In a shocking turn of events on November 21, the world’s largest cryptocurrency exchange, Binance, and its CEO, Changpeng Zhao (CZ), pled guilty to criminal activity. The implications of this plea deal extend beyond the downfall of a crypto giant; they may signal a pivotal moment for the entire digital asset class. As the crypto landscape undergoes a seismic shift, we explore the repercussions of Binance’s collapse and the potential rebirth of the industry.

The Era of Misconduct

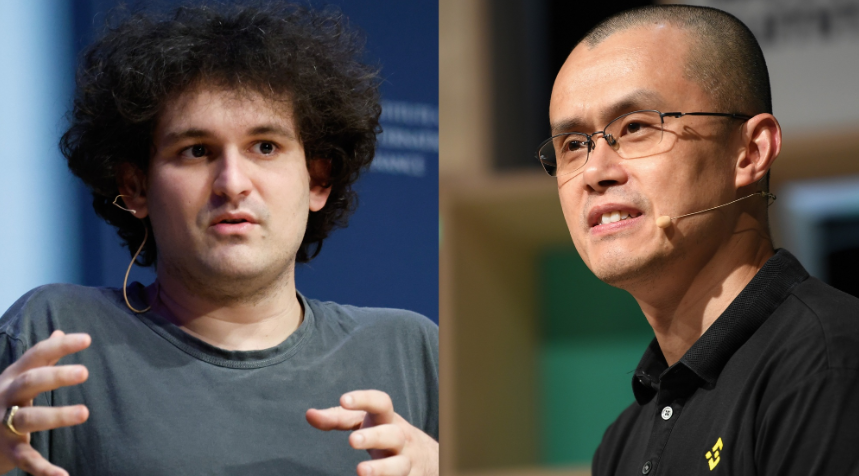

The cryptocurrency industry has long been marred by allegations of regulatory violations, with some prominent players accused of flouting financial rules. In particular, Binance and FTX founder Sam Bankman-Fried have been proven to have engaged in criminal activities. The new generation of participants in the digital asset space, however, seems poised to redefine the narrative.

Binance’s guilty plea and the subsequent actions paint a grim picture of the extent of its misconduct. The exchange faced charges related to failure to implement programs to prevent and report suspicious transactions involving terrorist organizations, ransomware attackers, money launderers, and other criminals. The Department of Justice (DOJ) revealed that Binance willfully failed to report over 100,000 suspicious transactions, enabling illicit actors to transact freely on its platform.

Binance’s guilty plea encompasses a range of criminal activities from its inception. The DOJ press release notes violations related to failure to implement programs to prevent and report suspicious transactions involving terrorist organizations, ransomware attackers, money launderers, and other criminals. Binance facilitated illicit actors to transact freely on its platform by failing to comply with Anti-Money Laundering (AML) and sanctions obligations.

Outside the DOJ settlement, Binance and CZ face thirteen outstanding charges from the SEC. These charges include operating unregistered exchanges, broker-dealers, and clearing agencies, misrepresenting trading controls and oversight on the Binance.US platform, and the unregistered offer and sale of securities. The unresolved SEC issues add another layer of uncertainty to Binance’s future.

The Plea Agreement

As part of the plea agreement, Binance agreed to pay a staggering $4.3 billion—the largest penalty in US Treasury and FinCEN history. Furthermore, CZ stepped down as CEO, facing fines and a potential prison sentence of up to ten years. Binance’s operations were allowed to continue under stringent conditions outlined in a consent agreement with the Financial Crimes Enforcement Network (FinCEN).

Perhaps the most impactful condition is the imposition of a five-year monitorship, during which the US Treasury Department will retain access to Binance’s books, records, and systems. The appointed Monitor will provide regular reports to FinCEN, the Office of Foreign Assets Control (OFAC), the Commodity Futures Trading Commission (CFTC), and the Department of Justice. Notably, the Securities and Exchange Commission (SEC) was not a party to the settlement, and Binance still needs to address SEC concerns.

Binance’s settlement agreement includes a complete exit from the United States, reflecting a significant retreat from its once-global operations. This withdrawal signals a shift in the cryptocurrency landscape, as legitimate businesses now can thrive without the shadow of alleged criminal conduct hanging over the industry.

The Dilemma for Binance Customers

The aftermath of Binance’s guilty plea raises a crucial question: what type of customer will continue with Binance? With increased scrutiny and information sharing with multiple US government agencies, potential customers may find the baggage associated with Binance hard to overlook. The challenge for Binance lies in defining its competitive advantage, especially if its previous advantage was a willingness to circumvent compliance obligations.

Binance’s admission of criminal conduct raises questions about the playing field in the cryptocurrency industry. The company’s disregard for compliance obligations may have allowed it to grow at the expense of legitimate competitors. The harm inflicted on both competitors and the digital asset class itself is immeasurable. With Binance’s demise, a more level playing field may emerge, enabling honest players to contribute to the industry’s growth.

The Path Forward For Binance and Industry

The downfall of Binance, once the best crypto trading platform, has opened the door for a new era in the digital asset class. The guilty plea and subsequent actions against Binance highlight the need for compliance and adherence to regulations within the cryptocurrency space. As the industry evolves, legitimate businesses now have an opportunity to thrive without the shadow of misconduct hanging over them.

In the last six days, more than $2.4 billion worth of different tokens have been taken out of Binance, but the exchange has also seen deposits totaling over $1.8 billion. Even if the net outflows on some days were greater than normal, market sentiment rather than Binance’s internal flaws were the main driver.

Surprisingly, the cryptos and related stock markets also responded positively to the news of Binance’s guilty plea. The price of Bitcoin rallied to over $38,000, signaling renewed confidence in the digital asset class. Binance’s crypto token, BNB, initially faced a 13% dip but later recovered, showcasing the resilience of the broader crypto market. Bitcoin and Ether, the two largest cryptocurrencies, also saw positive movement, suggesting that investors see the downfall of Binance as a new beginning for the industry.

A new era for Binance has begun with the departure of founder and CEO Changpeng Zhao and the appointment of Richard Teng. This leadership move enables Binance to concentrate on developing new cryptocurrency products and securing its position in the market now that the legal matter has been resolved.

Binance has had an interesting ride navigating the ever-changing regulatory landscape and commercial obstacles. Nevertheless, Binance emerges from the mayhem robust and prepared for a possibly stronger position in the market. Because of its resilience in the face of constant change in the cryptocurrency space, Binance exemplifies the resilience that characterizes this industry titan.

Conclusion

In conclusion, Binance’s recent tumultuous events mark a watershed moment for the cryptocurrency industry. The guilty plea and unprecedented penalties underscore the imperative for regulatory adherence and legitimacy within the digital asset landscape. As Binance undergoes a transformative leadership change, the industry stands at the cusp of a more transparent and accountable future.

The positive market response and investor confidence in major cryptocurrencies signal a collective belief in the resilience of the digital asset class. Binance’s challenges serve as a catalyst for heightened industry awareness, emphasizing the need for compliance and responsible practices. This chapter in Binance’s history may well contribute to a more mature and widely accepted era, fostering sustainable growth and establishing cryptocurrencies as a legitimate and integral part of the global financial landscape.

Also read: