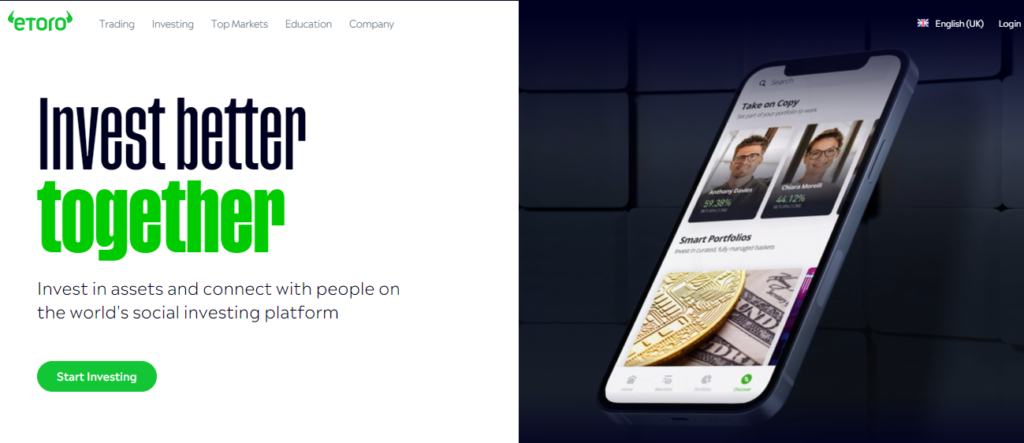

Leading online brokerage eToro provides stock and cryptocurrency trading. It was among the first online trading firms to make trading in cryptocurrency possible when BTC capability was introduced in 2014.

eToro is unquestionably one of the world’s best online brokers. The trading solutions offered by eToro, which concentrate on copy trading, CFDs, and even investment possibilities, are open to everyone. Continue reading our in-depth eToro Broker review to fully appreciate all of eToro’s features and assess whether it satisfies your trading requirements.

eToro Overview

In 2007, eToro made its debut in Israel as a user-friendly platform for FX trading and market analysis. The platform was modernized in 2009 to become a cutting-edge webtrader, and eToro debuted the first-ever social trading service in 2010.

Since then, eToro has unveiled a number of platforms, including a highly regarded trading app. More assets and instruments have also been added to the selection, allowing even more traders to make use of the broker.

As a result, the broker has proven to be among the top online brokers in history. And as of right now, eToro serves millions of users from 140 various nations, including, to name a few, the UK, the U.S., the EU, and Australia.

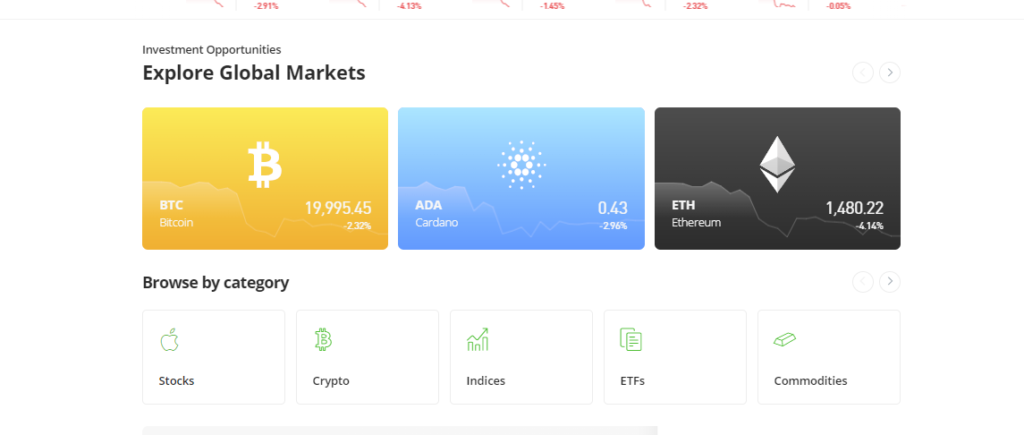

Assets Offered by eToro

The choice of assets available is one of the most important pieces of information you need when signing up with a new broker. The descriptions of each asset that the broker lets you trade and invest in are provided here:

- Stocks: There are 800 different stocks available, ranging from the top tech corporations in the United States to smaller enterprises from around the globe. eToro offers commission-free stock trading at all times.

