Fears of a housing market crash are increasing once more. Yes, because of a lack of inventory, the housing market has remained somewhat robust despite the sharp increase in interest rates. Even though existing house sales decreased to a six-month low in July, housing market prices were rising year over year. Homebuilders like KB Home likewise continue to be optimistic that a slowdown, much less a crash, is not just around the corner due to the shortage of housing inventory.

However, several economic indications point to the possibility of a fall shortly. For instance, the start of student loan installments this month might reduce discretionary spending by consumers. The straw that finally breaks the camel’s back maybe it, too.

The general economy could suffer from less discretionary spending, which could contribute to higher unemployment, more mortgage defaults, more forced home sales, and pressure on property values. These are the best equities to sell ahead of what might be the long-awaited start of the end for the early 2020s housing bubble, before a potential housing market meltdown.

1. Dream Finders Homes (DFH)

Compared to other homebuilders, Dream Finders Homes might not be as well known. However, thus far in 2023, the stock has been on fire, increasing nearly treble since January. The major drivers of this high performance have been the continuation of outstanding outcomes along with potential short-squeeze speculation.

The fact that DFH stock is currently one of the stocks to sell, though, may be due to two valid factors. The risk of a housing market crash is the first. Due to DFH’s substantial exposure to some of the most overheated housing markets (Texas and Florida), if a crash occurs, it could hurt the company’s operating results. Second, even if there is no housing catastrophe, DFH might still decide to pull out if its “squeeze appeal” starts to wane. Fintel claims that short interest has begun to decline. On July 31, it peaked at 23.64% of the float; today, it is at 22.5%.

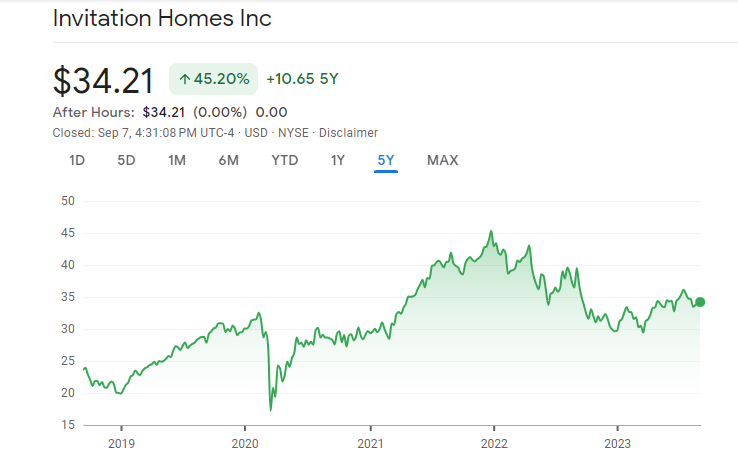

2. Invitation Homes (INVH)

Not just homebuilder equities are susceptible to steep falls in the event of a housing market crisis. Invitation Homes and other real estate investment trusts (REITs) that purchase/lease single-family homes may also be impacted.

Yes, in the case of INVH shares, preserving or increasing rental revenue may help to balance off a potential fall in the portfolio’s underlying value. However, there has already been a decline in rent prices. A double whammy of pressure on shares could result from a slower-than-expected increase in income growth and falling asset prices.

With that stated, if a housing crash occurs and then disappears, there might be a bright spot. It might be simpler for Invitation Homes to buy additional houses at good prices if the housing market is weak. Although a downturn may cause a sell-off in the short term, it may be wiser to sell now even though it might be a wash in the long run.

3. Lennar (LEN)

If a housing market crash materializes, Lennar is unquestionably in trouble. The price of the homebuilder’s share year-to-date (or YTD) has increased by almost 25% as a result of the housing market’s resiliency (due to low inventory).

Berkshire Hathaway, owned by Warren Buffett, recently purchased the shares, which has increased investor trust in LEN stock. This, however, might turn out to be an oversight on the part of the “Oracle of Omaha.” Why? Lennar and other homebuilders, according to the analyst, are in a hazardous situation.

A sharp increase in the supply of homes could result from a decline in loan rates and/or a recession. This would certainly soon put an end to the ongoing golden times for home builders. If this occurs, LEN might undergo a significant reversal. The stock may surrender all of its gains from 2023.

4. Opendoor Technologies (OPEN)

The risk of a housing market meltdown may appear to be already factored into a multi-year stock chart of Opendoor Technologies. The real estate iBuyer’s shares have fallen from about $35 per share to just under $4 per share as of today since early 2021.

But more recently, OPEN stock has started to make a significant comeback. With housing, the other shoe has yet to drop, so speculators have jumped back in, causing a 244.1% increase since January. The problem? This mega rally could end up being brief.

One can picture how terrible things could get if a genuine crisis comes given Opendoor’s weak financial performance in the current “less bad than expected” housing market, with huge revenue decreases and heavy losses. Do not worry about OPEN continuing its comeback. It might be more probable for prices to drop to below $1 per share.

5. Redfin (RDFN)

Another housing-related stock that appears to have priced in a lot of negativity is Redfin. Similar to OPEN, this real estate brokerage company’s stock has had a triple-digit price increase so far this year.

However, over the past few weeks, investor sentiment for the RDFN stock has turned back toward the negative. Since the beginning of August, the share price of RDFN has dropped from slightly over $15 to under $10. The company’s announcement that it would reach break-even adjusted EBITDA in mid-2024 rather than by the end of 2023 was a major factor in this decrease.

If there is a housing crash, there may be further drops and an extension of this break-even point. This could be the reason for the somewhat significant short interest in Redfin shares. Fintel estimates that Redfin has sold short 13.62% of its outstanding float.

Leave a Reply