Investing can assist you in achieving your long-term financial objectives if you have money available over and above what you need for survival. Despite this, it can be challenging to sort through the plethora of possibilities to find the best way to invest your money.

To assist with this, we’ll examine the best ways to invest your money in the UK in 2022 and provide a thorough tutorial on how and where to get started.

Best Ways to Invest Your Money 2022

Since there is no one-size-fits-all method for making investments, take “best” to be the finest choice in your particular circumstance. Before selecting the best option for you, keep in mind that every asset and investment vehicle is susceptible to market ups and downs.

We look at a few of the best ways to invest money one can choose from in the UK in the sections below.

1. Stocks & shares

Buying stocks is one of the most popular ways to invest your money. The advantage is that you might experience longer-term (and frequently shorter-term) growth compared to cash savings. Particularly when cash interest rates are low, as they are at the moment, stocks can be highly alluring.

The drawback is that since stocks can lose value as well, you might lose money—sometimes even all of it. Anyone who purchased soon before the Covid-19 disaster will have lost a sizable portion of their investment, which may take years to recover to its previous level. The Covid-19 catastrophe took a third off the prices of worldwide stock markets. This danger should always be recognised.

Over longer periods (5+ years), however, stock markets consistently exceed the majority of cash savings. You can also minimize your risk by using a fund or a range of securities purchases. Even if the possibility of loss cannot be completely eliminated, it can be significantly reduced. If you correctly plan your strategy and ask for assistance, you can keep the risk at levels you feel acceptable.

Here are some additional stock investment options outside buying shares.

Stocks & shares ISA

A tax-efficient savings account, an ISA is one that doesn’t charge taxes on growth or interest. One who possesses non-cash investments, such as stocks, is said to have an ISA for stocks and shares (but can include things like bonds and investment trusts too). If you plan to commit less than £20,000 per year, it implies to use a stocks & shares ISA for any investments you undertake. Although adding a cash ISA to your savings may lower your £20,000 yearly limits, cash ISAs now offer very few benefits due to the historically low return rates.

Continuing to invest the growth and the tax savings will cause your investment to grow inside the ISA faster than it would outside of it.

Learn more: Best Stocks and Shares ISA in UK 2022

Index funds and ETFs

ETFs and index funds are two fairly straightforward ways to start trading stocks. They can be a better instrument for speculating than open markets because they take the work out of picking individual stocks. Both kinds of mutual funds invest in a variety of securities with your money (securities include equities but also bonds). Since their diversity may protect you from sector-specific crashes, these diversified funds are viewed as lower-risk investments. There are numerous possibilities, and while some are noticeably riskier than others, you can select one that corresponds to your level of risk tolerance by looking for unbiased advice.

Learn more: Best Index Funds to Buy in UK 2022

Unit trusts and investment trusts

A trust deed establishes unit trusts, which are a type of group investment. A fund manager will make investments on your behalf in a portfolio of assets using pooled funds. The trust seeks to invest in high-yielding assets, typically stocks, bonds, and real estate funds and typically distributes any profits either as income or growth on a quarterly or biannual basis. As always, returns are not ensured, and you could experience a financial loss.

Unit trusts and investment trusts are similar, yet there are some significant differences. One is that, unlike unit trusts, investment trusts can borrow money in order to purchase additional shares. This increases their potential for growth while also putting the investor at more risk. An investment trust’s “net asset value” is determined not only by the value of the assets it owns but also by the market price of its own shares. If the net asset value surpasses the share price of the investment trust, you have the opportunity to increase your profits.

Value Investing

Value investing is a strategy for more seasoned investors and is a major factor in Warren Buffet’s success. The idea behind value investing is straightforward: purchase discounted stocks in promising firms and sell them when the company has lived up to its potential. So much for the theory; the challenging part is locating these businesses and forecasting their future success. You’ll probably need a few years of investment experience and be successful in your own firm before you can accomplish this well. It requires perseverance and a sizable initial investment, making it only suitable for wealthy investors.

Learn more: Best Value Investments in UK 2022

2. Bonds

If you believe that the stock market’s trip will be too turbulent for you, you may consider going to invest in government or corporate bonds. In essence, a bond is a debt to the state or company that distributes it. You loan them your wealth for a while, and they pay it back with interest.

Bonds are so commonly used to generate a predictable return over a set time period. Since it’s commonly said that bonds are less risky than stocks, the reality is a little more complicated. Bonds from established governments (gilts) are frequently the safest, while bonds from emerging markets or new businesses will be significantly riskier and should offer higher returns. As always, it comes down to assessing the risks and potential rewards.

You can add bonds to a stocks and shares ISA, and some low to medium risk bonds can act as a stabiliser against some of the more volatile markets.

