Coca-Cola stock represents a promising long-term investment opportunity. This prediction explores the compelling reasons to consider investing in Coca-Cola stock. The company’s recent financial performance, growth prospects, and historical dividend strength make it an attractive choice for patient investors. Here’s why Coca-Cola stock is worth considering for your long-term investment portfolio.

1. Resilient Financial Performance

Coca-Cola’s recent financial performance demonstrates its resilience and ability to thrive in changing market conditions. Despite concerns about the evolving beverage market, the company has posted impressive results. Organic sales grew by 11%, driven by a combination of rising prices and higher sales volumes. This indicates that Coca-Cola is not solely reliant on price hikes for growth. In the previous quarter, the company relied primarily on price increases, with flat volume.

Furthermore, Coca-Cola’s core beverage brands, including Coca-Cola Zero, Sprite, and Fanta, have contributed to market share growth. The company has also seen faster growth in non-traditional beverage categories such as bottled water, sports drinks, and energy drinks, aligning with shifting consumer preferences. This diversification positions Coca-Cola for continued growth and market dominance over the long term.

2. Strong Financial Fundamentals

Coca-Cola’s financial fundamentals are robust, providing a solid foundation for long-term investors. The company has improved its profit margins, and cash flow remains ample. This financial strength allows management to invest aggressively in growth areas like marketing. Additionally, Coca-Cola’s consistent dividend growth is a testament to its financial stability. The company recently raised its dividend by 5% and has a history of increasing dividends for 62 consecutive years. This commitment to returning value to shareholders is a compelling reason to invest for the long haul.

3. Growth Prospects

For a long-term investment, it’s crucial to assess a company’s growth prospects. Coca-Cola has a track record of adapting to changing consumer preferences and market dynamics. While traditional soda products face challenges, the company consistently adjusts its product portfolio to remain relevant. With ample resources at its disposal, Coca-Cola can fund strategic shifts if necessary in the coming years.

The company’s ability to diversify its offerings and expand into new beverage categories, such as healthier options like bottled water and energy drinks, positions it well for future growth. Coca-Cola’s strong brand recognition and global reach provide a competitive advantage in entering new markets and capturing market share.

4. Attractive Valuation

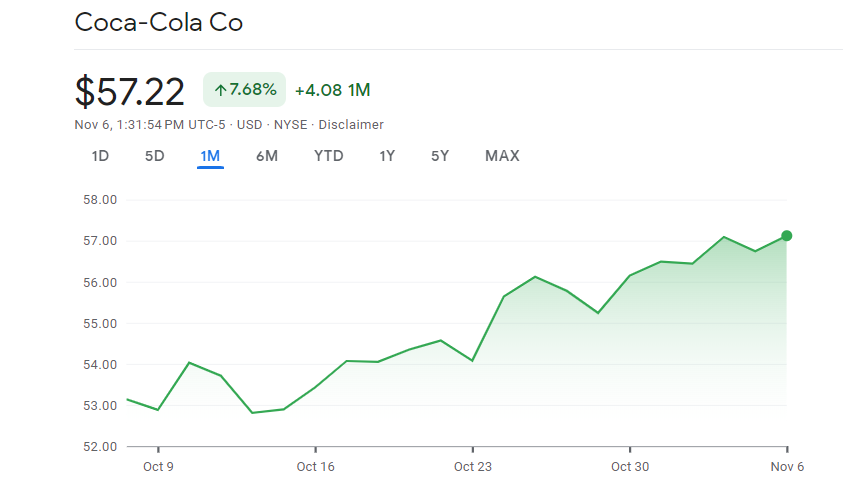

Coca-Cola’s present valuation offers a favorable proposition for investors with a long-term perspective. Currently, the stock is trading at just under 6 times annual sales, which positions it in the mid-range when compared to historical valuation extremes. Notably, during the market’s pandemic-induced slump, the stock was available at approximately 4.3 times sales, and during the subsequent rally, it reached a high of over 7 times sales.

What’s particularly encouraging is that Coca-Cola‘s valuation and its earnings potential are heading in opposite directions. Currently, the stock is trading at 24 times earnings, which represents a decrease from the nearly 30 times earnings it started the year with. If the company continues to maintain its positive operational momentum, it is likely that Wall Street will eventually recognize and reward the stock with a higher valuation. In the interim, investors can benefit from increasing dividend payments while they await the stock price to reflect the company’s operational achievements.

