Fidelity Investments Broker is a stalwart in the industry renowned for its comprehensive suite of investment options and cutting-edge platform offerings. With a commitment to empowering investors of all backgrounds, Fidelity provides access to an extensive array of assets, from stocks and ETFs to cryptocurrencies and retirement accounts.

In this Fidelity Investments Broker review, we’ll explore Fidelity’s strengths, investment options, trading platforms, fees, customer support, and security measures, providing insights to help investors make informed decisions in their financial journey.

Fidelity Investments Broker Overview

Fidelity Investments Broker stands as a stalwart in the financial services industry, renowned for its comprehensive suite of investment options and robust platform offerings. Notably, Fidelity’s zero-commission trading for stocks and ETFs, coupled with competitive fees for other investment products, makes it an attractive choice for cost-conscious investors seeking to optimize their returns.

One of Fidelity’s key strengths lies in its advanced trading platforms, notably the Fidelity Account Trader Pro, which offers a plethora of features catering to both novice and experienced traders. From advanced charting tools to a wide range of order types and real-time analytics, Fidelity Investments Broker empowers investors with the tools needed to make informed investment decisions. Moreover, Fidelity’s commitment to innovation is evident in its user-friendly mobile app, providing investors with on-the-go access to their portfolios, research tools, and trading capabilities.

Beyond its platform offerings, Fidelity distinguishes itself through its managed portfolio options and robust educational resources. Whether investors seek automated portfolio management through robo-advisors or personalized advice from financial experts, Fidelity caters to diverse investment preferences.

Investment Options

Fidelity Investments Broker offers a diverse range of investment options tailored to meet the needs of various investors, from novices to seasoned professionals.

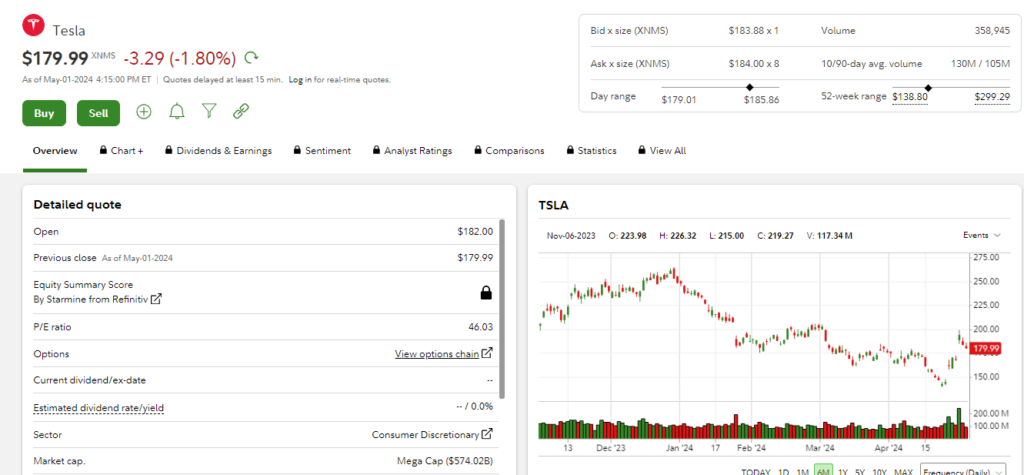

- Stocks: Stocks are a cornerstone of Fidelity’s investment offerings, allowing investors to access a wide range of publicly traded companies across various sectors and industries. With research tools, market insights, and trading platforms like Fidelity Account Trader Pro, investors can make informed decisions and execute trades efficiently. Fidelity also stands out for its fractional shares trading feature, allowing investors to purchase fractions of shares rather than whole shares.

- Cryptocurrencies: In terms of cryptocurrencies, Fidelity provides access to Bitcoin and Ethereum trading through its Fidelity Crypto account, available to clients in 38 states. However, it’s important to note that while crypto trading is advertised as commission-free, there’s typically a markup or markdown of up to 1% embedded in the execution, making it relatively costly compared to some other brokers like eToro Broker.

