One of the leading manufacturer of non-alcoholic beverages worldwide is Coca-Cola, which is based in the US. The business owns some of the most well-known soft drinks, and given its lengthy history, there is an opportunity for further expansion. As a result, Coca-Cola draws a lot of investors eager to purchase Coca-Cola stock.

Fortunately, we have put up this guide to walk you through each step. You will also get to know top brokers who we heartily suggest for stock investments in the company.

How to Buy Coca-Cola Shares – An Overview

Use a reasonably priced and simple-to-use online brokerage if you’re wanting to buy Coca-Cola shares.

- Step 1: Create a trading account – Create an account with basic details on the broker’s website or mobile application.

- Step 2: Verify your account – You must present a valid photo ID, such as a passport or driver’s license, in order to validate your account. Users must also present a document serving as proof of address.

- Step 3: Fund your account – After your account has been validated, you must make a deposit of fiat money. Select one of the numerous payment options the broker offers to proceed.

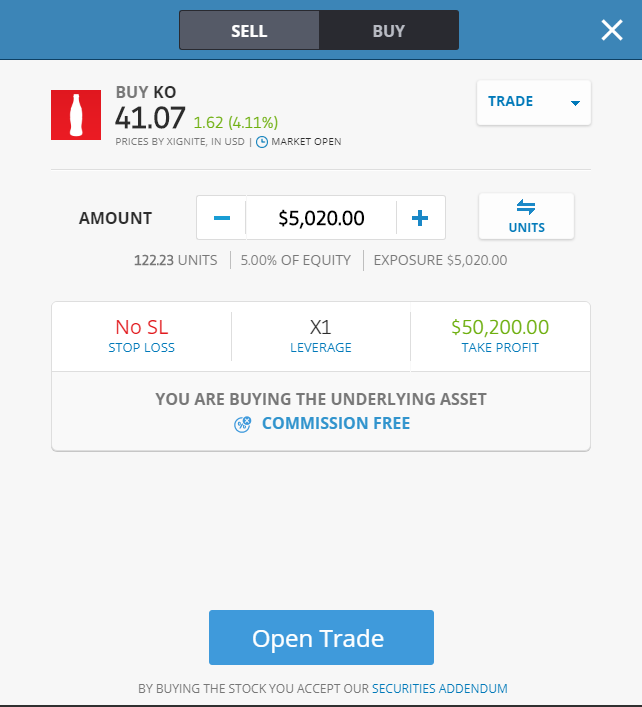

- Step 4: Buy Coca-Cola Shares – Utilizing the navigation tools, look for “Coca-Cola” and input the required position size. In order to finalize your purchase, click “Open Trade.”

Examine Coca-Cola Stock

Knowing where to purchase Coca-Cola stock now makes it crucial to do your research on Coca-Cola. Analyzing the company’s finances and business plan is crucial before making an investment choice, just like when you purchase Amazon shares.

To spare you time and research, we have finished thorough analysis of Coca-Cola below. Continue reading to find out some important financial information regarding Coca-Cola stock.

Coca-Cola Overview

Coca-Cola is among the most well-known brand names around the world. The Coca-Cola Company, which produces and sells a variety of non-alcoholic beverages, has maintained its position as one of the leading American corporations for nearly a century. It started paying a dividend in 1920 and has since increased it 58 times in a row.

To firmly establish itself at the forefront of the beverage business alongside its eponymous drink, Coca-Cola has made a number of bold purchases. If you’re seeking consistent, dependable dividends, this stock can be an interesting choice because it prioritized increasing its dividend even through a turbulent 2020.

KO has a solid reputation as a member of the Dividend Aristocrats Club, an organization comprised of businesses that have increased dividends for at least 25 years running. Coca-Cola has maintained growth despite obstacles like sugar levies and pressure to produce healthier drinks, and it might provide long-term gains. However, no investment is risk-free, so you should investigate its fundamentals as well as continue reading to learn more about the business and its prospects.