5. Mitigating Risks

While there are potential risks associated with any investment, Coca-Cola’s track record of resilience and adaptability suggests that it is well-prepared to navigate these challenges. Economic downturns, such as a recession in 2024, could impact the company’s performance, but Coca-Cola’s global presence and diversified product portfolio can mitigate such risks. Furthermore, the company’s ability to adapt to changing consumer preferences and innovate in response to market shifts positions it as a reliable long-term investment.

Also read: TOP STOCKS TO SELL BEFORE A POTENTIAL COLLAPSE IN THE HOUSING MARKET

Coca-Cola Stock Price Prediction for 2025:

Coca-Cola stock is expected to offer great returns for those willing to hold it through 2025. Our long-term forecast indicates that the stock has the potential to reach new all-time highs. Here are our predictions:

- Average Value: In 2025, we anticipate an average value of $130 for Coca-Cola stock. This represents a steady and conservative estimate.

- Bullish Scenario: If the market experiences a bullish trend, Coca-Cola stock may exceed our forecast. The maximum value could reach around $145 in 2025.

- Bearish Scenario: In the event of a bearish market, the minimum expected value for Coca-Cola stock may be around $120. This still represents a stable investment.

Coca-Cola Stock Price Prediction for 2030:

While making long-term forecasts is challenging, there is a strong possibility that Coca-Cola can recover and thrive in a positive market environment. Here are our predictions for 2030:

- Average Value: By 2030, we anticipate an average value of approximately $320 for Coca-Cola stock. This projection assumes steady growth and performance over the years.

- Bullish Scenario: If the market experiences bullish conditions, the maximum value for Coca-Cola stock could reach around $350 in 2030. This represents substantial potential for growth.

- Bearish Scenario: In a bearish market environment, the minimum expected value for Coca-Cola stock in 2030 might be around $280. Despite challenges, the stock is expected to maintain its value.

Is Coca-Cola stock really a good buy for long-term investment?

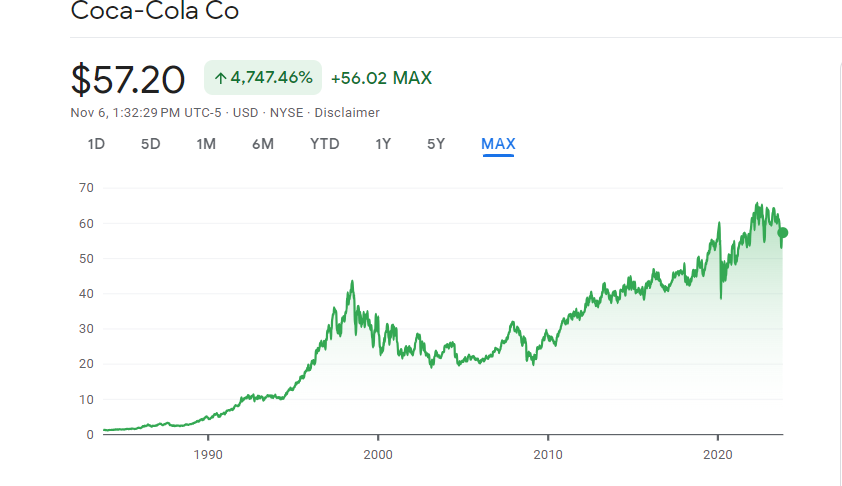

Coca-Cola stock boasts a robust history of sustained growth and a track record of delivering reliable returns to investors with a long-term perspective. Over the course of the last twenty years, Coca-Cola stock has consistently shown its capacity to increase in value, rendering it an appealing choice for individuals seeking investments with lasting value.

However, it’s essential to remember that stock forecasts are not always completely accurate. The performance of any stock, including Coca-Cola, is subject to market risks, economic fluctuations, and unforeseen events. Therefore, while Coca-Cola appears to have a bullish long-term outlook, investors must exercise proper risk management.

If you are a smart investor and believe in the potential of long-term investments, Coca-Cola is a solid choice. Its strong brand recognition, global presence, and continuous adaptation to changing market dynamics make it an appealing option for those seeking a reliable, long-term investment. Before making any investment decisions in Coca-Cola or any other stock, it’s advisable to conduct thorough research, consider your risk tolerance, and potentially seek advice from financial professionals to make informed choices. In the ever-evolving world of finance, Coca-Cola remains a classic choice for those looking to grow their wealth over time.

Leave a Reply