3. Peer-to-peer lending

Peer-to-peer lending companies normally provide returns on your investment of roughly 6%, but there are risks involved. P2P lending is to invest your money in a company or initiative that needs funding to expand. If the business or project is a success, you will receive your investment back plus interest. In periods of economic expansion, this kind of investment may offer lower risk.

4. Crowdfunding

This investing approach is a distant relative of peer-to-peer financing and involves making a direct financial investment in a startup business or initiative. Crowdfunding that is equity- or investment-based provides you a stake in the company and ultimately a cut of the earnings. One of the quickest ways to increase your wealth is to be fortunate or astute enough to predict the next great thing, as did the crowdfunders of the online bank Monzo. It is much more likely that the corporation will only give you a thank-you and possibly some complimentary items. Crowdfunding is more commonly associated with speculation than with investing, yet it certainly works for certain people.

5. Commodities

Oil and gold are two investments that have their own elegance. Contrary to popular belief, they typically don’t result in rapid financial success. Because gold is recognised for remaining steady during moments of crisis but oil is essentially erratic, oil and gold are essentially polar apart as investments.

The main factors influencing price of oil are supply and demand as well as global geopolitics. However, for the small amount of your portfolio that is deemed to be significant risk, oil stocks, futures, or options may be a viable investment. Any gains generated here can be skimmed off and put into assets that are safer, while any losses are limited to the small amount you put in.

On the other side, the state of the economy as a whole is frequently reflected in gold’s profitability. In other words, gold usually loses value or remain unchanged during times of rapid economic expansion. But, as gold is the last-resort asset, its value usually rises as stock markets decline and unpredictability increases. So when managing your portfolio, keep in mind that gold is the ideal counterweight to volatile commodities such as oil.

Learn more: How to Invest in Commodities – Beginners Guide

6. Investing in property

Let’s examine how to invest in real estate in the UK for the least amount of money possible.

REIT: A REIT is a vehicle for investment. A portfolio of shares from commercial and residential buildings that generate income is called a real estate investment trust (REIT). Shareholders receive profits, and they are frequently low-risk investments. Additionally, you can buy REIT shares.

Property lease option: You can rent a home with the goal of buying it at the conclusion of the rental period for as little as £1. The property owner and tenant come to an agreement, and at the end of the lease, either party may choose to exercise or forfeit the option.

Property crowdfunding: Real estate crowdfunding allows investors to purchase an equity stake in a building. Money from investors is put into a pool and used to purchase real estate. For instance, you can invest in real estate development, where the proceeds from the sale of the property are profit, or in buy-to-let crowdfunding, where the rental income is split among investors.

7. Crypto Earn Programs

Although cryptocurrencies have a bad reputation for being volatile, the previous few years have seen some amazing results. If you don’t want to trade or operate the crypto markets, you may always use Tap’s Earn programme on the smartphone app. With the help of this application, investors can safely store their fiat, stablecoin, or cryptocurrency holdings in an interest-bearing account

Based on the currency or instrument they desire to deposit, traders can put their British Pounds, Euros, or US Dollars into their Earn account along with a number of digital currencies and earn enticing yearly returns of up to 7% APY at the time of writing.

8. Pensions

One of the finest methods to invest money for your retirement is to pay into a pension. You may already have a working pension, but a Self-Invested Personal Pension (SIPP), which allows you more investing alternatives, is something you might want to think about.

Why invest your money?

Purchasing an asset that will generate returns is one way to use investing as a strategy to build your personal wealth. Money can grow through investing over a lengthy period of time, ideally with little involvement from the investor.

The advantages listed below can be attained when you invest your money:

Potential for higher returns: Compared to deposit account savers, investors have the ability to generate better returns on their investments. According to AJ Bell, the typical cash ISA has generated a total return over the past ten years of 17% as opposed to 100% for the typical stocks and shares ISA. Compared to £11,658 in a cash ISA, a lump sum investment of £10,000 in a fund-based ISA would have increased to £20,000 over a 10-year period.

Protect against inflation: Inflation in the UK is currently at a 40-year high of 9.4%, while the average interest rate on rapid access savings accounts, according to the Bank of England, was 0.31 percent (as of June 2022). If you put money in a savings account paying 1% interest and the inflation rate is 9%, your money’s “real” value is actually declining by almost 7% annually. Higher returns on investments may be possible, which would help fight inflation.

Compound growth: When any revenue or interest is reinvested and grows together with the original funds or “capital,” compound growth occurs. If you withdrew the “gain” each year from an investment of £10,000 for ten years with an average yearly return of five percent, it would be worth £15,000, as opposed to approximately £16,300 if you reinvested it. Compound growth accelerates the value growth of investments even more because investments typically provide larger returns than cash.