- Retirement services: Furthermore, Fidelity excels in retirement services, offering traditional, Roth, and rollover IRAs alongside comprehensive education and tools for retirement planning. Fidelity Investments Broker charges no miscellaneous fees for IRA accounts, making it an attractive option for investors looking to build wealth for their golden years.

- Bond: Moreover, Fidelity provides access to bonds, including government bonds, corporate bonds, and municipal bonds, offering fixed-income options for investors seeking regular interest payments and capital preservation. Additionally, Fidelity Investments Broker offers a wide array of mutual funds and exchange-traded funds (ETFs), providing diversified exposure to different asset classes and investment strategies.

Types of Fidelity Investments Accounts

Fidelity Investments Broker offers a wide range of account types to cater to various investment needs and preferences. These account types can be broadly categorized into taxable investing accounts, retirement accounts, education savings accounts, and specialty accounts.

- Taxable Investing Accounts: Fidelity provides individual and joint taxable brokerage accounts for investors looking to invest in stocks, bonds, mutual funds, ETFs, and other securities. These accounts offer flexibility in managing investments and do not have specific tax advantages.

- Retirement Accounts: Fidelity offers a comprehensive suite of retirement accounts, including Traditional IRAs, Roth IRAs, and Rollover IRAs. These accounts provide tax advantages, such as tax-deferred or tax-free growth, depending on the account type and contribution eligibility.

- Education Savings Accounts: Fidelity offers 529 College Savings Plans, Coverdell Education Savings Accounts (ESA), and UGMA/UTMA Custodial Accounts to help investors save for education expenses. These accounts offer tax advantages for education savings and can be used to fund qualified education expenses for beneficiaries.

- Specialty Accounts: Fidelity provides specialized accounts tailored to specific needs, such as Health Savings Accounts (HSA) for medical expenses, Solo 401(k)s for self-employed individuals, and Charitable Giving Accounts for philanthropic purposes. These accounts offer unique features and tax advantages relevant to their respective purposes.

Fidelity Investments Broker Trading Platforms

Fidelity Investments Broker offers a suite of trading platforms designed to cater to the needs of investors ranging from novices to seasoned professionals. These platforms provide a comprehensive range of features and tools to facilitate research, analysis, and trading activities across various asset classes.

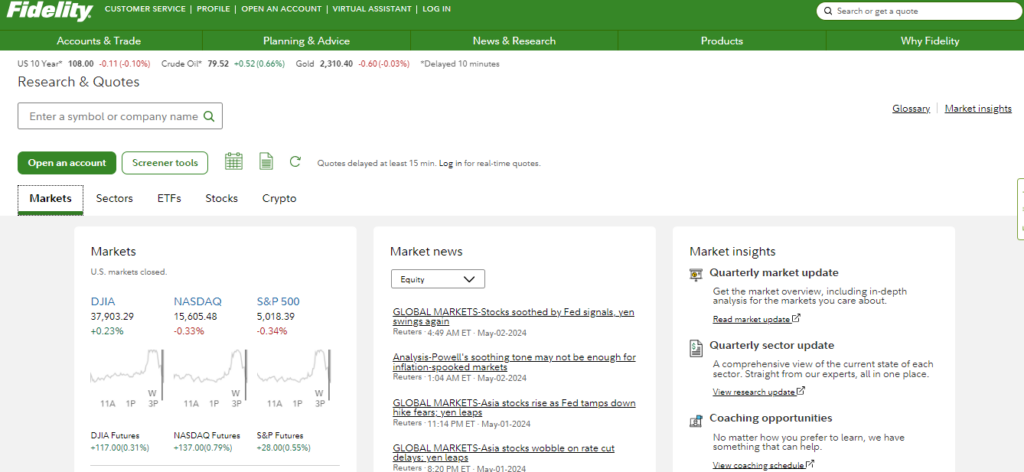

Fidelity Desktop Platform

Fidelity’s standard desktop platform offers a robust set of analysis capabilities and tools necessary for screening and researching investments. It provides portfolio analysis tools that break down holdings by stock and fixed income, investment ratings, style, and sector. Users can access multiple portfolio analysis screens, including performance, dividends, asset allocation, and fund rankings. The platform also allows users to link external accounts for a 360-degree portfolio view and analysis. With extensive third-party research and access to fixed-income specialists, Fidelity’s desktop platform is among the best in the online brokerage space.

