The attraction of the highest dividend paying stocks on the New York Stock Exchange (NYSE) has perennially captured the attention of smart investors seeking a potent combination of income and stability.

The NYSE, as one of the most prestigious and influential stock exchanges globally, serves as the backdrop for an exploration into the seven highest dividend paying stocks in 2024. These stocks, each offering yields surpassing 6%, not only present lucrative income opportunities but also reflect the dynamic nature of the market. Before listing the highest dividend paying stocks let’s learn how to invest in them.

How can I invest in the Highest Dividend Paying Stocks?

A calculated strategy is needed when investing in dividend stocks to take advantage of consistent income while managing market fluctuations. To begin, identify the highest dividend paying stocks through financial sites or your online broker’s platform. Conduct thorough evaluations, comparing dividend yields among peers and scrutinizing payout ratios to ensure sustainability.

After choosing dividend stocks, think about how much stock to buy and strive for diversification to reduce risk. After considering the stock’s risk profile, decide what proportion of your portfolio is invested in each stock.

Investors should prioritize the safety of dividends, as yields over 4% warrant scrutiny. Dividend stocks with yields over 10% may signal potential risks, including unsustainability or market pressures.

Furthermore, be mindful of tax implications, especially in taxable brokerage accounts. Dividends realized in the year they occur may impact tax efficiency for investors in higher income brackets. Consult with a financial professional to customize your dividend stock plan to your financial goals, risk tolerance, and tax status. Through diligent research and a calculated approach, investors can harness the benefits of dividend stocks as a reliable income stream within their investment portfolio.

7 Highest Dividend Paying Stocks on NYSE

Below are the seven highest dividend paying stocks on the NYSE that present income opportunities for investors seeking steady returns.

1. PennantPark Floating Rate Capital (PFLT) – Yield: 10.3%

PennantPark Floating Rate Capital, a Business Development Company (BDC), distinguishes itself with an eye-popping 10.3% dividend yield. Notably, it distributes payments monthly, setting it apart from many counterparts. The majority of the loans in PennantPark’s portfolio feature floating interest rates, contributing to a surge in average yields on debt investments. Despite a shorter track record than some peers, PennantPark has demonstrated resilience, with only a minimal portion of its portfolio on non-accrual status during economic slowdowns.

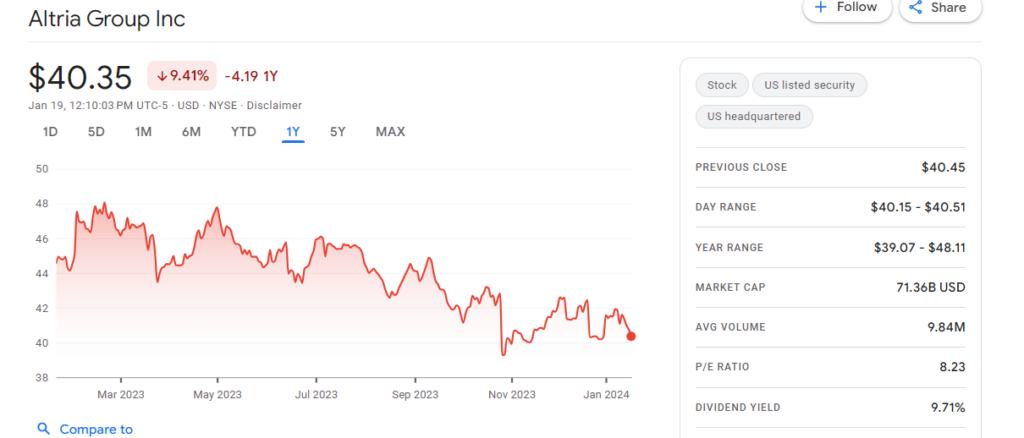

2. Altria Group (MO) – Yield: 9.7%

Altria Group, a legacy tobacco company with over two centuries of history, faces challenges from the secular decline in smoking. However, its stock presents an attractive opportunity for income-oriented investors for several reasons. The stock’s decline in 2023, driven by doubts about diversification beyond tobacco, has positioned it at a modest 7.8x 2028 estimated earnings. Altria’s strategic entry into new markets, such as pod-based e-vapor products, offers growth potential. With a substantial 9.71% dividend yield and management’s commitment to annual mid-single-digit increases, Altria’s high yield appears sustainable.

