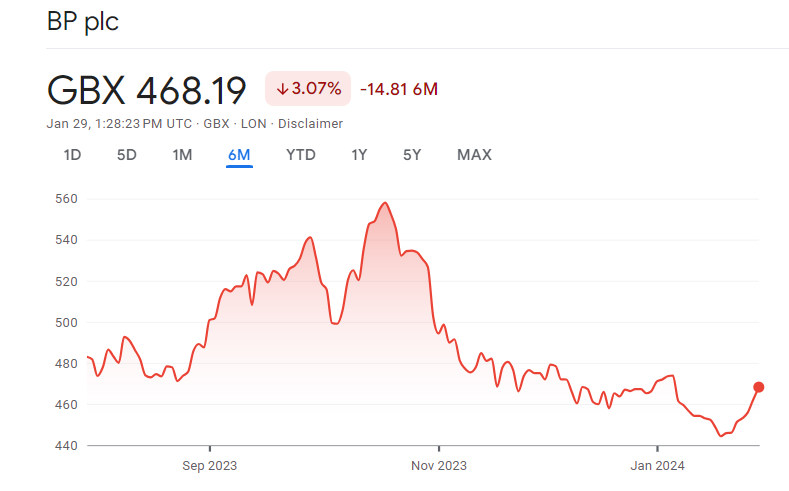

BP shares have recently faced a 17% decline since mid-October 2023, approaching their 52-week low. However, amidst this apparent turbulence, there lies an opportunity for astute investors to capitalize on a potential bargain.

The turbulent ride the oil company has had in recent years, especially following the pandemic-caused crash of oil prices in 2020, can be blamed for the current decline in the price of BP shares. However, the robust rebound after 2020 presents a positive image, which makes the current decline a fascinating entry point.

This positive viewpoint is centered on the stock’s favorable value. BP looks incredibly cheap, with a price-to-earnings (P/E) ratio of just four, which is half of what the average P/E ratio of FTSE 100 companies is. Even more alluring is the forward-looking P/E of six, which is significantly lower than the company’s historical average.

A healthy 4.8% dividend yield, with estimates pointing to a possible dividend increase in 2024, adds appeal to the investment thesis. While dividends are not guaranteed, the prospect adds a positive note to the investment proposition.

Navigating Risks

There are risks associated with any investment, though. One persistent worry is the volatility of oil stocks, which are prone to both macroeconomic and geopolitical variables. The increasing impact of ESG (environmental, social, and governance) investors avoiding traditional oil stocks highlights the extra issues posed by the global push towards renewable energy and the threat of the energy transition.

However, we believe that there will be a gradual shift away from traditional oil and gas products, giving BP time to adjust to these long-term trends. BP’s commitment to a more sustainable future is demonstrated by the company’s sustainability integration plan, which involves significant investments in green initiatives like expanding power trading operations and lower-carbon convenience stores.

In conclusion, we recommend taking advantage of the current opportunity even with the associated risks, considering BP shares to be a great deal at their current price. Investors who have confidence in the long-term value proposition offered by BP shares should open a stake in February, keeping a close watch on the possibility of the share price increase and using a diversified strategy for sustainability.

Also read: 7 Highest Dividend Paying Stocks In NYSE And How To Invest In Them

Leave a Reply