Best platforms to invest your money

There are numerous investment applications and stock brokers available in the UK. It has been reduced to just two: Fineco Bank and eToro. Because of excellent value for money, eToro rises to the top of the heap, but each individual investor’s needs will vary, as will the broker they choose to meet those needs.

1. eToro

We selected eToro because of its commission-free trading and some of the cheapest broker costs available. However, its user-friendly design, which puts an emphasis on light rather than fear, maybe just as significant. Additionally, eToro pays the stamp duty for share transactions on your behalf, saving you a lot of money.

The FCA-regulated broker, which currently has up to 20 million clients globally, enables you to invest in a variety of international stocks and the most well-liked ETFs. Additionally, it provides markets in its own exclusive CopyPortfolios. Additionally, several of its markets are accessible via CFD trading, and leverage is also offered for individuals wishing to stretch their dollars further.

ETFs on eToro can be accessible through CFD instruments or as the underlying product. The CFD version is displayed in the screenshot above.

You can use the Copy Trader tool in addition to the CopyPortfolios to passively follow particular traders. You can follow a seasoned trader with demonstrable results using the Copy Trader tool, which is available in real-time on the eToro platform.

It simply takes a couple of minutes to sign up for eToro, and you may add money straight away using a UK debit/credit card or e-wallet. For every withdrawal, a $5 fee is charged. The Financial Services Compensation Scheme insures deposits up to £85,000 and the company is completely regulated by the Financial Conduct Authority (FCA).

2. Fineco Bank

You are extremely likely to locate your favorite investment or asset class at Fineco Bank if it isn’t available on eToro. Fineco Bank has a full FCA licence and is backed by an Italian financial institution. You shouldn’t have to fear about the protection of your investment funds because FSCS safeguards are also in place.

Because of the enormous variety of markets it provides, Fineco Bank stands out in our eyes. In addition to sample portfolios, there are multitude of index funds accessible through exchange-traded funds.

If Fineco is your preferred option, you can enroll in its standard saving plan for a monthly charge. The entry-level plan is £2.95 per month. Although making 12 transactions for £19.85 a month represents considerable cost savings, it cannot compete with eToro’s 0% commissions. However, Fineco Bank can be the right option for you if you’re seeking a platform with a broad selection of stocks to choose from. Along with index funds and ETFs, other financial instruments include CFDs, bonds, shares (£2.95 per trade), and options and futures markets.

A platform fee of 0.25 percent annually must also be taken into account. On the other hand, Fineco Bank has a minimum investment requirement of just £100 and offers simple capital transfers from UK bank accounts.

How to invest your money?

In this section, we’ll demonstrate how simple it is to use an internet broker to invest your money. We chose the eToro broker as our example since it appears to be the most comprehensive in many regards.

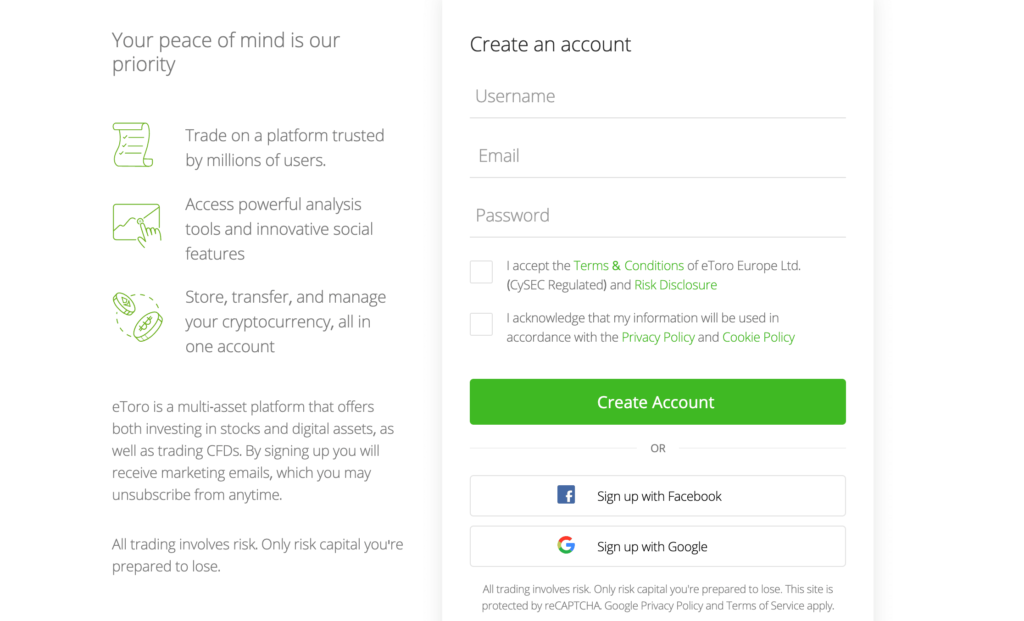

Step 1: Open an account

Visit the official eToro website and set up a new account with some basic information.

