As one of the world’s largest discount brokerages, Charles Schwab broker offers a comprehensive suite of services catering to investors, employers, and independent advisors.

In today’s rapidly evolving financial landscape, selecting the right brokerage platform is crucial for investors seeking to navigate the complexities of the market and achieve their financial goals. Among the myriad options available, Charles Schwab Broker stands out as a leading choice, renowned for its comprehensive suite of tools, extensive range of investment options, and commitment to customer satisfaction.

In this review, we delve into the various facets of Charles Schwab Broker, exploring its features, fees, trading platforms, and more, to help investors make informed decisions about their investment journey.

Charles Schwab Broker Overview

Charles Schwab Broker is a renowned financial institution offering a wide array of investment services and products. Founded in 1971 by Charles Schwab and his partners, the company has grown into one of the largest discount brokerages globally, with a strong emphasis on customer satisfaction. With assets totaling $8.56 trillion as of January 2024, Schwab’s acquisition of TD Ameritrade in 2020 further solidified its market presence.

The brokerage caters to a diverse clientele, ranging from individual investors to institutional clients and independent advisors. It prides itself on its customer-centric approach, encapsulated in its “Through Clients’ Eyes” strategy, which prioritizes meeting the needs and expectations of its customers.

Schwab offers a comprehensive suite of investment products and services, including stocks, ETFs, options, futures, and mutual funds. Notably, it provides commission-free trades for many securities, making investing more accessible for clients. Moreover, Schwab distinguishes itself through its robust educational resources, intuitive trading platforms, and extensive research reports, empowering investors of all levels with the tools and knowledge needed to make informed decisions.

Despite some limitations, such as the absence of cryptocurrency trading and occasional issues with its mobile app, Charles Schwab Broker remains a trusted choice for individuals and institutions seeking a reliable and comprehensive investment partner.

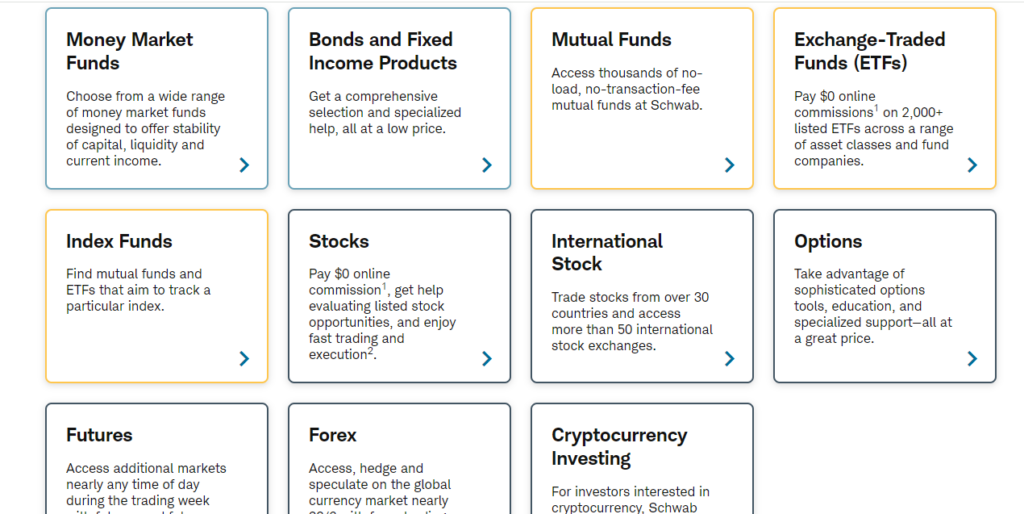

Investment Options

Charles Schwab broker offers a diverse range of investment options, catering to the needs of investors at every level of experience and risk tolerance. Whether you’re a novice investor looking to start small or a seasoned trader seeking sophisticated strategies, Schwab provides a comprehensive suite of products to meet your investment goals.

- Stocks: Schwab provides access to approximately 11,600 stocks, offering extended-hours trading, research tools, alerts, and watchlists. Investors can trade stocks with ease, benefiting from features like fractional shares, which enable small investors to build diversified portfolios with as little as $5.

- ETFs: With over 2,000 ETFs available, spanning various asset classes and fund companies, Schwab offers ample choices for investors seeking diversification. Additionally, Schwab offers 30 low-cost ETFs, and all ETFs trading on U.S. exchanges are commission-free, making it convenient and cost-effective for investors to build a diversified portfolio.

