Buying cheap stocks under $5 may seem attractive for investors aiming to accumulate shares at a low cost, hoping for substantial gains over time. However, in practice, investing in cheap stocks can be hazardous due to inherent risks. The landscape of cheap stocks is often cluttered with untested upstarts, struggling companies, and shaky balance sheets, managed by individuals who may have made poor capital decisions. Additionally, these cheap stocks tend to be thinly traded, exacerbating volatility and potentially leading to sizable losses.

Despite the risks, cheap stocks priced below $5 offer an opportunity for retail and small investors to participate in the market. Retail investors, who play a significant role in market movements, have been increasingly active, with their trading volume reaching record highs in 2023.

As of the start of 2024, over 1,800 stocks on major American exchanges are priced at $5 or less per share. While many grapple with structural challenges, a select few shine as hidden opportunities. In this article, we’ve curated a list of 6 cheap stocks under $5 with substantial potential, offering investors a chance to discover diamonds in the rough amidst the broader market landscape.

6 Best Cheap Stocks to Buy Under $5

1. LG Display Co. Ltd. (LPL)

Reputable South Korean company LG Display is one of the notable low-cost stocks because it designs and produces screens and display panels for a range of electronic gadgets. Despite recent challenges in consumer technology sales, LG Display remains resilient.

With shares trading below $5, investors can access this opportunity at an attractive valuation. LG Display’s strategic initiatives to address market challenges and capitalize on emerging trends make it an enticing prospect for those seeking cheap stocks with potential long-term value and growth.

While facing a downturn in demand, LG Display’s strategic initiatives aim to address market challenges and drive future growth. With expectations of returning to profitability in 2024 and shares trading at a discount to book value, LG Display presents an enticing investment opportunity. As the global economy recovers and technology sales rebound, LG Display is poised to capitalize on emerging trends and regain momentum in the display panel market, making it an intriguing prospect for investors seeking long-term value and growth.

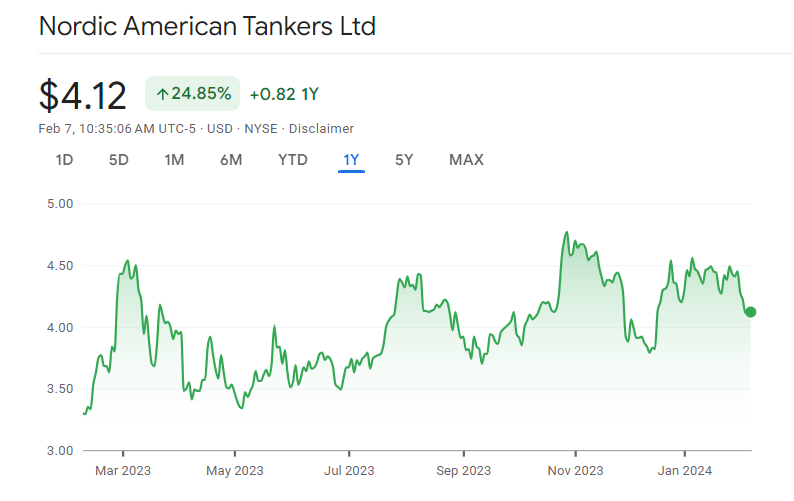

2. Nordic American Tankers Ltd. (NAT)

Nordic American Tankers Ltd. stands out as a cheap stock priced under $5 in the transportation sector. With its focus on crude oil transportation and a strong dividend yield of 5.4%, NAT offers investors an attractive opportunity for income generation and potential growth in the maritime industry. The company’s focus on crude oil transportation, particularly amid geopolitical tensions affecting shipping routes, underscores its strategic advantage and revenue potential.

NAT’s dividend yield is expected to increase further in 2024, reflecting positive revenue projections driven by favorable demand in the tanker market. With a reasonable valuation of 7.6 times forward earnings, NAT presents an attractive investment opportunity for income-oriented investors seeking stability and potential growth in the transportation sector.

As global demand for oil transportation services continues to rise, NAT stands to benefit from ongoing market dynamics, positioning it as a compelling investment option in the maritime industry.

Also read: 7 Highest Dividend Paying Stocks In NYSE And How To Invest In Them

3. Baytex Energy Corp. (BTE)

Baytex Energy Corp. is a notable cheap stocks under $5 in the oil and gas exploration sector. With its diverse production mix and commitment to shareholder value, BTE presents itself as a promising investment opportunity for those interested in cheap stocks with potential upside in the energy industry. The company’s diverse production mix, with a significant portion derived from crude oil, positions it well to capitalize on fluctuations in commodity prices.

Despite a decline in stock price towards the end of 2023, BTE continues to generate shareholder value through strategic initiatives such as share repurchases and dividend initiation. With shares trading at an attractive valuation of less than six times forward earnings, BTE offers investors an opportunity to benefit from potential upside as sentiment in the oil and gas industry improves. As global energy demand rebounds, BTE is well-positioned to deliver sustained financial performance and growth.

4. Blade Air Mobility (BLDE)

Blade Air Mobility stands out among cheap stocks in the aviation industry with its innovative solutions to congested ground routes. Despite facing challenges reflected in a recent decline in stock price, BLDE has demonstrated resilience and growth potential. Its recent earnings report revealed record revenue and profitability, marking a significant milestone for the company. With revenue growth across its business divisions and strategic improvements in Europe, BLDE is well-positioned for continued success.

Analysts have expressed optimism, with a consensus “Strong Buy” rating and a notable upside potential. BLDE’s ability to provide cost- and time-efficient transportation solutions, coupled with its strong financial performance, makes it a compelling investment opportunity in the aviation sector. As the company continues to innovate and expand its market presence, BLDE remains poised for sustained growth and value creation.

5. GoPro (GPRO)

GoPro stands at the forefront of the consumer technology industry with its flagship camera, the Hero 12 Black, garnering widespread acclaim for its advanced features. The company’s strategic focus on product development and marketing has positioned it as a benchmark in the market. GPRO’s balanced approach to segmentation, catering to both high-end and entry-level consumers, has been pivotal in sustaining growth.

Notably, the 12% year-over-year growth in retail channel revenue underscores GPRO’s efforts to strengthen its market presence. With a renewed emphasis on innovation and market expansion, GPRO is well-poised for continued success in the consumer technology space. The successful launch of the Hero 12 Black and the positive performance of entry-level price-point cameras indicate the effectiveness of GPRO’s strategies.

As the company continues to innovate and expand its market presence, GPRO presents a compelling investment opportunity among cheap stocks in the consumer technology sector, offering investors access to potential long-term growth.

6. Blink (BLNK)

Blink is a standout cheap stock under $5 in the electric vehicle (EV) infrastructure sector. With a low-cost stock, BLNK gives investors a chance to capitalize on the future growth of EVs through its strategic location in the EV market and complete approach to offering charging solutions.

Notably, the company’s upgraded network in 2023 led to lower maintenance requirements and ongoing costs, highlighting BLNK’s commitment to operational excellence. With a revised revenue target and a focus on gross margin expansion, BLNK demonstrates confidence in its financial outlook and sustained progress. Moreover, BLNK is strategically positioned to capitalize on the anticipated global expansion of the EV charging ecosystem, with forecasts indicating significant market growth.

As the transition to EVs accelerates, BLNK benefits from increased charging infrastructure demand. Overall, BLNK presents a compelling investment opportunity in the EV sector, combining innovative solutions with promising growth prospects in a rapidly evolving market landscape.