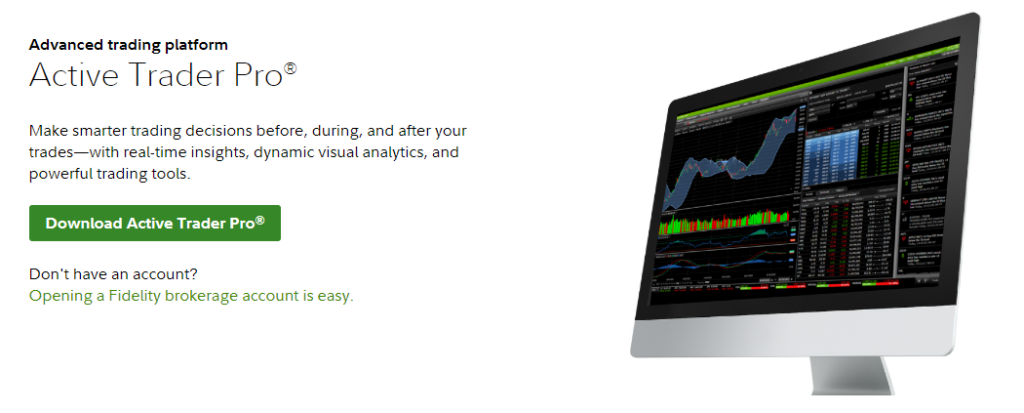

Fidelity Account Trader Pro

The Fidelity Account Trader Pro is a downloadable trading platform that ranks among the top three of surveyed brokers. It caters to both new-to-experienced traders and investors, offering near-perfect marks for essential features. Active traders benefit from level II quotes, heat mapping, a trade journal, and over 45 market filters. The platform’s advanced and customizable features include alerts, portfolio builder, AI assistant, watch lists, screeners, and multi-leg options trading. With real-time analytics and trading ideas, Fidelity’s Account Trader Pro platform provides a seamless trading experience, although it lacks certain features like a short locator and paper trading.

Charting and Order Types

Fidelity’s trading platforms offer robust charting capabilities suitable for day, active, and technical traders. With customizable chart features, including 114 chart indicators and drawing tools, users can conduct advanced technical analysis. Fidelity Investments Broker received a perfect score for order types, allowing users to access various order types, including conditional and durational orders, as well as multi-leg options orders. The company is known for superior order execution, with price improvement saving clients billions on trades in 2020, making it an attractive option for frequent traders.

Fidelity Investments Broker Fees & Commission

Fidelity Investments broker sets itself apart in the realm of commission and fees by offering zero-commission trading for stocks, ETFs, and over-the-counter (OTC) stocks, in line with industry standards. Notably, options trading is also commission-free, with a nominal charge of $0.65 per contract. Fidelity competes vigorously with Vanguard in the mutual fund arena, offering four zero-expense ratio, zero minimum investment index funds, alongside a selection of fee-free mutual funds, provided they are held for at least 60 days. However, investors should be cautious of commissions on non-fidelity mutual funds, which can be substantial, with a significant $49.95 commission at purchase.

Bond investors benefit from zero fees for new bond issue purchases, while secondary issues incur a modest fee of one dollar. Broker-assisted and treasury trades are reasonably priced at $19.95 per transaction. Fidelity’s average margin rate falls within the industry average at 6.94%, though it may not be the lowest available, with other brokers offering a notably lower rate at 2.6%. Fee-conscious investors appreciate Fidelity’s transparency and lack of fees for services such as outgoing wires, full account transfers, paper statements, and confirmations.

User interface and experience

Fidelity Investments Broker prioritizes user interface and experience across its trading platforms, aiming to provide intuitive and user-friendly interfaces that enhance the overall trading experience. The platforms are designed to cater to investors of all levels, from beginners to experienced traders, with clear navigation, customizable layouts, and interactive features.

Fidelity’s desktop platform and mobile app offer streamlined interfaces that make it easy for users to access essential tools and resources, monitor their portfolios, and execute trades efficiently. With a focus on simplicity and functionality, Fidelity’s platforms strive to minimize complexity while maximizing usability, ensuring that investors can navigate the platforms with ease and make informed decisions with confidence.