Performance

The Coca-Cola’s total producing revenue and profits have changed during the last ten years. 2022 marked the financial peak when the stock price reached $65. 2021 had the greatest revenue with $37.26 billion. At $62 per share in September 2022, revenue is approaching the pre-pandemic high of $36.41 billion. Market capitalization rose to $263 billion.

In comparison to the same quarter in 2021, net sales increased 17% in Q2 of 2022. Operational income increased by $38 million or 45 percent over the same time in 2021 to $121 million for the quarter. There may be more consistent profit releases from the Coca-Cola firm in the future.

Based on the current and previous multiples, specialists believe that the price of Coca-Cola stock is slightly overvalued. Considering past business growth and analyst predictions of future business success, the company might be valued at around $62 per share during the course of the following year, up about 15.05% from its present price of about $53.79 per share.

Since September 2021, the 52-week period performance number is +1.68 (+3.12%). The typical target price for Coca-Cola stock is $62.101. In 2021, the average annual growth rate for free cash flow per share was 65.50%.

Shareholders in Coca-Cola have benefited from strong returns, possibly the best in Wall Street history. Coke’s yearly distribution increased by 2% to $1.68 per share in February 2022. Investors who buy shares in Coca-Cola will receive a dividend return of 3.1%, which is twice as high as the present average return of the S&P 500, which is at 1.4%.

Coca-Cola fundamental analysis

It’s crucial to conduct a fundamental examination of the business before investing in Coca-Cola shares to ascertain whether the stock is now overbought or oversold. When conducting a fundamental study, a company’s senior leadership, financial accounts, operations, and consumer demand are all examined.

Additionally, the following three formulas can be used to display data about a company’s stock price and projected earnings, which can assist you in deciding whether you want to open a position.

Price-to-earnings ratio

The value of Coca-Cola stock can be determined using a price-to-earnings (P/E) ratio. This is so that you can see how much you would have to spend on Coca-Cola shares to generate a $1 profit from them using the P/E ratio. Investors may think that a company’s stock is overpriced if it has a high P/E ratio when compared to its main rivals such as PepsiCo.

Beginning of September 2022 P/E ratio for Coca-Cola was 25.43.

Dividend yield

The dividend yield evaluates Coca-current Cola’s share price in relation to its annual payouts. Dividend yield of a firm is compared to the dividend yield of the entire index to determine its relative dividend yield.

The dividend yield should be divided by the index’s average dividend yield, where the stock is mentioned.

The outcome could indicate that the company’s shares are now overvalued as compared to the shares of its rivals if it is comparatively low.\

Also read: Best Dividend Stocks You Should Buy in UK 2022

Return on equity

A company’s return on shareholder capital is gauged by its ROE. It is expressed as a percentage.

A low ROE may indicate that a stock is overvalued to prospective investors or traders. This is because the issuing company’s competitors are currently earning more money for every dollar invested by shareholders.

Should I invest in Coca-Cola stock?

Coca-Cola has often been a good corporation for long-term investors, notwithstanding challenges related to the epidemic. You can trust the dividend to give you a return on your investment, and the company has been diversifying into healthier drinks in response to market pressures. It can also rely on its global strength to shield it from typical economic downturns.

Because of its strength on a worldwide scale, it was able to survive a pandemic that caused major problems for the food and beverage industry. Because Coca-Cola is so popular worldwide, it stands to gain from the economies of China, Korea, and Hong Kong, which had the quickest return to normalcy.

It may be excellent news for the price of Coke shares when global activity picks up again. Although the company is restructuring in an effort to improve performance, it should be emphasized that there is still a great deal of uncertainty in the beverage market.

Best trading platform to Buy Coca-Cola Shares

You need an online stock broker in order to have the finest investing experience possible with Coca-Cola shares. The broker needs to have top-notch services and, most significantly, access to the NYSE, where Coca-Cola stocks are traded under the ticker symbol KO. Additionally, you ought to be able to trade the company’s shares as CFDs and indices through the broker.

