The much-anticipated Reddit IPO showcased a remarkable debut on the New York Stock Exchange, with its share price soaring from an initial $34 to an impressive $59.80. This fervent response underscores investor enthusiasm for the social media platform’s potential.

Investors face a critical decision regarding Reddit IPO: whether to dive in immediately or exercise patience. While the initial surge in Reddit stock price showcases enthusiasm, prudent investors might prefer a wait-and-watch approach. The volatility of early trading suggests uncertainty, and allowing the IPO excitement to settle could provide a clearer picture of Reddit’s true value.

Let’s find out all you need to know to make your decision more clear.

Reddit IPO: Overview

Reddit’s long-anticipated IPO marked a significant milestone for the social media giant, solidifying its position as a powerhouse in online discourse. Founded in 2005, Reddit has evolved into a sprawling “community of communities,” where users engage in discussions, share content, and vote on various topics. With over 100,000 active communities and a staggering 73 million daily active visitors, Reddit has cemented its status as one of the internet’s most influential platforms.

The announcement of Reddit IPO on February 22, 2024, generated widespread anticipation, fueled by the company’s impressive growth trajectory and massive user base. Despite initial challenges, including controversies and moderation issues, Reddit has emerged as a dominant force in the digital landscape.

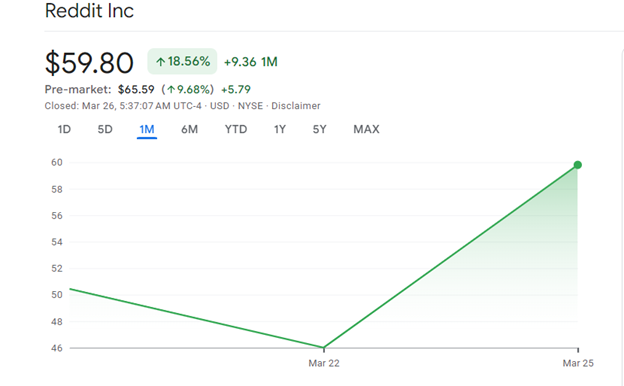

The IPO pricing, set at $34 per share, reflected strong investor demand, culminating in a valuation of $10 billion in 2021. However, the actual market debut exceeded expectations, with the Reddit stock opening at $47 and experiencing a frenzied surge to $59.80, resulting in a market cap of $9.5 billion. This remarkable performance underscored investors’ confidence in Reddit’s potential and signaled a promising start to its public journey.

Notable figures like Sam Altman, CEO of OpenAI, emerged as winners in the Reddit IPO, with Altman’s stake estimated at $600 million post-IPO. Additionally, renowned investor Cathie Wood of ARK Invest joined the fray, acquiring 10,000 shares worth approximately $500,000. These high-profile investments underscored the confidence in Reddit’s potential and hinted at the strategic importance of platforms like Reddit in the evolving landscape of technology and artificial intelligence.

Altman’s long-standing relationship with Reddit, coupled with his foresight regarding its user growth potential, highlighted the allure of the platform. While his initial investment predates the integration of AI, Reddit’s pivot towards licensing data for AI training underscores its adaptability and relevance in the digital age. This strategic shift not only enhances Reddit’s value proposition but also aligns with broader trends in leveraging AI for data-driven insights and innovation.

Also read: Reddit Shares Soar 48% in NYSE Debut

Assessing Reddit’s Investment Prospects

Before diving into Reddit IPO, it’s crucial to assess the company’s fundamentals and the broader market landscape. Reddit’s financial disclosures reveal robust revenue growth, with the platform generating $804 million in revenues in the 2023 fiscal year. However, despite this revenue growth, Reddit has yet to achieve profitability, posting significant losses in recent years.

The company’s reliance on digital advertising for revenue raises concerns about its ability to diversify income streams and navigate potential downturns in the advertising market. Additionally, Reddit’s profitability outlook remains uncertain, with challenges such as content moderation issues and advertiser concerns casting shadows over its long-term prospects.

Comparisons with competitors like Pinterest highlight the disparity in valuation and profitability, underscoring the risks associated with investing in Reddit at its current price levels. While speculation and hype may drive short-term gains, prudent investors must weigh the potential rewards against the inherent risks of investing in a company with an unproven business model and shaky financial footing.

The Reddit Investment Landscape

Investing in Reddit IPO presents a conundrum for investors: should they jump in headfirst or exercise caution and wait for more clarity? The decision hinges on individual risk tolerance, investment goals, and the ability to withstand market volatility.

For those drawn to the allure of high-growth opportunities and willing to weather potential turbulence, Reddit IPO may hold appeal. However, it’s essential to approach the investment with eyes wide open, recognizing the speculative nature of the stock and the inherent uncertainties surrounding its future performance.

Conversely, investors prioritizing stability and a proven track record may opt to adopt a wait-and-see approach, allowing Reddit to demonstrate its ability to deliver sustained growth and profitability over time. By exercising patience and conducting thorough due diligence, investors can position themselves to make informed decisions aligned with their long-term objectives.

Final Thoughts

As Reddit IPO frenzy captivates the market, investors face a pivotal choice: seize the opportunity or exercise restraint. While the allure of rapid gains may be enticing, it’s essential to temper enthusiasm with prudence and consider the broader investment landscape.

Ultimately, whether to invest in Reddit IPO or wait for two years boils down to individual circumstances and risk preferences. By conducting thorough research, evaluating the company’s fundamentals, and maintaining a disciplined investment approach, investors can navigate the Reddit IPO waters with confidence and clarity. Whether Reddit emerges as a success story or succumbs to the challenges ahead remains to be seen, but one thing is certain: informed decision-making is key to navigating the unpredictable currents of the stock market.

Also read: Best Performing Low Price Shares in 2024

Leave a Reply