- Cryptocurrencies: Since eToro was one of the first exchanges to get on the cryptocurrency trend, it’s not unexpected that it currently holds a monopoly on this industry. There are enough cryptocurrency pairs and more than 20 coins to satisfy all traders.

- Currency Pairs: When the broker first started out, it was just another FX broker. Since then, the broker has evolved, but it has maintained faithful to its origins. As a trader, you can choose from 49 different currency pairs, including majors, minors, and a few exotic ones.

- Long-Term Investments: Contrary to many other online brokers, eToro is also appropriate for long-term investments. Their investment portfolios, for instance, are a fantastic method to diversify your portfolio and lower your risk.

- Additional assets: Aside from the aforementioned, eToro additionally provides access to commodities, indexes, and exchange-traded funds as CFDs. There are also a number of distinctive assets that are solely provided by eToro, like Crypto Portfolios. This implies that building a varied portfolio is simple.

eToro Fees

There are some costs associated with trading even though creating an eToro account is technically free and there are no commissions. You must first invest at least £10 if you’re a resident of the UK. Although the minimum deposit amount is £500 if using a bank transfer, this requirement is quite low and a huge benefit. Each subsequent deposit must be at least £50.

Additionally, eToro charges a spread that is larger than many of its rivals and adds £5 to each withdrawal. Although depositing is free as long as you use one of the 14 authorised currencies, you will also need to pay foreign currency rates.

All things considered, eToro is a somewhat pricey broker to trade with, despite efforts to draw clients in with low minimum deposit requirements.

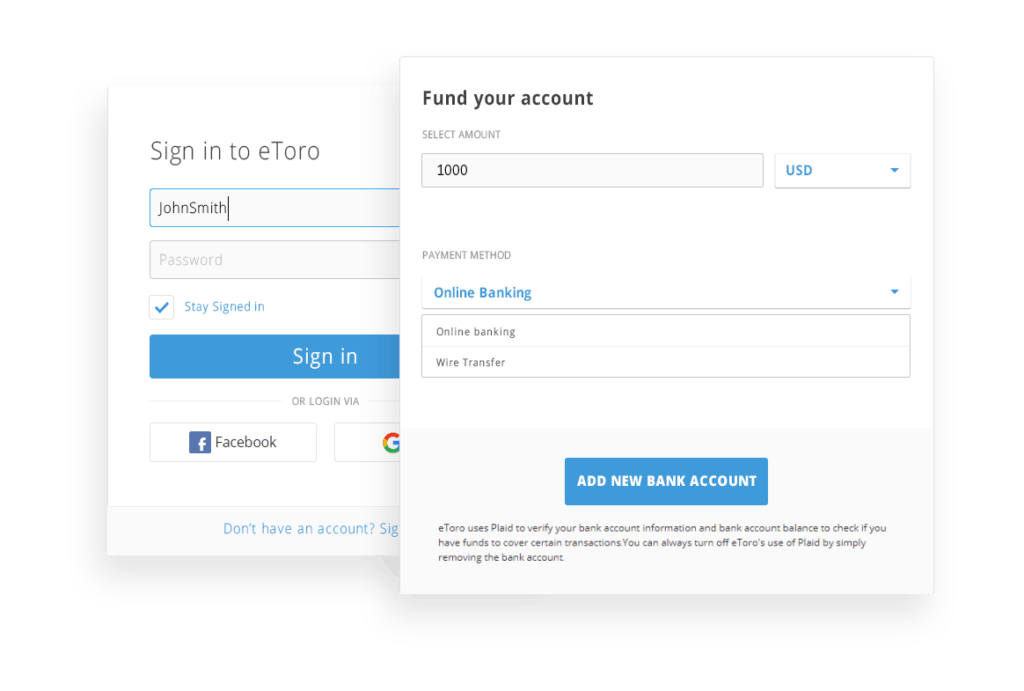

Deposit Methods

eToro offers a variety of widely used payment options so as to accommodate as many traders as feasible. Given that this website is targeted at the UK market, we shall concentrate mostly on the payment methods offered in Great Britain; however, you may have access to other local choices as well.