We simplify the decision-making process for you by offering the top two brokers for purchasing Coca-Cola shares based on the evaluations and comparisons of our specialists.

1. eToro

You will have a great experience with eToro because of its user-friendly website and top-notch resources. Additionally, it is the best broker for social and copy trading, which enables you to connect with experienced and like-minded traders, learn more about trading and investing from them, and replicate their positions with the potential to make a lot of money.

eToro charges a large spread even though buying Coca-Cola stock is commission-free. Trading enthusiasts interested in using the social trading platform should be aware that the broker requires a £300 minimum deposit. We urge you to carefully plan your budget before considering eToro because this cost is somewhat high for investors on a tight budget. Overall, investing through eToro is worthwhile due to the fact that you can also trade KO equities as CFDs and indexes.

2. IG Markets

An award-winning broker, IG Markets is providing customers throughout the world with high-quality services. You can take advantage of some of the best platforms with top-notch and cutting-edge resources by using them to buy Coca-Cola shares. The L-2 Dealer, ProRealTime, and MT4 platforms are such examples. Additionally, IG Markets is a social trading broker that links investors and traders from across the world on its IG Community platform so they can communicate and share knowledge.

On the other hand, the broker assesses significant costs for trading and investing in KO shares. Additionally, it has one of the higher minimum deposit requirements at £300. Additionally, the broker is appropriate for aggressive traders because it levies a £50 quarterly subscription cost if you do not invest at least three times in a three-month period.

How to Buy Coca-Cola Shares?

You probably want to understand how to purchase Coca-Cola shares using online brokers if you are a novice investor with no prior experience working with a broker. It should be noted that because the FCA oversees all brokers operating in the UK market, all of them follow comparable investment guidelines for KO stock. We’ll take you through each stage of buying Coca-Cola shares using eToro in the sections that follow.

Step 1: Visit eToro

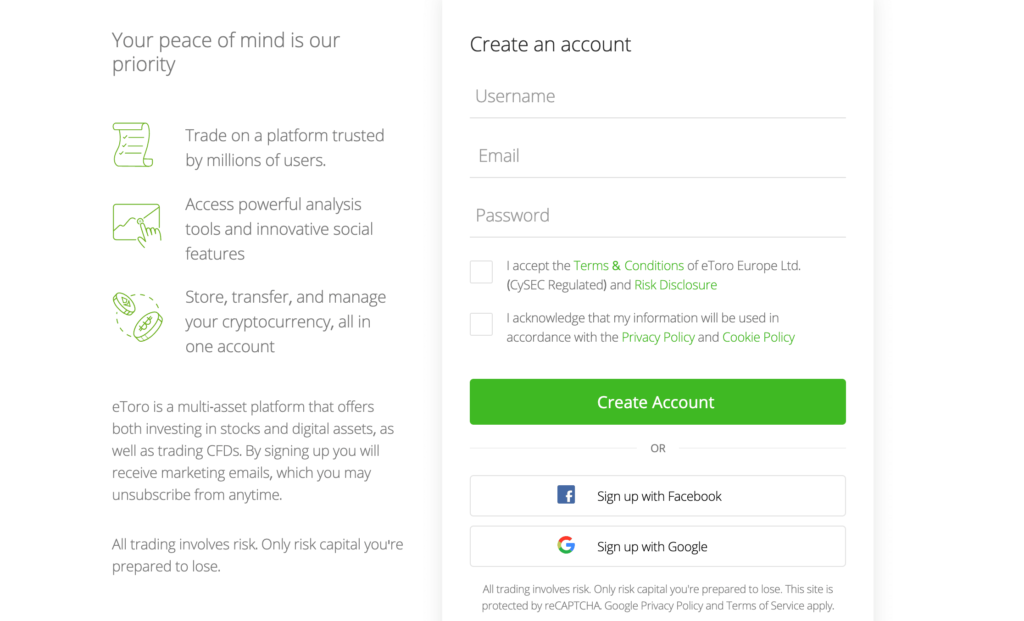

Without accessing the eToro website and completing the account registration process, you are unable to have a trading account. In this instance, click the buttons to the broker’s website that we share on this page to visit it. If you are a frequent trader, keep in mind that eToro provides a trading app you might want to consider downloading. In order for you to handle your financial operations while on the go, this is necessary.

