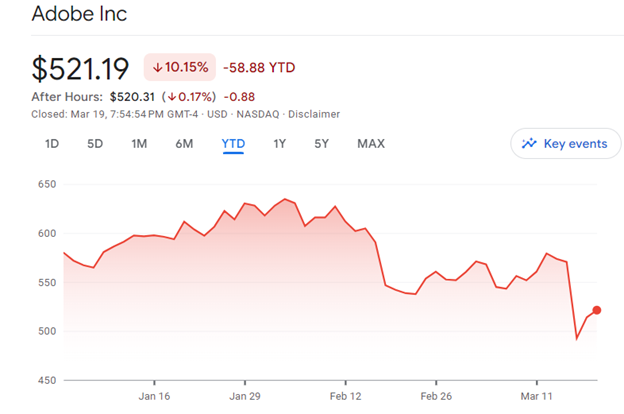

Adobe stock finds itself at a crossroads as investors grapple with concerns over its recent performance and future prospects. The tech giant’s stock has taken a hit, dropping 10% in 2024, contrasting sharply with the 7% rise in the S&P 500 index during the same period.

Friday’s trading session saw a staggering 13.7% decline in Adobe stock price, juxtaposed with a modest 0.7% gain in the broader market index.

The downward spiral comes on the heels of disappointing revenue guidance for the second quarter, raising red flags about the company’s growth trajectory, particularly in its generative artificial intelligence (AI) tools segment. Analysts and investors alike are closely monitoring Adobe’s ability to navigate through this challenging phase, especially in light of its historical performance.

Mixed Signals from Financial Performance

While Adobe surpassed consensus estimates in the first quarter of fiscal year 2024, with revenues climbing 11% year-over-year to $5.18 billion, concerns linger regarding its profitability. The company witnessed a decline in net income by 50% year-over-year, attributed partly to increased expenses, including a hefty $1 billion acquisition termination fee related to its failed bid to acquire Figma.

Looking back at fiscal year 2023, Adobe reported a 10% year-over-year increase in revenues to $19.41 billion, primarily driven by robust growth in its digital media segment, which accounts for over 70% of total revenues. However, the operating margin dipped slightly, prompting questions about the company’s cost management strategies.

Uncertain Future

As Adobe charts its course for the remainder of fiscal year 2024, uncertainties loom large amidst a backdrop of high oil prices and elevated interest rates. With revenue forecasts for the second quarter ranging between $5.25-$5.30 billion, and earnings projected to fall between $3.35-$3.40 per share (GAAP), analysts are cautiously optimistic about the company’s ability to weather the storm.

However, concerns persist over potential underperformance against the S&P 500 index, as observed in previous years. The recent volatility in Adobe stock, coupled with the broader economic uncertainties including high oil prices and elevated interest rates, has left investors seeking to invest in Adobe stock cautious about the company’s performance in the coming months.

Also read: How to Start Day Trading with $100

Leave a Reply