Additionally, you are not charged exchange costs when using the US dollar, the British pound, the euro, and the Australian dollar to fund your account.

- Credit/Debit card: Use a credit or debit card that is not a prepaid one to make a transfer.

- Paypal: By adding a credit/debit card to PayPal or by using an existing PayPal account, you can use PayPal to finance your account.

- Neteller/Skrill: To fund your eToro account, use the two most popular electronic payment methods available worldwide: Skrill and Neteller.

- Trustly: Trustly is a special payment system available to customers throughout Europe. Although internet banking is necessary for this functionality to work, no further registration is needed.

- Bank Transfer: The slowest option, but also the most dependable, is a bank transfer. Use regular banking procedures to transfer funds from your bank account to your new eToro account.

POLi (Australia) and iDEAL are two choices that are unavailable in the United Kingdom (EU).

eToro features

You can find a quick summary of the features provided by this broker in the section below, it is advisable to test them out with a sample account.

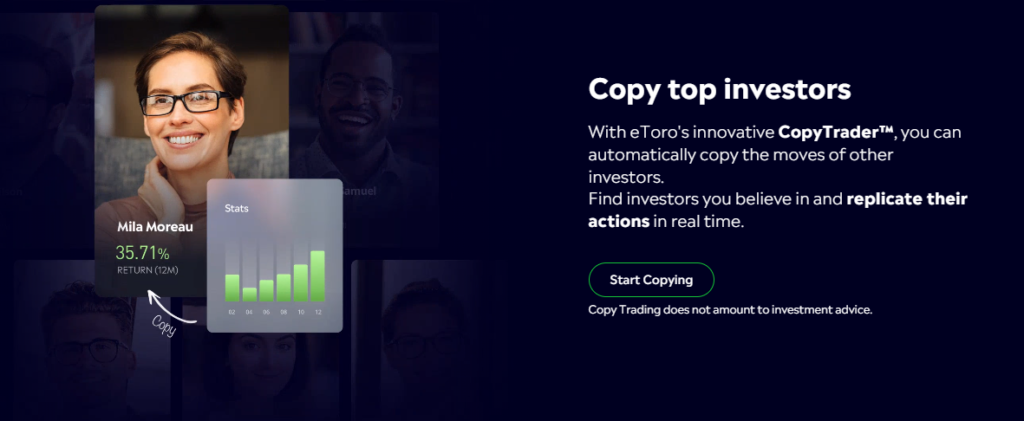

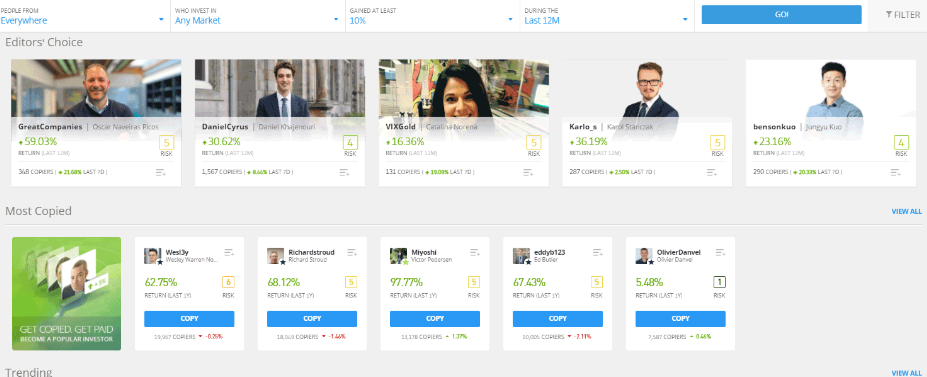

Copy Trading: The mainstay of eToro and the reason for its fame is copy trading. One can reduce the need to analyze the market by imitating more seasoned traders, which minimizes effort while enhancing the possible profit.

