Aviva shares emerge as an attractive investment with a robust dividend yield of nearly 8%, surpassing the current inflation rate. While it may not claim the top spot in FTSE 100 dividend payers, its focus on sustainability sets it apart. Despite a pandemic-induced dividend cut, Aviva has consistently increased payments over the last decade, exemplifying its commitment to shareholder returns.

Aviva’s decision to increase its interim dividend by 8% to 11.1p in H1 2023 is evidence of its sound financial standing. Its anticipated £915 million full-year distribution, which translates to a final payment of 22.3p in April 2024, gives investors confidence that it will fulfill its pledge to reward them.

Aviva’s Wealth division, though contributing a small percentage to overall operating profit, holds immense growth potential. Positioned to triple to £4.3trn in the next decade, the Wealth business is strategically positioned in workplace and advisor platforms.

Recent acquisitions, including Succession Wealth, demonstrate Aviva’s proactive approach to tapping into the expanding retirement advice market. The company aims to achieve £250bn assets under management and £280m profits in the next five years, paving the way for substantial share price growth.

Risks for Aviva Shares

Despite its promising outlook, Aviva shares face challenges stemming from its heavy investments in corporate and government bonds. The company’s solid Solvency II ratio of 202% indicates resilience against economic downturns. Potential losses from bond yield fluctuations are acknowledged, but Aviva’s exposure to promising trends, such as the growth of electric vehicles, adds a positive dimension. Innovations like Aviva Zero, a carbon-conscious motor insurance proposition, showcase the company’s adaptability to emerging market trends.

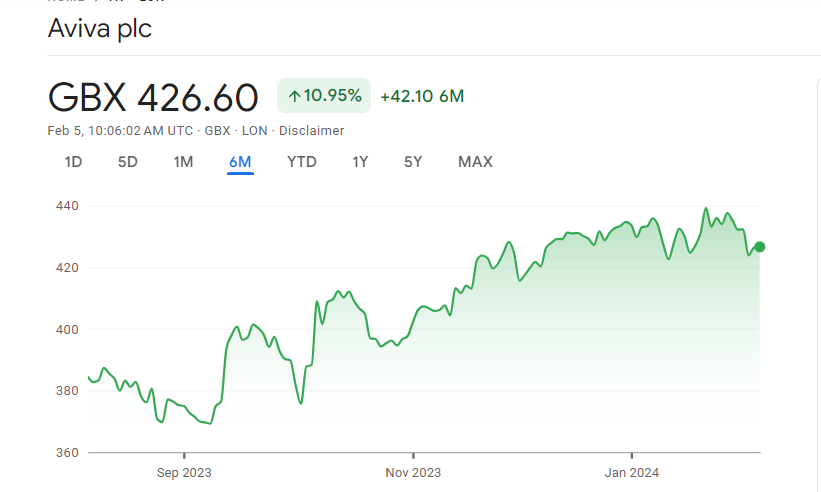

Aviva shares are positioned as a sleeping giant in the market. Despite recent share price fluctuations, the company’s strategic focus on sustainable dividends and growth opportunities in the Wealth division makes it an appealing prospect for investors.

The emergence of new insurance business models, driven by trends like the rise of electric vehicles, further positions Aviva shares as a forward-thinking investment choice with the potential for significant future gains. As finances allow, investors may find adding Aviva shares to their portfolio a prudent move.

Also read: Should You Buy Meta Platforms Stock In 2024?

Leave a Reply