Active stocks priced under $5 offer an enticing arena for day traders aiming to capitalize on short-term market movements. These active stocks, characterized by their affordability and potential for volatility, attract traders seeking rapid gains within the confines of a single trading day.

In this article, we explore five of the most active stocks under $5, delving into their recent performance, market dynamics, and suitability for day trading strategies.

5 Most Active Stocks Under $5 for Day Trading

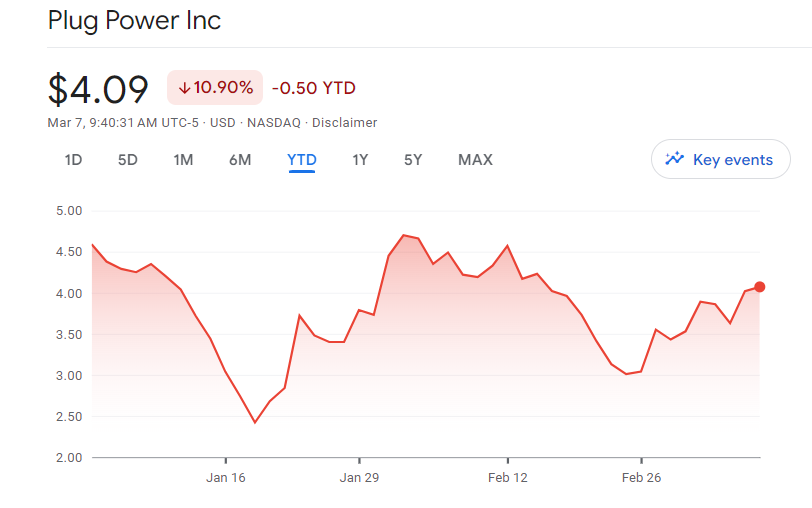

1. Plug Power Inc.

Plug Power Inc. (NASDAQ: PLUG) has surged to the forefront of attention in the day trading arena, despite its recent liquidity concerns. While the company’s past issues with cash balance and equity securities raised alarms, its latest earnings release announced the resolution of the going concern issue, marking a significant milestone.

Despite this positive development, analysts maintain a bullish outlook on Plug Power stock. Notably, analyst James West from Evercore ISI, while revising the stock’s price target downward, maintains an outperform rating, projecting nearly 55% upside potential from the current closing price. Additionally, Plug Power stands out as the most active stock under $5 for day trading, with a volume of 50 million.

Several factors contribute to analysts’ optimism regarding Plug Power’s future prospects. The company’s strategic agreements with investment bank B. Riley Securities and the Department of Energy for substantial funding injections alleviate immediate funding concerns. Moreover, Plug Power’s efforts to curtail cash burn through capital expenditure cuts and operational optimizations signal a commitment to financial sustainability.

While Plug Power presents potential opportunities for day trading, investors should remain vigilant and await tangible improvements in the company’s financial metrics before committing to the active stock.

2. New York Community Bancorp, Inc.

New York Community Bancorp, Inc. (NYSE: NYCB) finds itself in a precarious position as it scrambles to navigate through a turbulent period. The bank’s recent challenges, including unexpected losses, dividend cuts, and management upheaval, have prompted a sharp decline in its stock value, down 58% from its previous year’s level.

With the need for new equity financing looming large, NYCB aims to raise capital amidst mounting concerns about its financial stability. However, the prospect of an equity offering raises uncertainties for existing shareholders, potentially diluting their holdings and signaling the severity of the bank’s capital needs.

While NYCB endeavors to rebuild its management team and address internal deficiencies related to loan risk management, confidence in its ability to weather the storm remains fragile. The uncertainty surrounding the bank’s future viability makes it a risky proposition for day trading, especially given its current price under $5.

3. Opendoor Technologies Inc.

Opendoor Technologies Inc. (NASDAQ: OPEN) has experienced a tumultuous journey marked by declining sales and a significant drop in stock value following its latest earnings report. Despite a commendable 106% gain over the past year, investors are now faced with the reality of a challenging market environment and uncertain prospects for recovery.

The company’s current valuation, characterized by a low price-to-sales ratio, may seem appealing to investors with a high-risk tolerance. However, the likelihood of a swift rebound in Opendoor’s business remains slim, particularly amidst persistently depressed home sales and uncertain economic conditions.

Opendoor’s revenue plummeted by 55% in 2023, accompanied by a substantial decrease in the number of homes sold. While potential interest rate cuts by the Federal Reserve could spark a recovery in the home-buying industry, the timing and impact of such measures remain uncertain.

While Opendoor Technologies Inc. presents potential opportunities for day trading due to its active trading volume and low stock price, the current market conditions and uncertain business outlook warrant careful consideration and a cautious approach for investors looking to capitalize on short-term price movements.