- Mutual Funds: Schwab offers thousands of no-load, no-transaction-fee mutual funds, with a low investment minimum of $100. Investors can choose from pre-screened OneSource Funds or opt for Schwab Target Funds, designed for retirement and goal-based investing. The Personalized Portfolio Builder and MarketTrack Portfolios offer additional options for investors seeking tailored investment solutions.

- Closed-End Funds: Schwab provides access to dozens of closed-end funds, categorized for easy selection based on domestic, international, sector, and fixed-income options. These funds offer diversification and potential income opportunities for investors seeking alternative investment vehicles.

- Bonds and Fixed Income: With access to over 80,000 bonds and certificates of deposit from hundreds of dealers and brokers, Schwab offers a wide range of fixed-income options. Investors can choose from municipal bonds, corporate bonds, and more, with tools and resources available to assist in selecting the right bonds for their portfolios.

- Options: Schwab offers extensive options and resources, including tools, research, education, and specialists. Investors can trade single-leg and multi-leg options, with four levels of options trading available to accommodate various investment strategies.

- Futures: Schwab provides access to futures trading across multiple asset classes, including stock indexes, interest rates, energies, metals, and currencies. Advanced trading platforms and targeted education are available to help investors navigate futures markets effectively.

- International Investing: Schwab enables global investing in over 30 foreign markets, with ratings, screeners, and research available for more than 4,000 international stocks. Investors can trade in 12 international markets with a Schwab Global Account, offering real-time quotes and online trading in local currencies.

Types of Charles Schwab Broker Accounts

Charles Schwab broker offers a variety of account types to suit the diverse needs of investors, including individual, joint, retirement, custodial, business, and specialized accounts.

- Individual and Joint Accounts: Schwab One brokerage accounts provide access to a wide range of investment products and services, including stocks, ETFs, mutual funds, options, and more. Joint accounts allow multiple individuals to share ownership of assets and manage investments together.

- Retirement Accounts: Schwab offers Roth, Traditional, Rollover, Inherited, and Custodial IRA accounts, providing tax-advantaged savings options for retirement planning. These accounts offer various benefits and flexibility, allowing investors to choose the best option based on their financial situation and retirement goals.

- Business Accounts: Schwab accommodates small business owners with tailored account solutions, including brokerage accounts, retirement plans (e.g., SEP-IRA, SIMPLE IRA), and cash management services. These accounts help businesses manage their investments, employee benefits, and cash flow efficiently.

- Specialized Accounts: Schwab also offers specialized account services, such as managed portfolios, educational accounts (e.g., 529 plans), charitable giving accounts, trust and estate accounts, insurance, and annuities. These accounts cater to specific investment objectives and financial planning needs, providing customized solutions for investors seeking specialized services.

Charles Schwab Broker Trading Platforms

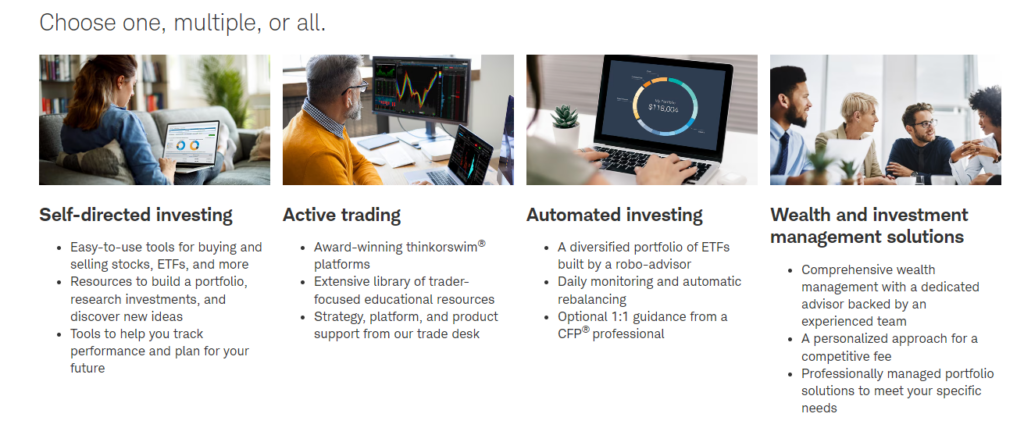

Charles Schwab broker offers a range of trading platforms designed to meet the diverse needs of investors, providing intuitive interfaces, advanced tools, and robust functionality for trading and portfolio management.

1. StreetSmart Edge

Charles Schwab broker provides the StreetSmart Edge trading platform, a downloadable solution offering professional-grade tools for trading and portfolio management.

- Features: StreetSmart Edge encompasses robust features such as portfolio analysis, screening, research, and real-time market data.