Step 2: Registration

You must provide your personal information to eToro in order to finish the account registration process, which typically takes a few minutes. Your full name, your place of employment, specifics, email, phone number, birth date, etc.

After you have provided all the information needed to register for an account, eToro will give you a fundamental knowledge exam to finish. The trading package you will receive from eToro will be based on how well you perform on this test. Because the broker offers CFD trading, you will eventually engage in leveraged trading. In this regard, a margin trading test will be offered to evaluate your skills and establish the most appropriate leverage limit for you.

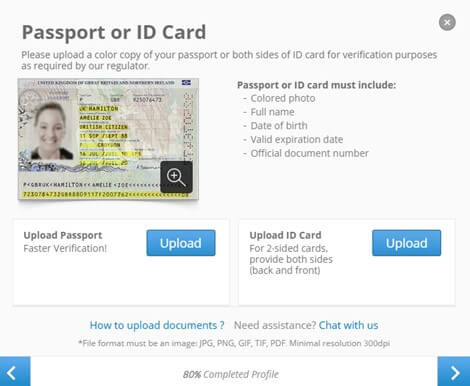

Step 3: Verification

Before completely activating traders’ accounts, all brokers are mandated by the FCA to confirm the traders’ identities. A copy of your identification, such as your ID card, passport, or driver’s license, must be shared with eToro in order to validate your identity. A copy of a recent utility or bank statement will also be required as identification of residence.

