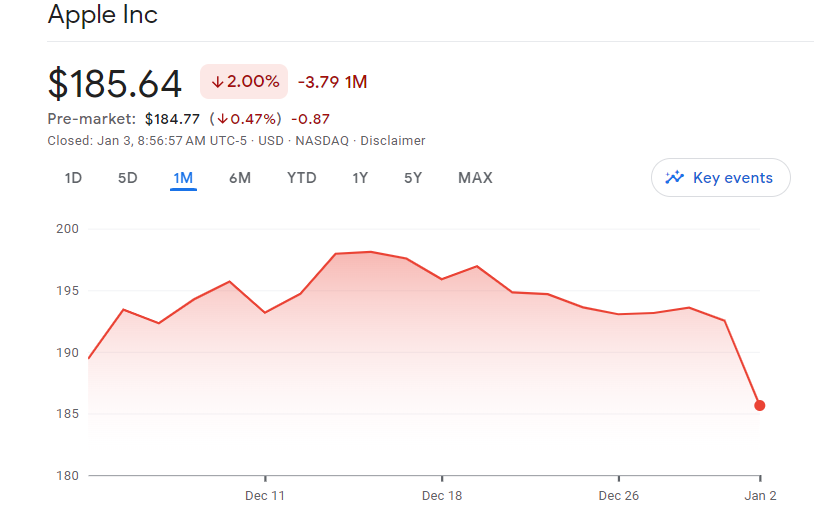

Apple stock, the tech behemoth that ruled the markets in 2023, is off to a difficult start in the new year. The company’s shares recently fell 3% as a result of a downgrade by Barclays, which highlights mounting concerns about the company’s projected lackluster demand for its products through 2024—from iPhones to Macs. Due to this downgrade, Barclays is now the second brokerage with an Apple “sell” rating, which represents the largest proportion of optimistic recommendations in the previous two years.

The iPhone 15’s poor performance is the main reason for the gloomy forecast, and Barclays believes the next iPhone 16 will suffer a similar fate. Due to a combination of slowing demand in developed economies and increased rivalry from local rival Huawei in China, Apple has been experiencing a decrease in demand since the beginning of the year. Analysts’ main concern has been the iPhone, which is a significant source of revenue for the business.

Furthermore, the services division of Apple, which generates close to 25% of the company’s overall income, is facing increasing risks. This market, which had previously outpaced the expansion of hardware, is currently under fire due to app store policies, especially in the US. Due to challenges to Apple’s overall business picture, the market responded on Tuesday by devaluing the company by $90 billion.

Barclays reduced its 12-month price estimate for Apple stock to $160 and downgraded the company from “neutral” to “underweight.” Since July 2022, the only other negative rating on Apple has come from Itau BBA’s “sell.”

Analysts generally still view the firm as a “buy” with a $200 median price target, despite these downgrades. Nonetheless, Apple’s present valuation is significantly higher than the benchmark S&P 500’s 19.8, at over 28.7 times its 12-month forward earnings expectations.

On the innovation front, D.A. Davidson analyst Gil Luria suggests that Apple needs to break free from stagnation. To justify further gains, Apple must showcase growth in existing products and introduce new ones.

Luria emphasizes the importance of innovation in artificial intelligence (AI), an area where Apple has been relatively tight-lipped about its projects. While there are reports of a substantial investment in AI chips from Nvidia, Apple’s plans in this realm remain undisclosed.

Apple stock has to show that it can overcome obstacles, spark innovation, and successfully compete in the quickly changing tech sector as it enters its second day of losses, trading at $185.64 in premarket trading on Wednesday.

In order to reassure stakeholders and investors alike, Apple is under pressure to demonstrate not only its short-term resilience but also its long-term growth potential.

Leave a Reply