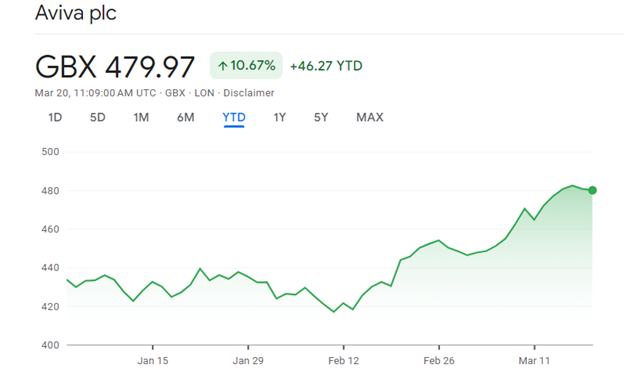

Aviva shares continues to attract investors seeking robust passive income, boasting dividend yields that outshine most other blue-chip shares. With the share price standing at 480p per share, Aviva shares promise a substantial 7.1% dividend yield for 2024, far surpassing the FTSE 100 index’s average of 3.8%. Looking ahead to 2025, the company anticipates an even more impressive yield of 7.7%.

Analysts foresee promising growth for Aviva’s earnings, with anticipated increases of 17% and 11% for 2024 and 2025 respectively. These optimistic forecasts bolster expectations that dividends will continue to grow during this period. Projections suggest a rise from last year’s payout of 33.4p per share to 34.22p in 2024, and further to 37.33p in 2025.

Despite concerns regarding weak dividend cover, currently sitting at 1.3 times the expected earnings for each of the next two years—below the industry benchmark of 2 times—investor confidence remains buoyant. Aviva’s strong balance sheet is cited as a key factor supporting this sentiment. The company’s Solvency II capital ratio, while experiencing a slight decline, remains robust at 207% as of December. This stability enables Aviva to announce a £300m share repurchase program, alongside plans to increase dividend payouts in the future.

A Premier Dividend Stock?

Despite potential challenges such as economic downturns and fierce market competition, Aviva shares stand poised to fulfill City forecasts for dividends in 2024 and beyond. Substantial restructuring efforts in recent years have fortified the company’s balance sheet, enhancing its ability to weather economic storms and maintain dividend payments.

Moreover, demographic shifts offer promising growth opportunities, particularly in areas such as bulk annuities and wealth management. Aviva’s strategic focus on these lucrative segments positions it as a frontrunner in the financial services sector.

While acknowledging the inherent risks associated with dividend investments, analysts remain optimistic about Aviva’s long-term prospects. The company’s resilience, coupled with its commitment to shareholder returns, solidifies its standing as a premier dividend stock worthy of consideration for investors seeking reliable income streams amidst market volatility.

In summary, Aviva shares present an enticing opportunity for dividend investors, backed by strong fundamentals and strategic initiatives aimed at driving sustained growth and shareholder value.

Also read: 5 Best Dividend Stocks to Buy in 2024 for Passive Income