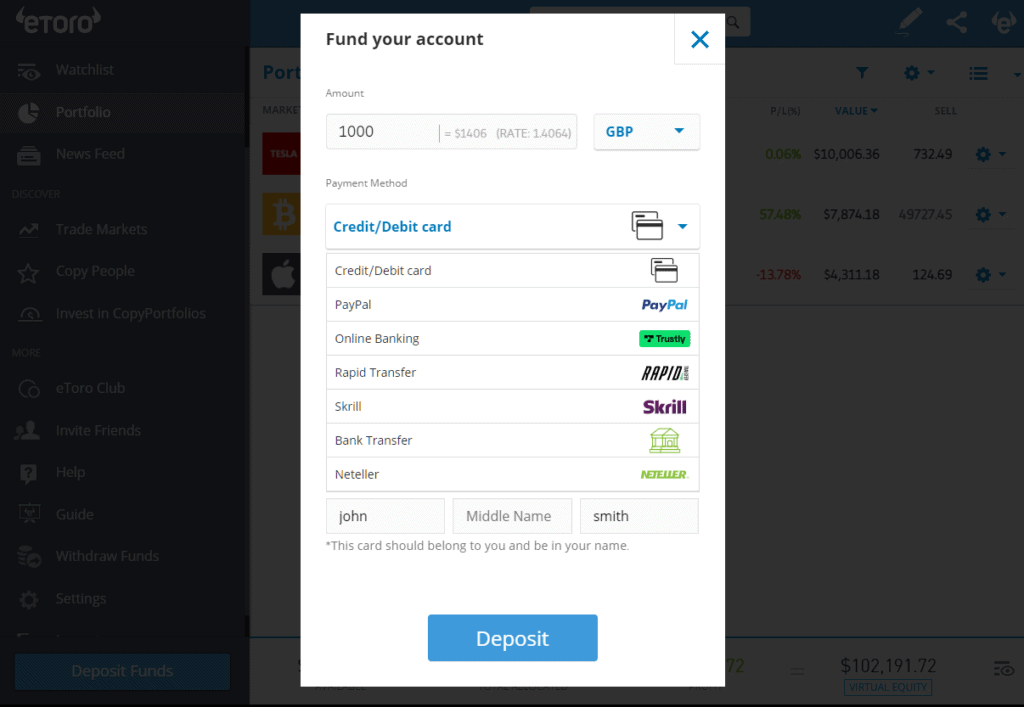

Step 4: Deposit funds

As soon as you make a deposit and log in to the NYSE, where KO shares are listed, your investment account will be completely operational. The lowest minimum deposit is £50, which is offered by eToro. Additionally, it enables the use of e-wallets, bank transfers, and debit/credit cards, among other payment options.

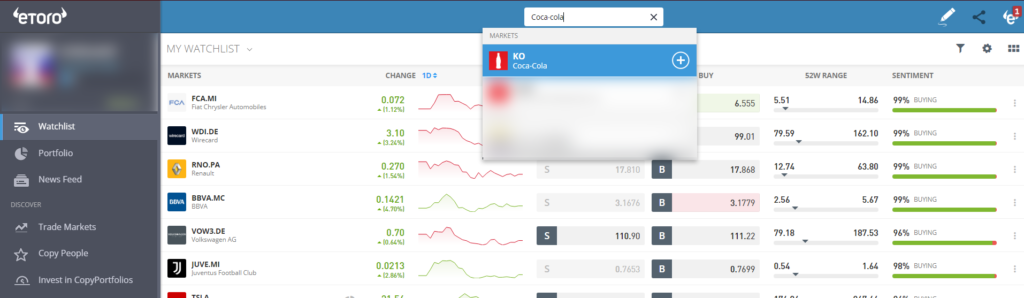

Step 5: Buy Coca-Cola Shares

The broker will authorize access to the NYSE, where Coca-Cola shares are listed and will confirm your deposit. You should invest in KO shares with money that you are willing to lose in the event that your investment suffers a loss.

You can trade the company’s shares as CFDs or indices with eToro. Be sure you fully comprehend these techniques and all associated dangers before committing.

Conclusion

If you were unsure about purchasing Coca-Cola stock, we hope that this article has clarified all of the advantages of doing so. Investment in the company’s shares may be lucrative for all investors because it pays reliable dividends with low volatility.

Do not, at any time, invest in KO shares with funds that you cannot afford to lose. Instead, if you want to increase your chances of success while investing in Coca-Cola shares, pay attention to the price you are paying, conduct a thorough market analysis, and carefully select a broker.

Frequently Asked Questions

Is it possible for me to buy one Coca-Cola share?

Yes. You can purchase one Coca-Cola stock or even a portion of a share, depending on your financial situation. To finalize the transaction, all you have to do is locate the best stock broker with access to the NYSE.

What is the price of buying Coca-Cola stock?

The share price of Coca-Cola fluctuates constantly, making it difficult to determine the actual KO share price. However, by using the live chart above, you may quickly comprehend the current share price of the company and decide when to act.

Is Coca-Cola a wise investment?

Absolutely. One of the biggest soft drink producers in the world, the Coca-Cola company has been around for many years. Pepsi is its main rival, and since Coca-cola is taking steps to dominate the market, buying stock in the company could be beneficial in the long run.

Where can I purchase shares of Coca-Cola?

Through internet brokers, buying Coca-Cola stock is simple. Make sure the broker you choose can access the NYSE, where KO shares are listed, and that they meet your investment needs.

How frequently does Coca-Cola distribute dividends?

Coca-Cola typically distributes dividends once every three months. On April 1, July 1, October 1, and December 15 these payments are made.

Can Coca-Cola be purchased online?

Absolutely. It is simple to purchase Coca-Cola shares using internet brokers. Finding an internet broker that the FCA regulates is necessary because not all online brokers are trustworthy. These brokers ensure the security of your trading funds and provide trading services at the most competitive prices.