Penny stocks, despite their high-risk nature, can present lucrative opportunities for investors seeking high returns. In 2024, several penny stocks show promising growth potential, presenting unique opportunities for those willing to take on the associated risks. In this article, we’ll delve into five penny stocks that have gained momentum and are poised for significant growth in 2024 and beyond.

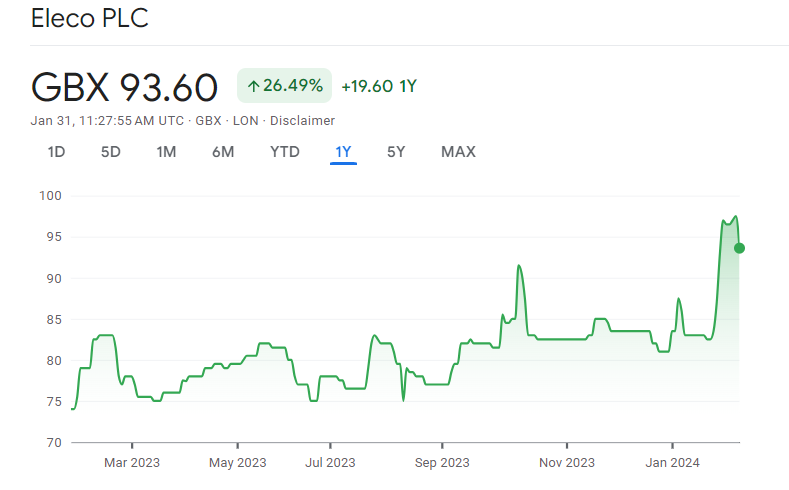

1. Eleco (LSE: ELCO)

Eleco, an under-the-radar software company specializing in building and project management solutions, is the first penny stock on our list. Despite experiencing subdued growth in recent years, the company has embraced a recurring revenue model, focusing on software-as-a-service (SaaS). Notably, Eleco’s consistent recognition as the ‘Project Management Software of the Year’ for the 10th consecutive year at the Construction Computing Awards 2023 highlights its industry excellence.

Analysts project a robust 16% revenue growth and a substantial 25% earnings growth for Eleco in 2024, underscoring its potential for investors. The recent 25% increase in the interim dividend further signals management’s confidence in the company’s future prospects. With a forward-looking price-to-earnings (P/E) ratio of 19, Eleco positions itself as an intriguing penny stock in the profitable SaaS sector, making it worthy of consideration for investors seeking growth opportunities in the software industry.

2. hVIVO (LSE: HVO)

hVIVO emerges as a promising penny stock in the healthcare sector, specializing in services for clinical trials and lab testing. The company caters to some of the top 10 global biopharmaceutical companies, showcasing its industry relevance. With a remarkable 52% revenue growth reported for the six-month period ending June, hVIVO has captured attention by exceeding expectations and demonstrating strong momentum.

Management’s commitment to annual dividends and the announcement of trading performance surpassing guidance in December underline hVIVO’s confidence in its current trajectory. Positioned with a price-to-earnings (P/E) ratio of 20, the stock appears attractively valued, presenting an opportunity for investors. The recent takeover offer for rival Ergomed adds a positive industry dynamic, further bolstering hVIVO’s potential as a penny stock with significant growth prospects in the evolving healthcare landscape.

3. Creo Medical (LSE: CREO)

Creo Medical emerges as a compelling penny stock within the healthcare sector, specializing in medical devices designed for endoscopic (minimally invasive) surgery. The company’s flagship product, Speedboat Inject, has garnered attention for its innovative multimodal endoscopic capabilities, contributing to a substantial 42% year-on-year increase in procedure volume and a 44% expansion of its user base in the first half of 2023.

While currently unprofitable, Creo’s forecasted 24% revenue growth in 2024 positions it as an intriguing investment opportunity. The risk associated with its lack of profitability is mitigated by the company’s success with Speedboat Inject and its potential for sustained growth. Creo Medical is an attractive penny stock worth considering for investors prepared to take on more risk in exchange for potential long-term rewards in the healthcare technology sector.

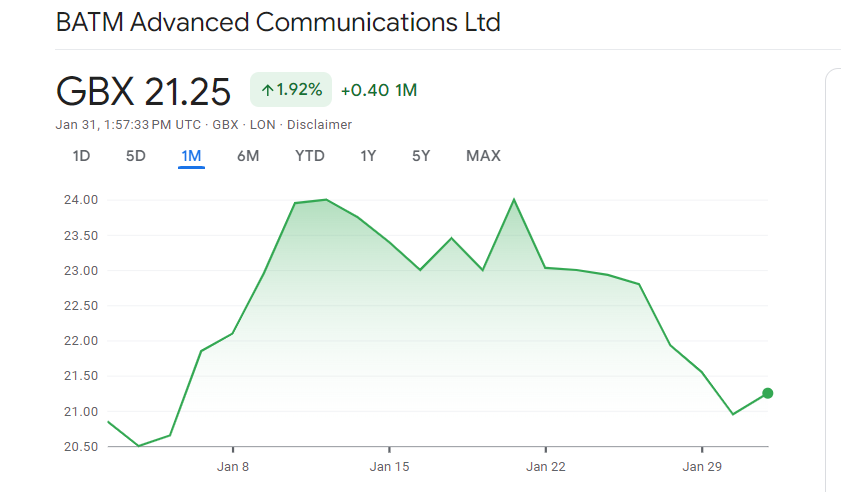

4. BATM Advanced Communications (LSE: BVC)

BATM Advanced Communications, an Israeli-based technology business listed on the LSE under the ticker symbol BATM, holds diverse interests in cybersecurity, networking, and medical technology. Despite a 31% drop in share prices over the past 12 months, BATM has showcased resilience and growth, accumulating $32 million in orders between June and December. The company’s strategic focus on cybersecurity comes at a time when governments are investing more on defense against these threats and digital risks are growing.

Trading at just over 21p, BATM’s recent performance and growing presence in the technology sector make it an intriguing penny stock. However, geopolitical risks, particularly in the Middle East, pose potential challenges. With a healthy balance sheet and positive half-year results, BATM Advanced Communications represents a small-cap stock with growth potential, particularly as governments continue to combat digital threats in the evolving landscape of cybersecurity.

5. Anglo Asian Mining (LSE: AAZ)

Anglo Asian Mining, focusing on copper and gold, concludes our list of penny stocks. With shares trading at 55p, down 100% from 110p a year ago, the company faces challenges associated with the cyclical nature of mining stocks. The economic slowdown in China has contributed to the decline, given its status as a major copper consumer.

While the risks are evident, the potential for a turnaround in demand for copper and gold, especially if the Chinese economy improves, makes Anglo-Asian Mining a stock to watch. Additionally, the current dividend yield close to 12% adds an income component for investors. However, caution is warranted, as dividends are not guaranteed, and geopolitical uncertainties could impact the company’s performance.

Also read: 7 Highest Dividend Paying Stocks In NYSE And How To Invest In Them

Conclusion

Penny stocks inherently carry high risks, but for investors seeking high-reward opportunities, the highlighted stocks present compelling cases. Eleco, hVIVO, Creo Medical, BATM Advanced Communications, and Anglo Asian Mining all exhibit growth potential, albeit with varying levels of risk.

Investors should stay up to date on macroeconomic issues affecting these companies, do in-depth research, and keep an eye on industry trends. When thinking about investing in penny stocks, diversification and a well-thought-out risk management approach are essential.

Leave a Reply