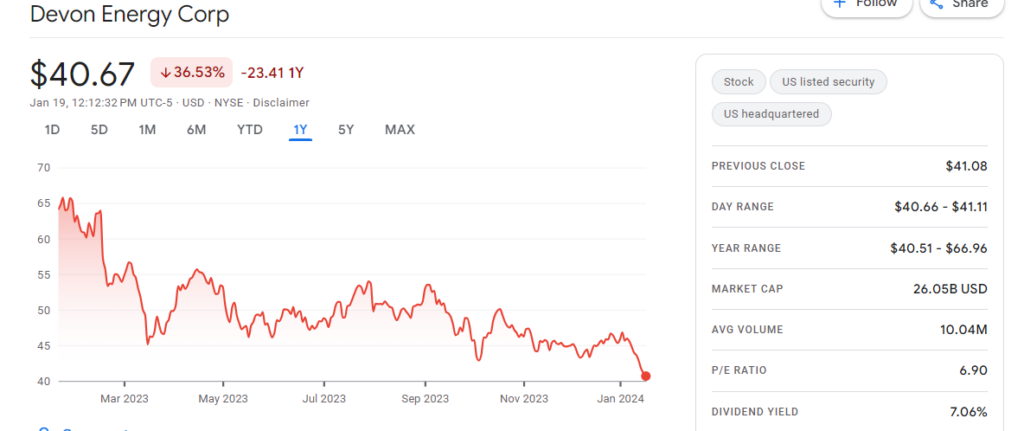

3. Devon Energy Corp. (DVN) – Yield: 7%

Devon Energy, a $28 billion oil and gas exploration company, has faced headwinds, reflected in its 25% decline in 2023. Operating in areas like Oklahoma and Texas, Devon’s onshore drilling had led to windfall profits in prior years. However, energy sector pressures have introduced volatility in its operations and dividend payments. Despite the fluctuation, DVN offers an impressive 7% yield, making it an intriguing option for investors willing to navigate short-term uncertainties in the energy sector.

4. Verizon Communications (VZ) – Yield: 6.7%

Verizon Communications, a leading U.S. wireless provider, faced challenges like the costly rollout of 5G and fiber optic networks. Despite a 21% stock price decline since 2020, several factors suggest a potential rebound in 2024. Improved free cash flow generation, a more stable pricing environment in the wireless industry, and an undervalued stock trading at 8.35x forward earnings position Verizon for a potential upswing. With a 6.7% yield, one of the highest in the telecom sector, and a track record of 17 consecutive years of dividend increases, Verizon remains attractive for income-focused investors.

5. AT&T Inc. (T) – Yield: 6.6%

AT&T, an iconic communications firm, underwent restructuring in 2022 to streamline operations and reduce long-term debt. While facing challenges in its wireless and landline businesses, AT&T remains a stalwart for long-term dividend investors. Despite a 12% stock slump in the past year, its 27.75 cent-per-share quarterly dividend remains stable, constituting only about half of its earnings. Short-term struggles should not deter investors seeking a reliable dividend income.

6. Kinder Morgan Inc. (KMI) – Yield: 6.6%

Kinder Morgan, a $40 billion “midstream” oil and gas company, operates an extensive network of pipelines and terminal facilities across the U.S. Unlike exploration firms, KMI’s midstream position provides a more stable business model, appealing to investors seeking reliability in earnings and dividends. While its 2023 performance was flat, KMI’s appeal lies in its generous 6.6% yield, making it one of the top dividend stocks on the NYSE.

7. Pioneer Natural Resources Co. (PXD) – Yield: 6.4%

Pioneer Natural Resources, a Texas-based oil and gas production company, faces market volatility driven by fluctuations in crude oil prices. With a dividend payout linked to the company’s free cash flow, PXD experienced windfall distributions in previous years. While recent dividends have been more modest, the current yield remains significantly higher than other stocks on Wall Street, providing income potential for investors willing to weather short-term uncertainties in the energy sector.

Conclusion

In conclusion, the highest dividend paying stocks on the NYSE presents a compelling opportunity for income-focused investors in 2024. To invest wisely, conduct thorough research, diversify your portfolio, and prioritize the safety of dividends. Be mindful of tax implications and consider consulting with a financial advisor. With a strategic approach, investors can harness the steady income potential of these top dividend stocks, navigating market dynamics for long-term financial success.