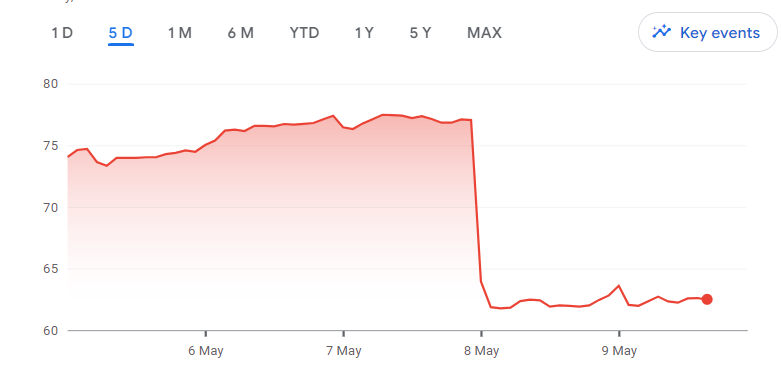

Shopify stock, the Canadian e-commerce giant, recently faced a significant dip in its price, shedding nearly $20 billion off its market value in a single day with shares tumbling 18%. This plunge came as the company provided guidance for the current quarter that fell short of investor expectations, despite delivering better-than-expected earnings and revenue for the first quarter.

But does this dip present an opportunity for investors to buy Shopify stock in 2024? Let’s delve into the factors influencing Shopify’s performance and whether it’s a prudent investment choice this year.

Should You Buy Shopify in 2024?

The million-dollar question remains: Is Shopify a buy in 2024? To answer this, let’s consider the fundamentals and growth prospects of the company. Despite the recent downturn, Shopify remains a compelling investment for growth-oriented investors. The company has consistently demonstrated its ability to innovate and adapt to the evolving e-commerce landscape. With its suite of tools empowering businesses to thrive in the digital realm, Shopify stands out as one of Canada’s most promising innovators.

While the current market volatility, particularly within the tech sector, has dampened Shopify stock price, it’s crucial to view this setback in the context of its long-term trajectory. The dip in 2024 represents just a blip compared to the challenges faced by the company in the past, such as the significant downturn experienced in early 2022.

Analysts, including those at Citi, maintain confidence in Shopify’s long-term growth prospects, citing the strength of its Merchant Solutions business and ongoing innovation efforts. Despite challenges in certain areas like logistics services, Shopify continues to invest in key initiatives such as artificial intelligence (AI) to enhance its offerings and drive future growth.

How to Buy Shopify Stock in 2024

For investors looking to seize the opportunity presented by Shopify’s recent dip, here’s a step-by-step guide on how to buy Shopify stock in 2024:

Step 1: Choose a Broker: Select a reputable brokerage platform to facilitate your stock purchase. Consider factors such as fees, user interface, and research tools offered by various brokerage firms. Platforms like Fidelity, known for their user-friendly interface and comprehensive research resources, can be a suitable choice for purchasing Shopify stock.

Step 2: Open and Fund Your Account: Follow the instructions provided by your chosen brokerage platform to open and fund your account. Typically, this involves verifying your identity and depositing funds into your account through bank transfers, debit/credit cards, or other accepted payment methods.

Step 3: Determine Your Investment Amount: Decide on the amount you wish to invest in Shopify stock, keeping in mind your investment goals, risk tolerance, and overall financial situation. Ensure that you have allocated a reasonable portion of your investment portfolio to Shopify, considering diversification principles.

Step 4: Place Your Order: Navigate to the trading platform on your brokerage account and input the relevant information to place your order for Shopify stock. Specify the number of shares you wish to purchase or the amount you intend to invest. Consider whether to place a market order, which executes immediately at the current market price, or a limit order, which allows you to specify a price at which you’re willing to buy.

Step 5: Confirm Your Order: Review your order details carefully before finalizing the transaction. Double-check the quantity, price, and order type to ensure accuracy. Once satisfied, confirm your order to become a shareholder of Shopify.

Final Thoughts

In conclusion, while the recent Shopify stock dip may raise concerns among investors, it also presents a compelling buying opportunity for those bullish on the company’s long-term prospects. By understanding the recent market dynamics, evaluating Shopify’s growth potential, and following the outlined steps to purchase Shopify stock in 2024, investors can position themselves to benefit from the potential upside of this innovative e-commerce juggernaut. As with any investment, thorough research and careful consideration of one’s financial objectives are paramount in making informed decisions in the stock market landscape.

Leave a Reply