Fidelity Research and Education

Fidelity’s research offerings surpass those of most online brokerage platforms, with recent updates enhancing the already impressive experience. Categorized by asset class, the research includes a plethora of tools, screeners, lists, and reports catering to stock, ETF, options, IPO, and fixed-income investors. High-quality third-party research reports from major financial firms like Compustat, Zacks, Argus, and Reuters further enrich the platform.

Each asset class features unique screeners and lists to aid in selecting optimal financial assets. For instance, ETF investors benefit from screening options by fund family, performance, volume, and comparisons, while options investors can access statistics, quotes, charts, and calculators. Stock investors have access to numerous tools for both fundamental and technical research, including sector analysis, market movers, and ESG scores.

Moreover, Fidelity Investments Broker offers a diverse range of educational resources, including articles, courses, podcasts, videos, coaching, webinars, and in-person events, catering to investors of all skill levels and interests.

Fidelity Investments Broker Additional features

Fidelity Investments broker offers a plethora of features aimed at providing comprehensive investment solutions and empowering investors to achieve their financial goals.

Expansive Managed Portfolio Options: Fidelity Investments offers a diverse range of managed portfolio options, catering to investors with varying needs and preferences. These options include basic and hybrid robo-advisors, as well as fully managed portfolios, available at different service levels and price points.

Fidelity Go and Personalized Planning and Advice: Fidelity’s robo-advisor offerings, including Fidelity Go and Fidelity Personalized Planning and Advice, provide investors with diversified investment portfolios and automatic rebalancing. Fidelity Go has no minimum investment requirement and offers fee-free management for accounts under $10,000, with a tiered fee structure ranging from $3 per month to 0.35% of AUM annually for higher balances. Personalized Planning and Advice combines automated investing with access to live financial advisors, requiring a minimum investment of $25,000 and charging a 0.50% AUM fee.

Additional Wealth Management Solutions: Fidelity Investments Broker provides additional wealth management solutions tailored to investors with higher asset levels. Portfolio Advisory Services, requiring a $50,000 minimum investment, grants access to a dedicated team of financial advisors for a 1.10% AUM annual fee. Wealth Management, with a $250,000 minimum investment, offers personalized financial planning and dedicated advisor support, with fees ranging from 0.50% to 1.5% of AUM annually. These services encompass comprehensive strategies, including estate planning and insurance, to address the complex financial needs of affluent investors.

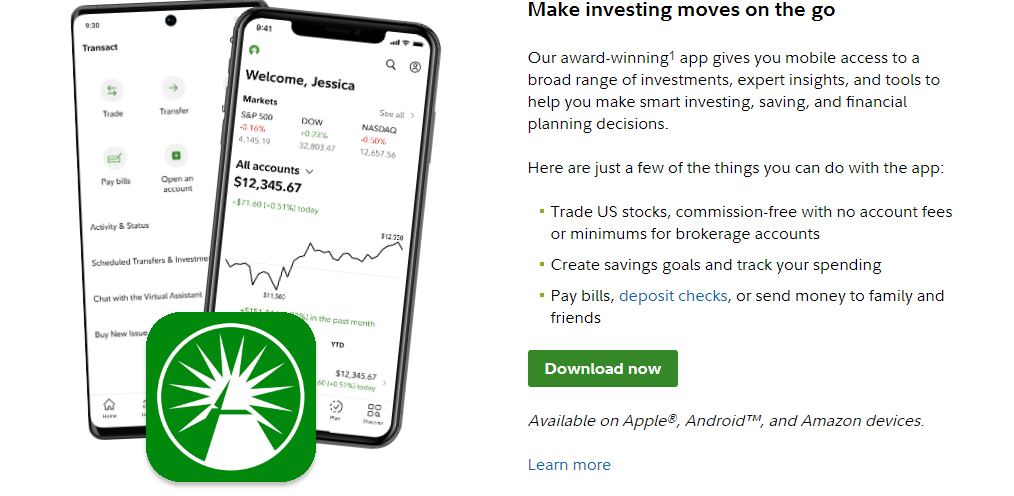

Fidelity Investments Mobile App

The Fidelity mobile app stands out with its high ratings on both Google Play and the iOS store, offering a comprehensive suite of features essential for investors. Users can access portfolio monitoring, banking services, and research tools, providing convenience and flexibility for managing investments on the go.