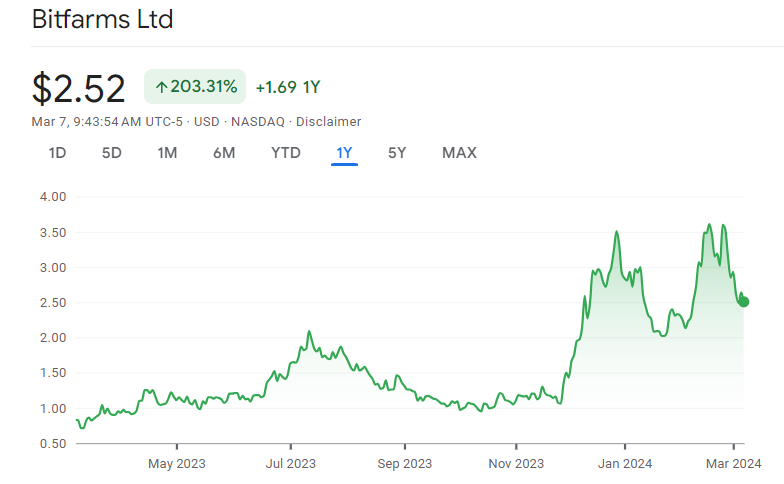

4. Bitfarms Ltd.

Bitfarms Ltd. (NASDAQ: BITF) emerges as a compelling option for day trading enthusiasts, particularly amidst the surging popularity of Bitcoin and the potential for lucrative opportunities in the cryptocurrency mining sector. Despite experiencing a remarkable surge of 200% in the last 12 months, Bitfarms remains undervalued relative to its growth prospects and expansion plans.

From a fundamental standpoint, Bitfarms boasts a robust liquidity buffer of $118 million as of Q4 2023, coupled with a zero-debt balance sheet, providing ample financial flexibility for aggressive expansion initiatives. The company’s plans to ramp up its hash rate capacity from 6.5EH/s to 21EH/s by the end of the year signify ambitious growth aspirations.

Considering Bitfarms’ active trading volume and its positioning as one of the most active stocks under $5, day traders may find ample opportunities to capitalize on short-term price movements in the cryptocurrency mining sector. With its strong fundamentals, growth prospects, and the broader bullish sentiment surrounding Bitcoin, Bitfarms presents an enticing option for day trading enthusiasts seeking exposure to the burgeoning cryptocurrency market.

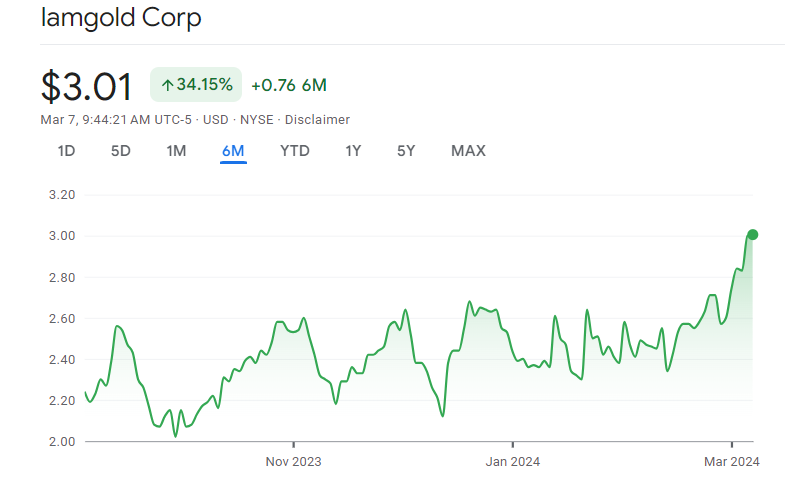

5. IAMGOLD

IAMGOLD (NYSE: IAG) emerges as a promising option for day trading enthusiasts seeking exposure to the gold mining sector, particularly amidst the bullish outlook for gold prices. With gold surging above $2,100 an ounce and potential rate cuts on the horizon, IAMGOLD presents an attractive opportunity for short-term gains.

Despite trading at an undervalued forward price-earnings ratio of 21, IAMGOLD has seen a notable uptrend of 33% in the last six months, reflecting growing investor interest. The company’s prospects for significant production growth in 2024, driven by the commencement of operations at the Cote mine asset, further bolster its appeal.

IAMGOLD’s strong liquidity position, evidenced by its robust liquidity buffer of $754.1 million at the end of Q4 2023, provides a solid foundation for growth and expansion initiatives. Moreover, the company’s pursuit of acquisitions to enhance reserves and capitalize on opportunities in the gold market underscores its commitment to long-term value creation.

As one of the quality active stocks under $5 for day trading in the gold mining space, IAMGOLD presents an enticing opportunity for traders looking to capitalize on short-term price movements amidst favorable market conditions.

Also read: Best Performing Low Price Shares in 2024