Blue-chip stocks are the bedrock of many investors’ portfolios, offering stability, growth potential, and dividends. In the face of economic uncertainty, some industry-leading companies continue to thrive, presenting compelling investment opportunities.

5 Top Blue-Chip Stocks to Invest in May

As we navigate through May 2024, here are five blue-chip stocks poised to deliver long-term value to investors.

1. Visa (NYSE:V)

Visa stands at the forefront of the digital payment revolution, making it a top pick for investors seeking growth and stability. With a global network spanning over 200 countries and territories, Visa has capitalized on the secular shift away from cash transactions toward digital payments. Despite competition from fintech disruptors, Visa maintains its dominance, posting steady revenue and earnings growth.

In its most recent fiscal year 2023, Visa reported robust financial results, with net revenues reaching $32.65 billion, marking an 11% increase year-over-year. Additionally, GAAP earnings per share saw an 18% rise to $8.28. Analysts project Visa’s revenues to grow at a compound annual rate of over 10% in the next three years, highlighting its potential for sustained growth.

The ongoing shift away from cash and paper transactions towards digital payments presents a significant opportunity for Visa. With various payment flows such as B2B, P2P, and remittances gaining momentum, Visa is well-positioned to capitalize on this trend and drive further growth.

Despite economic uncertainty, Visa remains a resilient blue-chip stock, offering investors both stability and growth potential. Its reasonable valuation adds to its appeal as a long-term investment, making it a top pick for investors seeking exposure to the cashless economy.

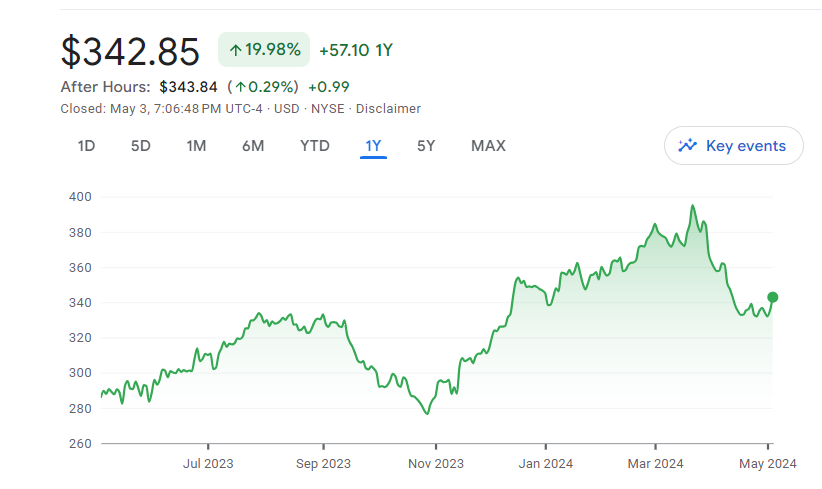

2. Home Depot (NYSE:HD)

Home Depot stands as a stalwart in the home improvement sector, providing investors with a reliable blue-chip stock option. Despite facing some near-term headwinds, Home Depot has demonstrated resilience, buoyed by its strong balance sheet and strategic growth investments.

The company’s recent increase in quarterly dividends and its commitment to shareholder value underscore its financial health and stability. Home Depot’s impending acquisition of leading specialty distributor SRS further expands its customer base, reinforcing its position as an industry leader.

While slowing home sales may have tempered demand for big-ticket purchases, the necessity of home repairs presents a continued opportunity for Home Depot. With a $1 trillion addressable market and over 2,300 stores, Home Depot remains well-equipped to capitalize on consumer needs in the home improvement space.

Despite a 24% decline in 2022, Home Depot’s resilience and long-term growth prospects make it an attractive blue-chip stock to consider for investors looking for stability and income potential.

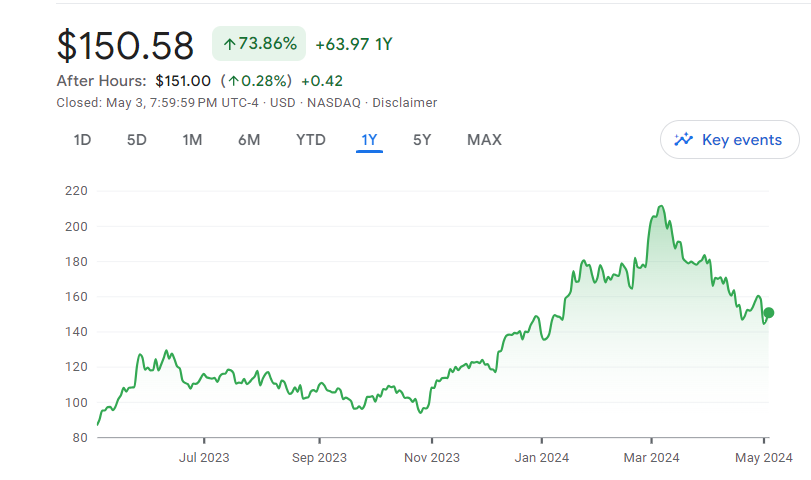

3. Alphabet (NASDAQ:GOOG)

Alphabet Inc, the parent company of Google, stands as one of the world’s most formidable tech giants, offering investors both growth and income potential. With a market capitalization exceeding $2 trillion, Alphabet’s recent announcement of dividend payments and share buybacks further solidifies its position as a blue-chip stock.