A new beta trading experience within the app allows users to conduct trading, research, and portfolio monitoring directly from the home dashboard, enhancing the mobile trading experience. However, this feature is currently exclusive to iOS users.

Other notable features of the app include a customized news feed and alerts, retirement planning tools, access to live TV, news, webinars, and podcasts, as well as screeners and social sentiment analysis. Additionally, users can execute trades, manage their finances, and pay bills seamlessly through the app. Despite its many strengths, the app’s reliance on transferring users to the online platform for certain research needs remains a drawback.

Fidelity Customer Support

Fidelity’s customer support is characterized by efficiency and reliability, with short wait times and prompt responses across various communication channels. Phone calls are typically answered within two to three minutes, ensuring quick access to human assistance. Emails receive timely attention, with responses provided within one to two days, often within hours. Although text chat is primarily handled by a chatbot, human responses are available during specified hours.

Is Fidelity Investments Broker safe?

Yes, Fidelity Investments Broker is considered a safe and trustworthy brokerage firm. The company employs multiple layers of security measures to safeguard investors’ assets and personal information. This includes features like firewalls, 128-bit encryption, and two-factor authentication, which help prevent unauthorized access to accounts. Additionally, Fidelity offers voice recognition for customer service, enhancing account security.

In terms of financial protection, Fidelity provides comprehensive insurance coverage. This includes the standard $500,000 of Securities Investor Protection Corporation (SIPC) coverage, which protects against the loss of securities and cash held in brokerage accounts in the event of broker-dealer failure. Fidelity Investments Broker also offers supplemental insurance of up to $1 billion per customer, providing an additional cushion against company failure or bankruptcy. Cash assets receive even higher coverage, with up to $1.9 million in additional protection.

Conclusion

In conclusion, Fidelity Investments Broker emerges as a formidable force in the realm of brokerage services, offering a comprehensive suite of investment options, cutting-edge trading platforms, and unparalleled customer support.

Throughout this review, we’ve uncovered Fidelity’s commitment to empowering investors of all levels, from beginners to seasoned professionals, with the tools and resources needed to succeed in today’s dynamic markets. With zero-commission trading for stocks and ETFs, competitive fees, and robust security measures, Fidelity ensures that investors can optimize their returns while safeguarding their assets.

Whether you’re building a diversified portfolio, planning for retirement, or seeking personalized advice, Fidelity Investments Broker stands ready to support your financial goals with integrity, reliability, and excellence.

FAQs

What investment options does Fidelity Investments Broker offer?

Fidelity provides access to a diverse range of investment options, including stocks, ETFs, mutual funds, cryptocurrencies, bonds, and retirement accounts like IRAs and 401(k)s. Investors can build diversified portfolios tailored to their needs and preferences.

Are there any fees for trading with Fidelity?

Fidelity offers zero-commission trading for stocks, ETFs, and over-the-counter stocks. Options trading incurs a nominal charge of $0.65 per contract, while bond investors benefit from zero fees for new bond issue purchases and reasonable fees for secondary issues and broker-assisted trades.

What trading platforms does Fidelity offer?

Fidelity provides a suite of trading platforms catering to investors of all levels. From the standard desktop platform offering robust analysis capabilities to the advanced Fidelity Account Trader Pro with customizable features and real-time analytics, investors have access to tools that facilitate research, analysis, and trading activities.

Does Fidelity offer managed portfolio options?

Yes, Fidelity offers a variety of managed portfolio options, including basic and hybrid robo-advisors, as well as fully managed portfolios. These options cater to investors with varying needs and preferences, providing diversified investment portfolios and automatic rebalancing.

How does Fidelity prioritize security?

Fidelity employs multiple layers of security measures to safeguard investors’ assets and personal information. This includes features like firewalls, encryption, two-factor authentication, and comprehensive insurance coverage, ensuring that investors can manage their assets securely and with peace of mind.