Nvidia Stock, a tech powerhouse renowned for its contributions to artificial intelligence (AI), data centers, robotics, self-driving vehicles, and high-performance computing, has captured the attention of investors as it embarks on a new year. After weathering the storm of the previous year’s bear market alongside other industry giants like Apple, Alphabet, Amazon, Microsoft, Meta Platforms, and Tesla, Nvidia stock experienced a remarkable rebound, soaring 365% from its October 2022 low to a new high in August. As we approach 2024, this post explores the variables influencing the future course and possible ramifications for Nvidia Stock.

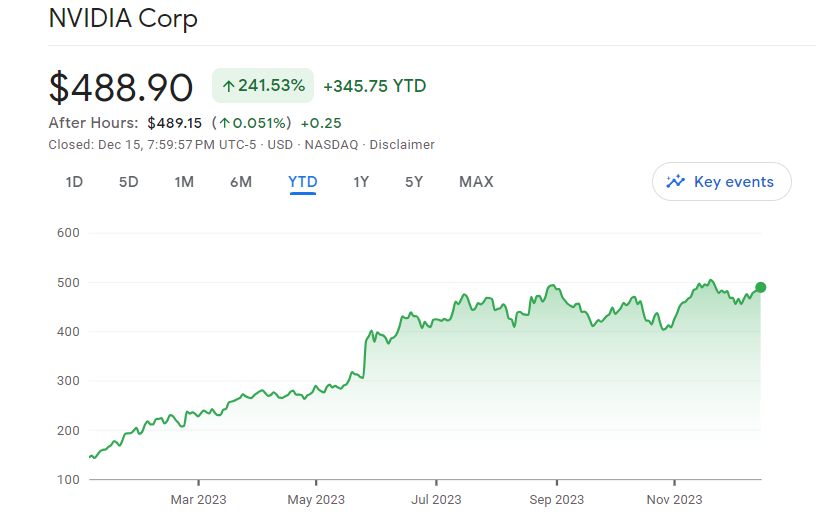

A Recap of Nvidia stock in 2023:

Nvidia stock performance in 2023 was marked by a remarkable 240% surge in its stock, reflecting the investor enthusiasm fueled by the booming demand for advanced chips, particularly in the artificial intelligence (AI) domain. The company’s strategic shift towards AI-capable GPUs for enterprise clients, particularly in data centers, propelled its revenue to new heights. Nvidia’s third-quarter results showcased a staggering 206% YoY revenue jump to $18.12 billion, with the data center segment now constituting 80% of total sales. Notably, the net income skyrocketed by over 1,000%, reaching $9.24 billion, underlining the company’s robust financial health and profitability.

Reasons Behind Nvidia stock’s Meteoric Rise:

1. Incredible Operating Results:

Nvidia’s foundation in 1993, marked by pioneering graphics processing units (GPUs), has positioned it as a leader in GPU technology. The company’s early focus on video game hardware provided a substantial advantage that has translated into broader applications, especially in artificial intelligence. In the third quarter of the previous year, Nvidia’s revenue surged by a staggering 206% YoY to $18.12 billion, primarily driven by the sales of AI-capable GPUs for enterprise clients, particularly data centers. Notably, the data center segment now constitutes 80% of the company’s sales, surpassing the once-dominant gaming segment. The flagship H100 GPU, retailing for $30,000, signifies a shift towards higher-margin products, leading to a net income margin of an impressive 51%.

2. AI Market Dynamics:

The artificial intelligence market, a focal point for Nvidia stock, is expansive and continues to attract competition. While Advanced Micro Devices (AMD) poses a notable threat, Nvidia’s economic moat remains intact. The company’s continuous innovation and timely releases of advanced chips have kept it at the forefront. With the AI chip market projected to reach $400 billion by 2027, there is substantial room for both Nvidia and its competitors to thrive. The expected competition from AMD, while significant, is offset by Nvidia’s lead in both performance and market presence, providing a window for maintaining pricing power.

