In the ever-evolving landscape of financial markets, a few successful American investors have carved their names into the annals of investment history. Their strategies, philosophies, and successes have not only amassed incredible wealth but have also become invaluable lessons for aspiring investors. From the legendary Warren Buffett to the astute Charlie Munger, and the bold Bill Ackman to the tenacious Carl Icahn, each of these successful American investors offers a unique perspective that has contributed to their success. Let’s delve into the lives and wisdom of these financial titans.

1. Warren Buffett: The Oracle of Omaha

Warren Buffett, who is frequently referred to as the “Oracle of Omaha,” is the model long-term value investor. His path is emblematic of wealth development as the CEO and chairman of Berkshire Hathaway. Buffett’s investment approach is finding cheap firms with solid fundamentals and hanging onto them for the long term. His catchphrase is to purchase exceptional businesses at a reasonable cost instead of purchasing subpar businesses at a discount.

Key Lessons: Buffett’s patient and disciplined approach to investing emphasizes the importance of thorough research, a focus on intrinsic value, and an unwavering commitment to long-term holding. The annual Berkshire Hathaway meetings have become a pilgrimage for investors seeking insights into his investment philosophy.

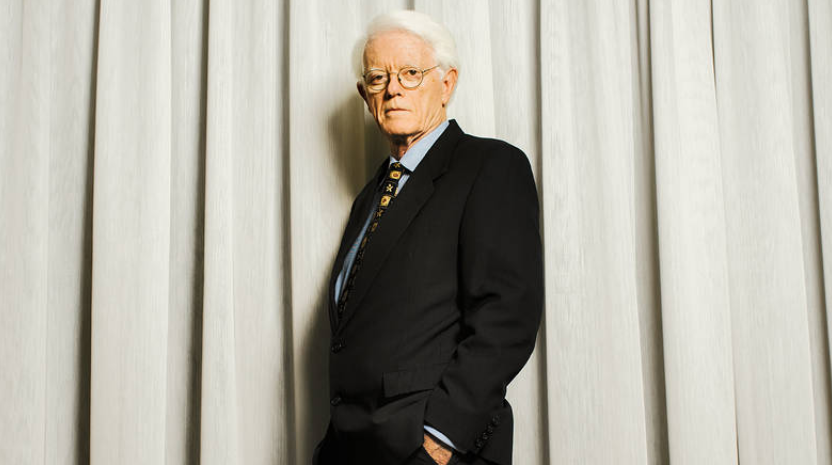

2. Charlie Munger: Buffett’s Right-Hand Man

Charlie Munger, Berkshire Hathaway’s vice chairman, has been Warren Buffett’s trusted partner for decades. Munger’s intellectual prowess and wit shine through in his acerbic wisdom. His famous advice to “invert, always invert” encourages investors to focus on avoiding pitfalls rather than seeking success. Munger’s approach combines a deep understanding of businesses with a pragmatic assessment of human behavior.

Key Lessons: Munger’s lessons place a strong emphasis on the value of intellectual flexibility, the effectiveness of reasoned thought, and the necessity of comprehending the psychological components of investment. His “no-nonsense” answers at Berkshire’s annual meetings offer insightful guidance to individuals trying to understand the intricacies of the market.

3. Peter Lynch: Master of Common-Sense Investing

Peter Lynch, former manager of Fidelity’s Magellan fund, achieved legendary status for his exceptional returns from 1977 to 1990. Lynch’s common-sense approach to investing is encapsulated in his famous advice: “buy what you know.” He believed in the potential of everyday observations to uncover lucrative investment opportunities.

Key Lessons: Lynch’s emphasis on simplicity, understanding the businesses you invest in, and avoiding the allure of short-term trends remains relevant. His books, “One Up on Wall Street” and “Beating the Street,” provide accessible insights for investors looking to navigate the market with a clear and rational mindset.

4. Bill Ackman: High-Profile Investor with Ups and Downs

Bill Ackman, the founder of Pershing Square Capital Management, has been a high-profile American investor known for his bold bets and media presence. His successes, such as betting against mortgage insurer MBIA during the financial crisis, are matched by notable failures, including a highly publicized clash with Carl Icahn over Herbalife.

Key Lessons: Ackman’s journey underscores the importance of resilience in the face of setbacks. His willingness to learn from mistakes, even after public failures, exemplifies the ever-evolving nature of the market. Ackman’s experiences caution investors against overconfidence and stress the need for adaptability.

5. Carl Icahn: The Tenacious Corporate Raider

Carl Icahn, a pioneer of corporate raiding in the 1980s, has evolved into one of the most successful activist American investors. Known for his tough negotiating style, Icahn’s ability to identify undervalued companies and drive strategic changes has redefined shareholder activism. His bold move against Ackman on Herbalife showcased his assertiveness and strategic acumen.

Key Lessons: Icahn’s career highlights the importance of strategic activism, the art of negotiation, and the ability to adapt to changing market dynamics. His successes and setbacks serve as a testament to the unpredictable nature of investments and the need for a diversified and well-researched portfolio.

What makes these American investors successful?

The success of these investors stems from a combination of a clear and disciplined investment philosophy, patience, continuous learning, risk management, and leveraging their unique strengths. Their ability to adapt to changing market conditions and learn from both successes and failures has contributed to their enduring influence in the world of finance. Aspiring investors can draw valuable lessons from their experiences and principles to navigate the complexities of the financial markets successfully.

Conclusion:

Following in the footsteps of these successful American investors provides a unique opportunity for aspiring investors to glean insights and hone their financial acumen. From Buffett’s long-term vision to Munger’s intellectual rigor, Lynch’s common-sense wisdom, Ackman’s bold maneuvers, and Icahn’s tenacity, each of these American investors offers a rich tapestry of lessons. Even though each of their strategies may be different, they are all committed to the value of discipline, ongoing education, and in-depth market knowledge. As investors navigate the dynamic world of finance, embracing the teachings of these financial titans can serve as a compass, guiding them toward informed decision-making and, ultimately, financial success.

Also read: How To Start Trading With $100 And Build A Sustainable Portfolio

Leave a Reply