Day trading stocks offer the potential for substantial gains within a short timeframe, but it also comes with inherent risks. Traders engaging in this practice aim to capitalize on temporary price fluctuations, betting on both upward and downward movements.

The key to successful day trading lies in identifying stocks with a combination of strong fundamentals, frequent trading activity, and the potential for short-term volatility. In 2024, amidst a dynamic market environment, certain large-cap stocks stand out as prime candidates for day trading.

In this guide, we’ll explore the top 8 stocks for day trading in 2024, highlighting their strengths, recent performance, and potential for short-term gains. These day trading stocks, characterized by robust financial performance, technological innovation, and market dominance, present enticing opportunities for traders seeking quick profits.

Best Stocks for Day Trading in 2024

Here are the top 8 stocks for day trading, all of which are heavily traded, large-cap stocks:

1. Marathon Digital (NASDAQ: MARA)

Marathon Digital, a prominent Bitcoin miner, presents enticing opportunities for day traders owing to its shares’ susceptibility to significant fluctuations. The recent inclusion of cryptocurrencies in spot bitcoin exchange-traded funds (ETFs) further bolsters the company’s position within the market, making it a prime candidate for day trading.

Marathon’s strategic move to enhance its bitcoin production efficiency by acquiring mining sites totaling 390 megawatts of capacity demonstrates its commitment to maximizing operational effectiveness. This acquisition, expected to be fully operational by April 30, is projected to reduce operating fees and production costs, thereby augmenting profitability.

In January, Marathon experienced a notable increase in daily bitcoin production, up 58% year-over-year, accompanied by a substantial improvement in its energized hash rate by 262% compared to the previous year. Consequently, the company reported impressive third-quarter revenue of $97.8 million, marking a significant upswing from the same period in the previous year, leading to a turnaround in net income from a loss to $64.1 million, highlighting Marathon’s resilience and profitability amidst Bitcoin’s volatility.

2. Palantir Technologies (NYSE: PLTR)

Palantir Technologies, a leading U.S. software company, capitalizes on the growing demand for big data analytics, particularly amplified by the surge in AI adoption. Established in 2003, Palantir has been pivotal in analyzing vast datasets across various sectors, including counterterrorism, healthcare, and finance, making it an attractive option for day trading.

In the fourth quarter, Palantir’s revenue soared by 47% year-over-year to $608 million, with a remarkable 203% increase in net income, marking its fifth consecutive quarter of profitability. Notably, commercial revenue surged by 32% to $274 million, outpacing government revenue growth. With an optimistic outlook, Palantir anticipates revenue between $2.652 billion and $2.668 billion for 2024, with U.S. commercial revenue expected to exceed $640 million, signaling a robust growth trajectory.

3. Microsoft (NASDAQ: MSFT)

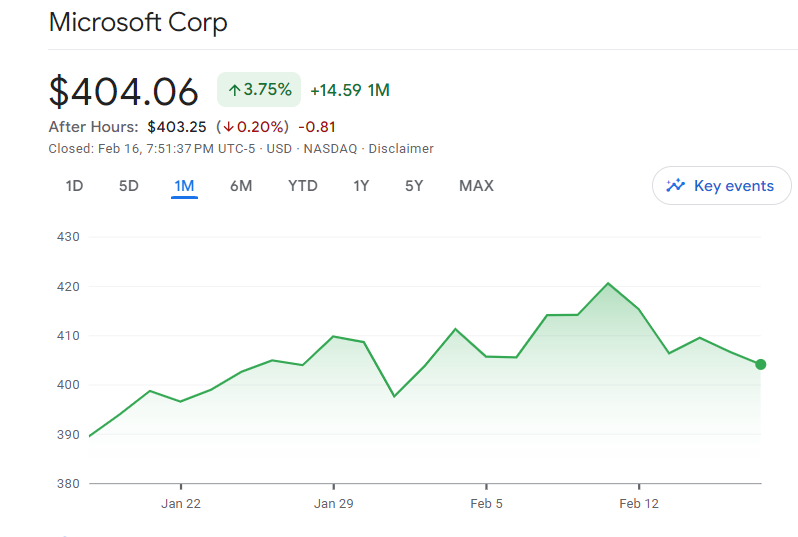

Microsoft, a tech juggernaut, continues its upward trajectory driven by robust quarterly results and a diversified portfolio. As the world’s most valuable company as of February 2024, with a staggering $3 trillion market cap, Microsoft’s strategic investments in cloud computing and AI, including collaborations with OpenAI, fuel its growth prospects.

