AI stocks present an enticing opportunity for investors seeking exposure to one of the most promising sectors of the technology industry. As artificial intelligence continues to reshape industries by enabling machines to perform tasks traditionally requiring human intelligence, companies leveraging AI technologies stand poised for growth. From tech giants pioneering comprehensive AI solutions to startups focusing on niche applications, the landscape offers a diverse array of investment opportunities.

However, navigating this dynamic sector requires thorough research and a clear understanding of AI technologies and market applications. In this post, we explore five AI stocks worth watching in 2024’s stock market.

5 Best AI Stocks to Buy in 2024

1. Palantir (NYSE: PLTR)

Palantir, a trailblazer in data mining software and machine learning, has demonstrated impressive prowess in leveraging these technologies to drive business success. With a recent surge in revenue, up by 60% year-over-year, Palantir’s commercial business has particularly stood out, signaling a strategic shift in revenue mix that favors commercial clients. This transition holds the promise of higher margins and enhanced scalability, positioning Palantir for sustained growth in the AI stocks sector.

Central to Palantir’s success is its Artificial Intelligence Platform (AIP), a generative AI-powered software suite designed to integrate and analyze vast amounts of unstructured data from disparate sources. Moreover, Palantir’s innovative Bootcamp-based go-to-market strategy has proven effective in accelerating customer adoption of AIP, driving engagement, and converting prospects into paying clients.

With solid financial performance, a growing customer base, and increasing adoption of its AI solutions, Palantir emerges as a formidable contender in the AI landscape, offering investors compelling growth potential.

2. Super Micro Computer (NASDAQ: SMCI)

Super Micro Computer stands out as a provider of AI-optimized high-end servers and rack-scale total IT solutions, setting itself apart from competitors through its modular architecture approach. This unique strategy allows for highly customizable and scalable solutions tailored to diverse client needs across various industries.

With a global clientele of over 1,000 clients across more than 100 countries, Super Micro Computer has established itself as a trusted partner in enterprise, cloud, telecommunications, and AI sectors. The company’s strategic partnership with Nvidia has further bolstered its position, enabling it to capitalize on the explosive growth of the generative AI market.

Notably, Supermicro’s fiscal performance reflects its success, with over half of its revenue generated from the sale of AI servers and rack-scale total IT solutions in the second quarter of fiscal 2024. As the AI server market continues to expand, Super Micro Computer is well-positioned to capitalize on this growth, further solidifying its position as a top contender in the AI space.

Also read: Super Micro Computer Stock Soars 947% Over The Past Year. Should You Invest In SMCI Stock?

3. Microsoft (NASDAQ: MSFT)

Microsoft Corporation remains a powerhouse in the global technology landscape, boasting a diverse portfolio spanning software, hardware, and cloud computing services. With a significant presence in artificial intelligence and cloud computing through its Azure platform, Microsoft aims to empower individuals and organizations worldwide to achieve more through technology, making it a key player in AI stocks.

In its second-quarter 2024 financial results, Microsoft exceeded expectations, reporting earnings of $2.93 per share compared to estimates of $2.76 per share. Additionally, the company posted revenue of $62.02 billion, surpassing estimates of $61.03 billion, marking a notable 17.58% increase compared to the same period the previous year.