Brokers are required by law to adhere to the KYC procedure, which includes the last clause. To verify your account, you will then require to present valid identity and proof of address.

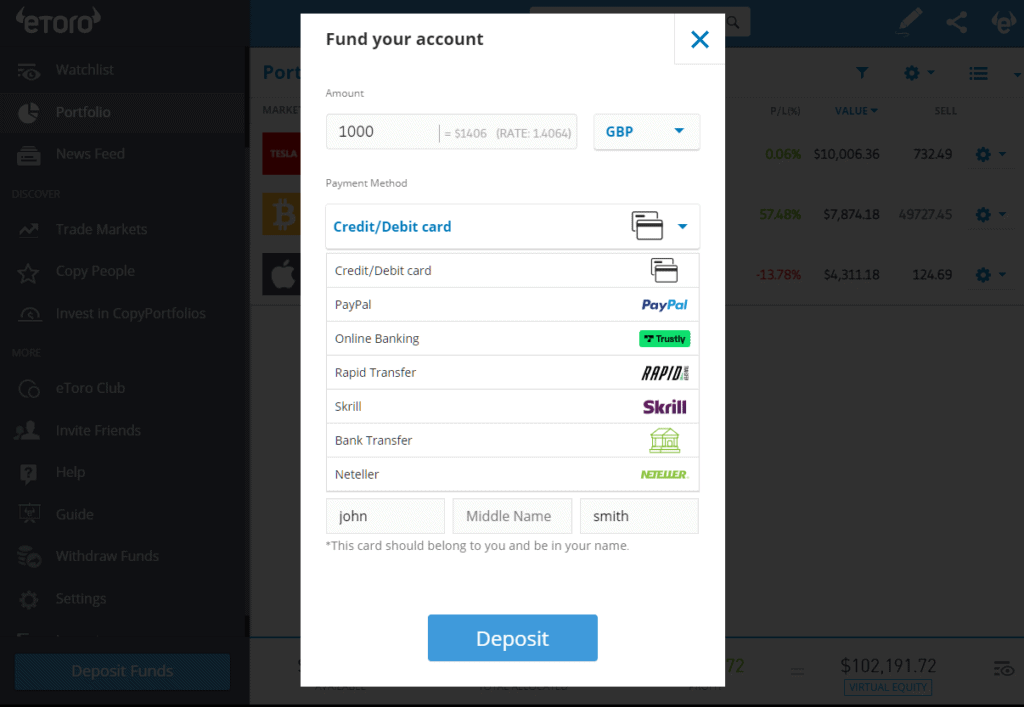

Step 2: Deposit funds

The next step is to add funds to your trading account using one of the many payment methods that eToro offers.

Step 3: Invest your money

Simply use the search box at the top of the home page to conduct a direct search for the stock name.

After selecting your chosen stock you will be asked for your desired investment amount, leverage, and “Stop Loss” and “Take Profit” thresholds. You must set this level in order for your position to be automatically resold. Simply select “Open Trade” from the menu.

Conclusion

Your needs and interests should be taken into consideration while choosing the best way to invest your money. Additionally, it is a properly thought-out investment that takes into consideration some favorable aspects. The part of the asset you want to invest in that is closest to and furthest away. These factors frequently depend on the asset type that was chosen. Keep in mind that it is crucial to comprehend all of the potential and hazards that affect your investment.

Even the best ways to invest your money aren’t one-time deals. For the entire investment to be a smart investment, diversification is crucial. Online brokers are quite effective and may readily trade attractive spreads for the majority of traditional instruments. eToro appears to be a really intriguing option right now to invest your money in stocks, cryptocurrencies, stock indexes, ETFs, and commodities.

Frequently Asked Questions

Can investing in shares cause me to lose all of my money?

Any investment carries some risk, but the risk associated with shares is particularly high because you could lose all of your money if the company fails.

Should I make a safe haven investment in gold?

Due to its long history as a safe-haven asset and its established reputation, gold ought to be at the top of your list of safe havens for your money. The disadvantage of gold is that it does not generate any income, including neither dividends nor interest.

Which stocks of companies provide the best returns?

Growth stocks, or stocks that offer the prospect of increased capital value, or an increase in the value of the company’s shares, are typically found in industries like technology.