- Customization: It offers customizable dashboards and advanced charting capabilities, enabling investors to tailor their trading experience according to their preferences.

- Efficiency: With intuitive navigation and comprehensive tools, StreetSmart Edge empowers investors to make informed decisions and execute trades efficiently.

2. thinkorswim®

As part of the integration of TD Ameritrade, Charles Schwab offers access to the thinkorswim® trading platform.

- Comprehensive Tools: thinkorswim® provides advanced charting, technical analysis tools, options trading capabilities, and customizable features.

- Versatility: Catering to various trading styles and strategies, the platform supports a wide range of investment instruments and trading methods.

- Research and Education: Investors can access extensive research and educational resources through thinkorswim®, enhancing their knowledge and skills for successful trading.

Charles Schwab Broker Fees & Commission

Charles Schwab broker offers competitive fees and commissions, making it an attractive option for investors seeking cost-effective brokerage services. The brokerage provides commission-free online trades for stocks, ETFs, preferred stocks, REITs, Treasuries, and thousands of mutual funds available through Schwab Mutual Fund OneSource. This fee structure allows investors to trade a wide range of securities without incurring transaction costs, making it convenient and affordable to build diversified portfolios.

However, Schwab does charge fees for certain investment products and services. Options trading incurs a fee of $0.65 per option contract, while futures and futures options trading carries a fee of $2.25 per contract. Additionally, bond, CD, and other secondary trades incur a fee of $1 per bond with a $10 minimum and $250 maximum fee per trade. Mutual funds not part of Schwab Mutual Fund OneSource may also have fees of up to $49.95, depending on the fund.

While Schwab’s fees are competitive, investors should be aware of potential costs associated with their trading activity. It’s important to review Schwab’s fee schedule and consider how these costs may impact investment returns when making trading decisions.

Charles Schwab Mobile App

The Charles Schwab mobile app offers clients convenient access to their investment accounts and a comprehensive suite of features to manage their portfolios on the go. Available for both iOS and Android devices, the app provides a seamless user experience with intuitive navigation and robust functionality.

Key features of the Charles Schwab mobile app include real-time account management, allowing clients to view their balances, holdings, and transaction history from anywhere. Clients can also execute trades for stocks, ETFs, options, and mutual funds directly from their mobile devices, with access to market data and research to inform their decisions.

The app also offers mobile deposit functionality, enabling clients to deposit checks into their Schwab brokerage accounts by simply taking a photo of the check. Additionally, clients can access research reports, market news, and educational resources to stay informed about market developments and investment opportunities.

With security features like fingerprint and face ID authentication, customizable alerts, and easy access to customer support, the Charles Schwab mobile app provides a secure and convenient way for clients to manage their investments anytime, anywhere.

User interface and experience

Charles Schwab broker offers a user-friendly interface and seamless experience across its various platforms, catering to the needs of investors at every level. The brokerage’s website and mobile app are designed with intuitive navigation, making it easy for users to access their accounts, research investment options, and execute trades efficiently.

The website features a clean and organized layout, with customizable dashboards and tools that allow users to personalize their investing experience. Investors can access real-time market data, research reports, and educational resources, empowering them to make informed decisions about their investments.

Overall, Charles Schwab broker prioritizes user experience by providing a user-friendly interface, comprehensive tools, and reliable performance across its platforms. Whether investors are accessing their accounts from a desktop computer or a mobile device, Schwab’s interface and experience are designed to streamline the investing process and enhance customer satisfaction.

Research and Education

Charles Schwab broker prioritizes research and education, providing investors with comprehensive resources to enhance their investment knowledge and decision-making capabilities. The brokerage offers a wide range of research reports, market analyses, and educational materials to empower investors at every level of experience.

Schwab’s research offerings include proprietary and third-party reports covering various asset classes, industries, and market trends. Investors can access fundamental and technical analysis, earnings reports, and stock ratings to stay informed about market developments and investment opportunities.

In addition to research reports, Schwab provides educational resources tailored to investors’ needs, including webinars, articles, videos, and online courses. These resources cover topics such as investment basics, portfolio management strategies, retirement planning, and advanced trading techniques, catering to investors seeking to expand their knowledge and skills.

Furthermore, Schwab’s commitment to education extends to its customer service, with knowledgeable representatives available to assist investors with questions and provide guidance on investment strategies.

Charles Schwab Customer Support

Charles Schwab broker offers comprehensive customer support, providing clients with access to live representatives via phone, chat, and email 24/7. Clients can also visit physical branches for in-person assistance. Additionally, the Schwab Assistant feature on the mobile app allows clients to use voice commands to find information or get answers to questions. Schwab’s customer support team is knowledgeable and responsive, providing timely assistance and guidance to clients on a wide range of topics, including account inquiries, trading assistance, and technical support.