Social Platform: eToro enables you to engage with and learn from others in addition to emulating other traders. This is carried out through the eToro social trading platform.

Analytic Tools: Since eToro built its own platform, you are only able to use the broker’s tools as a trader. Having said that, eToro has created a fantastic platform that is consistently improved and upgraded.

Virtual practice portfolio: It’s uncommon to see a broker offer the same capabilities for cryptocurrencies, despite the fact that certain big trading platforms and brokers will let you set up a “paper trading” account to test your stock trading technique. Actually, the simulated account looks a lot like the real trading account. With a $100,000 virtual practice account, you can test your trading strategy or practice entering buy and sell orders. For novice cryptocurrency traders who are still learning how to read indications and spreads, this tool may be extremely helpful.

Market research features

Overall, eToro’s research is competitive and gets better every year, but it still doesn’t win any prizes. For instance, there are no daily market analysis videos, and other functions are restricted until particular account tiers are met.

Research overview: eToro provides podcasts, a daily market analysis series, a calendar of earnings reports, news headlines, and a regular economic calendar. Despite this, some of these functions are not formally included in the eToro platform. eToro club members who have attained a certain tier level are the only ones who have access to Trading Central, which is also available but not accessible to other customers. Those who have sponsored accounts can also access stock research reports.

Market news and analysis: In both its share trading platform and the daily blog posts, eToro does a fantastic job of incorporating fundamental analysis. However, because to the lack of technical analysis, which would improve eToro’s Analyst Per week series of blogs, it behind leading companies including IG and Saxo Bank.

Sentiment data: Rather than displaying sentiment based on data from all users, eToro only uses the transactions of its top traders to produce sentiment data. This elevates it above the standard sentiment analysis tools that brokers offer, and it is comparable to how CMC Markets presents this information.

Wall newsfeed: For each instrument, eToro employs a wall feed of general commentary a la Twitter. This public feed shows a collection of updates from many other eToro members to provide you with an overview of what other traders are talking about on the eToro network. Because it is created by eToro customers, the content’s quality can differ. Although it is undoubtedly distinctive, we believe that content created by internal workers or by outside experts is often of greater quality.

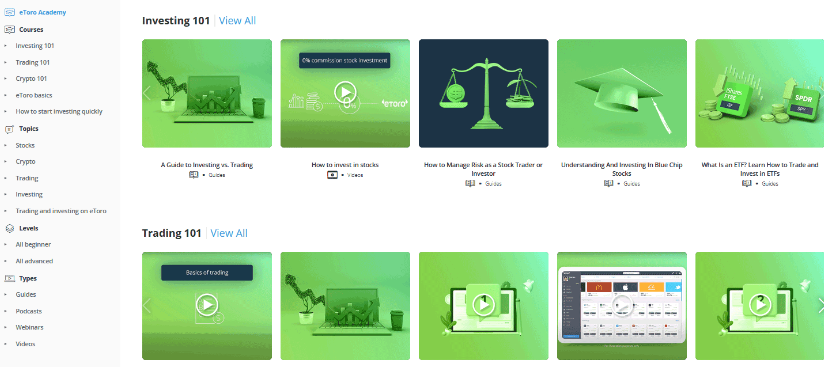

Education resources

Although the eToro Learning Academy and blog offer a substantial number of videos, blogs, and weekly workshops, the calibre and quantity of their content is inferior to those of companies like AvaTrade, Saxo Bank, or IG.

Learning center: eToro offers a virtual trading academy with a wide choice of videos and blogs categorised according to level and subject matter.

