As 2024 unfolds, the spotlight intensifies on AI stocks, with Tesla and Nvidia emerging as pivotal players in this dynamic landscape.

In this post, we scrutinize the contrasting trajectories of Tesla and Nvidia, evaluating crucial financial metrics and growth prospects. Beyond this high-stakes competition, we delve into some alternative AI stocks, offering investors a diverse array of opportunities in the flourishing AI sector.

Tesla and Nvidia: A Financial Face-Off

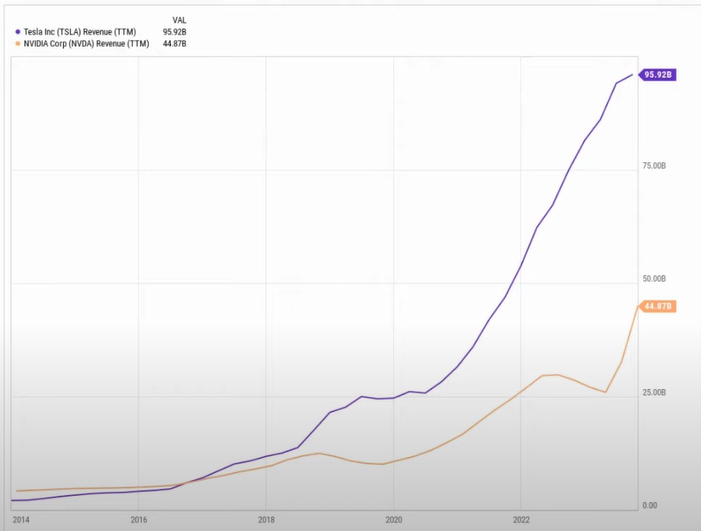

Trailing 12-Month Revenue:

Comparing the trailing 12-month revenue of Tesla and Nvidia reveals an interesting trend. In 2016-17, both companies were neck and neck, but Tesla has since surged ahead, generating $95.9 billion in the most recent trailing 12 months. In contrast, Nvidia lags behind at $44.87 billion.

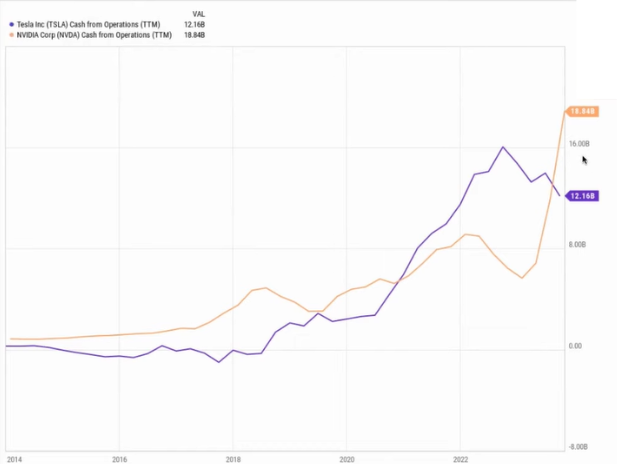

Notably, Nvidia has demonstrated superior cash flow from operations, generating $18.8 billion compared to Tesla’s $12.16 billion. This raises questions about Tesla’s capital-intensive nature and the impact of slowed electric vehicle (EV) demand in 2023.

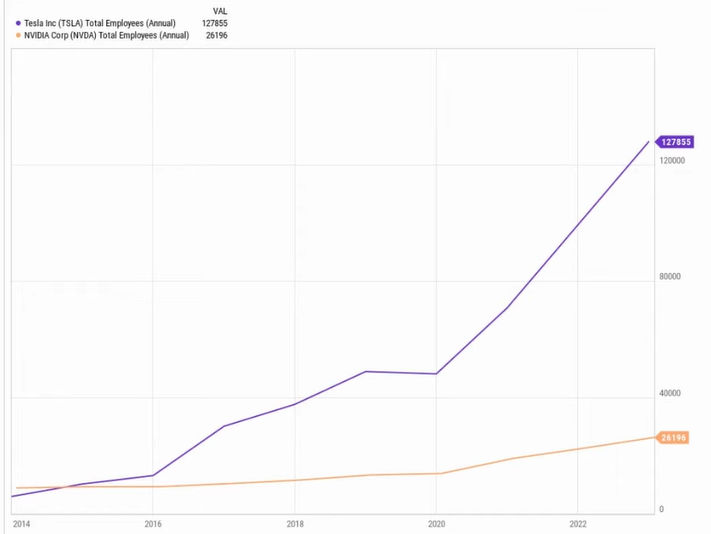

Efficiency and Employee Count:

Examining the total employee count provides insights into operational efficiency. Surprisingly, Tesla has nearly five times the employees of Nvidia (127,000 vs. 26,000). However, Nvidia excels in generating cash flow with fewer employees, showcasing better profitability and a more lucrative business model.