Charles Schwab Broker Additional Features

In addition to its core features, Charles Schwab Broker offers a range of additional features designed to enhance the investing experience and provide added value to its clients.

- Fractional Shares: Schwab offers fractional share trading through its Stock Slices feature, allowing investors to purchase partial shares of stocks with as little as $5. This feature enables investors to diversify their portfolios and invest in high-priced stocks without needing to buy whole shares.

- Portfolio Management Tools: Schwab provides portfolio management tools, such as the Schwab Plan digital financial planning report, to help clients analyze their current financial situation, set investment goals, and create personalized investment plans. These tools offer insights and recommendations tailored to each client’s unique circumstances and objectives.

- Managed Solutions: Schwab offers a range of managed portfolio solutions, including robo-advisors and professionally managed accounts, for clients who prefer a hands-off approach to investing. These solutions provide diversified portfolios managed by experienced professionals, offering convenience and peace of mind to investors.

- Margin Trading: Schwab offers margin trading accounts, allowing clients to borrow against their securities portfolio to access additional capital for investment purposes. Margin trading can enhance buying power and potentially increase returns, but it also involves additional risks that investors should carefully consider.

- International Investing: Schwab enables clients to invest in international markets through its Global Account, which provides access to over 30 foreign markets in several local currencies. Clients can trade international stocks, access research and ratings for foreign securities, and receive guidance from global investing specialists.

- Retirement Planning Tools: Schwab offers retirement planning tools and resources to help clients plan for their financial future. These tools include retirement calculators, educational materials on retirement planning strategies, and guidance on retirement account options such as IRAs and 401(k) rollovers.

Is Charles Schwab Broker safe?

Yes, Charles Schwab Broker is generally considered safe for investors. The brokerage adheres to industry-standard security measures to protect client accounts and data, including encryption, two-factor authentication, and biometric verification. Additionally, Schwab offers account protection through the Securities Investor Protection Corporation (SIPC), which provides coverage for brokerage accounts up to $500,000, including up to $250,000 in cash balances.

While no investment platform is completely risk-free, Schwab has a strong reputation for reliability, transparency, and financial stability. The company has been in operation for decades and manages billions of dollars in client assets. Schwab also discloses potential risks associated with investing, such as market volatility and the potential for loss, and provides resources to help clients make informed decisions about their investments. Overall, Charles Schwab Brokerage is considered a safe and reputable stock broker option for investors. If you want to consider to compare it with alternative brokers then we suggest you check out our Fidelity Investments Broker Review.

Conclusion

In conclusion, for US stock investors, Charles Schwab Broker emerges as an ideal platform offering a comprehensive suite of tools and resources tailored to their needs. With access to advanced trading platforms like StreetSmart Edge and thinkorswim®, investors can make informed decisions and execute trades efficiently.

Moreover, Schwab’s commitment to customer support and security ensures a seamless and trustworthy investing experience. Whether you’re a novice investor or an experienced trader, Charles Schwab provides the necessary tools and expertise to help you achieve your investment objectives in the dynamic landscape of the US stock market.

FAQs

How do I open an account with Charles Schwab broker?

Opening an account with Charles Schwab broker is simple and can be done online or by visiting a local branch. You’ll need to provide personal information, such as your name, address, and Social Security number, and select the type of account you wish to open.

Can I trade options and futures with Charles Schwab?

Yes, Charles Schwab allows clients to trade options and futures contracts through its trading platforms. Clients can access advanced options trading tools and educational resources to support their trading strategies.

Are there any fees associated with Charles Schwab accounts?

While Charles Schwab does not charge monthly maintenance or inactivity fees for brokerage accounts, fees may apply for certain investments and services, such as broker-assisted trades and mutual funds not part of Schwab Mutual Fund OneSource.

How can I access customer support at Charles Schwab?

Charles Schwab provides 24/7 customer support via phone, chat, and email. Clients can also visit physical branches for in-person assistance. The Schwab Assistant feature on the mobile app allows clients to use voice commands for support.

Is my money safe with Charles Schwab?

Yes, Charles Schwab Brokerage is considered safe for investors. Client accounts are protected by the Securities Investor Protection Corporation (SIPC), providing coverage for up to $500,000, including up to $250,000 in cash balances.

Can I access my Charles Schwab account on mobile devices?

Yes, Charles Schwab offers a mobile app for both iOS and Android devices, allowing clients to access their accounts, trade stocks, deposit checks, and access research and educational resources on the go.