-listed firms are included in this. Regardless matter the market you wish to invest in, eToro enables you to purchase shares without paying a commission.

Given that this is unusual in the online share trading sector, the platform is excellent if you want to keep your expenses as low as possible. Since eToro allows you to begin with minimal investment, we also appreciate it. The lowest deposit amount on eToro is just $50, and shares in a company can be bought for as little as $10. This is accurate regardless of the share price because eToro supports fractional ownership. Furthermore, the Copy Trading tool on eToro is well-known.

As eToro is governed by the FCA, one of the most reputable regulators in the UK, your money is likewise protected with the broker. Additionally, the FSCS program will protect your money.

2. IG

/IG-ef2684aaa37d4d218af819f98d676d02.png)

UK investors looking to buy growth stocks frequently use IG. In any case, the broker offers you immediate access to more than 10,000 stocks. You have more than enough options for diversifying your portfolio thanks to the enormous number of companies listed on both the London Stock Exchange and AIM. You can trade on worldwide stock exchanges using IG, just like eToro.

In addition to conventional stock trading, IG also offers spread betting and CFD stock trading. This is a useful tool to have if you wish to engage in short-selling or leveraged trading of high-growth equities. IG costs £8 per trade to invest in shares in terms of fees.

If you join the 178,000 IG clients, you will probably invest through the system’s primary website, MT4, or on your mobile device. This makes it possible to purchase and sell growth stocks from any location in the world.

Specifically speaking, IG was established in 1974, making it one of the market’s oldest brokerage firms. Its investment firm is quoted on the LSE and has a current market capitalization of £2.7 billion. After all, it does possess several brokerage licenses, including the FCA’s. This guarantees that you can always trade in a secure environment.

Step 2: Open an Account

You can use this step-by-step tutorial to buy your first growth stock in the UK on eToro.

Typically, creating an eToro account won’t take more than ten minutes. Your basic personal data, such as your complete name, home address, phone number, date of birth, and country, will need to be entered.

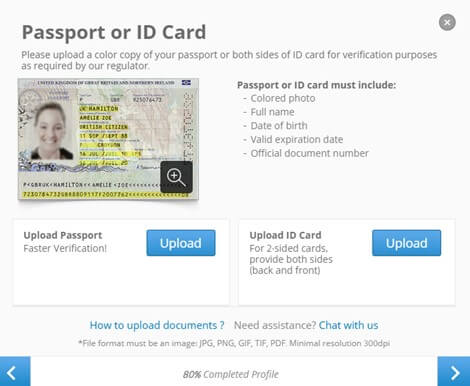

You will also be required to present an identity proof to eToro since it is a regulated platform. Either your passport or your driver’s license will do the identity verification. As proof of address, a utility bill or bank statement will do.