Its recent fiscal 2024 second-quarter performance underscores this momentum, with a notable 11% year-over-year revenue increase to $62 billion and a 33% surge in net income, reaching $21.9 billion. Key revenue drivers like the Azure cloud platform and commercial Office 365 subscriptions are thriving, yet the stock remains subject to volatility, particularly amidst shifts in investor sentiment during periods of rising interest rates. Moreover, competition in the cloud computing sector poses a challenge, with any advancements by rivals impacting Microsoft’s stock price.

4. Alphabet (NASDAQ: GOOG)

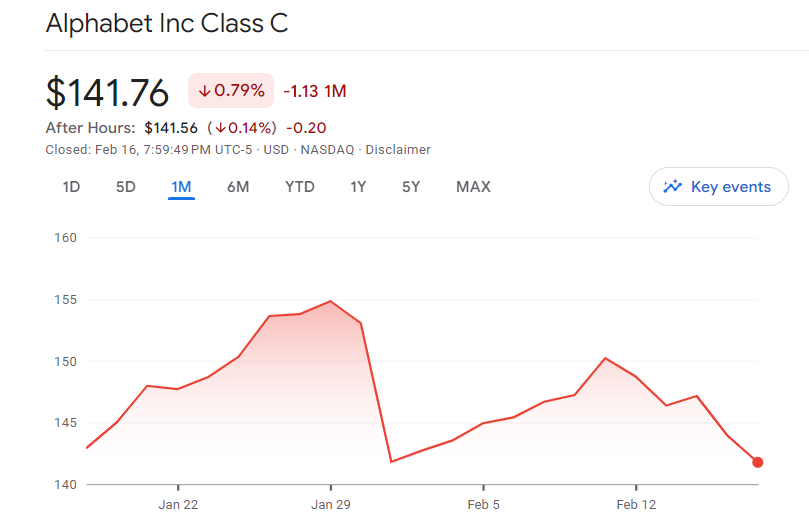

Alphabet, with its dominant search engine and YouTube platform, stands at the forefront of AI integration, poised for substantial revenue growth. Leveraging AI across diversified products, including Google Cloud, Alphabet anticipates heightened profitability. The company’s focus on enhancing search capabilities, exemplified by the launch of Gemini Ultra, underscores its commitment to innovation.

In the fourth quarter, Alphabet showcased impressive financial performance, with revenue reaching $86.3 billion, marking a 10% year-over-year increase, and net income soaring to $20.7 billion, up 52%. Notably, Google Cloud’s revenue surged by 25.6% year-over-year to $9.2 billion, reflecting its growing significance within Alphabet’s revenue stream.

