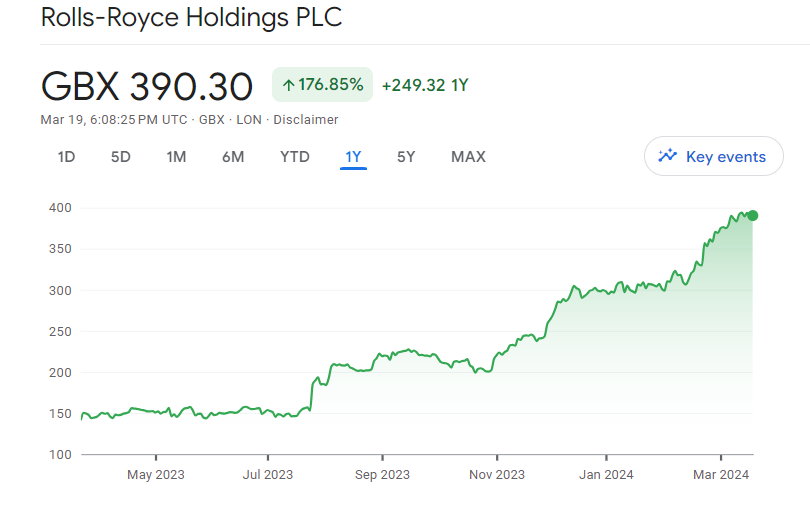

Rolls-Royce shares have been on a remarkable upward trajectory, capturing significant attention in the financial markets. Over the past month alone, the stock has surged by an impressive 18%, and in the last 12 months, it has experienced an astounding 176% increase. For investors who entered the market earlier, the returns have been lucrative, with an initial £1,000 investment potentially growing to £2,760 today.

On March 15th, Rolls-Royce shares hit a new 52-week high, reaching 398p per share. While this achievement is undoubtedly exciting for existing shareholders, it raises questions for prospective investors like myself regarding the sustainability of such rapid growth. The speed at which the stock has risen may indicate a level of investor exuberance, leading to concerns about whether the current valuation is justified.

Rolls-Royce Valuation Concerns

The company’s current momentum stems from a combination of macroeconomic factors, including heightened demand in civil aviation and defense sectors, alongside micro-level strengths such as a prolonged period without major engine issues and a focused management team dedicated to enhancing efficiency and profitability through cost-cutting measures.

However, amidst this growth, concerns about overvaluation linger, prompting investors to scrutinize the stock’s potential upside. Technically, indicators suggest further room for growth, buoyed by positive trends and oscillations. Analyst sentiment also remains bullish, with targets from Deutsche Bank, Oddo BHF, and JPMorgan indicating potential price appreciation, albeit with some dissent from Berenberg.

Notably, a Discounted Cash Flow (DCF) analysis conducted by Simply Wall St underscores the potential undervaluation of Rolls-Royce, estimating its true value at 976p, signaling a potential upside of around 60%. Additionally, the company boasts a relatively low trailing price-to-earnings (PE) ratio of 13.5 compared to its industry peers, implying an attractive valuation proposition. However, the forward PE multiple paints a slightly different picture, suggesting some overvaluation.

From a valuation perspective, Rolls-Royce shares appear to be trading at a premium. With a forward price-to-earnings ratio of approximately 27 times earnings, the stock is nearly triple the FTSE 100 average and significantly higher than many of its industry peers. While the company has made remarkable progress in its recent financial performance, including a 143% increase in underlying profit to £1.6bn and significant debt reduction, the elevated valuation warrants careful consideration.

In navigating these valuation dynamics, investors must strike a balance between recognizing the company’s growth potential and addressing underlying concerns about its current valuation metrics. While optimistic projections and favorable analyst targets indicate potential upside, caution is warranted given the possibility of market exuberance and the need to assess the sustainability of recent performance.

Positive Developments and Leadership Initiatives

Despite valuation concerns, there are several positive indicators surrounding Rolls-Royce. The company’s improved financial performance, driven by CEO Tufan Erginbilgiç’s strategic initiatives, suggests that it may be on a path toward sustained growth. Under Erginbilgiç’s leadership, Rolls-Royce has taken decisive actions to enhance its business model, including a tougher stance on contracts and a rigorous cost-cutting program resulting in significant staff reductions.

A noteworthy development is the recent upgrade in Rolls-Royce’s debt rating by Standard & Poor’s, marking the first investment-grade rating in nearly four years. This upgrade reflects the company’s stronger-than-anticipated performance in 2023, indicating improved confidence in its financial stability and future prospects. Erginbilgiç’s proactive measures and focus on operational efficiency have played a pivotal role in restoring investor confidence and positioning Rolls-Royce shares for potential long-term success.

Rolls-Royce shares forecast

Based on supportive technical indicators, Rolls-Royce shares are poised for further gains. With consistent trading above key moving averages and a recent breakthrough of a critical resistance level at 380.2p, bullish momentum is evident. Oscillators like RSI and MACD signal upward momentum, suggesting potential for continued ascent. Bulls aim to breach the key resistance at 443p, its highest level in 2013.

Could Rolls-Royce shares hit £5 in 2024?

While Rolls-Royce shares have shown strong performance and positive momentum, reaching £5 in 2024 would require significant continued growth and favorable market conditions.

Current EPS forecasts for 2024 suggest a P/E ratio of about 40 at 500p, which appears ambitious. However, if the company surpasses profit expectations and brokers revise forecasts upward, achieving £5 becomes feasible. A 25% increase in FY2024 EPS forecasts to 15.75p could drive a P/E ratio of 32, still high but within reach given potential positive developments. Achieving this milestone will depend on continued strong performance and favorable market conditions.

Final Thoughts

Investing in Rolls-Royce shares in 2024 requires a nuanced approach. While the company has demonstrated impressive growth fueled by macroeconomic factors and internal strengths, concerns about overvaluation persist. The stock’s recent surge, coupled with a forward price-to-earnings ratio significantly higher than industry peers, warrants cautious consideration.

However, positive developments under CEO Tufan Erginbilgiç’s leadership, such as improved financial performance and a debt rating upgrade, offer promising signs for future growth. Analysts’ bullish sentiment and supportive technical indicators further underscore the potential for continued upside.

Ultimately, investors must weigh the company’s growth prospects against valuation concerns and market exuberance, conducting thorough research to make informed investment decisions aligned with their risk tolerance and financial goals.

Also read: 6 Best Cheap Stocks To Buy Under $5 With High Potential

Leave a Reply