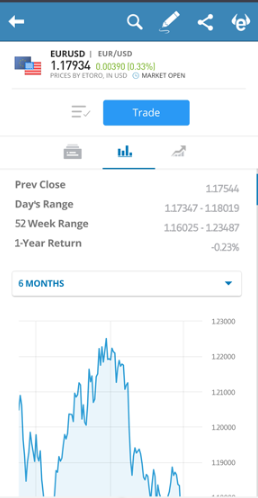

Integrated educational tidbits: Each symbol on eToro’s site has additional information for beginners next to it, including specifics about trading instruments (such as the EUR/USD currency pair) and general information to keep in mind before investing.

Room for improvement: Although eToro has a respectable number of videos on its YouTube account, including market analyses and recordings of past webinars, it can be challenging to tell which ones are for teaching purposes and which ones are for research. To balance eToro’s video material in this category, playlists for instructional content should be created and platform lessons should be kept apart from financial market education.

eToro Customer Support

You must submit a support request through the cryptocurrency broker’s website for the majority of eToro questions. This section is rated 3.5 out of 5 due to the company’s assertion that it could take up to 7 days to hear back from customer support, which is much longer than the majority of other large brokers.

The live chat option is only available to users who have active eToro accounts. On Monday through Friday, live chat is available through your brokerage desktop if you have a current eToro account.

eToro doesn’t currently provide any kind of phone support or assistance for people who have hearing problems. A help center is also accessible.

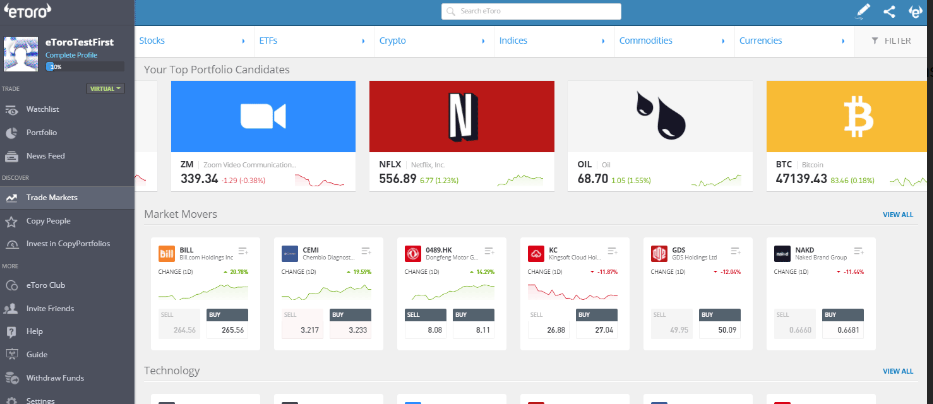

eToro platforms

Platforms overview: The web platform’s primary features are simplicity of layout and ease of usage, and basic functions may be completed quickly and easily. By exploring accessible markets, traders can access features like the possibility to add instruments and the creation of watchlists. In the categories of Ease of Use and Beginners in 2022, eToro was recognized as Best in Class thanks to these design features.

Charting: When you open the ProCharts preset on eToro, the charting’s complete functionality really comes to life. ProCharts comes with 13 charting tools, 66 indicators, the ability to store and choose from preset layouts, and more.

Trading tools: The CopyPortfolios function on eToro, which organizes traders into separate funds for copy trading, is another ground-breaking technology. For traders who want to utilize eToro casually, CopyPortfolios provide a solution since they enable them to create an entire portfolio out of one or more CopyPortfolios. But, self-directed investors can also utilize CopyPortfolios to broaden their trading, making it a tool that all eToro users might find useful.

Cryptocurrency tools: 108 supported cryptocurrency pairs are available for users to find trading ideas and copy other traders. For users who want to withdraw the fundamental digital currencies from their accounts, eToroX offers the eToro Mobile wallet application. This app closely resembles the company’s mobile FX app and serves as a custodian with a multi-signature system.

Copy trading structure: Completely automated trading platforms, commonly referred to as algorithmic trading, such as those offered by MetaTrader, are not permitted at eToro. You can be confident that a trader is placing each trade manually when you imitate them on eToro. The fact that numerous other social trading platforms that integrate trader performance often permit both manual trading and automated trading strategies makes knowing this highly useful.

