What is the most effective technique to increase wealth and succeed in the stock market? It’s not through day trading, penny stock speculation, or any other risky strategy but it is what you read in the title, to find the stocks with high growth potential and no downside risk.

Investing in reliable companies with enormous growth potential and no downside risk is the best and most dependable approach to make money with stocks. Here are three stocks in particular that investors, both novice and seasoned, would prefer to look into in July 2022.

PayPal (NASDAQ: PYPL)

- Sector: Information Technology

- Price: $71.40

With 429 million active accounts and more than $1.2 trillion in annual payment volume, PayPal is a huge company. With shares down more than 60% so far in 2022, it is also one of the worst-performing stocks in the S&P 500 index.

Fair enough, there are some positive elements. PayPal’s recent growth in active users has been disappointing, and the business has acknowledged that it was unlikely to reach its growth goals (the company had been hoping for 750 million users within a few years). PayPal is now concentrating on monetizing its present user base.

Despite the fact that this was undoubtedly frustrating for investors, it’s vital to remember what a strong corporation this is. With a 15 percent increase in revenue year over year in its main business during the first quarter, PayPal, the undisputed leader in online payments, has been growing impressively. In the quarter, the typical PayPal user completed 47 transactions, an increase of 11% from the previous year. And with an annual free cash flow of over $5 billion and incredible flexibility to spend in its own expansion, PayPal is a veritable cash generator.

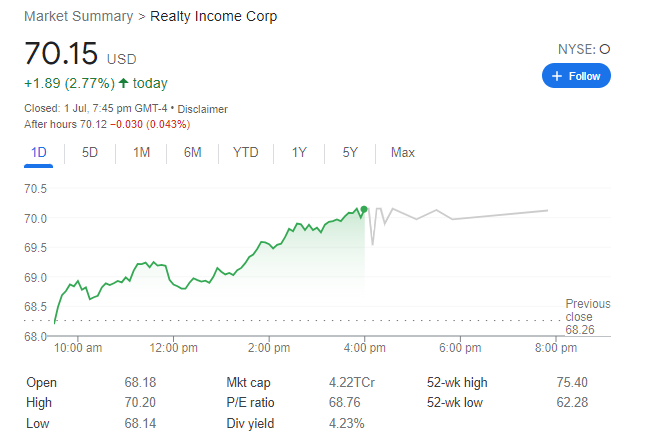

Realty Income (NYSE: O)

- Sector: REIT

- Price: $70.15

- Dividend yield: 4.23%

Realty Income is arguably the best dividend stock overall available on the market. The real estate investment trust, or REIT, has increased the payout for 99 consecutive quarters at an annualized growth rate of 4.4 percent and has paid stockholders monthly dividends for 624 straight months. And it’s not just an income play either; since debuting on the New York Stock Exchange in 1994, Realty Income has produced an outstanding average annual return of 15.3 percent.

Retail tenants make up the majority of the single-tenant buildings in which Realty Income invests. According to the most recent data, the corporation owns more than 11,200 properties across Europe and the United States.

Don’t let the term “retail” worry you. The majority of Realty Income’s tenants are companies that are resilient to e-commerce challenges as well as recessions. Walgreens, Dollar General, FedEx, and Walmart are just a handful of Realty Income’s biggest clients. Creating wealth for long-term shareholders has been a top priority for this high-yielding dividend growth stock.

Disney (NYSE: DIS)

- Sector: Consumer Discretionary

- Price: $96.14

The epidemic caused Disney financially since it had to close or curtail operations at its theme parks, cruise lines, and movie theatres for much of 2020 and 2021. Asia’s theme parks are still impacted, too.

Disney’s main business, though, has roared back. Six of the upcoming seven days have no available reservations for at least one of the Walt Disney World theme parks, as of this writing. Its film franchises are once again profitable. Additionally, Disney’s merchandising and cruise businesses are doing well. Additionally, Disney has built a sizable recurring revenue stream that was essentially nonexistent prior to the pandemic thanks to the fantastic subscription growth from the Disney+, Hulu, and ESPN+ streaming services.

Disney’s company is doing better than it did before the epidemic, and as its streaming business develops, it should do much better. Moreover, the stock is currently trading close to its five-year low.

Conclusion

All three of these companies have a very strong foundation, successful operations, and a lengthy history of achievement and expansion. But given the significant economic challenges we are currently facing, it would be prudent to anticipate that volatility would last for some time. In around ten years, investors who purchase these will be happy they did, but in the meantime, expect some turbulence.

Three Top Dividend-Paying Stocks You Should Buy in July 2022