Economies of Scale:

Both companies exhibit economies of scale, with their operating profit margins evolving over time. Nvidia has consistently outperformed Tesla, boasting a 45.94% operating profit margin compared to Tesla’s 11.22%. This highlights Nvidia’s efficiency in scaling its operations and maintaining profitability.

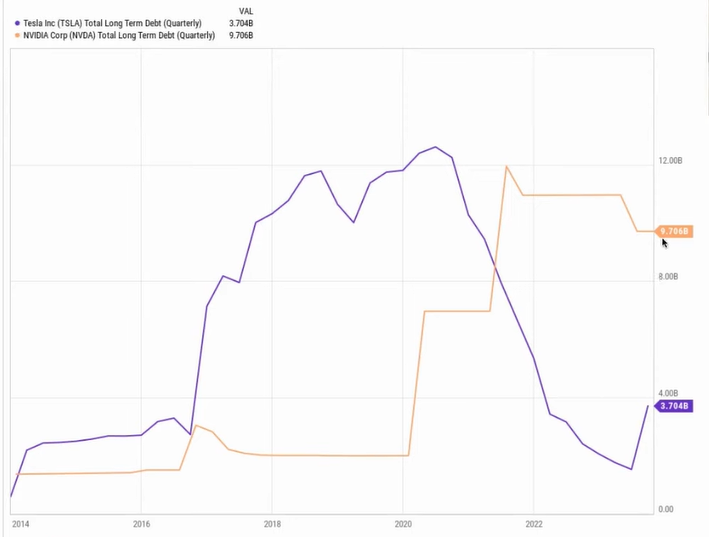

Balance Sheet Strength:

Analyzing the balance sheets, Tesla emerges as the stronger contender with over three times the cash and equivalents of Nvidia ($15.9 billion vs. $5.5 billion) and lower long-term debt ($3.7 billion vs. $9.7 billion). Tesla’s robust balance sheet positions it favorably for future endeavors.

Growth Projections:

Looking at investor expectations for the next few years, Nvidia appears to have more promising growth prospects. With projected revenue growth of 56% in 2024 and 17.5% in 2025, coupled with impressive earnings per share growth, Nvidia’s trajectory surpasses that of Tesla.

Valuation:

Considering the forward price-to-earnings (P/E) ratio, Tesla trades at a significantly higher valuation (61.99) compared to Nvidia (24.41). Despite Tesla’s strong balance sheet, Nvidia’s better operational efficiency, growth outlook, and lower valuation make it an attractive investment option.

The Winner:

In the head-to-head comparison, Nvidia emerges as the preferred AI stock for investment. Its operational efficiency, stronger growth projections, and more favorable valuation make it a compelling choice for investors seeking exposure to the thriving AI industry. While Tesla holds promise, its challenges in navigating a competitive EV market and a capital-intensive business model warrant cautious consideration.

Also read: Analyzing The Future Trajectory Of Nvidia Stock In 2024

Alternative AI Stocks for 2024:

As investors look beyond the formidable duo of Tesla and Nvidia in the dynamic AI sector, several alternative stocks present promising opportunities for 2024. Diversifying your portfolio with these AI-centric companies offers exposure to different aspects of the industry and enhances the potential for robust returns.

1. Alphabet Inc. (GOOGL – GOOG):

Alphabet has firmly established itself as an “AI-first” company, reflecting its commitment to advancing artificial intelligence technologies. Despite initial setbacks, Alphabet has surged forward, recently unveiling its Gemini generative AI model. This model has surpassed competitors, including OpenAI’s GPT-4, in various benchmark tests.

Moreover, Alphabet’s cloud computing product, Google Cloud, stands to benefit significantly from the increasing demand for computing power and storage space to support proprietary AI models. The company’s recent move to restructure its advertising business is a strategic step towards further integrating AI and monetizing these advancements.

Despite its impressive strides in AI, Alphabet’s stock is currently trading at a modest 21 times 2024 earnings, presenting an attractive valuation compared to other major tech stocks.

2. CrowdStrike Holdings Inc. (CRWD):

CrowdStrike distinguishes itself as a cybersecurity company leveraging AI, specifically machine learning, to create adaptive and continuously evolving software that shields clients from the ever-evolving landscape of cyber threats.

With an annual recurring revenue of $3.15 billion, CrowdStrike has rapidly ascended to become one of the largest cybersecurity providers, witnessing a notable 35% growth in the third quarter of fiscal 2024.