Step 3: Deposit Funds

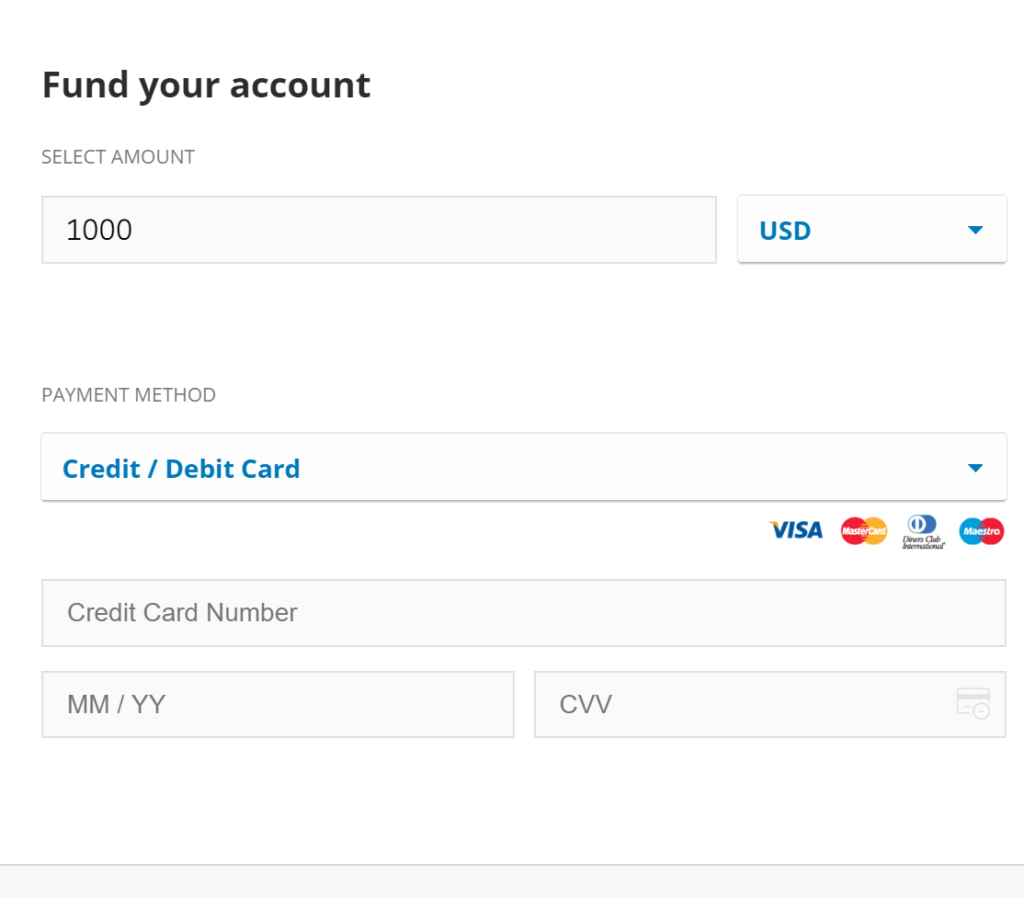

The following step is to fund your online brokerage account with investing dollars. On eToro, you can select from a number of payment options. The easiest option is to use a debit or credit card. As an option, you can send money using an e-wallet like PayPal, Skrill, or Neteller.

Step 4: Buy Growth Stocks

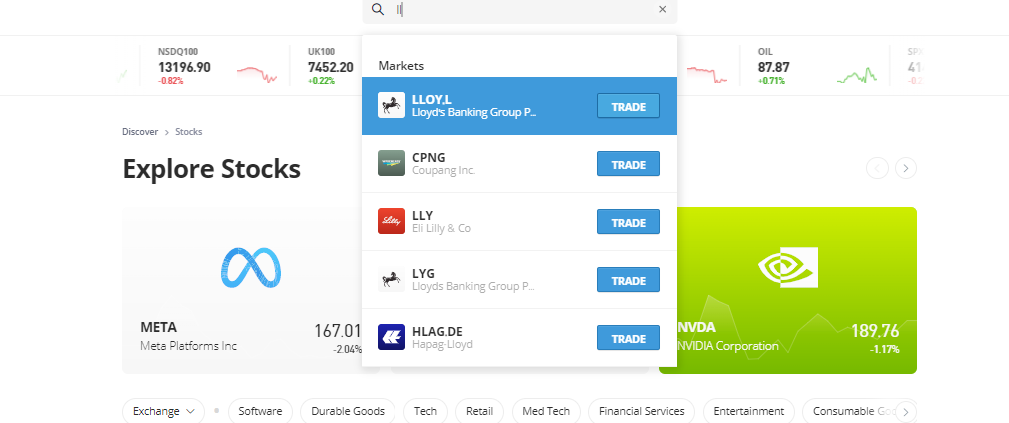

Make sure to investigate the best growth stock UK to buy before making an investment. By conducting a search on eToro, you can identify the relevant stock.

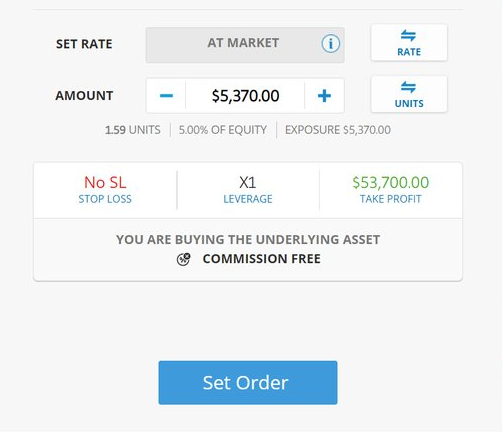

Click the “Trade” button once you’ve located the growth stock you wish to purchase.

You will reach an order box after doing this. You can enter your desired investment amount in the growth stock here (in US dollars). Select the “Open Trade” option when you are ready to buy your growth stock.

Conclusion

Experienced investors frequently use growth stock investments to diversify their portfolios. As you now understand, the goal is to identify businesses with strong growth potential and hold onto your shares for a long time.

Having said that, it is essential that you are informed of the advantages and disadvantages of investing in startups. While investing in growth stocks might yield returns above average, you need also be aware of the risks involved with backing a startup company.

As a result, it is crucial that you thoroughly investigate the market before you spend any money. Consider eToro, an FCA-regulated trading platform, if you’re looking for an online broker to help you get started in investing. With eToro, you may purchase growth stocks with no commission.

Frequently Asked Questions

How can growth stocks be recognized?

Different elements will indicate whether a stock has strong growth potential. An innovative company concept and a high P/E ratio, for example, can aid in determining whether the stocks are worthwhile investments.

Why are growth stocks unique?

Growth stocks are similar to other investments in many respects. The main distinction is that these shares are anticipated to rise at a significantly faster rate than the market average.

Which businesses provide growth stocks?

Growth stocks are mostly traded on the AIM in the UK. Emerging businesses with modest to medium market capitalizations are hosted on the exchange.

Is there a required minimum capital to start purchasing growth stocks?

The minimal capital costs range from one online broker to the other. The very minimum investment with eToro is simply $50 for each growth stock.