5. Nvidia (NASDAQ: NVDA)

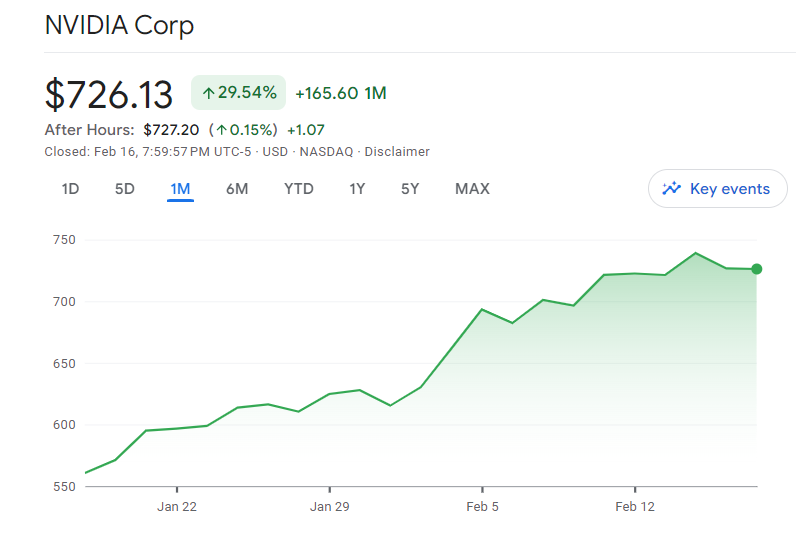

Nvidia emerges as a formidable player in the AI realm, resilient despite geopolitical challenges such as export bans. With its cutting-edge technology powering AI platforms for over 40,000 companies, including industry giants like Amazon, Alphabet, Meta, and Microsoft, Nvidia remains at the forefront of innovation. Despite occasional dips during bear markets, the stock consistently rebounds, reflecting its robust fundamentals and market dominance.

In the third quarter, Nvidia reported staggering revenue growth of 206% year-over-year, reaching $18.1 billion, propelled by record data center revenue of $14.5 billion, marking a remarkable 279% increase from the same period in 2022. Forecasts predict a further surge to $20 billion in fourth-quarter revenue. The recent launch of its 40-series Super GPUs underscores Nvidia’s commitment to staying ahead of competitors like Advanced Micro Devices.

Also read: Unveiling The Tesla And Nvidia Rivalry And Exploring Diverse AI Stock Opportunities

6. Amazon (NASDAQ: AMZN)

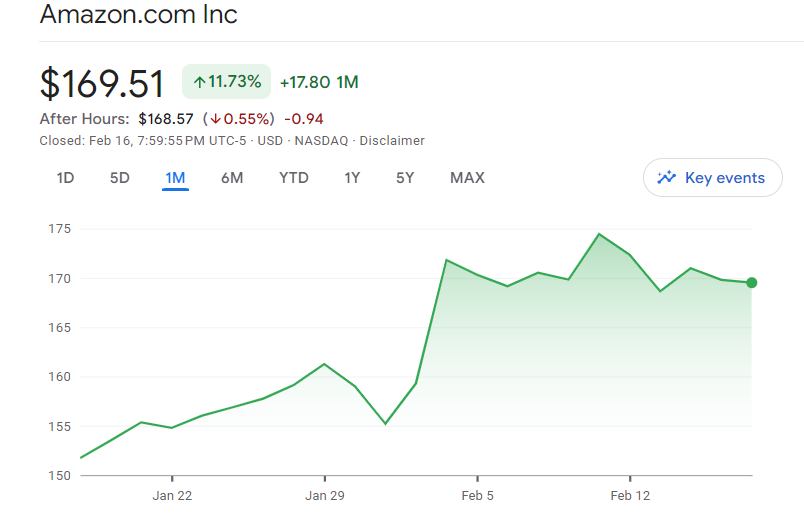

Amazon, a dominant force in e-commerce and cloud computing, continues to showcase impressive financial performance driven by its diverse revenue streams. With a recent market cap surpassing Alphabet, Amazon underscores its market significance and growth trajectory. Leveraging e-commerce and cloud platform expansion, alongside innovative AI initiatives like personalized size recommendations and the upcoming AI shopping assistant, Rufus, Amazon solidifies its competitive edge.

In the fourth quarter, Amazon reported record-breaking revenue of $170 billion, marking a 14% year-over-year increase. Net income soared to $10.6 billion, translating to $1 in EPS, a substantial leap from the previous year. Annual sales reached $574.8 billion, up 12%, while net income surged to $30.4 billion, bolstering investor confidence in the company’s resilience and profitability.