Operating in an industry estimated to be worth $100 billion in 2024, CrowdStrike stands at the forefront of a cybersecurity sector expected to expand to a staggering $225 billion by 2028, indicating significant growth potential.

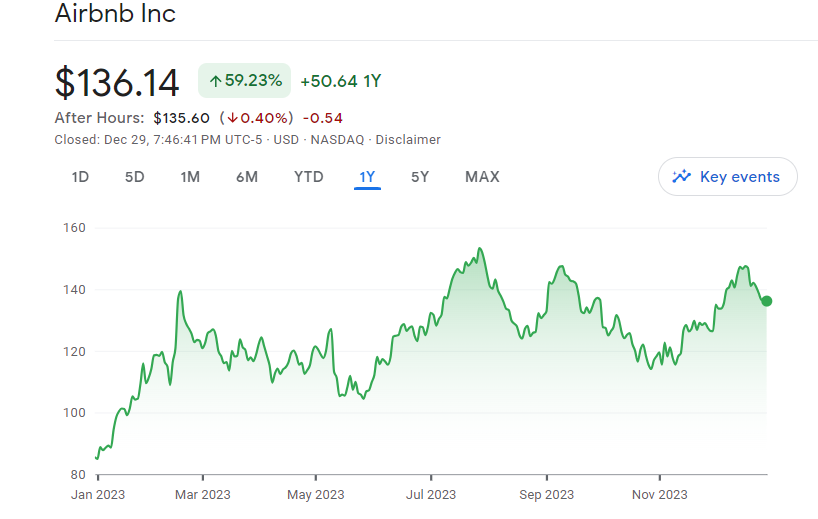

3. Airbnb Inc. (ABNB):

While renowned for its role in short-term rentals, Airbnb quietly integrates AI into its platform to enhance user experiences. Notably, its AI model predicts and prevents disruptive events such as parties, addressing concerns that tarnished the company’s reputation.

Airbnb’s strategic move to acquire GamePlanner.AI adds an intriguing layer of potential innovation, as the exact application of the newly acquired AI model remains undisclosed. This acquisition underscores Airbnb’s commitment to staying ahead in the evolving tech landscape.

Boasting an 18% increase in revenue in its latest quarter and an impressive operating margin of 44%, Airbnb not only incorporates AI innovation but also maintains a robust financial performance.

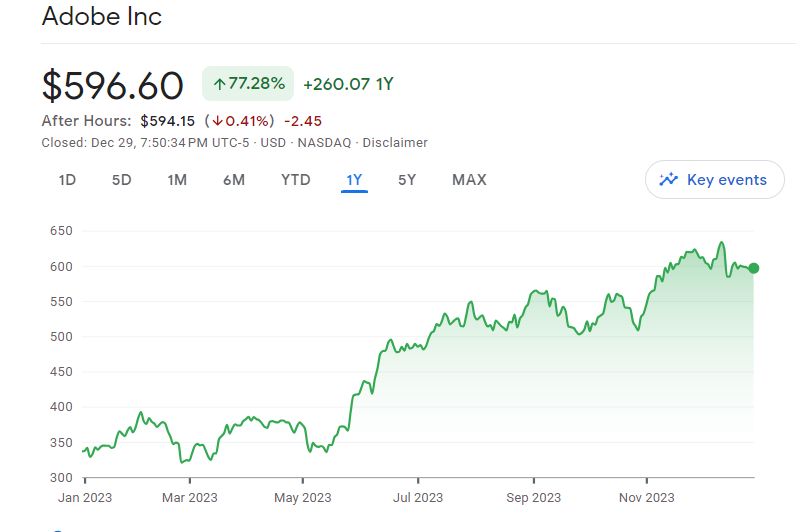

4. Adobe Inc. (ADBE)

A leader in the digital media space, Adobe has seamlessly integrated AI into its products. The Firefly generative AI, allowing users to modify or create images with simple text input, is a standout feature.

Adobe’s will to stick with a business model that has continuously produced growth is evident in its decision to scrap its costly acquisition plans with Figma. The company recorded a 12% year-over-year gain in revenue and a significant 29% growth in profitability in the fourth quarter of fiscal 2023.

Management projections for 2024 indicate a continued growth trajectory, with a forecasted 10% rise in revenue and a 15% increase in earnings.

Final Thoughts:

In conclusion, as AI stocks take center stage in 2024, the Tesla and Nvidia rivalry unfolds with Nvidia emerging as the preferred investment choice. Its operational efficiency, robust growth projections, and appealing valuation position it as a key player in the thriving AI landscape. Beyond this dynamic duo, alternative options present diverse opportunities for investors, showcasing the expansive potential within the AI sector.