It can be a fantastic idea to purchase stocks during bear markets in order to boost portfolio returns for years to come. In a bear market, not every stock loses for the same reason, which can present possibilities for investors looking to select specific equities.

Purchasing index funds during a slump and adopting a more passive strategy are both acceptable strategies. However, stock pickers can perform even better by purchasing shares of outstanding corporations whose stocks can experience significant recovery once a weak market ends. Tesla, NextEra Energy, and Apple are three excellent companies to invest in as we emerge from the present bear market.

Tesla (NASDAQ: TSLA)

When the next bull run happens, investors who lost money investing in speculative stocks might adopt a different strategy. That doesn’t imply people shouldn’t still desire to own rapidly expanding brands; rather, the emphasis should be on ensuring steady profits and a positive cash flow. One of those stocks with rapid growth in an industry with rapid growth has been Tesla. Naturally, the confluence has produced a high valuation. However, tesla still has a long way to go. It has actual net income, not just increasing sales.

Over the past year, the company has increased profits at a compound quarterly growth rate of 65.9 percent. However, Tesla share prices are down roughly 32% in 2022 and is essentially unchanged from the beginning of 2021.

The company has had certain setbacks as a result of supply chain problems, difficulties with the startup of additional plants, and production delays at its Shanghai plant caused by COVID-19. Elon Musk, the company’s CEO, has also been preoccupied with issues related to Twitter and the departure of the head of Tesla’s autonomous driving division. Tesla is a stock that long-term investors should hold when this bear market ends since the EV sector appears to be growing for years to come — the U.S. recently passed the milestone of having 5 percent of new car sales being electric.

NextEra Energy (NYSE: NEE)

During this downturn, growth companies are being affected harder than utilities and other more defensive sectors. But stocks like NextEra Energy are already terrific buys, so investors don’t need them to decline. Additionally, NextEra is more than just a utility; its subsidiary for renewable energy, NextEra Energy Resources, has a growing section. Its investments in battery storage and renewable energy are well positioned in a fast-growing industry.

However, NextEra Energy also provides investors with dependable income. The company forecasts a 10 percent annual growth rate in its dividends per share for at least the next few years, even though it anticipates its earnings to rise at a consistent mid- to high single-digit rate through 2025. And if history is any indication, the business ought to succeed in that.

To increase its cash flow and fund that expanding dividend, NextEra has also just entered the water utility industry.

Apple (NASDAQ: AAPL)

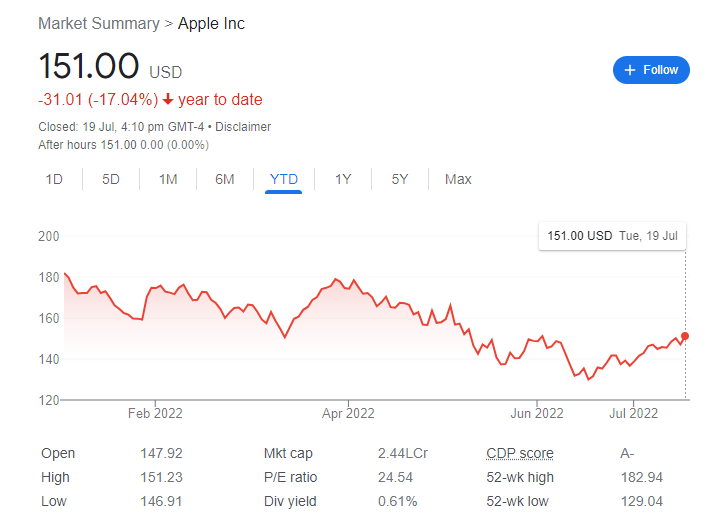

Finding a terrific firm at a discount is a third option to invest in the current bear market. That is currently being offered by Apple stock. Revenue for the company’s second fiscal quarter, which ended on March 26, set a record and increased by 9% compared to the same period last year. Additionally, it has more than $190 billion in cash on hand, which is usually a welcome safety net during recessions. Apple’s price-to-earnings (P/E) ratio is also close to a multi-year low after falling by about 20 percent this year.

Over the past five years, Apple’s annual income has climbed by 60%. When the market cap is already very close to $1 trillion, that is not a simple task. Investors took note of this, and Apple’s current market value exceeds $2.3 trillion. However, over the past 18 months, sales growth has quickened, making the company a strong buy right now.

Conclusion

Together, Apple, NextEra Energy, and Tesla help a portfolio become more diverse. However, each one of them also has a benefit that an investor should desire when the market shifts from bear to bull mode. A wonderful method to prepare for that impending swing is to purchase them now.

Also read: Three Top Dividend-Paying Stocks You Should Buy in July 2022

Leave a Reply