3. Valuation Perspective:

Despite the apparent richness in Nvidia stock price following the remarkable ascent in 2023, a deeper look at valuation metrics reveals a more nuanced picture. The price-to-sales (P/S) multiple of 26 may seem elevated, being 10 times higher than the S&P 500 average. However, this doesn’t fully account for Nvidia’s rapid growth rate and exceptional margins. A forward price-to-earnings (P/E) multiple of 24 positions Nvidia as relatively cheap compared to projected future profits. As the company capitalizes on the AI boom, investors may still find value, and the stock may not be overvalued based on its long-term potential.

Also read: Forget AI Stocks! It’s Time To Purchase These Dividend Stocks

Nvidia stock’s Growth Trajectory:

1. AI-Related Revenue and Market Dominance:

Nvidia stock’s success over the past decade is attributed to outstanding revenue and earnings growth, primarily driven by the rapid expansion of GPU applications. The company’s data center business, fueled by the explosive demand for AI-focused graphics cards, is a key driver. With Nvidia controlling an estimated 80% of the AI server market, the company is well-positioned to maintain its hegemony. The upcoming release of the H200 GPU, coupled with a tripling of output for the flagship H100 in 2024, indicates the potential for Nvidia to generate $45 billion to $60 billion in revenue from AI chips alone. Analysts foresee the AI chip market reaching $400 billion by 2027, presenting substantial growth opportunities.

2. Diversification and Additional Catalysts:

Beyond AI, Nvidia has identified additional growth catalysts. The digital twin market, with a projected revenue opportunity of $150 billion, presents a significant avenue for expansion. Nvidia’s strategic partnerships with automakers like Mercedes-Benz and BMW demonstrate its commitment to capitalizing on this market. Furthermore, the cloud gaming market, where Nvidia holds a dominant position, is poised to contribute significantly to the company’s revenue. As the tech giant continues to diversify its revenue streams, it solidifies its position as a multi-faceted player in the tech industry.

3. Optimistic Earnings Growth Projections:

Analysts anticipate Nvidia’s earnings to grow at a compound annual growth rate (CAGR) of 113% over the next five years, a substantial increase compared to the 48% CAGR achieved in the past five years. Even with a relatively conservative earnings growth projection of 50% over the next five years, Nvidia could see its earnings per share reach $93. This conservative estimate, when multiplied by Nvidia’s five-year forward earnings multiple of 42, suggests a stock price of $3,900 per share after five years. These forecasts suggest that there could be large returns, which gives investors a strong incentive to think about Nvidia stock for long-term growth.

Challenges and Considerations for Nvidia stock:

1. Geopolitical Challenges:

Despite the optimistic outlook, Nvidia stock faces challenges, particularly in the form of geopolitical tensions. Recent U.S. restrictions on the export of advanced AI chips to China pose a significant hurdle. The emergence of small chip players seeking to challenge Nvidia’s dominance in the Chinese chip market adds an element of uncertainty. These geopolitical dynamics could impact Nvidia’s top-line growth in the coming quarters.

2. Valuation Concerns:

The current high valuation of Nvidia shares, reflected in its elevated price-to-sales ratio of 25.9, raises concerns. While some analysts argue that the premium valuation is justified given the company’s technological prowess and financial performance, the risks associated with future multiple expansions in a challenging geopolitical environment cannot be ignored. A potential reversion to Nvidia’s five-year average P/S ratio of 22.58 in 2024 suggests a market capitalization of $2 trillion, resulting in a share price of around $820 in the best-case scenarios.

Conclusion:

In conclusion, Nvidia stock’s journey in 2024 holds promise, propelled by its dominance in the AI space, diversified growth strategies, and optimistic earnings projections. While geopolitical challenges and valuation concerns loom, the company’s position as an industry leader and its commitment to innovation presents a compelling case for investors. As Nvidia navigates the complex landscape of technology, artificial intelligence, and global dynamics, retail investors may find value in considering a stake in the company, recognizing both the opportunities and challenges inherent in this high-growth trajectory.

Leave a Reply