Examining the best stocks to invest in 2024 reveals a dynamic market characterized by a rising S&P 500, indicating the possibility of an end to the bear market, as well as a combination of chances and obstacles. By the time 2024 rolls around, investors will need to find stocks that not only beat the market but also show signs of steady growth in the future year. In this post, we will explore the 10 Best Stocks to invest in 2024 which are poised for growth in the coming year.

10 Best Stocks to Invest in 2024

Here are the 10 Best Stocks to invest in 2024 which range from disruptive innovators in travel and e-commerce to stalwarts in finance and retail. These stocks not only have outperformed the S&P 500 but also show potential for sustained growth.

1. Airbnb (ABNB): Disruption and Diversification

Airbnb, the short-term lodging disruptor, has demonstrated remarkable growth, boasting a 57% increase in the past year. Beyond its initial high growth, Airbnb has evolved into a sophisticated, cash-flow-positive travel giant. With an 18% YoY increase in Q3 2023 revenue, Airbnb has solidified its dominant position in the industry. The company’s agile, asset-light business model positions it for profitable growth in the years to come, making it a compelling choice for long-term investors.

2. Amazon (AMZN): E-commerce Dominance and Beyond

Amazon’s impressive 75% surge in the past year is indicative of its resilience and adaptability. E-commerce is rebounding, and Amazon’s cloud computing segment, Amazon Web Services (AWS), is fortified with robust generative AI. The company’s diverse revenue streams, including advertising, streaming, and healthcare services, position it as a powerhouse in the market. With a track record of innovation, Amazon remains a stalwart in any investor’s portfolio.

Also read: Amazon Share Price Prediction: What Lies Ahead for AMZN Stock?

3. Costco Wholesale (COST): Sustainable Growth and Global Expansion

Costco’s unique warehouse retail model, supported by membership fees, has contributed to a 31% increase in its stock value this year. The company’s recurring revenue stream, loyalty-driven customer base, and global expansion plans, especially in China, provide a solid foundation for continued growth. As inflation moderates, Costco is poised to benefit from increased consumer spending on higher-priced products, driving revenue growth in the foreseeable future.

4. Global-e Online (GLBE): Enabling Global E-commerce

With a stock value that has increased by an astounding 77%, Global-e Online offers cross-border solutions to e-commerce companies. Online firms can expand their global presence by utilizing its services, which include localized checkout and customs calculations. Global-e is an attractive option for investors looking to get into the e-commerce industry because of its growing list of high-profile clients and strategic alliance with Shopify, which puts it in a strong position to profit from the developing e-commerce market.

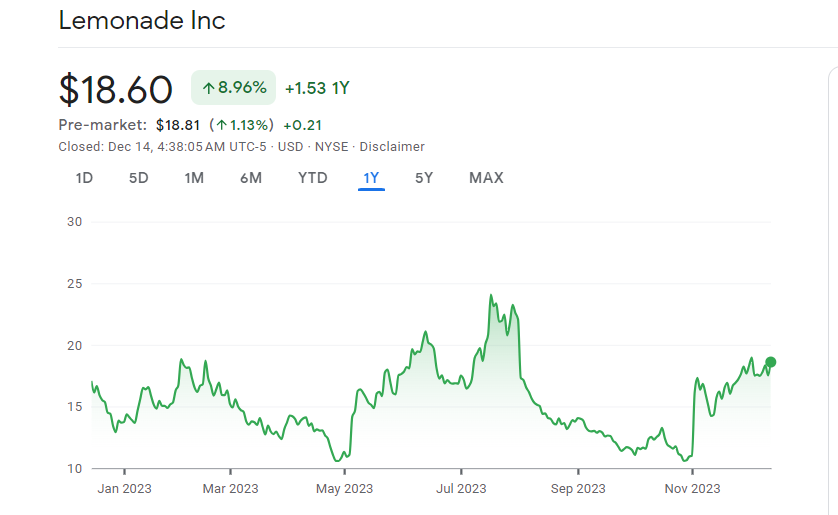

5. Lemonade (LMND): Insurtech’s Evolving Landscape

Lemonade, despite facing volatility and a decline of 87% from its highs, has shown promise with a 34% increase in its stock value this year. The company’s focus on increasing profitability while scaling up, coupled with the success of its AI algorithms, sets the stage for potential growth in 2024, making it one of the best stocks to invest in 2024. As in-force premiums increase and loss ratios stabilize, Lemonade could be on the path to a turnaround, presenting an opportunity for investors with a long-term horizon.

6. Lululemon Athletica (LULU): Beyond Athleisure Trends

Lululemon’s premium athleisure clothing has become more than a trend, with a 46% increase in its stock value this year. The company’s consistent high growth, coupled with its ability to capture market share in regular clothing collections, positions it as a leader in the industry. With non-seasonal products and industry-leading margins, Lululemon is well-poised for sustained profitability and growth in the years ahead.

