Since January 1st, Glencore shares price has decreased 22% in value. The larger FTSE 100 index, in contrast, has barely changed. And as long-term investors, we think that now is a great time to buy on a dip. Data from stock screener Digital Look indicates that the army of analysts in the City also agrees.

Of the 13 analysts who have given Glencore shares ratings, 11 believe the business is a “buy,” and eight believe it is a “strong buy.” The company has been given a ‘hold’ rating by the two remaining analysts.

Here are some reasons to add Glencore shares to your stock portfolio right away.

Too cheap to pass up?

As worries about China grow, commodities stocks like this one are falling. Recent statistics released overnight, which revealed that the services sector in the nation grew at its weakest rate in eight months, have heightened concerns about the Asian economy.

Demand for raw resources depends critically on a robust Chinese economy. However, despite difficulties in the real estate and manufacturing sectors, we are still looking to purchase Glencore shares. We are certain that this FTSE 100 firm will continue to produce extraordinary profit growth over a longer time horizon (let us say a decade), even if earnings decline dramatically in the near term.

In addition, Glencore shares’ low price is a reflection of the threat posed by China’s faltering economy. It currently trades with a forward price-to-earnings (P/E) ratio of 8.7 times, which is significantly lower than the FTSE average of 14.

Glencore shares have surged since 2020

Glencore shares fell below 120p on March 20, 2020, when the COVID-19 panic rocked the world’s financial markets. How we wish we had staked all on these shares back then since they have now surged.

This well-liked stock is currently trading at 431.75p. The global miner and commodity trader is now valued at £54.3 billion, making it a super-heavyweight in the FTSE 100. However, the Glencore share price has significantly declined from its 2022–2023 highs.

This share momentarily reached 576.12p on January 18 of this year, which was its 52-week high. Therefore, the stock is significantly closer to its 405.06p 52-week bottom from 15 March than it is to its 2023 top. However, we see Glencore as a major factor in the movement toward a low-carbon, clean-energy future because of its strong market presence in important metals and commodities.

Also read: 3 Cheap FTSE 100 Stocks Under £100

What if Glencore had been purchased five years earlier?

This Footsie share has lost 7.6% of its value over the past year, cash dividends excluded. But one of the reasons we bought this company last month was because of these cash dividends. We paid 435.1p per share total (including purchase commission and stamp duty). As a result, we currently have the smallest paper profit ever.

Glencore shares have been among the FTSE 100’s top performers over the past five years. They easily outperformed the larger index, increasing by 47.2%. In fact, according to our calculations, they are the 21st-best performing blue-chip share throughout this period.

Nevertheless, these figures do not include dividends, which Glencore frequently pays to its shareholders. How much did they cost in total during the last five years? Here is the answer:

| Year | Dividends | In sterling |

| 2018 | $0.20 | £0.16 |

| 2019 | ||

| 2020 | $0.16 | £0.13 |

| 2021 | $0.37 | £0.30 |

| 2022 | $0.52 | £0.42 |

| Total | $1.25 | £1.00 |

Glencore’s dollar dividends of $1.25 over the last five years neatly add up to a lovely, round pound. We will presume that these dividends were not reinvested into more shares to make my life simpler.

Therefore, these dividends would have increased the capital gain by a further 33.8% based on a share price of 295.95p five years ago. As a result, your shares would be worth 435.65p, plus 100p in dividends, if you had purchased this FTSE 100 stock at this price five years ago. That amounts to an 81% increase over our fictitious buy price of 295.95p.

You would therefore have about £9,050 now if you had invested £5,000 in Glencore shares five years ago. A profit of £4,050 (+81%) results from this.

Also read: HOW TO USE DIVIDEND STOCKS TO PASSIVELY AIM FOR £500 EVERY MONTH

A positive perspective

Long-term increases in the global economy and population both result in rising commodity demand. Fortunately for investors today, experts predict that demand for metals will increase quickly over the next ten years, driving up prices as supply shortages start to materialize.

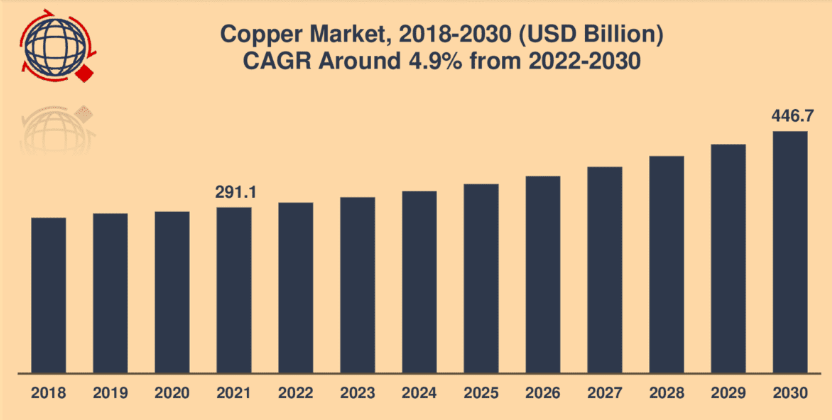

This represents the shift to green technologies and modifications to supply chain models made in response to COVID-19. The demand for copper alone is predicted to increase significantly through the year 2030, as shown in the chart below.

An excellent stock to purchase

To take advantage of this new commodities supercycle, Glencore is in excellent form. It produces copper, nickel, and other essential battery metals. Additionally, it sells a much wider variety of raw resources, such as gold, aluminum, and iron ore.

The company can make significant investments to accelerate the growth of its profits because of its robust balance sheet, which had net debt at a manageable £1.5 billion as of June. Recently, it paid Pan American Silver $475 million to acquire complete ownership of the copper and gold asset known as Mara in Argentina.

Due to Glencore’s strong financial position, City experts anticipate that the company will continue to pay out significant dividends even as short-term profits decline. The miner boasts dividend rates of 8.5% and 6.7% for 2023 and 2024, respectively, that surpass the market.

All things considered, we believe that the mining behemoth is currently too inexpensive to pass up.