Despite facing challenges such as extensive layoffs and negative press, Alphabet has continued to impress investors with its performance. The company’s stock price has surged nearly 19% in 2024 and an impressive 56.23% in the past year, reflecting its resilience and growth prospects.

Alphabet’s dividend payments and share buybacks signal confidence in its financial strength and commitment to rewarding shareholders. With its diverse portfolio of products and services, including search, advertising, and cloud computing, Alphabet is well-positioned for continued growth in the tech sector.

As one of the legendary ‘Magnificent Seven’ Silicon Valley stocks, Alphabet offers investors an opportunity to gain exposure to a tech titan with a strong growth trajectory and potential for market-beating returns.

Also read: How To Invest In Alphabet Stock In 2024

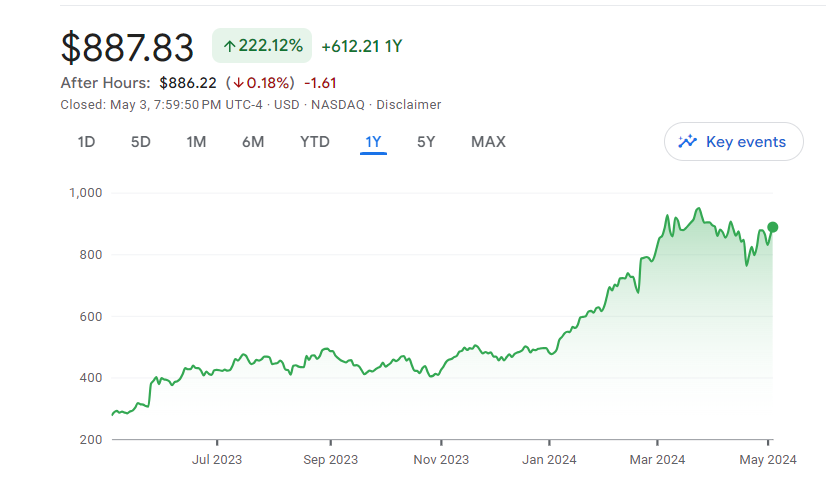

4. Nvidia (NASDAQ: NVDA)

Nvidia is a standout blue-chip stock in the semiconductor industry, characterized by its remarkable performance and groundbreaking innovations. With its stock price soaring nearly 200% in the past year and an impressive 72% increase in 2024 alone, Nvidia has captured the attention of investors seeking exposure to AI and chip technology.

As the poster child for AI-related technologies, Nvidia continues to lead the way with its cutting-edge products. The recent unveiling of the Blackwell GPU chip at the annual GTC conference further solidifies its position as an industry leader. Investors anticipate yet another stellar financial report in the upcoming earnings season, reflecting Nvidia’s consistent track record of exceeding expectations.

With the demand for AI-driven solutions on the rise, Nvidia is well-positioned to capitalize on emerging opportunities in various sectors. Its relentless focus on innovation and strategic investments makes it a compelling long-term investment option for those looking to capitalize on the AI boom.

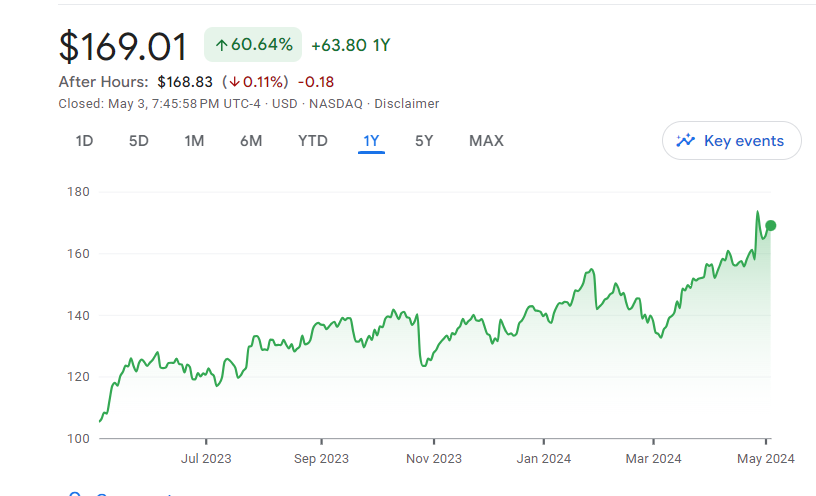

5. Advanced Micro Devices (NASDAQ: AMD)

Advanced Micro Devices stands out as a trusted blue-chip stock in the semiconductor industry, renowned for its consistent growth and strong market presence. With its stock price climbing over 60% in the past year, AMD has established itself as a formidable competitor in the AI market.

As one of the earliest Silicon Valley companies, AMD boasts a rich history of innovation dating back to 1969. Despite being relatively cheaper compared to some competitors, AMD offers investors significant growth prospects in the AI sector. Analysts project that AMD could capture a notable share of the AI market, potentially worth upwards of $90 billion.

With its focus on developing cutting-edge semiconductor solutions, AMD is well-positioned to capitalize on the increasing demand for AI-related technologies. The company’s long-standing reputation for reliability and its commitment to innovation make it an attractive choice for long-term investors seeking exposure to the AI boom. As the AI landscape continues to evolve, AMD remains poised for sustained growth and market leadership.

Leave a Reply