Amidst the abundance of bargain stocks within the FTSE 100, HSBC shares emerge as a compelling choice for investors eyeing the banking sector. The renowned financial institution, according to analysis, appears to offer substantial value, particularly when considering its earnings and dividend metrics.

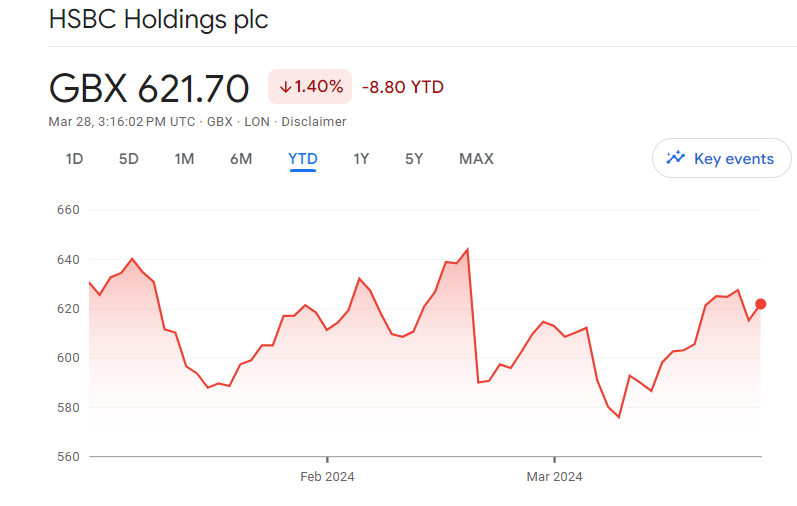

The current HSBC share price of 621p reflects a historical price-to-earnings (P/E) ratio of merely 6.7 times, significantly lower than the FTSE 100 average of 11 times. This places HSBC in an advantageous position relative to its banking counterparts like Lloyds Banking Group and Barclays, with a modest P/E ratio that signifies potential undervaluation.

One of HSBC’s standout features is its robust dividend yield, currently standing at an impressive 7.9%. This surpasses not only the broader FTSE 100 average but also outshines its banking peers such as NatWest Group and Standard Chartered. With dividends representing a substantial percentage of the current HSBC share price, it presents an appealing income opportunity for investors seeking reliable returns.

Despite trading at a higher price-to-book (P/B) value compared to other major FTSE 100 banks, HSBC still presents an attractive proposition, trading below the value of its assets. A P/B ratio below 1 typically indicates undervaluation, further reinforcing HSBC’s position as a potentially lucrative investment opportunity.

Long-term Outlook For HSBC Investors

While short-term challenges, particularly concerning China’s economic performance, may pose some uncertainty, analysts remain optimistic about HSBC’s long-term prospects. The bank’s strategic focus on emerging markets, coupled with the region’s promising growth trajectory, positions HSBC for sustained profitability and expansion.

HSBC stands poised to capitalize on the burgeoning opportunities in emerging markets, where banking product penetration remains relatively low. With rising population levels and increasing personal incomes, HSBC is well-positioned to leverage its extensive network and expertise to drive future growth and enhance shareholder value.

In conclusion, for investors seeking to invest in bargain stocks, HSBC shares emerge as a potential FTSE bargain, supported by favorable valuation metrics and promising long-term growth prospects. While short-term uncertainties may persist, the bank’s strategic positioning and focus on emerging markets present compelling opportunities for investors seeking value and income within the FTSE 100.

Also read: 6 Best Cheap Stocks To Buy Under $5 With High Potential

Leave a Reply