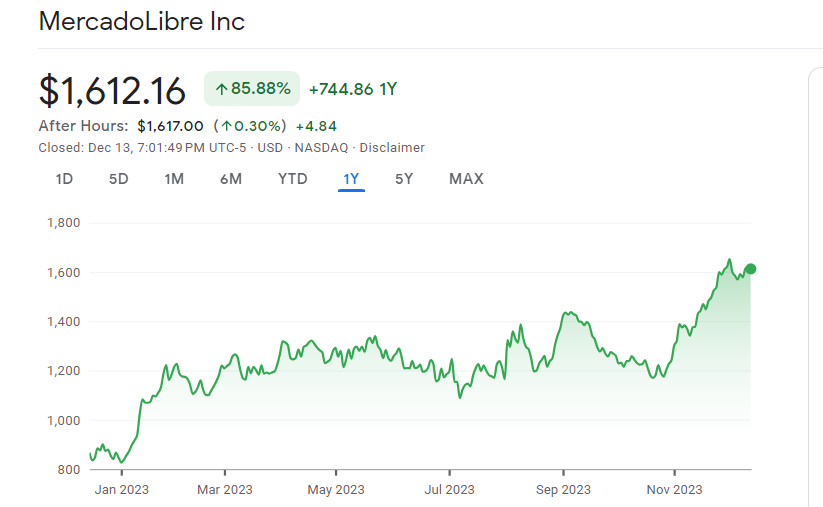

7. MercadoLibre (MELI): Latin America’s E-commerce Giant

MercadoLibre, often dubbed the “Latin American Amazon,” has experienced a staggering 95% surge in its stock value this year. Operating in 18 Latin American countries, the company provides e-commerce services and fintech solutions, reporting high double-digit growth and increasing profits. With a focus on improving delivery times and expanding its fintech segment, MercadoLibre stands out as a key player in the growing Latin American e-commerce market.

8. Nu Holdings (NU): Banking on Growth in South America

Brazil-based Nu Holdings is the operator of a bank that has grown spectacularly, as evidenced by the 104% increase in the value of its stock this year. The company’s growing customer base and cross-selling and upselling tactics have produced excellent financial results. Nu Holdings offers investors looking to gain exposure to the South American financial industry a strong opportunity, as the company has plans for additional expansion in Brazil and other areas.

9. SoFi Technologies (SOFI): Fintech’s Evolution

SoFi Technologies has had a stellar year, with a 70% increase in its stock value, driven by the expansion of its financial services beyond lending. The company’s success in upselling and cross-selling to a loyal customer base has contributed to improving profitability. With a focus on providing user-friendly digital banking services, SoFi has a promising growth trajectory, aiming to report positive net income in the near future.

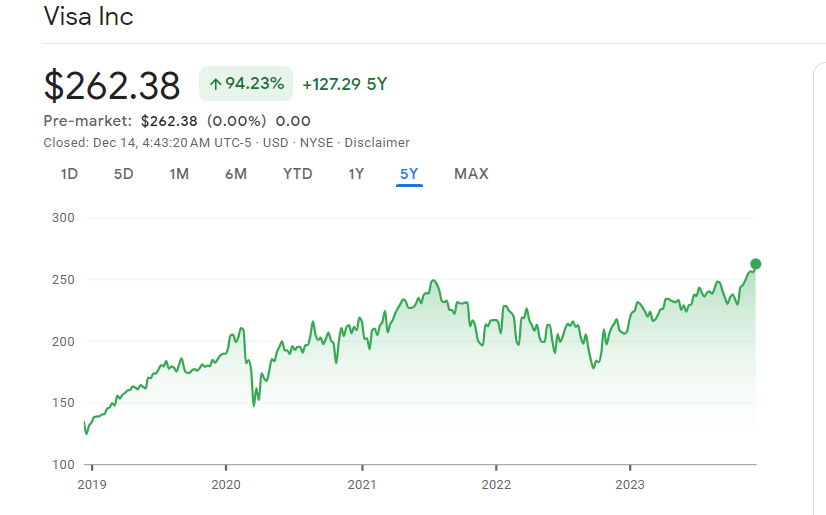

10. Visa (V): Financial Stability and Innovation

Visa, the largest credit card network with a 23% increase in its stock value this year, stands out as a natural candidate to round out a diversified stock portfolio. Despite challenges in the retail climate, Visa has posted increasing revenue and net income, boasting industry-leading profit margins. With growth drivers in new flows, value-added services, and institutional partnerships, Visa remains a market leader and a reliable long-term investment.

Conclusion

As we approach 2024, the investment landscape is rife with opportunities for those seeking to build a robust and diversified portfolio. The recommended 10 stocks to invest in 2024 span various industries, from travel and e-commerce to fintech and athleisure, offering investors a mix of growth potential and stability. And these top stocks showcase promising attributes, the dynamic nature of the market requires ongoing monitoring and adaptation to ensure a successful investment journey in the approaching 2024 and beyond years.