Low price shares, often falling within the small-cap universe with market capitalizations below $2.0 billion, present unique investment opportunities. With nearly half of the 9,500 stocks on major U.S. exchanges fitting this criterion, investors can capitalize on their lower price/book ratios compared to midcap and large-cap stocks. This characteristic makes them appealing for investors seeking attractive returns. Additionally, low price shares often include growth companies and those operating in niche markets, offering further diversification benefits.

In this article, we’ll examine five promising low price shares recommended by analysts, highlighting their potential for investors looking to enhance their portfolios with high-growth opportunities.

5 Best Performing Low Price Shares to Buy in 2024

1. SoundHound (NASDAQ: SOUN)

SoundHound AI, valued at just over $1 billion, offers investors exposure to the burgeoning artificial intelligence (AI) space. With its AI voice recognition technology, it enables machines to understand human speech, drawing significant attention, especially after receiving investment from Nvidia, the leading chipmaker. This investment led to a remarkable 67% surge in its shares.

The company’s focus on developing conversational intelligence further enhances its potential, catering to various sectors like restaurants and carmakers. Despite being currently unprofitable, SoundHound AI’s stock has soared by 190% year-to-date in 2024, showcasing investors’ optimism. Its management anticipates a substantial increase in sales, reflecting the growing interest in AI technology.

With a promising outlook in a rapidly evolving industry, SoundHound AI presents an enticing opportunity for investors seeking exposure to innovative AI solutions within the low price shares realm.

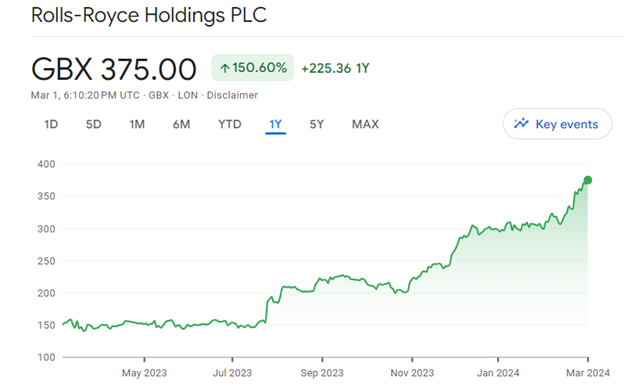

2. Rolls-Royce (LON: RR)

Rolls-Royce, with a market capitalization of £27.5 billion ($37.7 billion), stands as a stalwart in the aerospace industry, offering stability and growth potential to investors. As the world’s second-largest aircraft engine manufacturer, Rolls-Royce boasts a rich history dating back to 1904, providing engines for a diverse range of commercial and military aircraft.

Despite its roots in luxury car manufacturing, Rolls-Royce has successfully transitioned into a global leader in aerospace technology. The company’s recent stock performance reflects its resilience and growth trajectory, with a 150% increase over the past year. Optimism surrounding Rolls-Royce is further fueled by its optimistic earnings predictions, signaling a substantial increase in underlying operating profit in the medium term.

With its diverse portfolio and strong market position, Rolls-Royce offers investors a stable and promising investment opportunity in the aerospace sector, making it a standout choice among low price shares.

3. Bitfarms (NASDAQ: BITF)

Bitfarms, a Canadian cryptocurrency mining company, stands out as a lucrative investment opportunity in the low-cost stock market. With a market value of CAD 1.44 billion ($1.07 billion), it operates server farms across Canada, the U.S., Paraguay, and Argentina, mining various cryptocurrencies, including Bitcoin.

Bitfarms’ recent performance reflects its robust growth trajectory, with a remarkable 130% increase in its stock price since December 2023. The company’s strategic focus on expanding its hash rate, a key metric in cryptocurrency mining, is expected to significantly enhance its revenue-generating potential. Despite fluctuations in cryptocurrency markets, Bitfarms has managed to narrow its net losses while demonstrating substantial revenue growth. Analysts foresee a promising outlook for Bitfarms, projecting an 86% increase in revenue for 2024.

With its strong market presence and growth prospects in the cryptocurrency sector, Bitfarms emerges as a top contender for investors seeking exposure to the burgeoning digital currency market within the realm of low price shares.

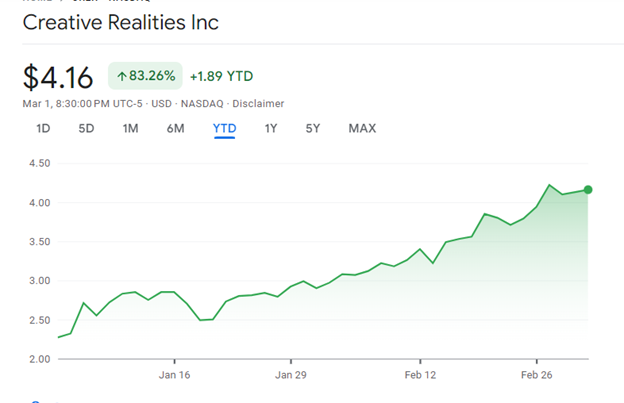

4. Creative Realities (NASDAQ: CREX)

Creative Realities, with a market capitalization of $38.6 million, offers investors a unique opportunity in the digital technology sector. Specializing in designing and implementing digital technologies for retail environments, the company has seen a steady rise in revenue, driven by increased demand for its integrated digital signage solutions.

With a record revenue of $11.6 million in the third quarter and a projected revenue growth to $60.0 million to $80.0 million for 2024, Creative Realities demonstrates its ability to capitalize on evolving market trends. The company’s diverse offerings, spanning from hardware to Software as a Service, cater to a wide range of corporate clients, enhancing customer engagement and monetization of digital networks.

With an impressive year-to-date stock price increase of 83% and a relatively low price-to-earnings ratio, Creative Realities presents an attractive investment opportunity for those seeking exposure to the rapidly growing digital signage industry within the realm of low price shares.

5. Acurx (NASDAQ: ACXP)

Acurx, a biopharmaceutical company listed on the Nasdaq with a market capitalization of $41 million, offers investors an intriguing opportunity in the low-cost stock market. Specializing in developing novel antibiotic treatments for challenging bacterial infections, Acurx has garnered attention with its recent share price surge of over 67% in the past six months.

The company’s decision to expedite Phase 3 trials for its antibiotic candidate, ibezapolstat, based on promising results in treating Clostridioides difficile infection (CDI), reflects its commitment to innovation and addressing critical medical needs. While still in the clinical stage, Acurx has shown signs of progress, narrowing its net losses and maintaining a healthy cash position of $7.1 million. Analysts remain optimistic about its growth potential, driven by its promising pipeline and strategic advancements in antibiotic therapy.

With a focus on tackling antibiotic-resistant infections, Acurx emerges as a compelling investment prospect for those seeking exposure to the biopharmaceutical sector within the realm of low price shares.

Also read: Best Penny Stocks for 2024