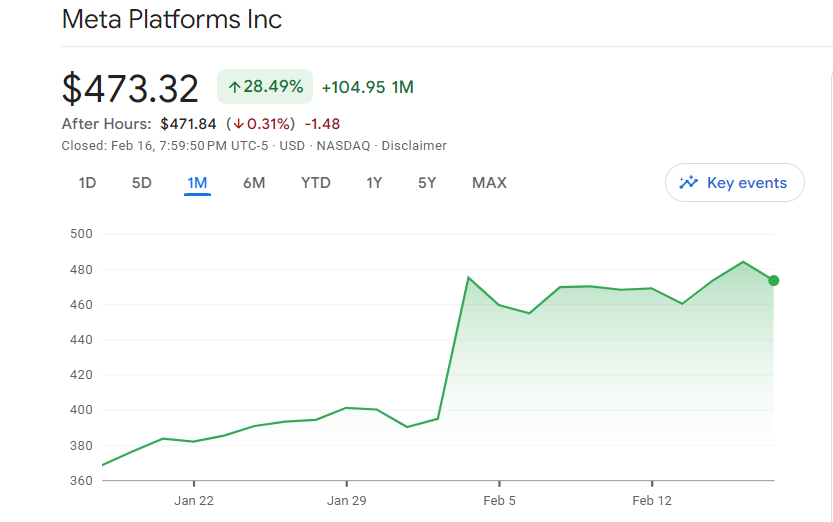

7. Meta Platforms (NASDAQ: META)

Meta Platforms, the parent company of Facebook, Instagram, and WhatsApp, emerges from a robust fourth quarter, marked by a significant revenue surge primarily driven by advertisements across its platforms.

With approximately 98% of its revenue sourced from advertising, Meta’s fourth-quarter revenue reached $40.1 billion, exhibiting a remarkable 36% year-over-year increase. Notably, earnings per share (EPS) soared by an impressive 203% over the same period, reaching $5.33.

The announcement of Meta’s inaugural dividend payout, albeit modest at $0.50 per quarterly share, further enhances investor sentiment. Although the company faced challenges, such as the impact of Apple’s iOS privacy changes on targeted ads and scrutiny over privacy issues in Senate hearings, Meta’s resilience remains evident. Despite short-term concerns, particularly regarding ad sales from China, Meta’s stock has demonstrated a tendency to rebound, emphasizing its potential as a growth stock garnering value from advertising revenue across its diversified platforms.

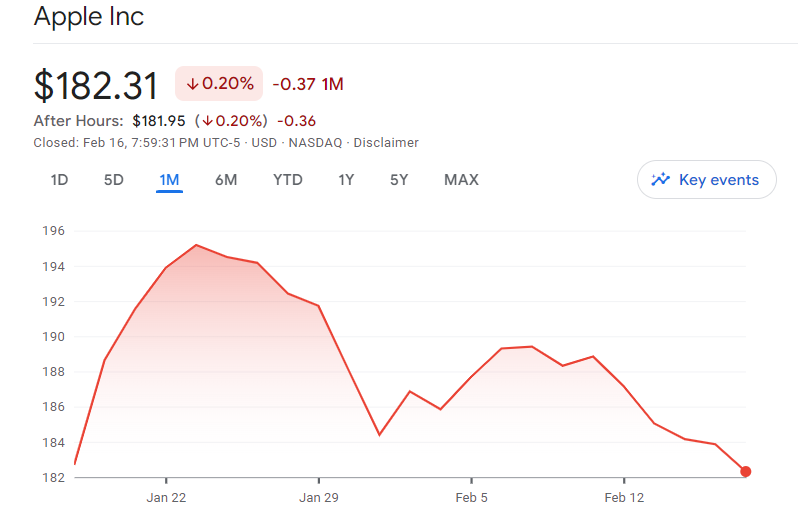

8. Apple (NASDAQ: AAPL)

Apple, renowned for its innovative products, including the iPhone, recently introduced the Vision Pro virtual reality headset, targeting enterprise markets. Despite issuing underwhelming guidance, Apple’s shares rebound quickly, underlining investor confidence in the company’s resilience. Although the fiscal 2024 first-quarter report anticipates a 5% decline in revenue and a 10% drop in iPhone sales, Apple’s robust financial performance remains evident.

With a 2% year-over-year revenue growth to $119.6 billion and an EPS increase of 16% to $2.18, Apple showcases its enduring strength in the market. The anticipation surrounding potential applications of generative AI, particularly in enhancing iOS and Siri, further fuels optimism.

Apple’s consistent dividend increases over the past 11 years, including a recent 4% boost to $0.24, contribute to its appeal for investors. Trading at under 30 times earnings, Apple presents itself as a reasonably priced option for day trading, offering the potential for short-term gains amidst its ongoing product innovations and financial stability.

Leave a Reply