Mobile trading apps

Generally, it’s a pleasure to use eToro on a mobile device. Users who utilise multiple devices will value eToro’s high usability and nearly comparable functionality on both its web platform and its mobile application.

Apps Overview: The eToro app and eToro Money are two mobile apps that the broker provides for bitcoin and cash transactions. For iOS and Android devices, respectively, both apps are available on Google Play and the Apple App Store.

Ease of use: The mobile application includes useful features like synced watchlists and dark and light mode themes that assist to unify the platform experience across devices, as we noticed during our testing on Android. It also maintains the appearance and feel of the web version.

Charting: The charts are dynamic and strongly mimic the online platform experience even though there are only 5 indicators supplied as compared to 67 on the web. The app lacks any drawing capabilities, which would be a great addition to an otherwise well-integrated and cleanly-designed mobile app.

Cryptocurrency wallet: eToro Money, a distinct mobile app where users can deposit and withdraw cash and genuine cryptocurrencies, is the company’s cryptocurrency wallet. Your private bitcoin keys are kept safe by eToroX, which also holds your cryptocurrency holdings. The eToro Money Wallet substantially resembles the appearance and interface of the mobile application and offers social trading.

Licenses and Security

There are 140 nations in the world where eToro is accessible. For this to function, eToro has been granted licenses by a number of the strictest regulatory organizations in the world, in addition to numerous local governments. This implies that eToro is authorized and subject to control by:

- Europe Ltd. – License No. 109/10, issued and administered by the CySEC.

- UK Ltd. – FCA license number 583263, authorized and governed.

- AUS Capital Limited – ASIC license number (AFSL) 491139; authorized and governed.

- USA LLC – eToro USA Securities Inc. holds a FinCEN licence as a Money Service Business and is a part of FiNRA, SIPC, and both organisations.

How to begin with eToro?

eToro offers a number of different accounts based on your expertise level and the type of trading you intend to do. The most prevalent type of account is a standard trading account with copy trading. Then, day traders can demonstrate their trading expertise by opening a professional account. The corporate account is the last option for business.

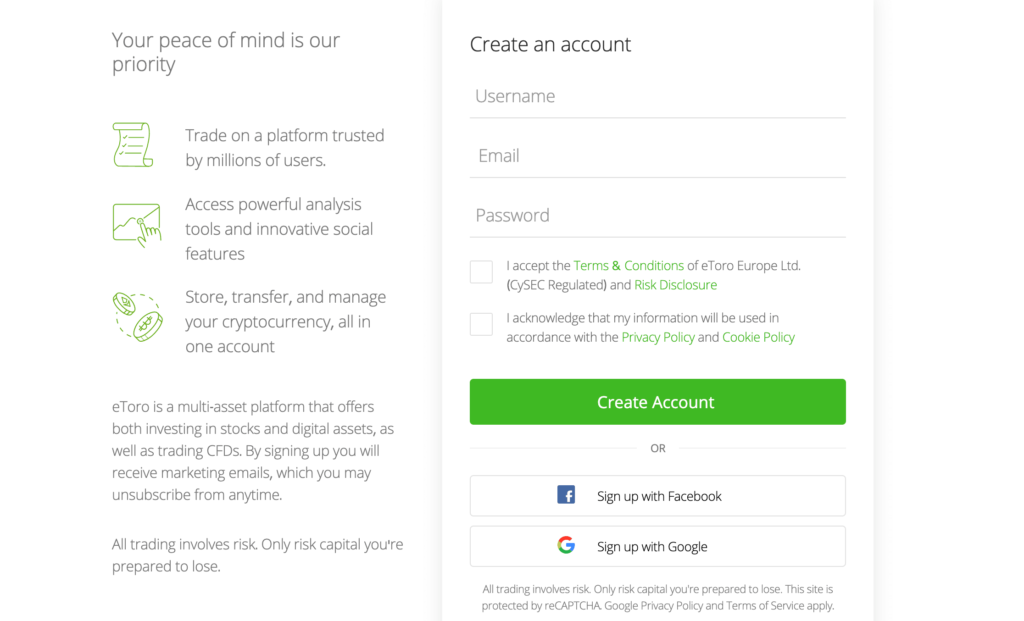

Creating an eToro account is really easy and simply involves the following 5 basic steps:

Step 1: Visit eToro

Use our links to access the broker, and you’ll be sent to the signup page.