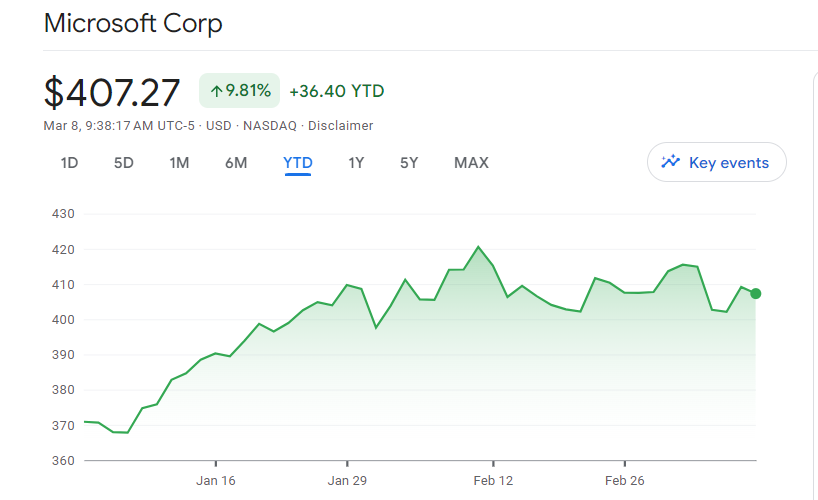

Year-to-date, Microsoft stock has seen a respectable 9.81% increase, with shares trading at $407 during Friday’s trading session, reflecting a 1.62% uptick. Long-term investors have reaped significant rewards, with shares gaining 69% over the past year and an impressive 269% over the past five years. With a strong start to the year, boasting a 12% year-to-date gain, Microsoft continues to offer investors a solid opportunity for growth and stability in the ever-evolving tech sector.

4. Nvidia (NASDAQ: NVDA)

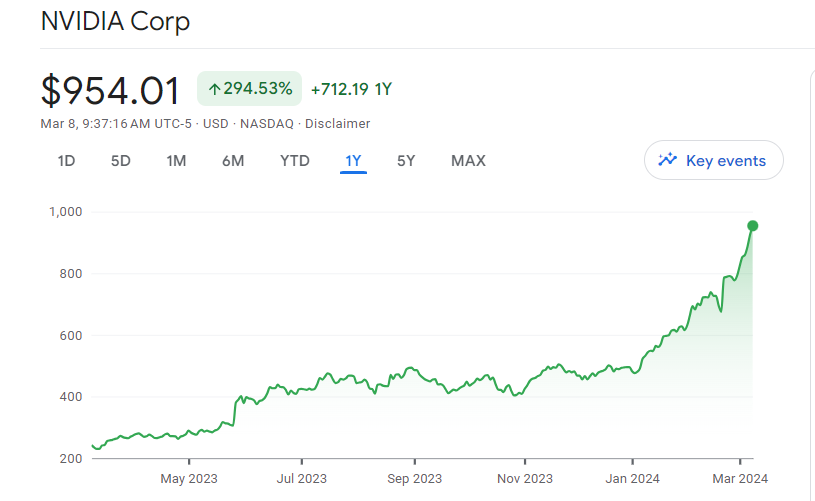

Nvidia stands at the forefront of the artificial intelligence revolution, wielding significant influence over the AI stocks market with its earnings reports. The company’s latest earnings report for Q4 FY24 revealed staggering year-over-year revenue growth of 265% and net income growth of 491%, surpassing even the remarkable 294% gain in the stock’s value over the past year.

Beyond its dominance in AI, Nvidia boasts thriving business segments in gaming and professional visualization, further solidifying its status as a powerhouse in the tech sector. With shares soaring by approximately 2,000% over the past five years, Nvidia has demonstrated its ability to deliver exceptional returns to investors. Nvidia remains a compelling investment option for those seeking exposure to the booming artificial intelligence market, hence an important consideration in AI stocks.

5. Dell Technologies (NYSE: DELL)

Dell Technologies has experienced a remarkable surge in its stock price, more than tripling over the past year as the significance of its artificial intelligence endeavors becomes increasingly evident. Despite a year-over-year decline in revenue, Dell’s Q4 2023 earnings report showcased an impressive 89% increase in diluted earnings per share, highlighting the company’s ability to capitalize on AI-related opportunities.

A notable aspect of Dell’s performance is the substantial growth in AI-optimized server orders, which surged by nearly 40% quarter-over-quarter, leading to a significant increase in total backlog. This growth story fueled a remarkable 40% post-earnings surge, underscoring investor confidence in Dell’s AI-related initiatives.

Furthermore, Dell’s decision to raise its dividend by 20% reflects the company’s commitment to returning value to shareholders. With an annual dividend now standing at $1.78 per share, investors can expect a steady income stream from their investment in Dell.

Despite its impressive performance, Dell’s valuation remains reasonable, with a P/E ratio of 34 and a forward P/E ratio of 17.64, offering investors a greater margin of safety compared to other AI stocks. With steady cash flow and promising growth prospects, Dell Technologies presents an attractive opportunity for investors seeking exposure to the burgeoning AI market in AI stocks.

Leave a Reply