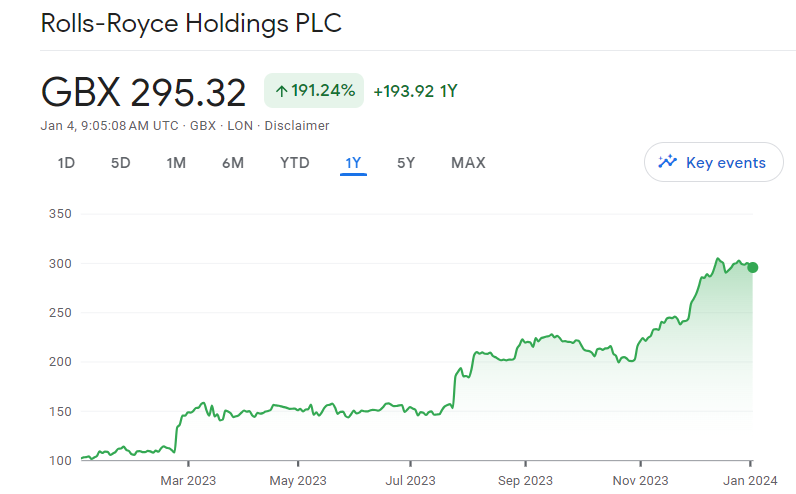

Rolls-Royce shares enjoyed a remarkable surge in its shares during 2023, tripling in value. While the stellar performance is undeniable, potential investors must carefully evaluate the risks before considering a purchase in 2024.

On the positive side, Rolls-Royce has benefited from booming demand in civil aviation, propelling both revenues and profitability. The appointment of a new CEO, who has implemented aggressive cost-cutting measures, has been well-received by the market. The current market capitalization, even after the surge, remains at around £25 billion, approximately 10 times the company’s medium-term target for annual operating profits of £2.5 billion to £2.8 billion.

However, there are three key reasons to exercise caution.

Firstly, execution risks loom large. The current share price reflects high expectations for commercial performance, yet implementing a robust plan remains a significant challenge. Corporate overhauls can lead to weakened employee morale and potential overreach by the sales team, posing risks to long-term profitability. While the ambitious turnaround plan has intrigued investors, the jury is still out on whether management can deliver on its promises.

Secondly, the uncertain demand outlook in the core industry raises concerns. Rolls-Royce operates in a sector with limited competition, selling complex and expensive products that require regular servicing. However, the industry’s susceptibility to external shocks, as witnessed during the pandemic and historical events like the Icelandic volcano eruption and the 2001 US terrorist attacks, poses a significant systemic risk. Such unforeseen events can dramatically impact engine sales and servicing demand, dampening the appeal for risk-averse investors.

Lastly, the challenging valuation adds another layer of skepticism. Despite the seemingly attractive 10 times projected medium-term operating earnings, caution is warranted. The price-to-earnings ratio may not accurately reflect the true picture, as factors like debt servicing can create a notable difference between operating and reported earnings. Rolls-Royce’s historical profitability volatility, coupled with the absence of clear plans for smoother profit delivery, raises questions about the sustainability of the current valuation.

In conclusion, while there are positive factors, the prevailing risks suggest that the current price of Rolls-Royce shares may already factor in expectations of success. As such, potential investors might find limited opportunity for significant returns, even if the company performs as anticipated. It is essential to weigh the potential rewards against these substantial risks before making an investment decision in 2024.

Also read: Unveiling The Tesla And Nvidia Rivalry And Exploring Diverse AI Stock Opportunities