Coca-Cola stock had a difficult year in 2023 as its stock price dropped significantly due to worries about weight-loss pills like Ozempic and Mounjaro. Even while the pharmaceutical sector benefited from the widespread use of these drugs, investors’ perceptions of Coca-Cola were affected and questions were raised about the future of sugary drinks. But we think the worries are exaggerated, and the company offers 2024 bargain hunters a special chance.

In contrast to the pessimistic forecast, Coca-Cola’s financial performance held steady in 2023, as increasing revenue and profits demonstrated a continued demand for its drinks. The story that weight-loss pills are bad for the company does not seem to be true, especially when you contrast it with competitor PepsiCo, which experienced remarkable growth in both snacks and beverages.

Beyond classic sodas, Coca-Cola offers a wide range of products, including water, coffee, and sports hydration drinks. Selling syrups and concentrates to bottlers brings in a sizable amount of money for the company, exposing other income sources that support its overall performance. With this multifaceted strategy, Coca-Cola is positioned as more than just a soft drink company, and the effects of shifting consumer tastes are lessened.

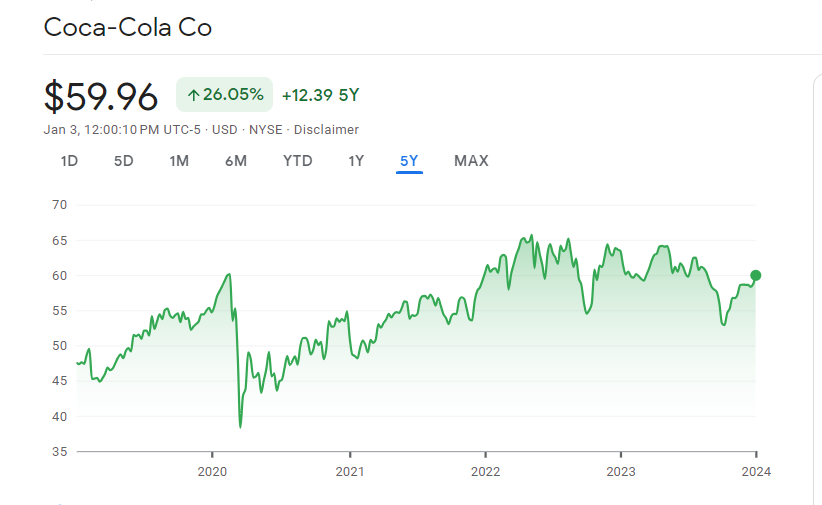

In 2023, Coca-Cola’s stock price fell by 7%, yet the renowned brand has maintained a history of steady dividend increases for more than 50 years. For investors looking for consistent income, the current price-to-earnings (P/E) ratio of 24 is an appealing choice because it represents a significant discount to long-run averages.

Coca-Cola stock is an appealing option for people who prioritize passive income due to its stability and cheap valuation, even though other investors may be lured to higher-growth options. Income-focused investors are aligned with the company’s commitment to delivering value to shareholders through dividends.

In summary, we believe that purchasing Coca-Cola stock in 2024 is a no-brainer. Investors seeking consistency and stability may find the company interesting due to its attractive valuation, good financial performance, and broad portfolio. We expect a positive shift in investor sentiment as the market comes to terms with Coca-Cola’s true depth beyond soda, further solidifying its position as a reliable and profitable investment.

Also read: Apple Stock Faces Challenges in 2024 Amidst Barclays Downgrade

Leave a Reply