Step 2: Register an Account

Give all of your contact details, including name, address, and phone number.

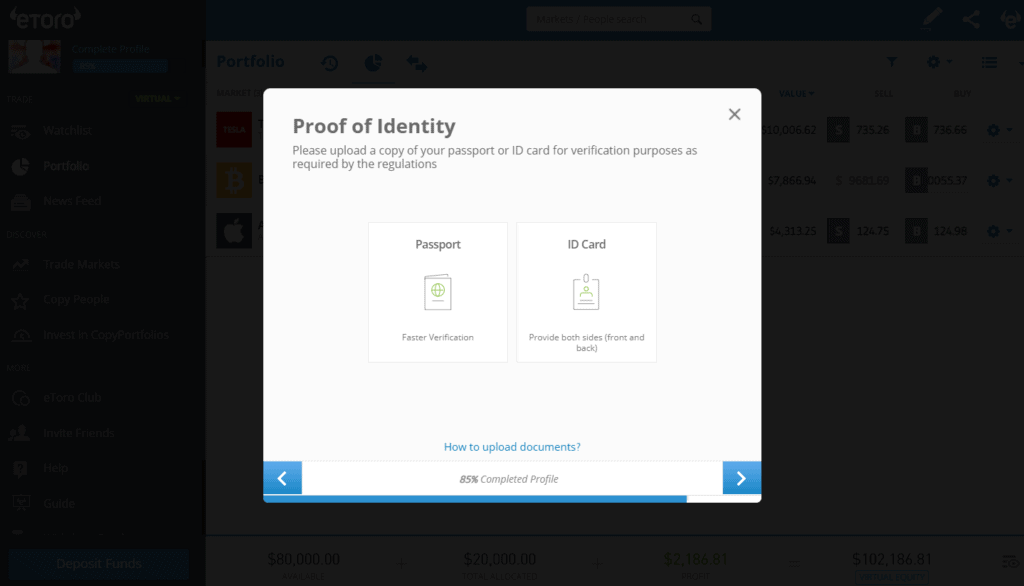

Step 3: Identity Verification

Verify your identity by submitting a copy of your ID as well as documentation of your address (utility bill).

Step 4: Initial Deposit

Put down a down payment that satisfies eToro’s minimum deposit criteria.

Step 5: Start Trading

Start trading with your newly created eToro copy trading account in the fifth step.

Conclusion

This is a fantastic broker, in accordance with our analysis and the opinions of approximately 100,000 eToro users. You will have access to thousands of CFD markets while trading with eToro. However, the broker has recently begun to include both real stocks and cryptocurrency, making it a more diversified experience.

When you take into account that the broker is also accessible as a forex broker in the United States, which is no minor effort, it is clear that it is able to conform to the strict legal criteria of financial markets all over the globe.

This logically implies that we do endorse eToro to all of our visitors. To start, simply click the button below.

Frequently Asked Questions

Is eToro a solid long-term investment platform?

The broker can be used for long-term investments, especially in stocks and digital currencies, although it is mainly an online trading broker. As a result, eToro is ideal for short-term investments techniques like swing trading and day trading.

What if the trading platfrom fails?

Because of the FCA’s licensing and regulation, the broker is required to keep client funds apart from the rest of the business. Consequently, trader funds will still be available and distributed to each trader even if the company fails.

What is the processing time for aa withdrawal?

Transaction timeframes vary significantly depending on the payment type you choose. Withdrawals to electronic wallets like Skrill or PayPal are typically processed right away. Bank transfer times vary and are dependent on your bank.